1526 words 5 minute read – Let’s do this!

What remains in the market for Q4 2024? The U.S. National Retail Federation (NRF) expects imports at the nation’s major container ports to continue at elevated levels this month despite the 3 day strike staged by the International Longshoremen’s Association (ILA). As we all know by now, the ILA ended its three-day strike on October 3rd with a tentative agreement on wages and agreed to extend the deadline for a new contract until January 15th to sort through other issues like Port automation and healthcare.

The U.S. National Retail Federation (NRF) expects imports at the nation’s major container ports to continue at elevated levels this month despite the 3 day strike staged by the International Longshoremen’s Association (ILA). As we all know by now, the ILA ended its three-day strike on October 3rd with a tentative agreement on wages and agreed to extend the deadline for a new contract until January 15th to sort through other issues like Port automation and healthcare.

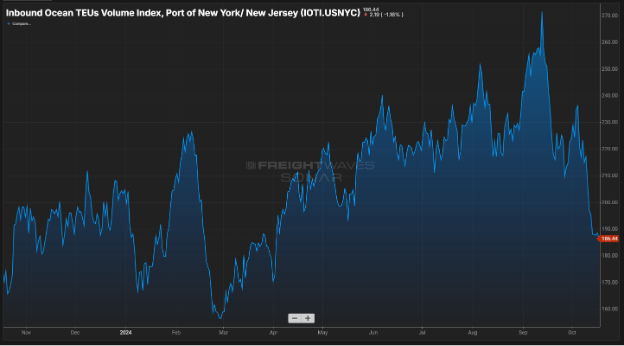

The U.S. ports covered by Global Port Tracker, released by the National Retail Federation (NRF) and Hackett Associates, handled 2.34m TEU in August, although the Ports of New York/New Jersey and Miami have yet to report final data. That was up 0.9% from July and up 19.3% year-on-year for the highest volume since the record of 2.4m TEU set in May 2022.

The U.S. Ports have not yet reported September’s numbers, but Global Port Tracker projected the month at 2.29m TEU, up 12.9% year-on-year. October is forecast at 2.12m TEU, up 3.1% year over year. “That is slightly higher than the 2.08m TEU forecast for October a month ago, and the strike did not appear to affect national totals,” NRF said.

November is forecast at 1.91m TEU, up 0.9% year over year, and December at 1.88m TEU, up 0.2%. That would bring 2024 to 24.9m TEU, up 12.1% from 2023. January 2025 is forecast at 1.98m TEU, up 0.8% year over year, and February 2025 is forecast at 1.74m TEU, down 11.2% because of fluctuations in the timing of Lunar New Year shutdowns at Asian factories.

Despite its short duration, the strike has had an impact, with vessels queuing during the stoppage. According to Sea-Intelligence, a Copenhagen-based maritime analysis firm, this could negatively affect capacity availability in origin regions. “In the most optimistic view, the impact is limited to the three days of striking, but realistically, as it will take some time to clear the backlog of vessels and containers, the impact is likely to be closer to a week of capacity loss,” Alan Murphy, CEO, Sea–Intelligence, said. This graph from Sea-Intelligence shows the anticipated relative capacity loss for Asian exporters, where a 3-day and a 1-week impact, are compared against a baseline scenario where there is no strike. The figure shows a -17% drop in capacity offered from Asia to U.S. East Coast in week 46 (November 11th – 17th), if the impact is limited to the minimum of vessels being stuck in the U.S. East Coast for just 3 days, while if it takes a full week to get the vessel backlog cleared, then this is closer to a -40% capacity loss for a short period. Similarly, for North Europe to U.S. East Coast, exporters should prepare for a capacity reduction of -14% in week 44 (October 28th – November 3rd 2024), rising to -30% if clearing of the congestion takes a full week. On the Mediterranean to the U.S. East Coast, a 3-day impact leads to a -10% capacity loss in week 43 (October 21st – 27th), increasing to -25% for a week-long impact.

What will happen as we get closer to the January 15th contract mark? We encourage you to subscribe to the Port X Logistics LLC LinkedIn page for up to date news and solutions for your supply chain, and to get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox email Marketing@portxlogistics.com

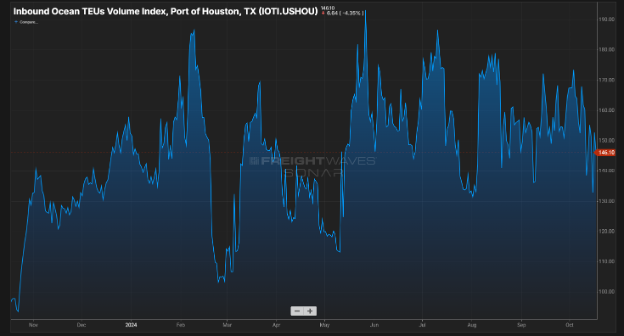

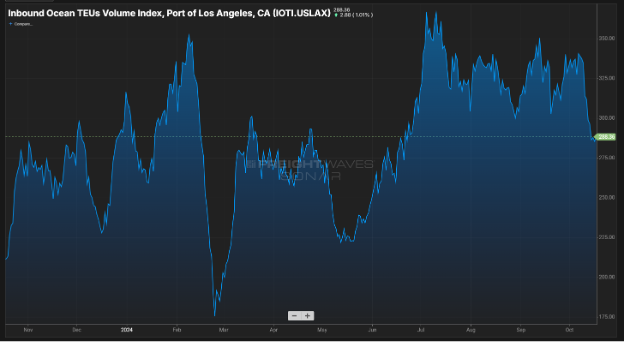

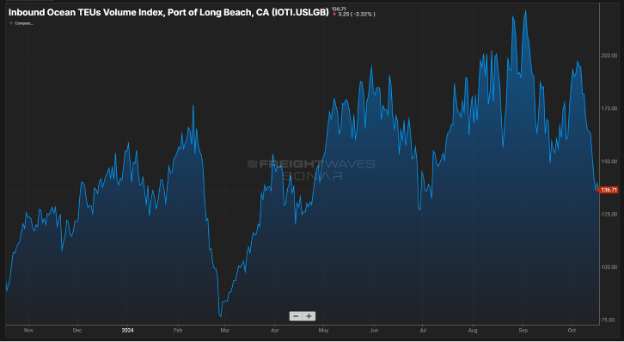

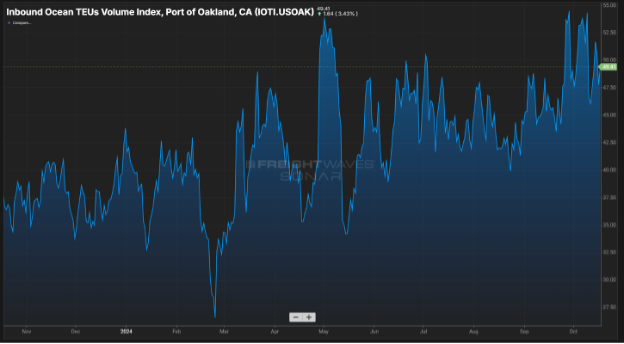

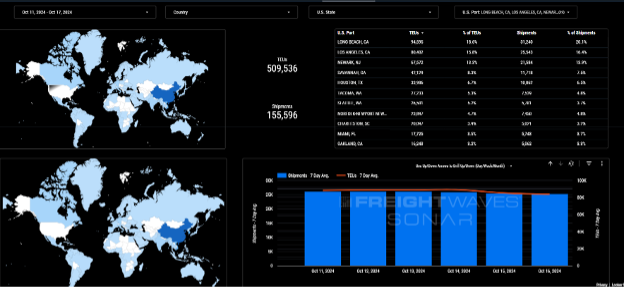

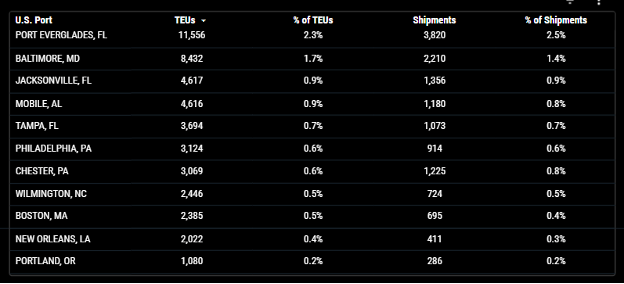

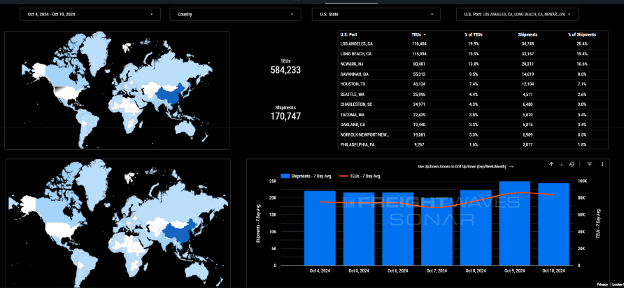

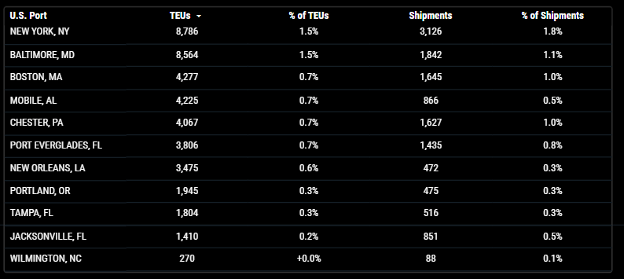

Import TEUs are down 12.875% from this week from last week – with the volume coming into Long Beach at 20.3%, Los Angeles 18.2% and Newark NJ 12.3%. The LA and Long Beach ports could still see an increase of U.S. imports from Asia if the contract negotiations between the ILA and USMX drag on next month and through December. Retailers with time-sensitive spring merchandise will likely continue to ship through Southern California until a final contract is reached, forwarders said. Imports are projected to peak in Los Angeles at 125,882 TEUs during the week of October 20th before dropping to 111,713 TEUs the next week, while Long Beach’s imports are expected to fall from 102,756 TEUs next week to 87,780 TEUs in the week of October 27th according to data from the ports.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Weekly Port & Rail Updates

LA/LGB: We have been reporting on the increase of rail dwell times out of the LA and Long Beach terminals over the last couple weeks, and we are now seeing 9.25 average days inbound container shipments waiting for rail transport at the LA/LGB terminals – Up from 8.2 in September and the longest dwell time since October 2022, according to the Pacific Merchant Shipping Association.

Whenever supply chain disturbances directly affect the market like long rail dwell delays, and union uncertainty, remember Port X Logistics can play a role in helping to improve the flow of your supply chain – We are the Gold Standard in drayage, transloading and trucking. We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. Transload orders have been piling up as many shippers have been taking the early initiative to speed up deliveries whether it was an ocean delay or to avoid the rails, but we have all the capacity in the world for you! If you want more information on how you can get your cargo diverted at the port and on the road for a speedy delivery with full visibility contact Letsgetrolling@portxlogistics.com. We have immediate capacity in LA to pull your diverted containers for transload to avoid the rail, capacity is tendered to on a first come first serve basis. We also have 66 trucks and a huge amount of yard space to take on your LA and Long Beach drayage moves.

Houston: The rail dwell effects of the LA/LGB ports are starting to hit the Houston rails – the Houston Union Pacific rail is seeing backups from a huge influx of train arrivals this week. Expect long driver wait times and buried containers at the rail. If you have containers stuck at the Houston UP, it may be days or weeks for the containers to become available and could also create capacity shortages for drayage moves. Port X Logistics has drayage assets in Houston with the capability of long-haul drayage and we have a transload warehouse in LaPorte that can transload anything from standard pallets, to heavy lumber and industrial coils. We have plenty of capacity if you need help in the Houston area – we got your back. Contact letsgetrolling@portxlogistics.com

Chicago: There was a crane down and technical issues Tuesday at the Norfolk Southern. Long driver wait times and delays will occur through the remainder of the week. Even with all that wait time, our Chicago asset drayage team has full capacity to get your Chicago containers moving. We have 80 trucks and secured yard space and we are able to secure permits to haul heavy containers. For great rates, capacity and supreme customer service contact the team at letsgetrolling@portxlogistics.com

Did you know? The U.S. Customs Border Protection (CBP) recently updated its required Air Cargo Advance Screening (ACAS) Data Elements for air freight shipments traveling to or through the United States. While a firm effective date is pending, the new data elements, as required by the CBP, will also be required by United Cargo for shipping to the U.S. in the imminent future. This imposed advanced screening could create some significant air import delays putting your urgent cargo at risk. The good news is that our Carrier911 team is on standby for your most urgent shipments. We can get your drivers assigned and on site at the airport in most cases within 1 hour. We have access to cargo vans, straight trucks, dry vans and more. Every one of our drivers has experience with airport and CFS pickups and have access to retrieving the proper documentation to make these pickups seamless. Don’t forget we provide shareable tracking links and PODs sent at the time of delivery, so you can relax stress free with all of your most critical shipments. Contact the Carrier911 team 24/7/365 info@carrier911.com

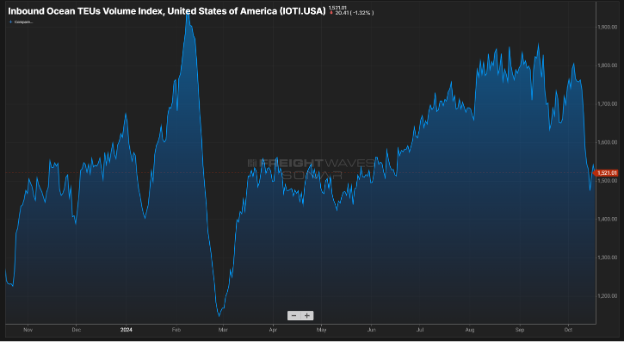

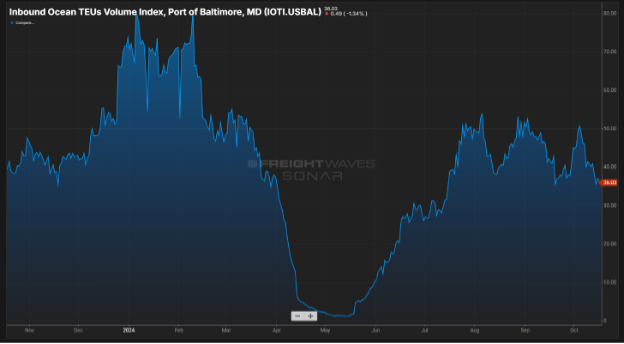

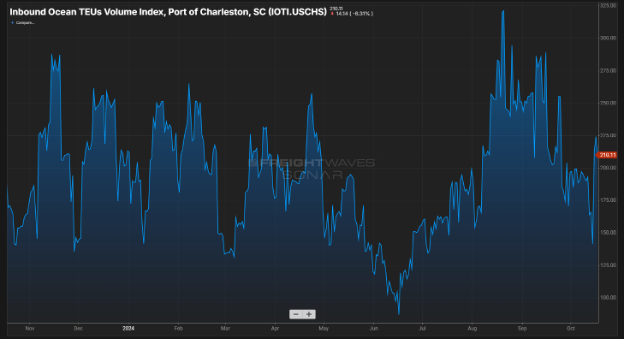

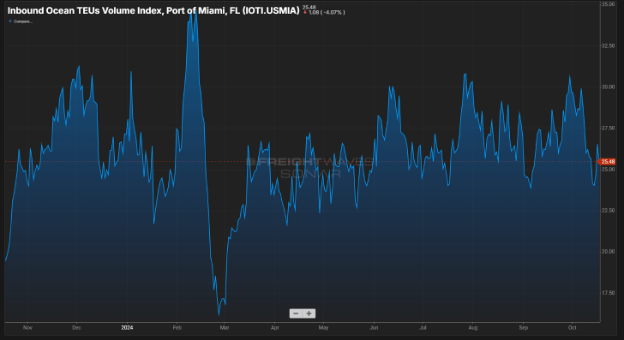

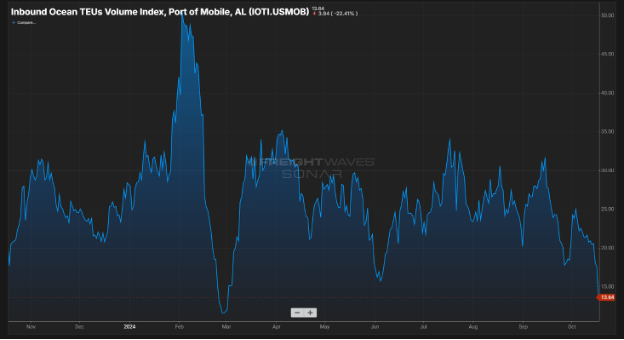

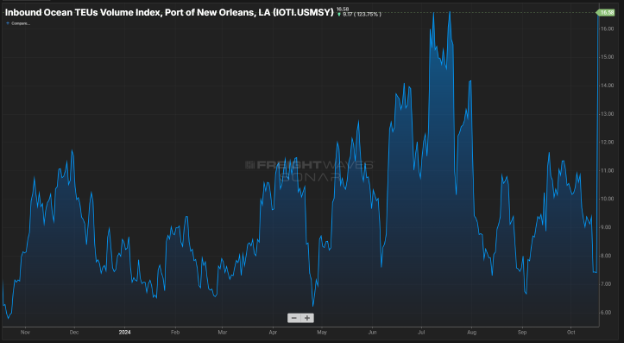

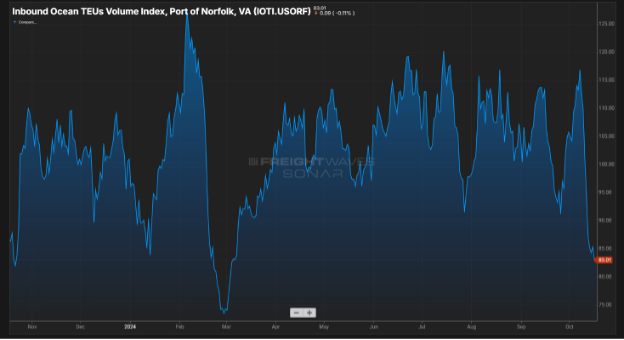

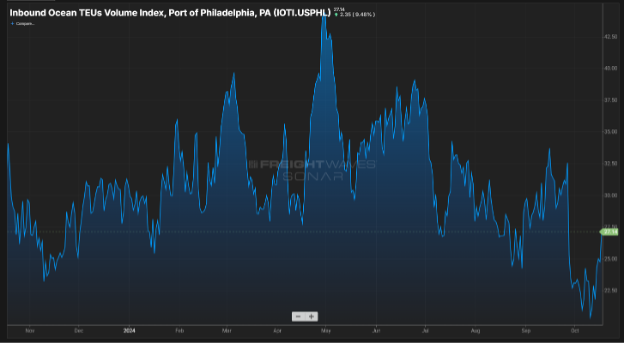

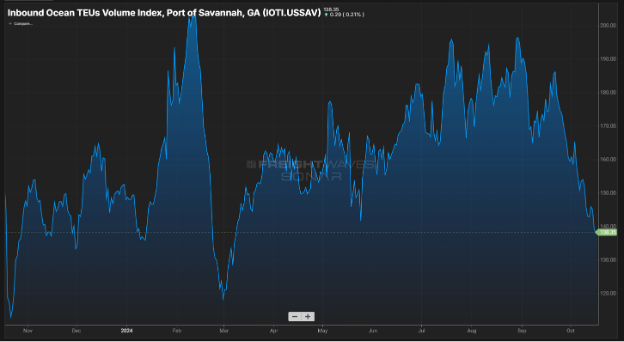

SONAR Import Data Images