1450 words 5 minute read – Let’s do this!

Today is my little brother Jeff’s birthday, so a special shout out to him! The election is over and it was a pretty big win for Donald Trump and the Republican party, another historic event to wrap up 2024.

There are new policies to come into 2025 that will affect the U.S. economy and market, and it will be an interesting year to see how the market tables turn.

President Trump will take office just days after the set January 15th date to resolve outstanding issues with the United Maritime Alliance (USMX) and renew their already expired contract – and it could result in the new administration pressuring the ports to accept a deal that includes some concessions to the ILA’s demand to limit port automation. The ports are already well behind the international standard for automation, in large part thanks to the unions. Uncertainty still remains as it is up in the air still on how the negotiations will play out and if it could lead to further issues at the U.S. East and Gulf Ports mid to late January. We encourage you to subscribe to the Port X Logistics LLC LinkedIn page for up to date news and solutions for your supply chain, and to get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox email Marketing@portxlogistics.com

Disruption continues across Canadian ports as rail embargoes are announced – and with no end in sight, carriers must weigh up whether their ships wait at anchorage or turn around. The union representing longshoremen at the port of Montreal, CUPE 375, began an indefinite strike on October 31st over its contract dispute with the Maritime Employers Association, affecting container terminals operated by Termont and with no indication of when it might end.

This past Tuesday at 7 am, Montreal Gateway Terminals (MGT) rail operations at both Cast and Racine facilities were suspended “until further notice”, due to “operational constraints and uncertainty”. As a result, Canadian National will suspend and remove all capacity at its inland terminals for exports destined for Cast and Racine. But despite the closure of rail lanes from the U.S. to Montreal, truck gates will remain open.

Meanwhile, on the Canadian west coast, The British Columbia Maritime Employers Association (BCMEA) formally initiated a lockout of over 700 unionized West Coast port workers on Monday (November 4th). BCMEA has been negotiating with the International Longshore and Warehouse Union Local 514 (ILWU514) since its labor contract expired.

With no new collective agreement reached, Frank Morena, president of ILWU Local 514, told BCMEA that the union would engage in limited job action only, with an overtime ban and a refusal to implement technology change, beginning November 4th. In response, to facilitate a safe and orderly wind-down of operations, BCMEA issued the lockout.

BCMEA presented its “final offer” to ILWU Local 514 the weekend just before the strike activity and lockout. The offer remains open until withdrawn. The proposed contract includes an increase in median compensation from C$246,323 to C$293,617 and an average C$21,000 lump sum signing bonus, including retroactive pay. Additionally, if accepted, the ILWU Local 514 retirement payment will increase to C$108,750 above and beyond their pension and benefits.

“ILWU Local 514’s strike action has already begun to impact B.C.’s waterfront operations, and strike activity can easily escalate, including a complete withdrawal of labor without notice,” said BCMEA on its website. “Accordingly, to facilitate a safe and orderly wind-down of operations, the BCMEA has made the difficult decision to lock out forepersons and other Local 514 members on November 4th, 2024 commencing on the 16:30 shift and continuing until further notice. This lockout will not apply to grain or cruise operations,” said BCMEA.

Some of the commodities affected are potash, coal, pulse crops, beef, pork and forestry products. A strike could put $800 million in trade that flows through the ports at risk per day.

A BCMEA coastwide lockout will also remain in effect until further notice. Railroad Canadian Pacific Kansas City (CPKC) said export loads and pre-billed empties destined for the port of Vancouver would not be accepted, but non-billed marine empties were still being accepted. Canadian National Railway (CN) has suspended all international intermodal capacity at its inland terminals, including CSX & NS interchange traffic from Ohio Valley, for exports destined for Prince Rupert, Roberts Bank, Centerm, Vanterm and Fraser Surrey Docks.

Will the Canadian government intervene with these lockouts? During his nine-year tenure, Prime Minister Trudeau has waited more than two weeks to end various port strikes and a political protest in 2020 that shut down western rail networks. Under his watch, Canada in August experienced its first nationwide strike, albeit only 17 hours, involving both Class I railroads since 1987. Conservative coziness with organized labor has tempered Parliament from ordering unions back to work.

If you have questions on how the current state of the Canadian ports could affect your upcoming shipments, or how your shipments will even be affected after the ports come to terms with the Labor Unions, our team in Canada has years of knowledge and experience with all Canadian ports and we can dray, transload and provide crossborder deliveries to and from all Canadian ports. Contact the team at Canada@portxlogistics.com

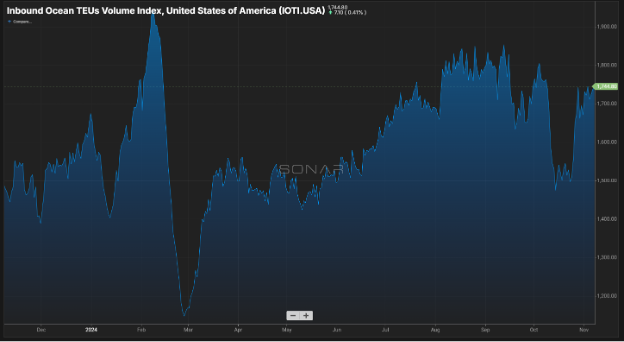

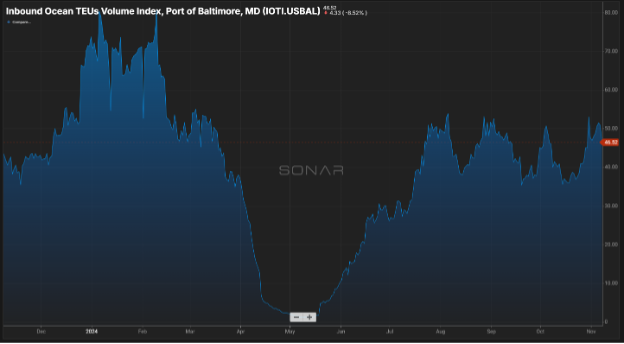

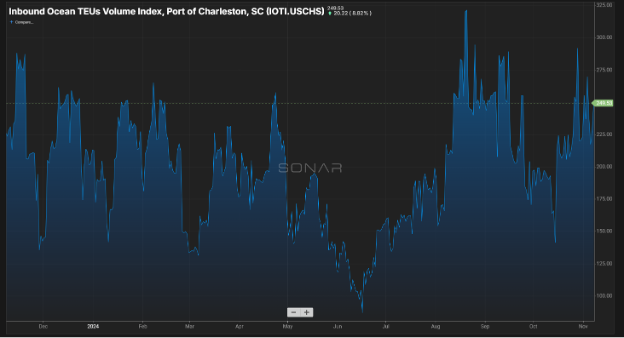

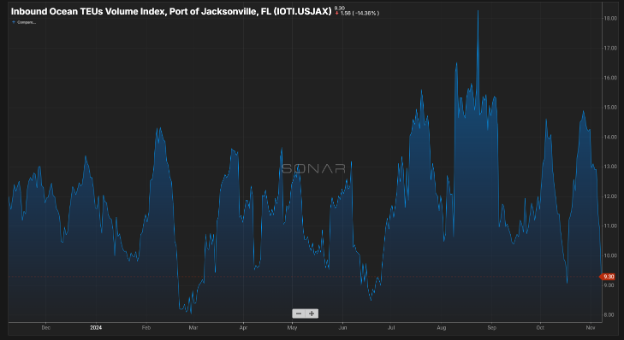

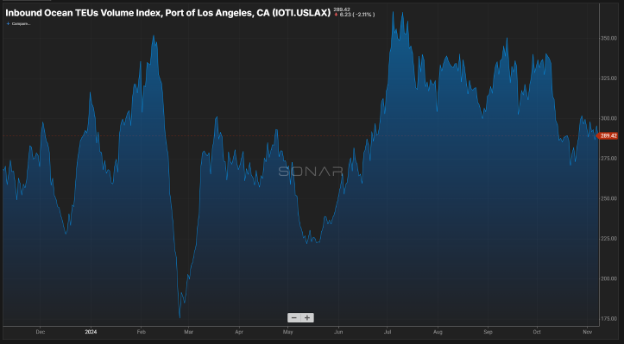

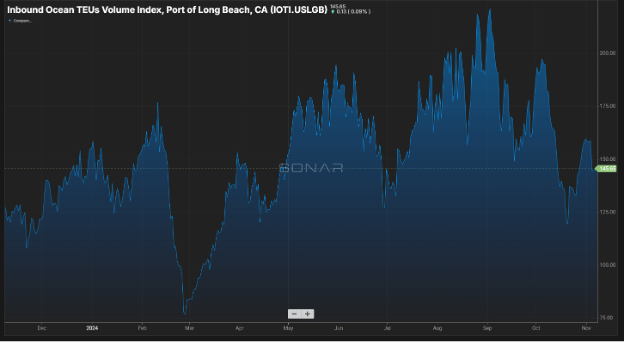

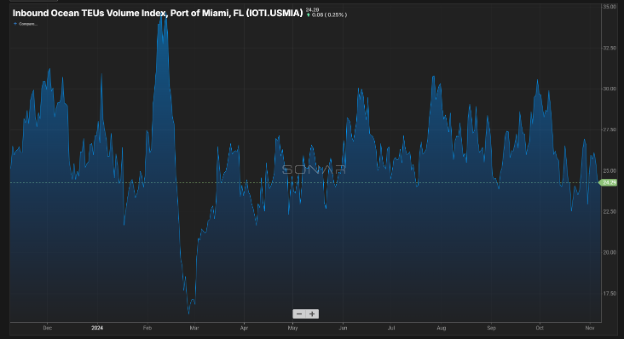

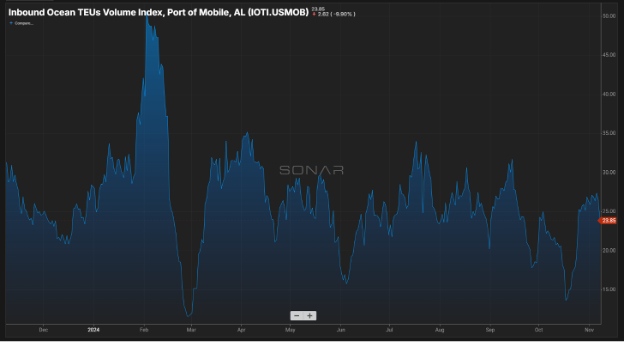

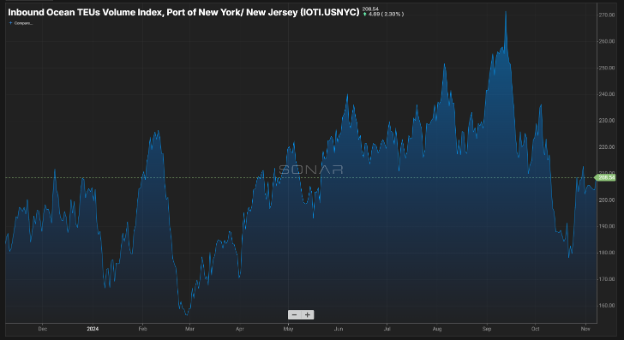

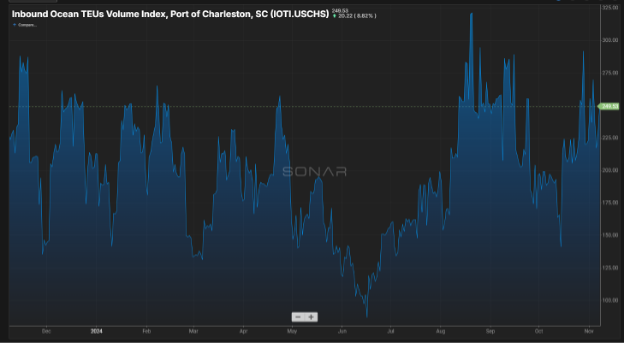

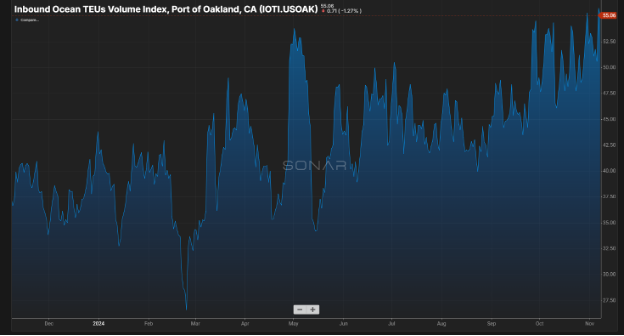

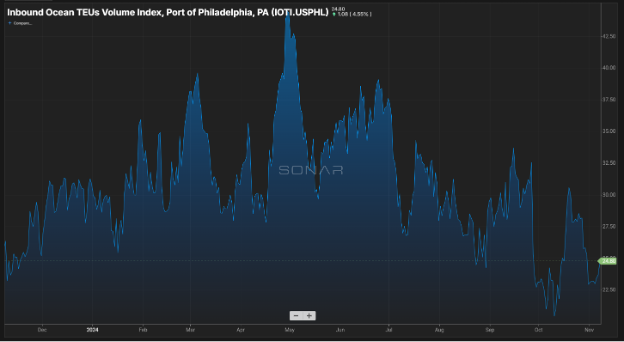

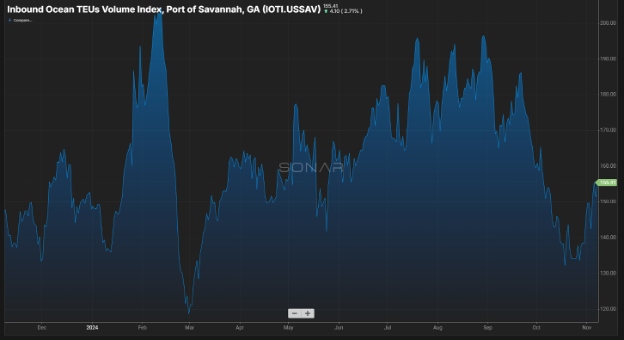

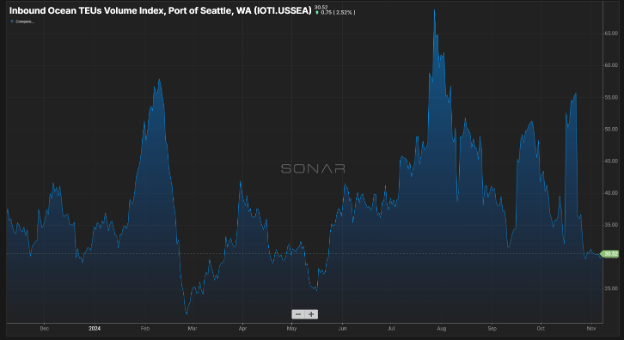

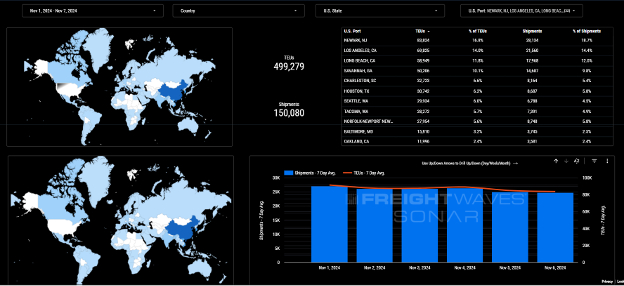

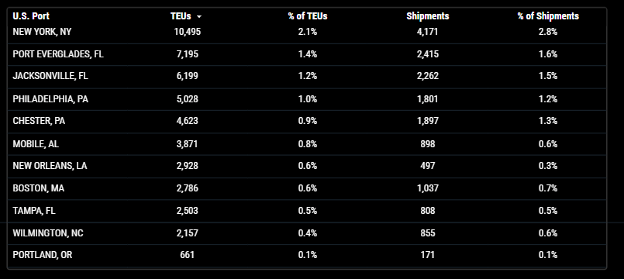

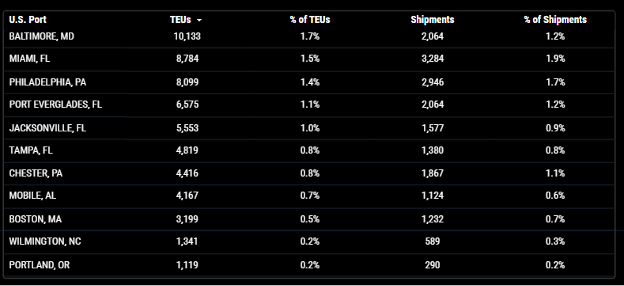

Import TEUs are down 14.25% from this week from last week – with the highest volumes coming into Newark NJ at 16.8%, Los Angeles 14% and Long Beach 11.8%. The trans-Atlantic ports have returned to the “calm waters” mode that typically characterizes the westbound trade lane, with rates trending down into November and U.S. import volume flattening out into the fourth quarter. There is no sign of any rush ahead of potential tariff increases on European imports or to get cargo moving before a possible second strike by the ILA in January. The demand picture shows U.S. East Coast imports from North Europe and the Mediterranean rising year over year through September, according to the latest data available from PIERS. But the subsequent rate decline through October and into November suggests a slowdown in volume into the fourth quarter. The latest data from Container Trades Statistics shows US September import volume from Europe at 435,540 TEUs, up just 1% from August.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

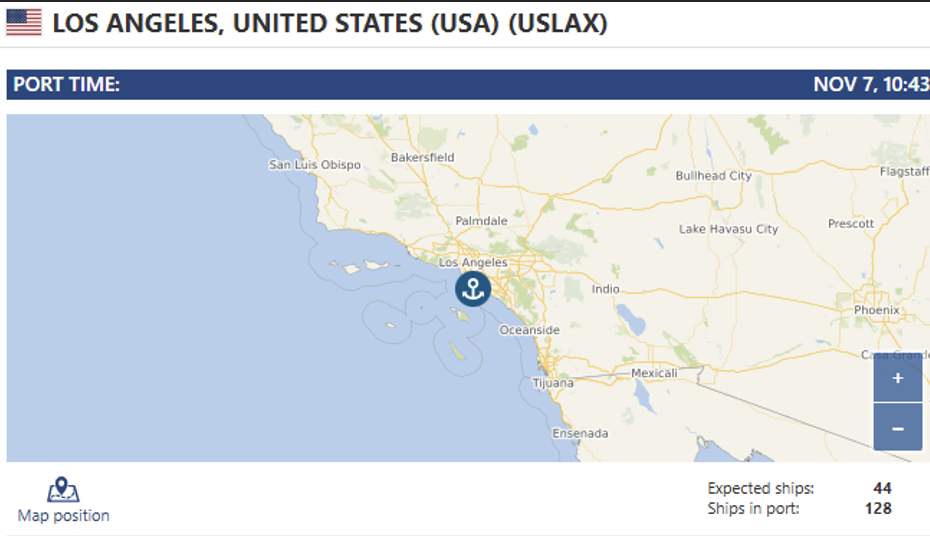

LA/LGB: Rail dwell times are slowly decreasing but currently at an average of 8.2 days, still on the higher side and still slowing down rail container transit times – We have immediate capacity to pull any diverted containers for transload to avoid the rail, capacity is tendered to on a first come first serve basis. We also have 66 trucks and a huge amount of yard space to take on your LA and Long Beach drayage moves. If you are interested in learning how to expedite diverted containers or looking for LA/LGB dray capacity contact Letsgetrolling@portxlogistics.com

Oakland: Snow chain season is in full effect for Oakland containers headed towards Lake Tahoe and beyond – just like putting snow tires on your own vehicles doesn’t happen with the snap of a finger or without a labor charge, it takes a lot of effort for drivers to chain their tires to conquer the conditions ahead, while being outside braving the elements in the most unsafe conditions. We have plenty of drayage capacity in Oakland and a transload warehouse on site, if you are looking for coverage, competitive rates or more information about the need and process for snow chains contact our Oakland team Oakland@portxlogistics.com

Did you know? Our Seattle location is built for efficiency – Just 2.5 miles from the Port of Seattle, we’re positioned to move cargo faster and offer services tailored to each customer’s needs.

Transloading is where we stand out, we have a wide array of warehouse capabilities for ongoing transloading projects. It’s our advantage in ensuring shipments are delivered smoothly, flexibly, and right on time.

With a full-service warehouse, logistics, transportation, and distribution team ready to go, we’re here to support every step of your supply chain. Contact letsgetrolling@portxlogistics.com for immediate transload capacity and great drayage and warehouse rates.

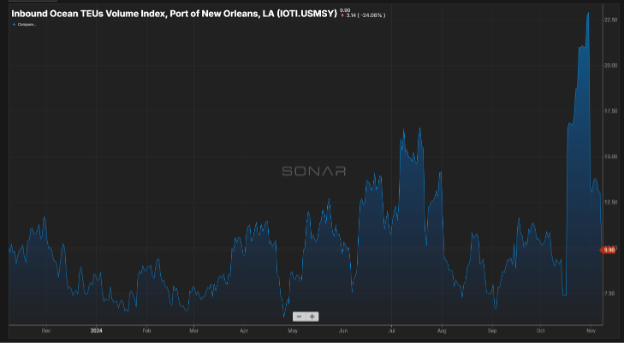

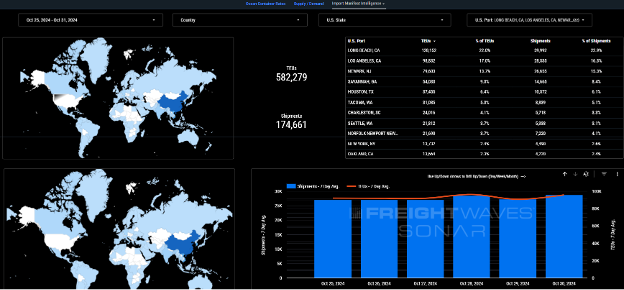

SONAR Data Import Images