1452 words 6 minute read – Let’s do this!

The ongoing wildfires in Southern California are on track to become the most damaging in U.S. history, with significant implications for the regional economy. Power outages and water shortages across Ventura and Riverside counties have further disrupted daily life and business operations. Damage to homes and infrastructure is likely to drive long-term economic consequences. Los Angeles and Ventura counties have median home prices more than double the national average, meaning rebuilding costs will be substantial. Stringent zoning regulations and potential construction labor shortages, intensified by federal immigration policies and tariffs on construction materials, may further complicate recovery efforts. On behalf of Port X Logistics, we want to give our deepest condolences to those affected by the California wildfires.

As the state and safety of Southern California improves while firefighters fight hard to contain the fires, there will surely be ongoing market changes within the industry while California pushes to rebuild the southern California counties sadly affected by the fires. The LA fires have caused significant disruptions to transportation networks. Five separate fires, including those in Palisades and Pasadena, are burning on the outskirts of Los Angeles. These fires have led to road closures and detours, making it difficult for trucking operations to maintain supply chain continuity.

High winds further complicate the situation by increasing the risk of broader disruptions. Transportation services face interruptions as fires threaten populated areas, delaying deliveries and straining logistics. Rail and port operations in Los Angeles have also been affected. Smoke from the wildfires reduces visibility, creating challenges for rail operators. Evacuations of over 110,000 residents have caused traffic congestion, further delaying freight movement. Ports, critical hubs for international trade, experience operational slowdowns as logistics strained by the fires struggle to adapt. These delays disrupt the efficiency of supply chains, increasing costs for carriers and shippers.

Warehouse and distribution center operations face delays due to infrastructure damage and power outages caused by the fires. Proactive planning and communication are essential to mitigate these challenges. However, the current LA fires continue to strain logistics, leading to increased costs and operational inefficiencies. The wildfires impact retail and e-commerce sectors by delaying deliveries. Road closures and detours slow down trucking routes, leaving customers waiting longer for their orders. High winds and smoke exacerbate these delays, making it harder for logistics providers to meet delivery timelines.

This disruption affects both local businesses and large-scale e-commerce platforms. Shortages of essential goods have become a pressing issue in wildfire-affected regions. Damage to agricultural infrastructure reduces food supplies, while road closures delay the transportation of critical items. Energy disruptions further complicate logistics, impacting the availability of water and other necessities. The destruction of trees also limits the supply of wood products, driving up prices. These shortages highlight the urgent need for effective supply chain management during crises.

We urge you to subscribe to the Port X Logistics LLC LinkedIn page for industry information and up to date news following the LA wildfires and our panel of industry expert’s solutions for helping to strengthen your supply chain. To get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox email Marketing@portxlogistics.com

As Washington, D.C. prepares to shift to a new administration next week, the American Association of Port Authorities (AAPA) has released an 8-point wish list for it’s recommended policy agenda to support the U.S. Seaports. According to AAPA, the policies are necessary to revitalize America’s ports, keep America safe and secure, and unleash sustainable economic growth. The announcement comes shortly after the 119th Congress began its 2025 session on January 3, and just days before the January 20 inauguration of Donald Trump for a second term as president.

The AAPA said one of its top priorities is infrastructure spending. It asked Congress “not [to] rescind infrastructure spending” from the Inflation Reduction Act and the Bipartisan Infrastructure Law (BIL), two hallmark pieces of legislation from the outgoing Biden administration. The AAPA also joined many other business groups in opposing Trump’s plans for fresh import tariffs, arguing that higher import duties may reduce cargo volumes and affect port revenues.

In AAPA’s words, its policy agenda includes:

- Reauthorizing oversubscribed mainstay infrastructure grant programs

- Ensuring timely passage of navigation channel funding

- Opposing tariffs that hurt consumers and stifle growth

- Reforming burdensome federal permitting

- Pushing back against and educating stakeholders on the harmful effects of vessel speed restrictions

- Empowering ports to power America with an all of the above energy strategy

- Securing our ports and their assets from potential threats with the necessary resources and personnel

- expediting “Build America Buy America” waivers and incentivizing domestic manufacturing of ship-to-shore cranes.

In support of those ideas, AAPA staff have already begun meeting with members of congress and industry to advocate for the priorities. And AAPA’s president & CEO, Cary Davis, and John Bressler, its VP of government relations, have met with President-elect Trump’s transition team, as well as with US Department of Transportation Secretary nominee Sean Duffy’s team. Any existing and expanded tariff revenue should be used to fund port infrastructure, which would strengthen our supply chains and have a deflationary effect on the economy,” the AAPA said.

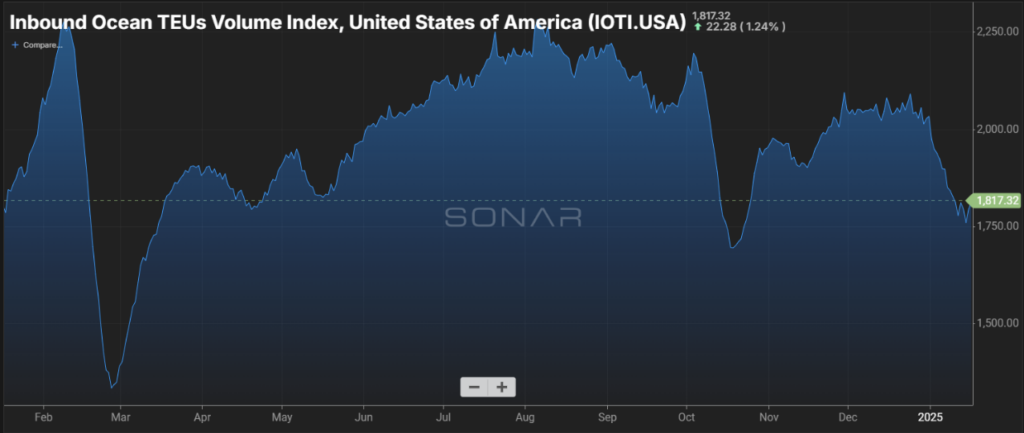

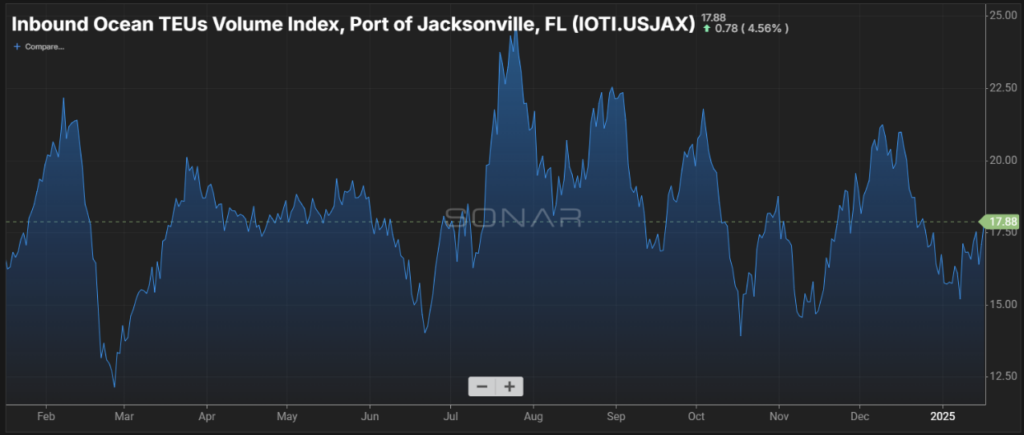

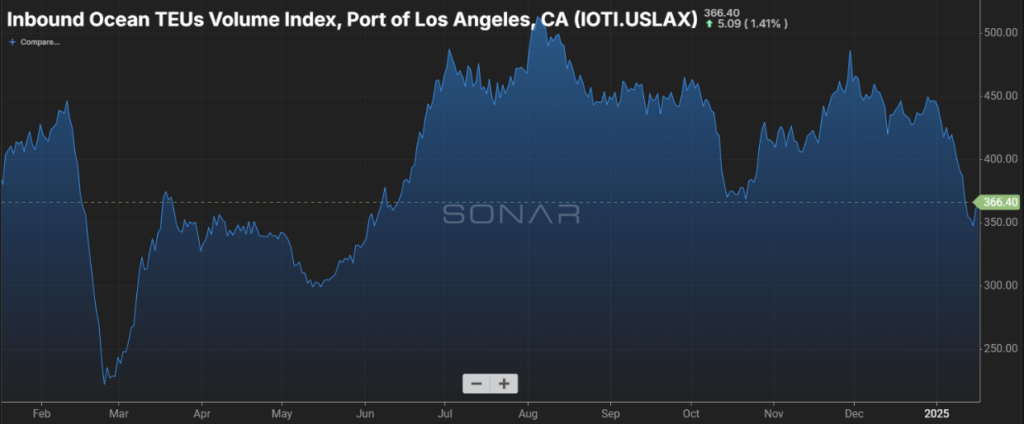

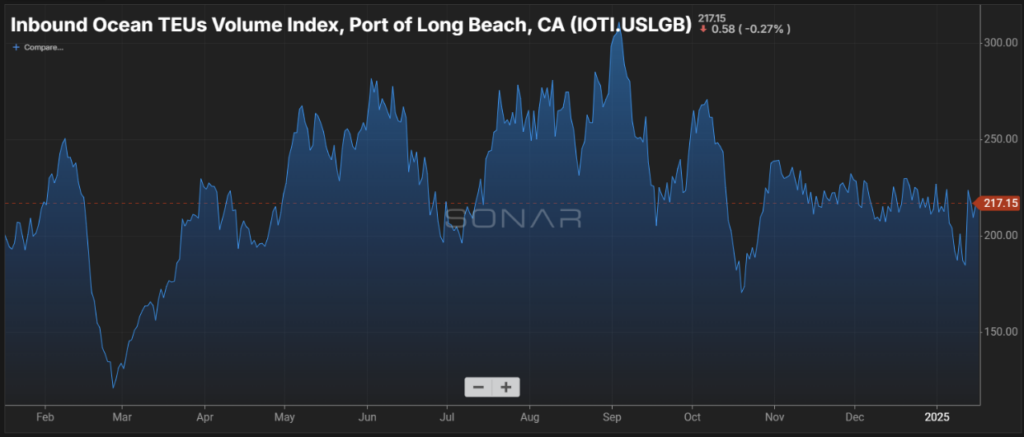

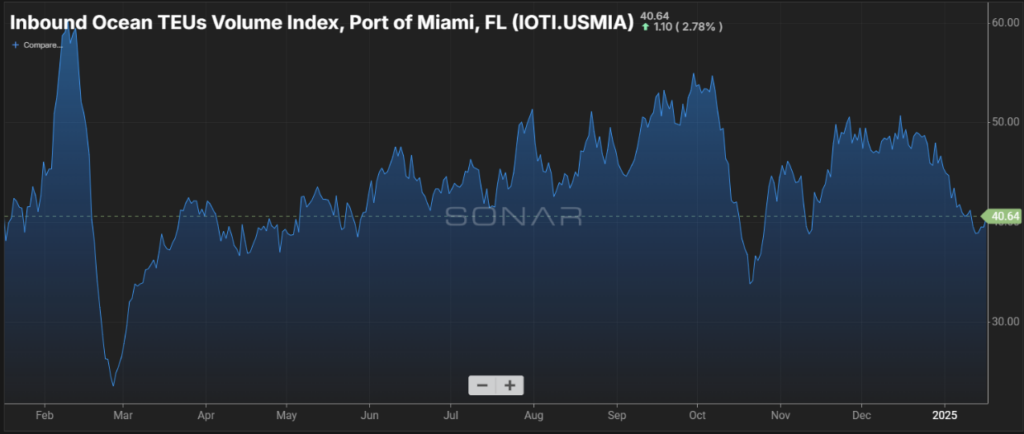

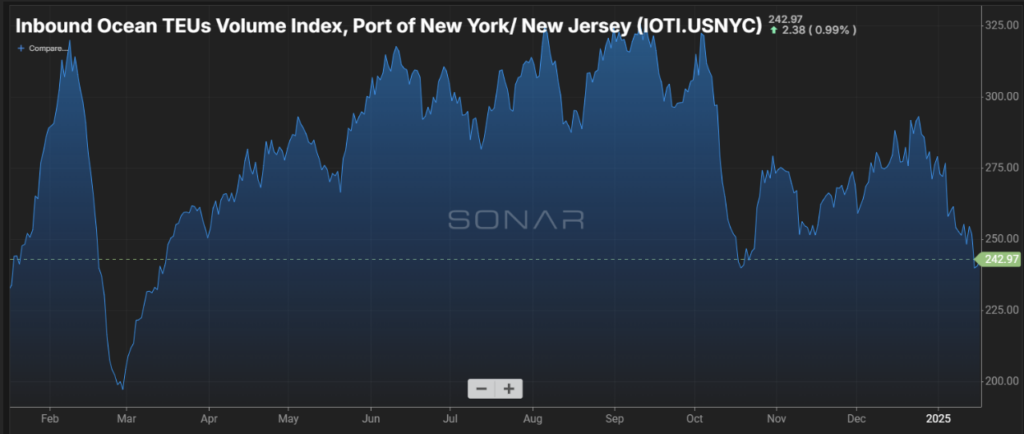

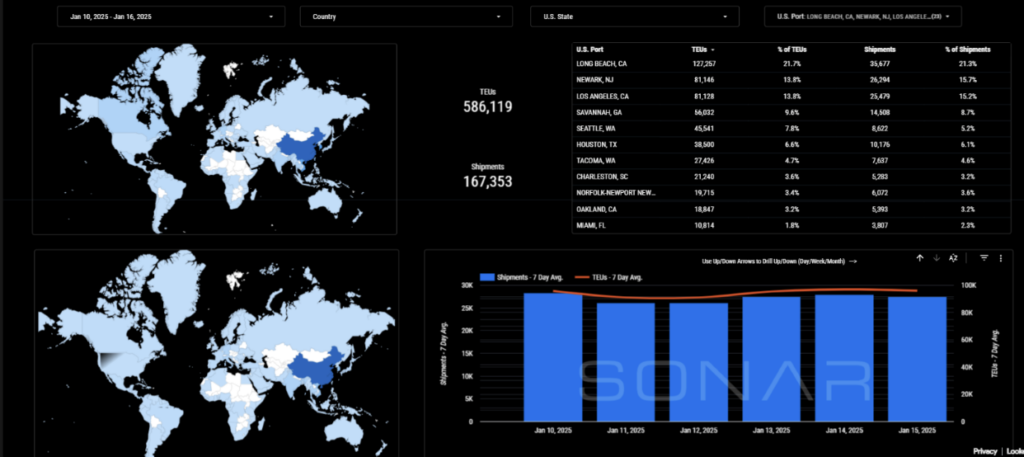

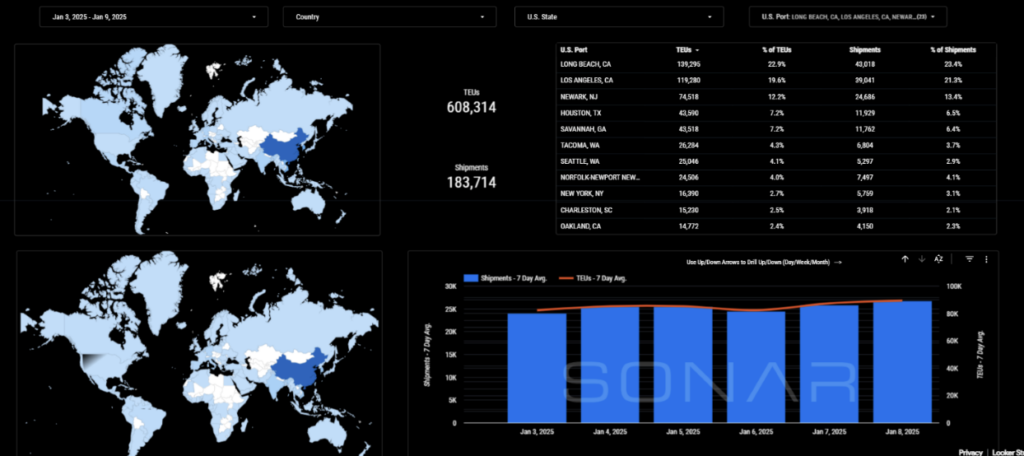

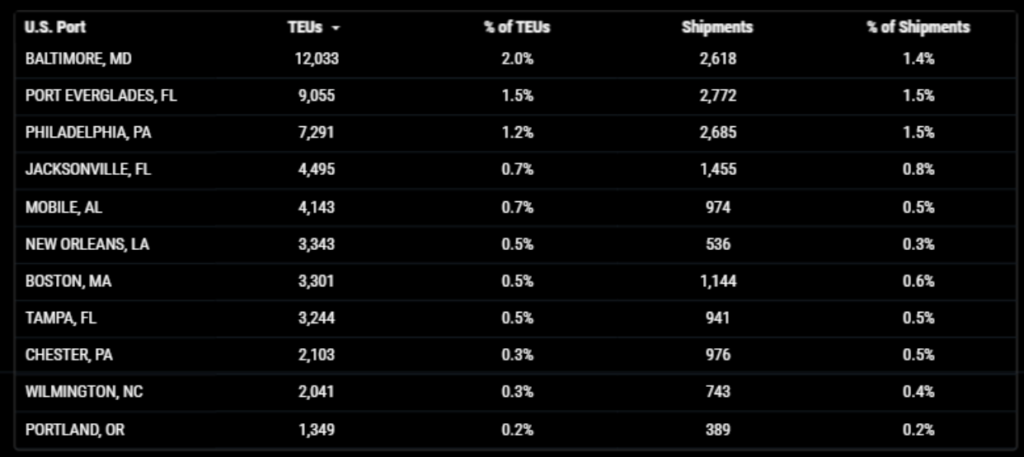

Import TEUs are down 3.64% from this week from last week – with the highest volumes coming into Long Beach at 21.7%, Newark at 13.8% and Los Angeles at 13.8%. Outbound Truckload spot rates from some of the major U.S. seaport markets jumped significantly toward the end of 2024, with the normal seasonal pattern getting an additional boost from a potential strike at ports along the East and Gulf coasts. The average outbound dry-van shipper-paid truckload spot rate from New York and New Jersey rose 7% month over month in December to $2.38 per mile, according to a JOC analysis of pricing data on more than 4,000 lanes from DAT Freight & Analytics, Loadsmart and other collected data sources.

On the West Coast, the average outbound truckload spot rate from Los Angeles rose 5% in December to $2.77 per mile, a 26-month high.

In Seattle, the average rate rose 4% from the prior month, climbing to $2.37 per mile. That was a 19% increase for Seattle from May, which, coupled with a 10.8% rate hike from Los Angeles in the same period points to the impact of cargo shifting from the East and Gulf coasts — and from Canada in the case of Seattle — to the West.

Overall, spot truckload rates are expected to decline towards the end of January through February, both weaker months for trucking demand. The extent of that decline may depend on the severity of winter weather, or impacts of the current state of Southern California, but typically demand tends to only pick up closer to the spring season.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

Seattle/Tacoma: Do you want to learn how shipping through the SEA/TAC ports can benefit your supply chain and if you are looking for an all-star drayage/transload warehouse team? Our Seattle operation has plenty of drayage capacity with the addition of 11 new drivers and a huge amount of warehouse capabilities for ongoing transloading projects. Contact letsgetrolling@portxlogistics.com for capacity and great drayage and warehouse

LA/LGB: Average Dwell time on Terminal as well as On-Dock Rail dwell time has slightly increased this week from next week. Although we do not know the current state of container volumes affected by the wildfires, we are keeping an eye on whether we will start to see any signs of congestion or chassis shortages. We currently have immediate drayage capacity to pull your LA/LGB containers for drayage an transloading, capacity is tendered to on a first come first serve basis. contact letsgetrolling@portxlogistics.com

Did you know? When traditional routes become unpredictable and time is of the essence, Carrier 911 is built for the challenge. Our team thrives in high-pressure logistics, navigating complex roadblocks to keep your freight moving, no matter the urgency. When every second counts, we’ve got the expertise, tech, and 24/7 support to make it happen. info@carrier911.com

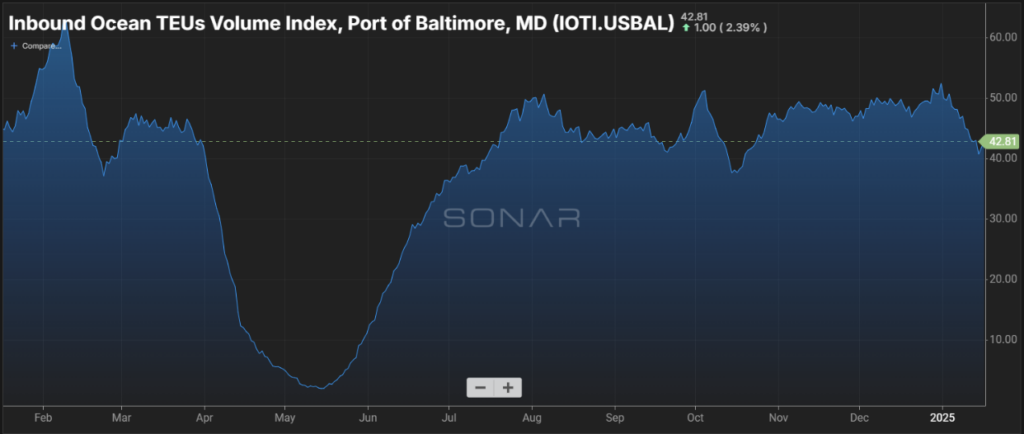

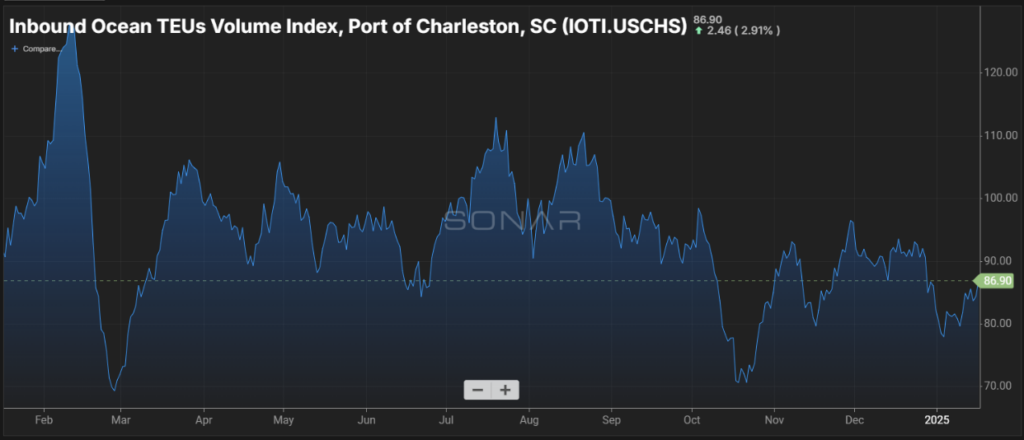

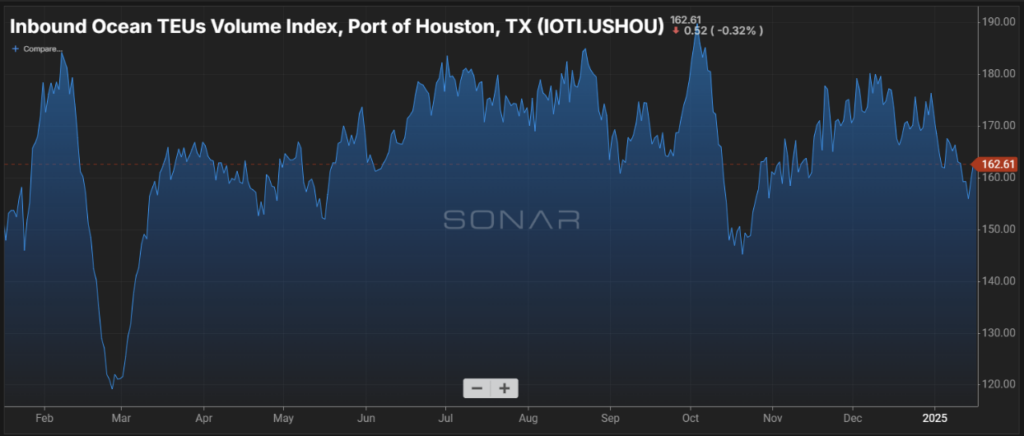

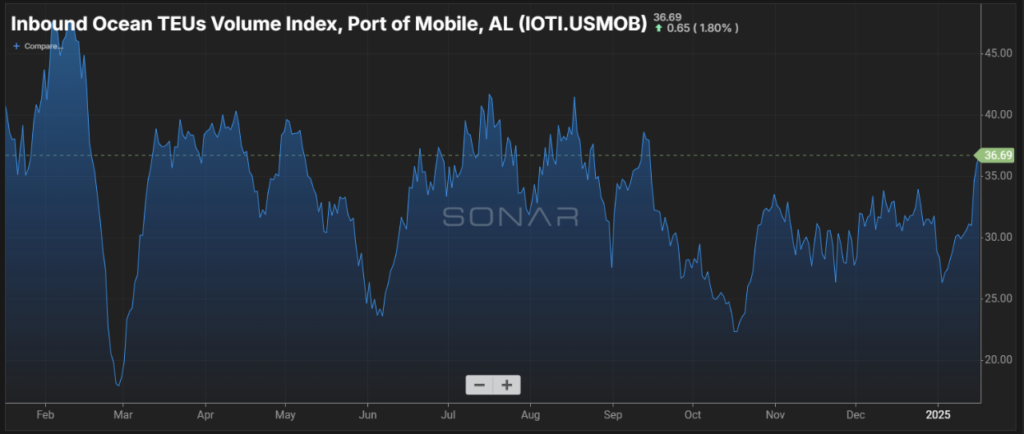

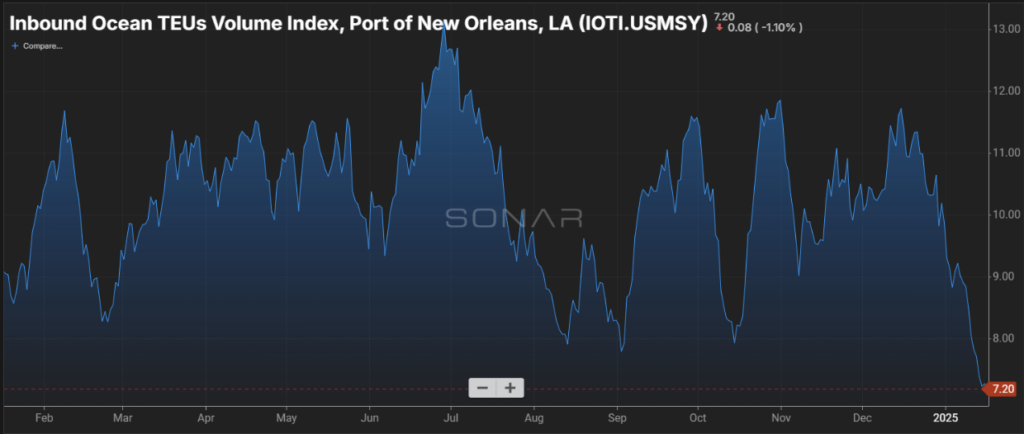

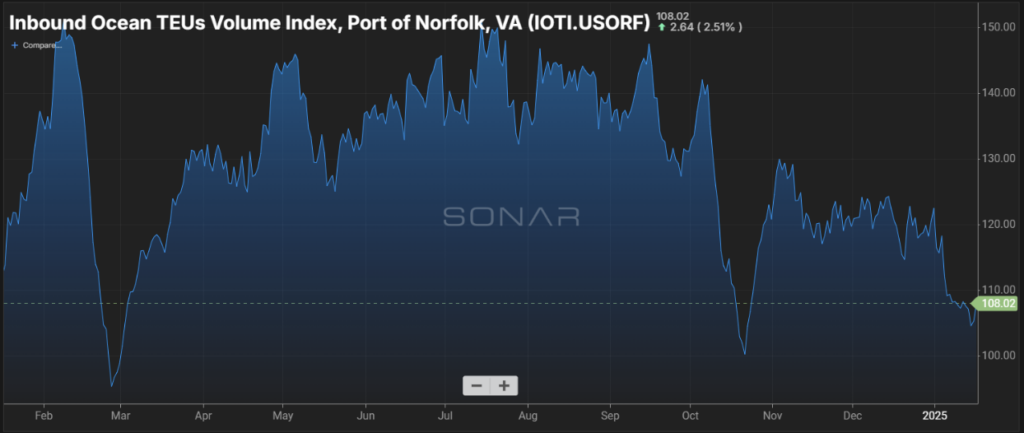

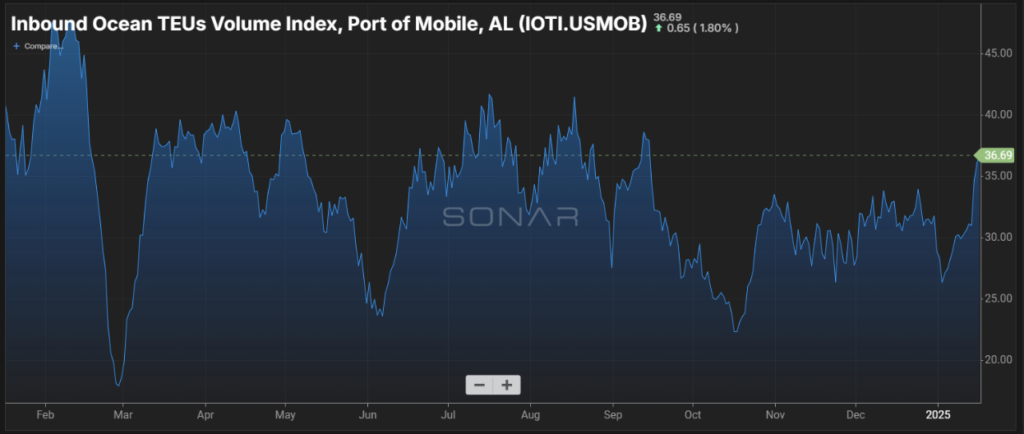

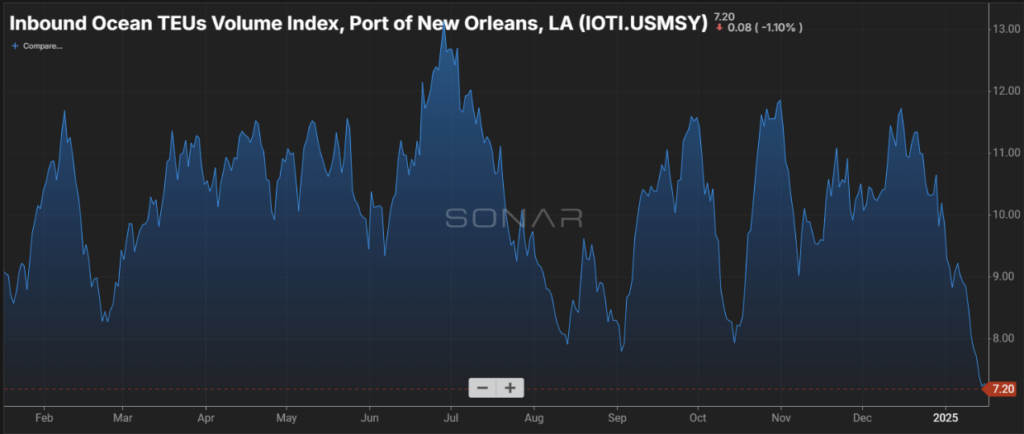

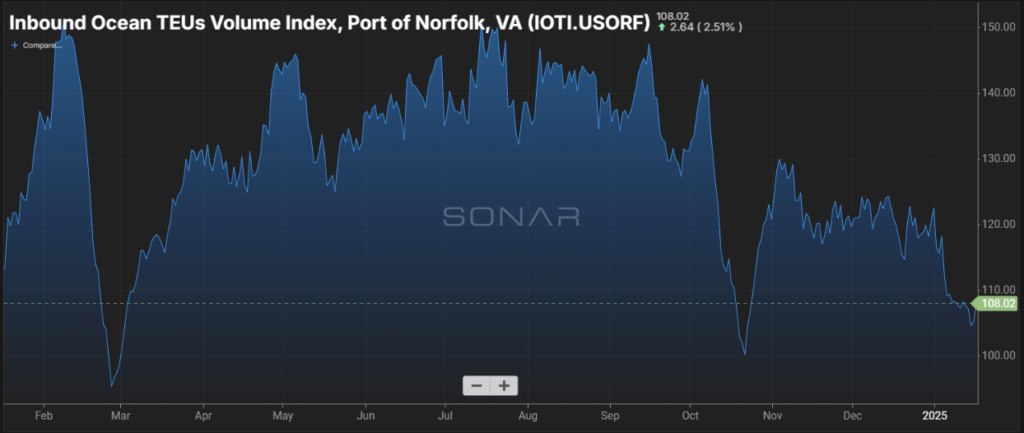

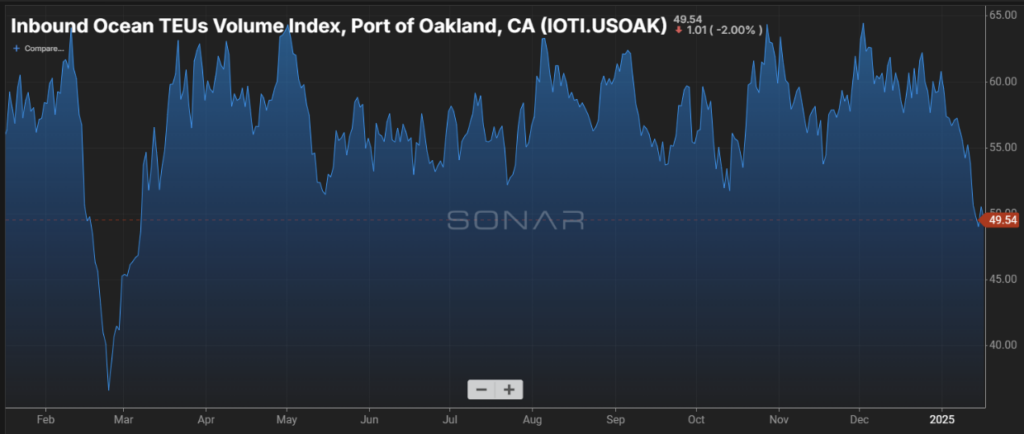

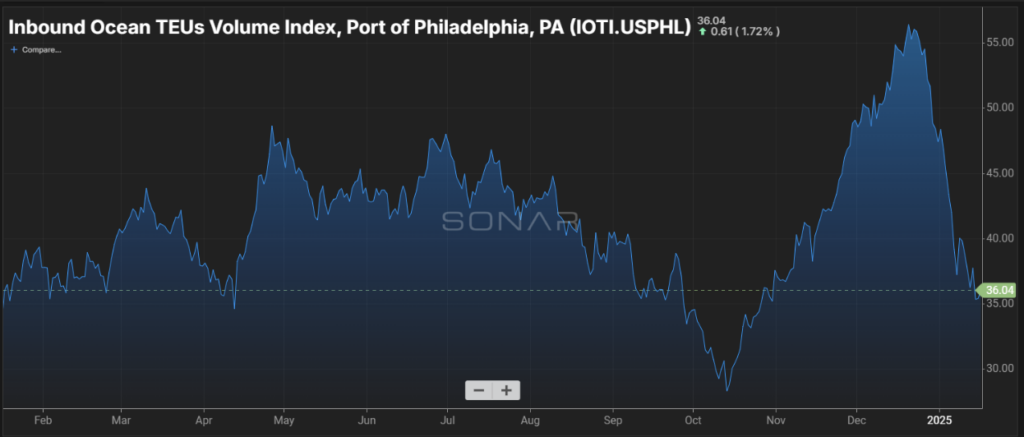

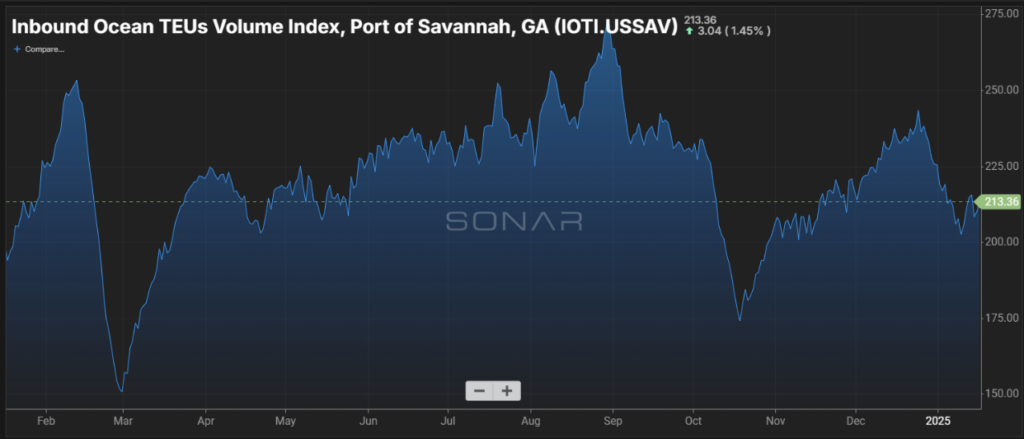

SONAR Data Import Images