1437 words 5 minute read – Let’s do this!

We made it to the end! Our last Market Update for 2024 – what a wild year it has been. Strikes in both the U.S. and Canada, Market fluctuations everywhere caused by the Panama Canal and Red Sea diversions, wars in Europe and the Middle East, and now a huge change in the U.S. Administration.

Check out our past blogs to get experience of the year in review on our blog page https://portxlogistics.com/blog/. We encourage you to subscribe to the Port X Logistics LLC LinkedIn page for more helpful industry information and up to date news and solutions for your supply chain, and to get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox email Marketing@portxlogistics.com

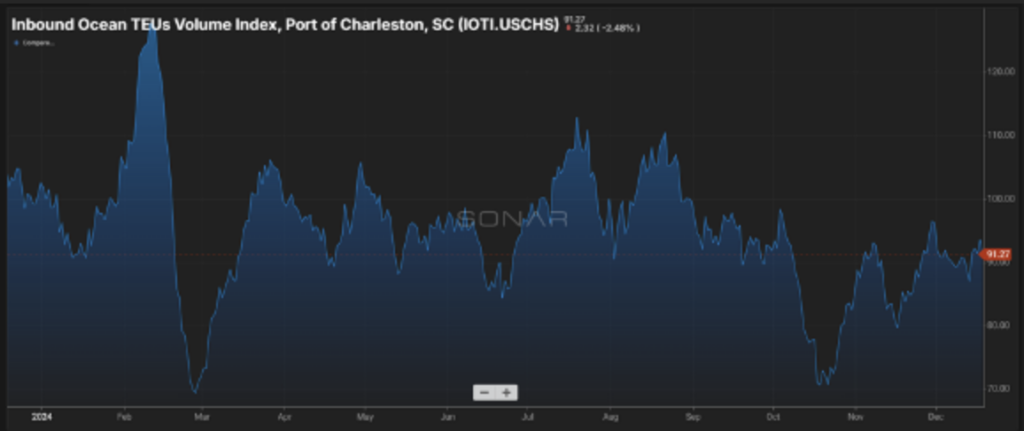

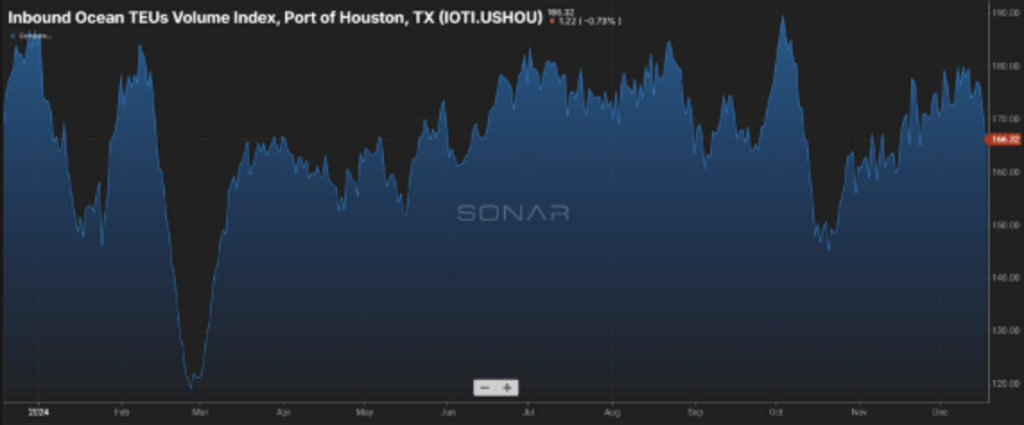

The strikes are not entirely over and new tariffs seem inevitable on imports from China and Canada. Shippers have started transitioning some of their shipments away from the East and Gulf Ports and there is anticipation that Asian imports will increase in order to be ahead of any new tariff changes and the upcoming Lunar New Year.

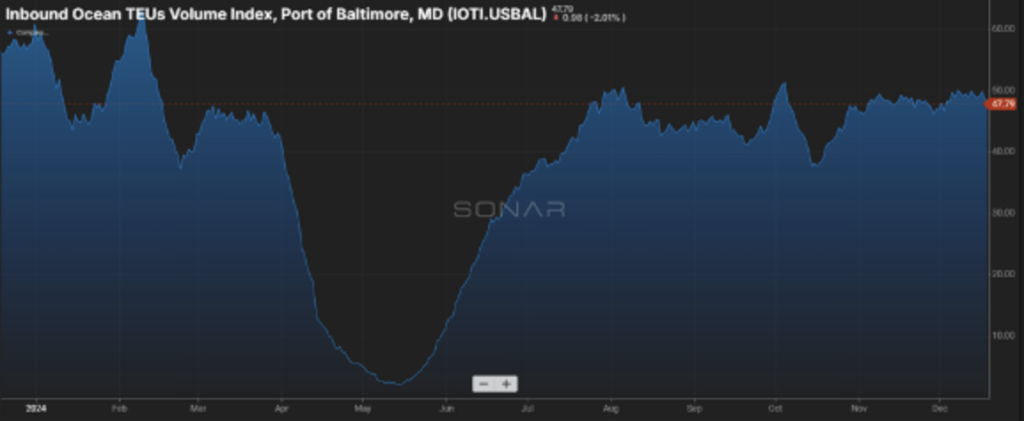

Last week President-elect Donald J. Trump offered his support to the International Longshoremen’s Association (ILA). Trump said that he had met with ILA leaders and was sympathetic to their concerns: “I’ve studied automation, and know just about everything there is to know about it,” he wrote. “The amount of money saved is nowhere near the distress, hurt, and harm it causes for American Workers, in this case, our Longshoremen.” The ILA believes ports are using automation to reduce the number of workers needed to handle cargo. But the employers, mainly large shipping companies, say automation is central to their efforts to make U.S. ports cheaper to use and more efficient. The employers’ negotiating group, the United States Maritime Alliance, released a statement on Thursday that said, “We need modern technology that is proven to improve worker safety, boost port efficiency, increase port capacity, and strengthen our supply chains.” Unions across the labor movement are watching the port dispute to gauge how supportive Trump may be of workers in his second term. What could this mean for the ILA as their contract extension expires on January 15th? The administration won’t step in to interfere with the possibilities of a strike if the union is not satisfied with the wage increase, benefits and port automation plans. This spells big trouble for the cargo flow in the East and Gulf coast ports. If the strike goes into effect, the immediate impact — as we also saw during the three-day strike in October — is that we will see vessels anchor up outside major US East and Gulf coast ports. We will also see some cargo discharged in alternate locations. In October some cargo was discharged earlier than planned in U.S. East Coast ports to get the cargo off the vessel before a strike, and some was discharged into regional hubs such as Freeport and Kingston. We are likely to see the same pattern unfold this time. Most U.S. East and Gulf coast ports reduced the strike-associated ship backlogs within weeks, but a longer work stoppage this time around could challenge even the most efficient marine terminals. There is plenty of cargo coming down the pipe. U.S. retailers aren’t expecting to let up on pulling through a surge of imports until early spring at the soonest, according to the latest Global Port Tracker.

Whenever supply chain disturbances directly affect the market like union uncertainty, remember Port X Logistics can play a role in helping to improve the flow of your supply chain – We are the Gold Standard in drayage, transloading and trucking. We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. Transload orders have been piling up as many shippers have been taking the early initiative to speed up deliveries whether it was an ocean delay or to avoid the rails, but we have all the capacity in the world for you! If you want more information on how you can get your cargo diverted at the port and on the road for a speedy delivery with full visibility contact Letsgetrolling@portxlogistics.com.

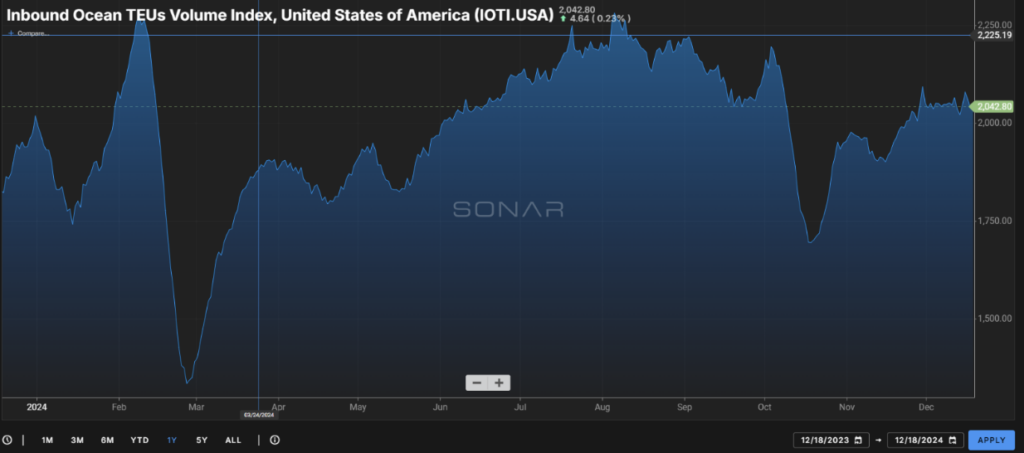

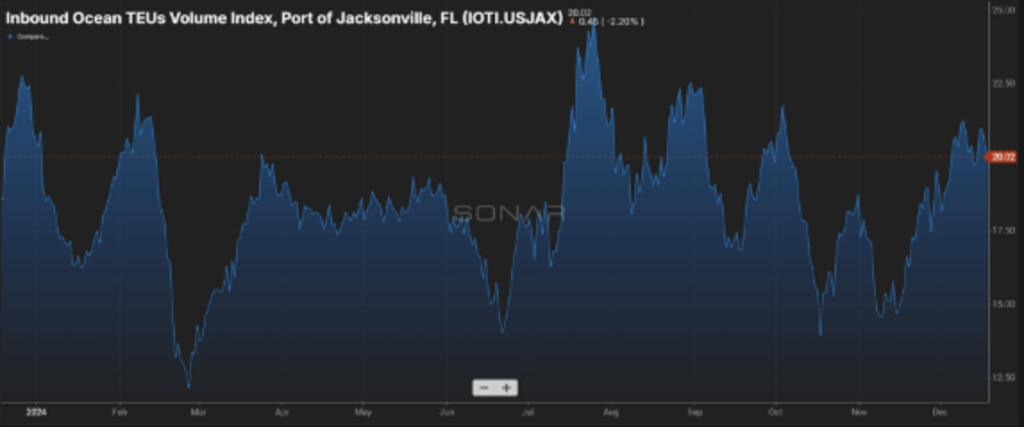

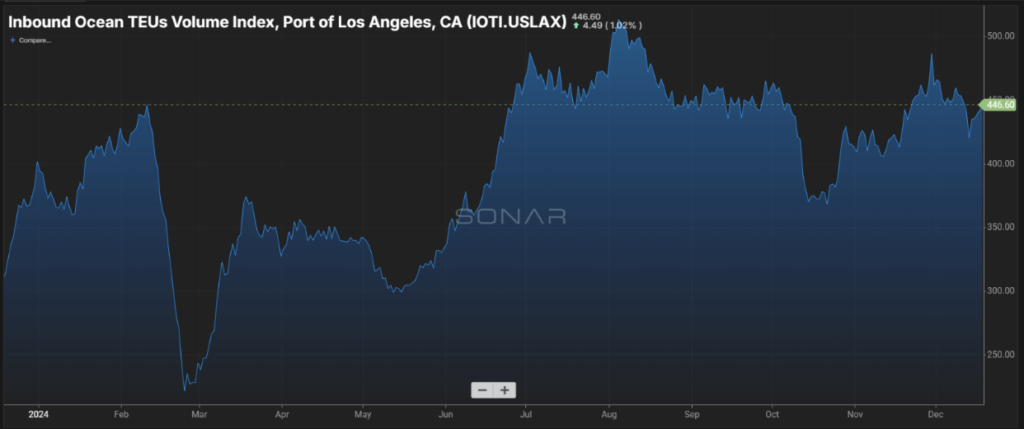

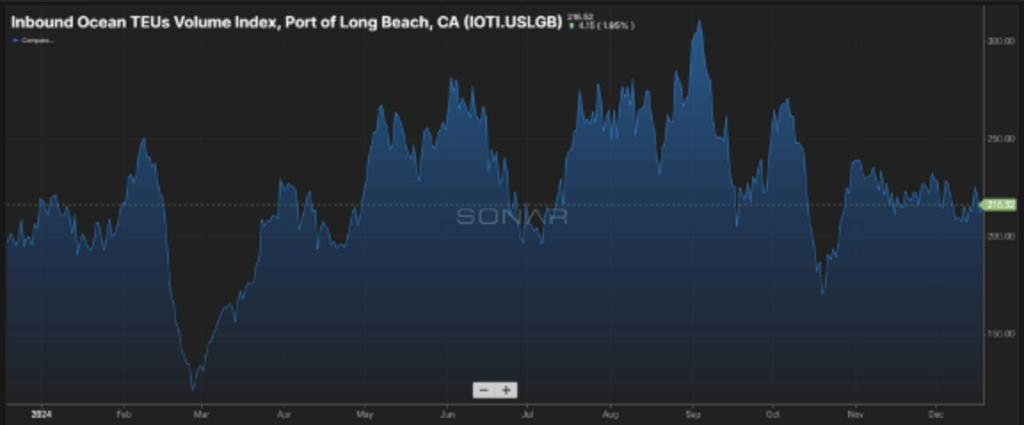

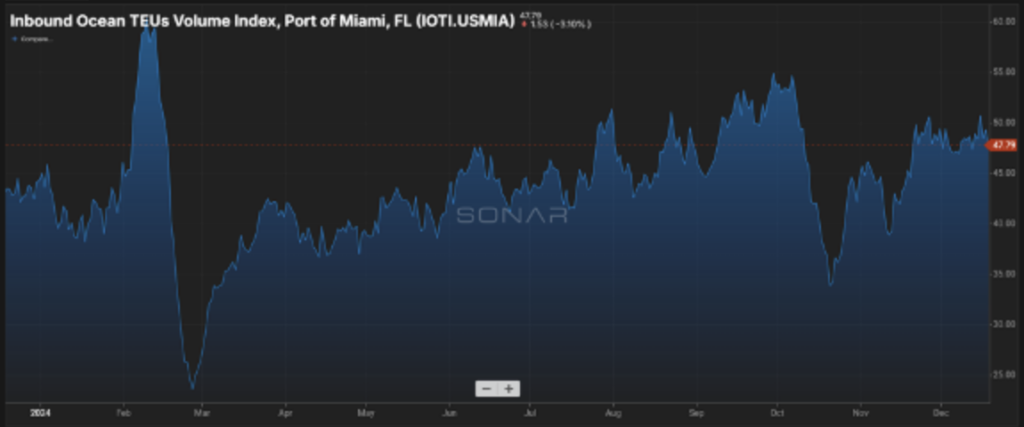

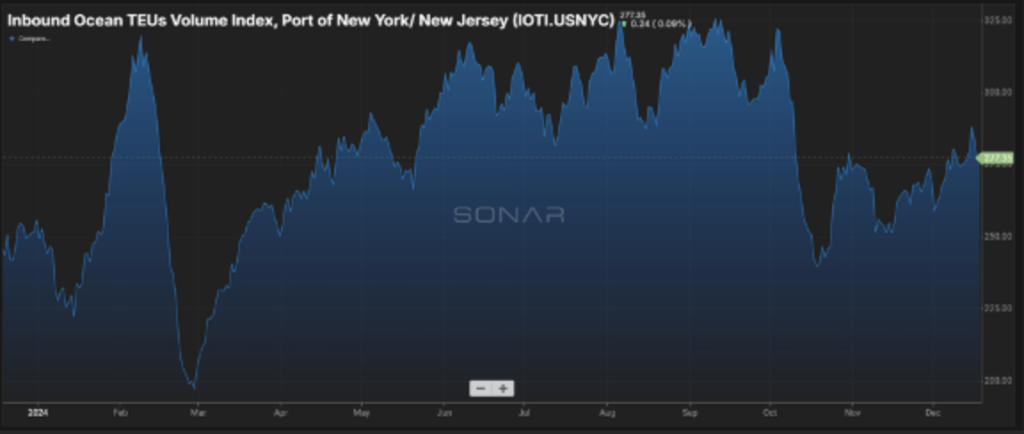

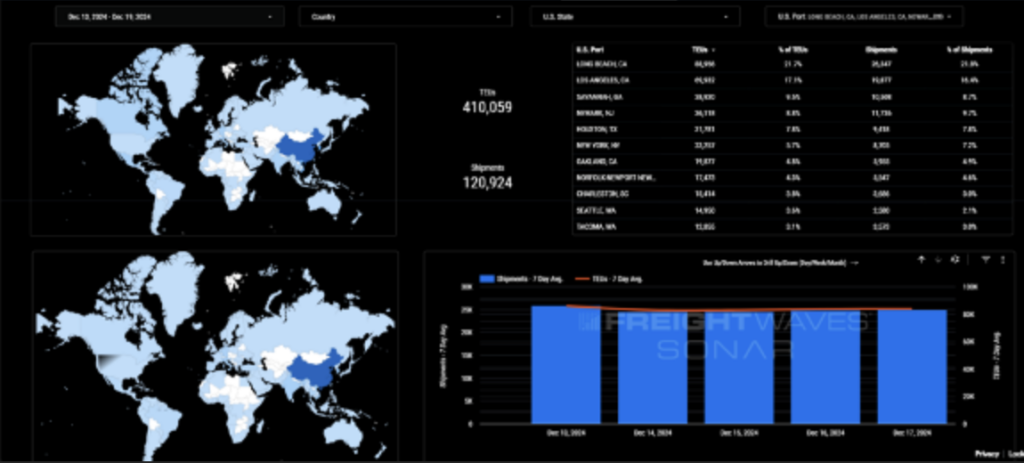

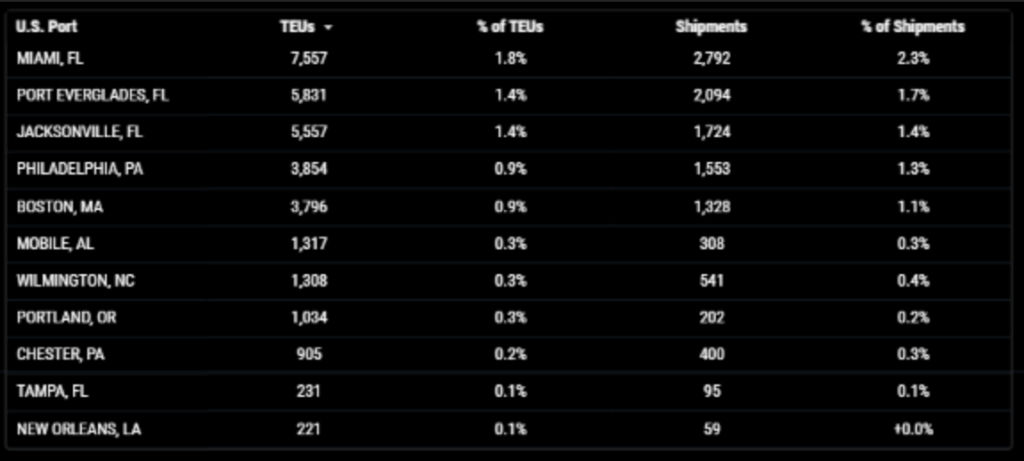

Import TEUs are down 19.07% from this week from last week – with the highest volumes coming into Los Angeles at 21.9%, Long Beach at 15.9% and Newark at 10.9%. Retailers are forecasting a strong close to December and a double-digit increase in U.S. imports from Asia in January. Global Port Tracker, which is published monthly by the National Retail Federation and Hackett Associates, forecasted a 14.3% year-over-year increase in import volume in December and a 12% increase in January. These factors have produced a near-historic rise in spot rates this week. The last time spot rates reached this lofty level in December, which is normally a slow month, was in mid-December 2021, when the West Coast rate was $8,760 per FEU and the East Coast rate was $10,300, according to Platts. The trans-Pacific in late 2021 came back strongly from the pandemic when U.S. imports from Asia had plunged.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

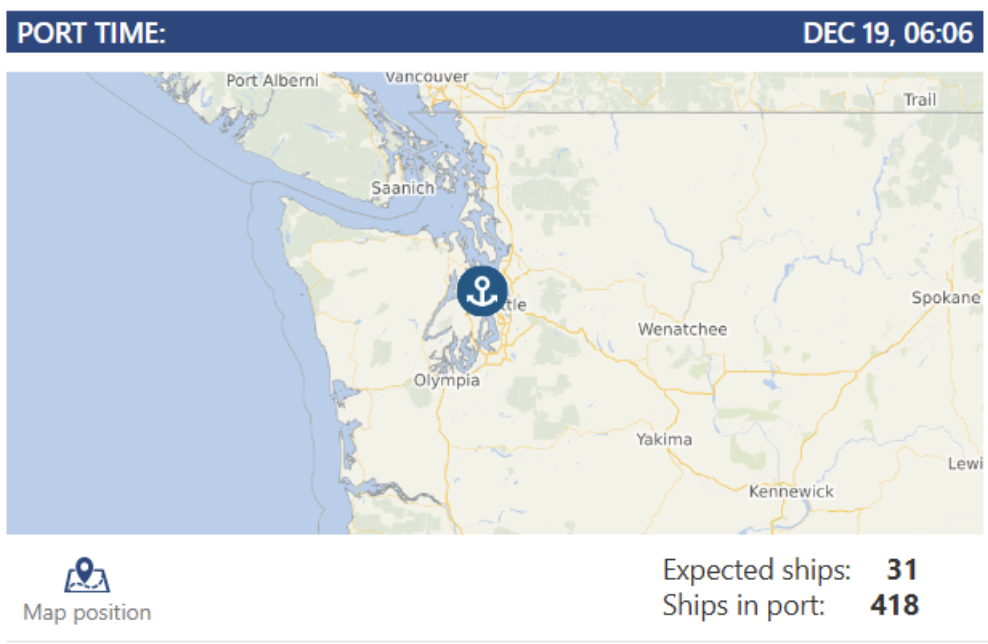

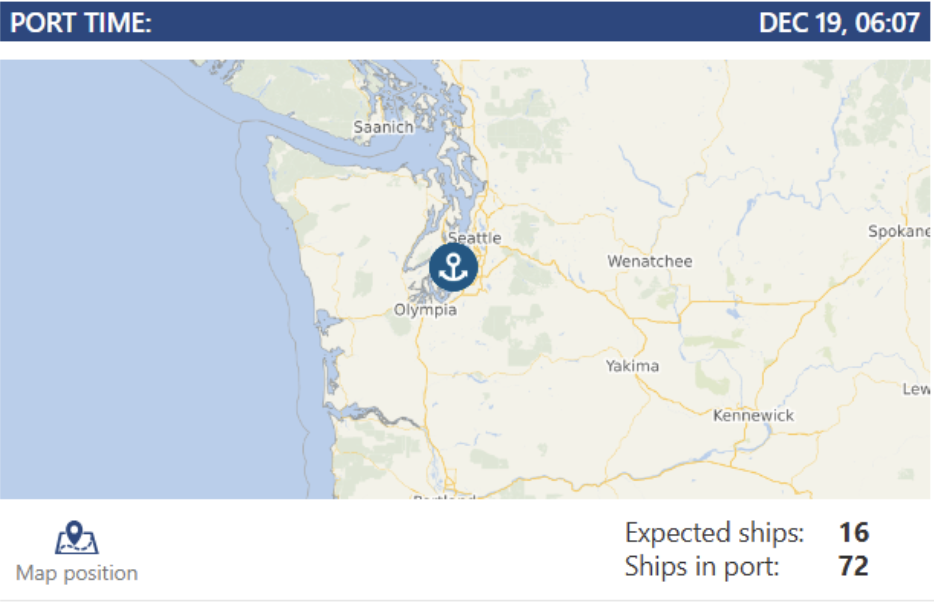

Seattle/Tacoma: The Port of Seattle and Washington Maritime Blue are renewing a Memorandum of Understanding (MOU) continuing their long-standing collaboration on maritime innovation and environmental stewardship. Building on years of successful partnership, this renewed MOU will further the productive partnership between the Port and Maritime Blue in supporting the development and growth of new maritime businesses working to advance innovative approaches to solving some of the Port and our region’s most pressing problems. This partnership also advances maritime businesses in a global marketplace, creates living wage jobs, and supports an innovative hub to reinforce Washington’s position as a leader in maritime innovation and sustainability. If you want to learn how shipping through the SEA/TAC ports can benefit your supply chain and if you are looking for an all-star drayage/transload warehouse team, our Seattle operation has plenty of drayage capacity with the addition of 11 new drivers and a huge amount of warehouse capabilities for ongoing transloading projects. Contact letsgetrolling@portxlogistics.com for capacity and great drayage and warehousing

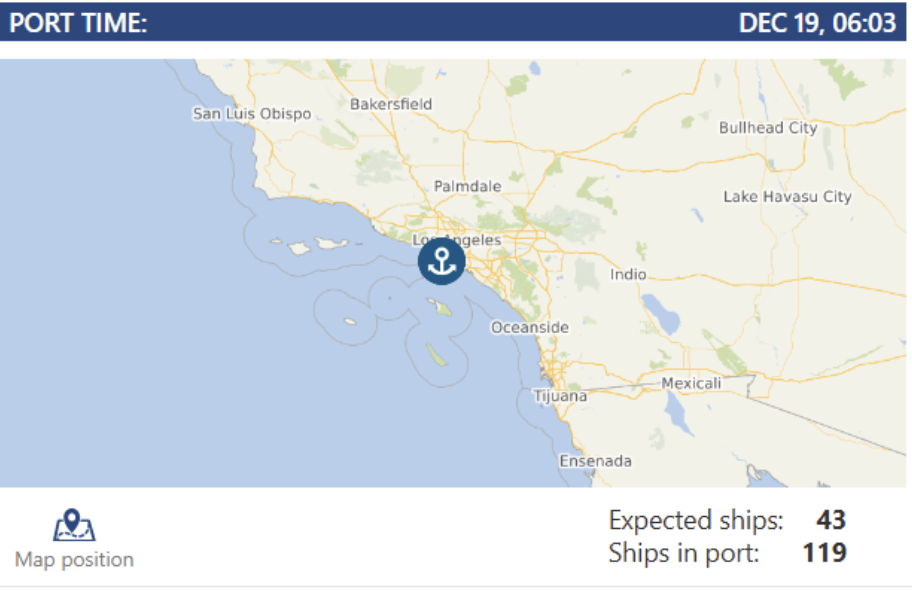

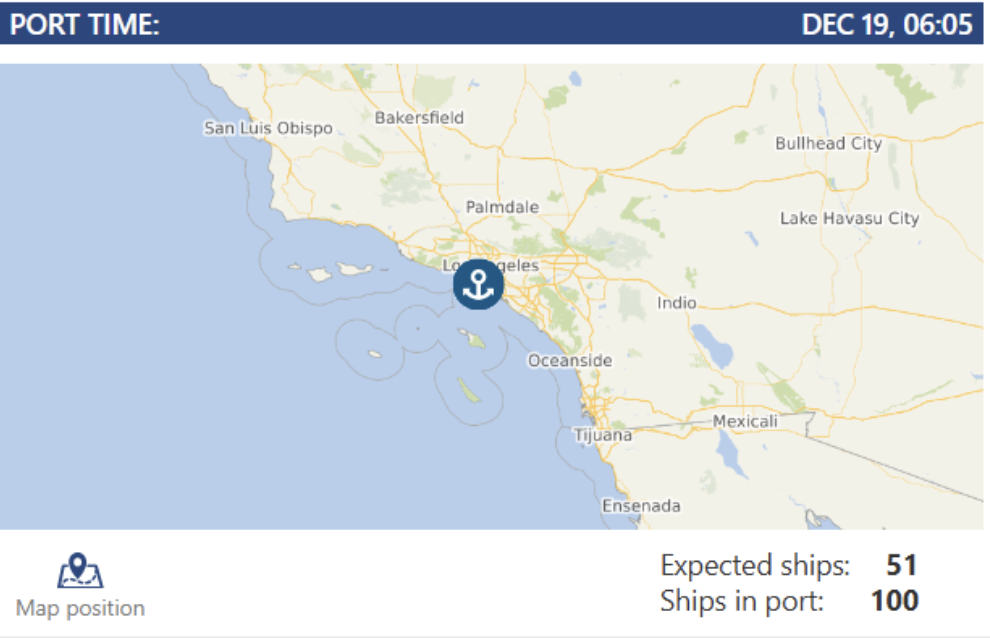

LA/LGB: The Port of Los Angeles is set for its busiest December on record, and the Port of Long Beach is on track to have its best-ever year after the container hubs handled an early and sustained peak season in 2024. Both LA and Long Beach Ports — which together account for roughly a third of all U.S. container imports — have gotten more traffic as some businesses reroute goods via California, to avoid disruption from the still unresolved that shut down East and Gulf coast ports in October and potential upcoming tariffs. So far in 2024, the Port of Los Angeles has processed 9.4 million TEUs, 19% more than in 2023 and 7% above the five-year average, Seroka said. Last month, the container hub handled 884,000 containers, up 16% from the same month last year.

If you have hot containers that need to get moving we recommend diverting your hot rail containers to the port for transloading. We have immediate capacity to pull your diverted containers for transload to avoid the rail, capacity is tendered to on a first come first serve basis. Interested in learning how to expedite diverted containers or looking for LA/LGB dray capacity? contact letsgetrolling@portxlogistics.com

Did you know? Every year our Founder BK sets up the New Year tone with his Market predictions of the New Year – This year is no exception. Check out his prediction list here and comment your 2025 predictions or ask him why the “McRib”?

If you are interested in chatting with BK or meeting with him at TPM25 email marketing@portxlogistics.com

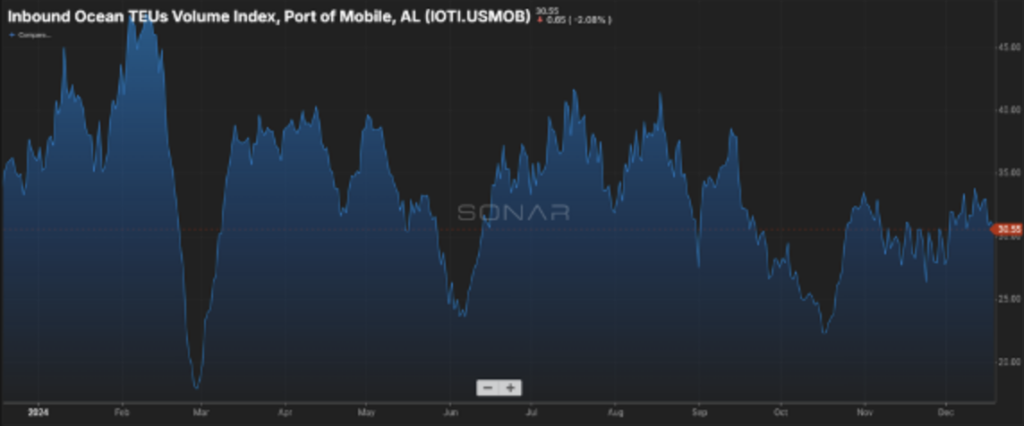

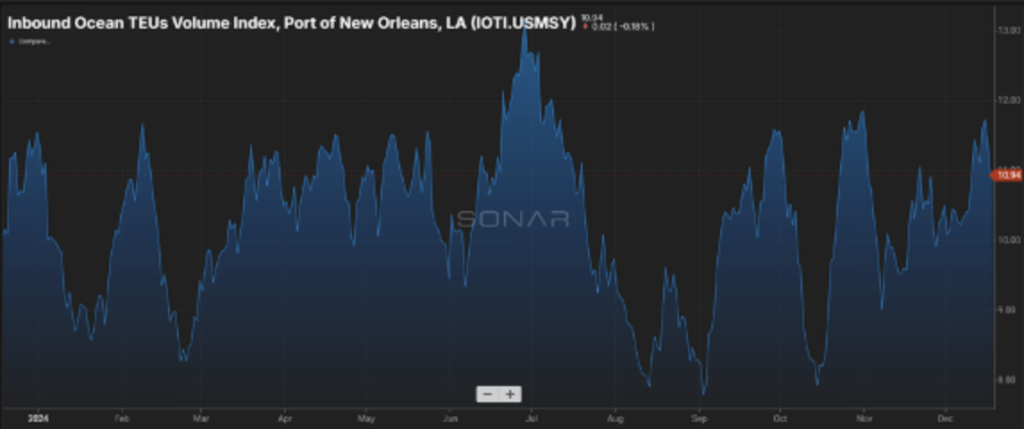

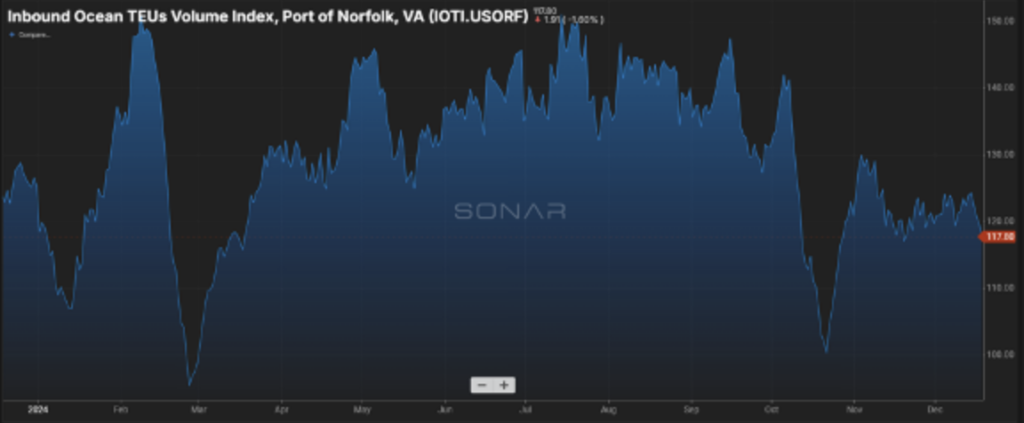

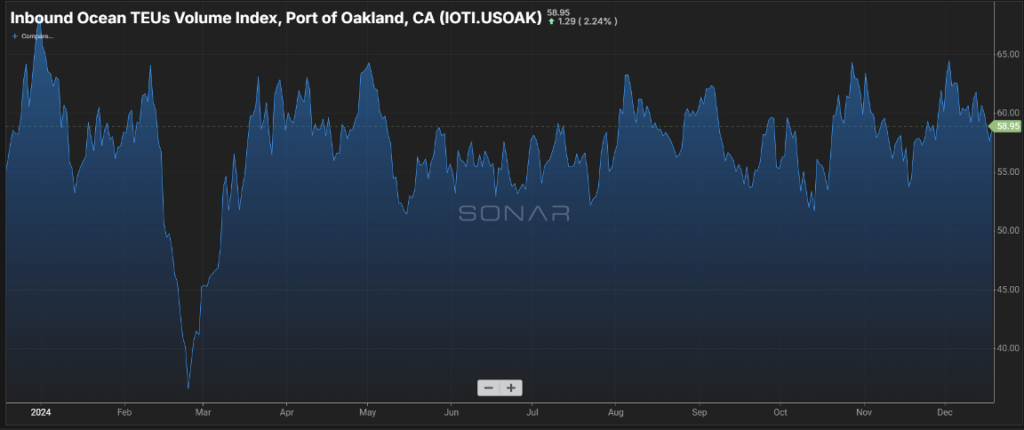

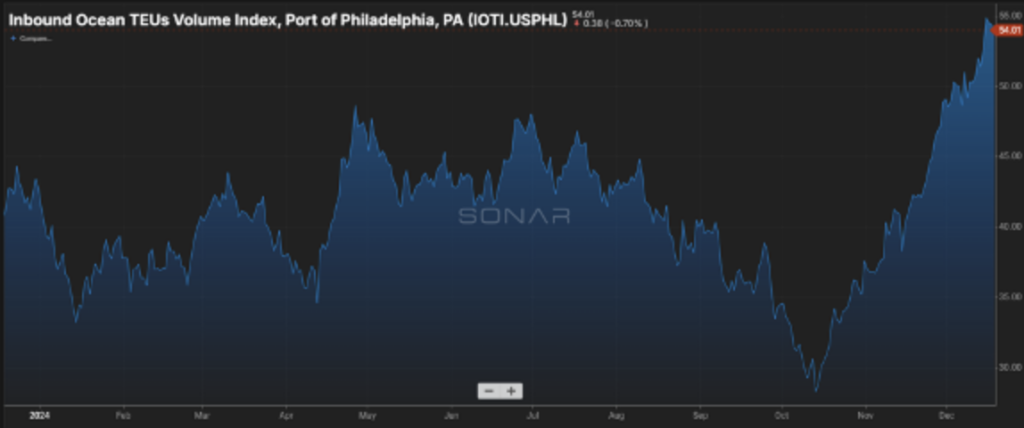

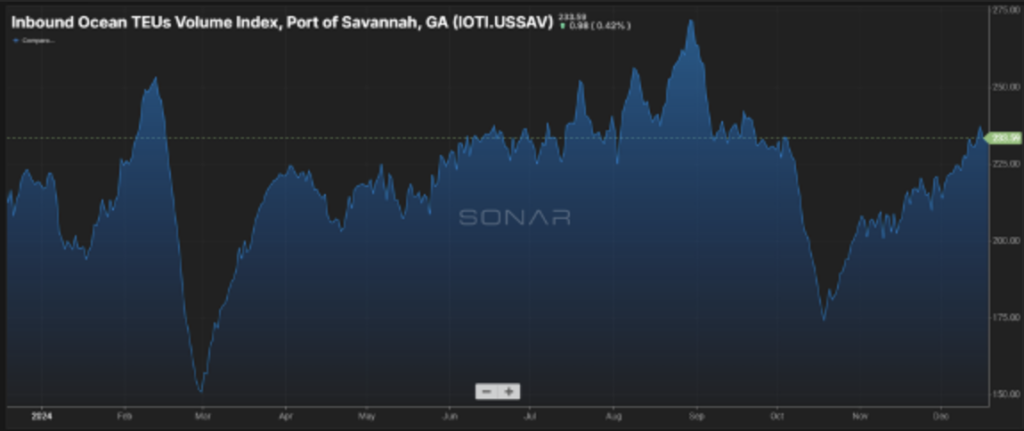

SONAR Import Data