1525 words 6 minute read – Let’s do this!

We are back to reality folks – Fall is on its way, school, football, and cooler weather. With holiday shipping season also upon us, it is important to pay close attention to the industry news, especially as it pertains to the International Longshoremen’s Association (ILA) union contract set to expire on the 30th of this month. Follow the Port X Logistics LLC LinkedIn page for up to date news and solutions for your supply chain and email Marketing@portxlogistics.com to sign up for this weekly Market Update Newsletter for updates on this new and future industry related news.

The International Longshoremen’s Association union (ILA) began two days of meetings on Wednesday to review wage demands and prepare for a potential strike on October 1st. Formal talks have reached an impasse as the union and the United States Maritime Alliance (USMX) employer group wrangle over pay, terminal automation, healthcare coverage and retirement benefits.

The ILA has asked for a 77% pay bump over the life of the new contract. The final increase would likely improve on the 32% rise the West Coast International Longshore and Warehouse Union (ILWU) negotiated last year. ILA International President Harold Daggett has warned that workers will strike if a new labor agreement is not reached before the current six-year contract expires on September 30th. The USMX said in previous statements it has been trying to set a meeting with the ILA to resume talks.

The National Retail Federation (NRF) urged the two sides on Tuesday to return to the bargaining table, following similar calls by the Retail Industry Leaders Association and the American Apparel & Footwear Association. “A strike or other disruption would significantly impact retailers, consumers and the economy. The administration needs to offer any and all support to get the parties back to the table to negotiate a new contract,” NRF CEO Matthew Shay said in a statement.

Any work slowdown or stoppage would affect key Eastern and Gulf ports backing up goods ahead of the holiday season and U.S. presidential elections.

In preparation for China’s upcoming Golden Week holiday which falls on October 1st – October 7th, ocean carriers are implementing blank sailing plans that will impact Weeks 38 through 41 to adjust capacity on the Trans Pacific East Eastbound route.This may lead to changes in sailing schedules or transit times, particularly for transshipment connections, as blank sailings could result in rollovers to the next available schedule. During Golden Week, many businesses and government offices are closed, which can lead to delays or stoppages in domestic and international shipping. How does Golden week affect your import shipments and drayage strategy?

Reduced port and customs operations: China’s ports and customs offices may have reduced operations during Golden Week, which can cause delays in international shipping.

Increased demand: Importers may rush to get products shipped out before the holidays, which can create a surge in demand and make space capacity more limited.

Higher freight costs: The demand for space in the week before and after Golden Week can lead to higher freight costs and tighter space.

Closed factories: Most Chinese factories close during Golden Week, which can impact just-in-time supply chains and logistics operations.

Reduced Ocean carriers’ sailings: Ocean carriers generally don’t sail during Golden Week.

Supply and inventory issues: Businesses may be caught out by supply and inventory issues.

To avoid issues, some recommend planning ahead and avoiding shipments in or out of China during Golden Week. For ocean shipments, some recommend booking two to three weeks before Golden Week, and for air shipments, some recommend booking at least one week before.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

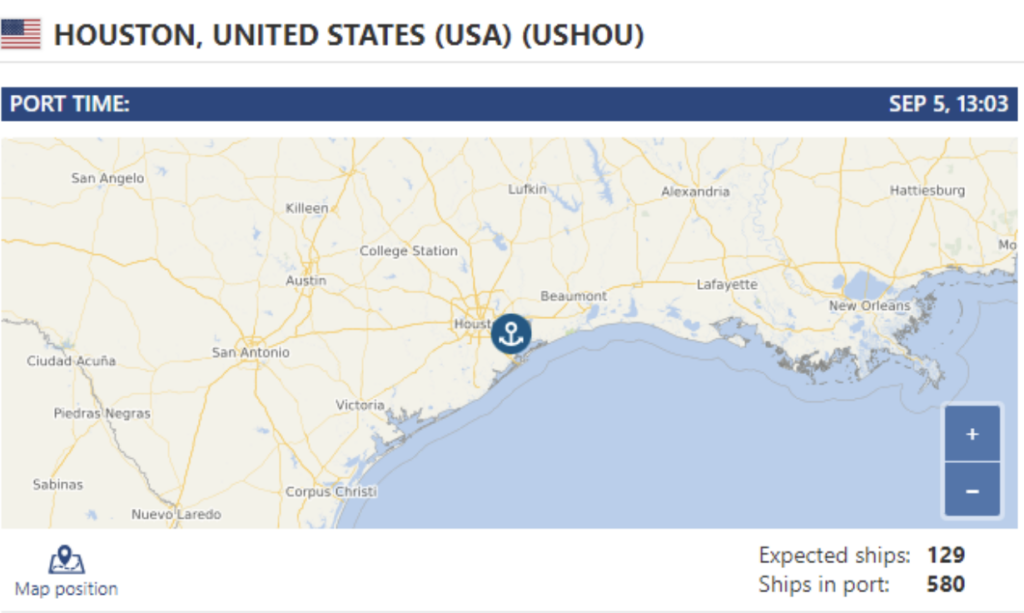

Houston: Houston received three additional ship-to-shore cranes last week that will be installed at Bayport container terminal, bringing its total crane count to 18. Houston also has on order another eight cranes that are expected to arrive in 2026. Four of those will go to a new berth at Bayport while the others will be installed at redeveloped berths at Barbours Cut. The new cranes will eventually serve the larger ships that are coming with the expected 2025 completion of Project 11, the multi-year endeavor to widen Houston’s ship channel to accommodate two-way traffic of neo-Panamax vessels, allowing an additional 1,400 vessels of all types to call the port each year. Portions of the channel are also being deepened to 46.5 feet to accommodate the larger ships. We’re excited about the future growth of the terminals in Houston and our Houston team has both drayage operations and a Houston transload warehouse. If you need drayage in Houston (And Dallas!) or transloading in Houston including heavy and hard to unload cargo like coils and pipes we have you covered letsgetrolling@portxlogistics.com

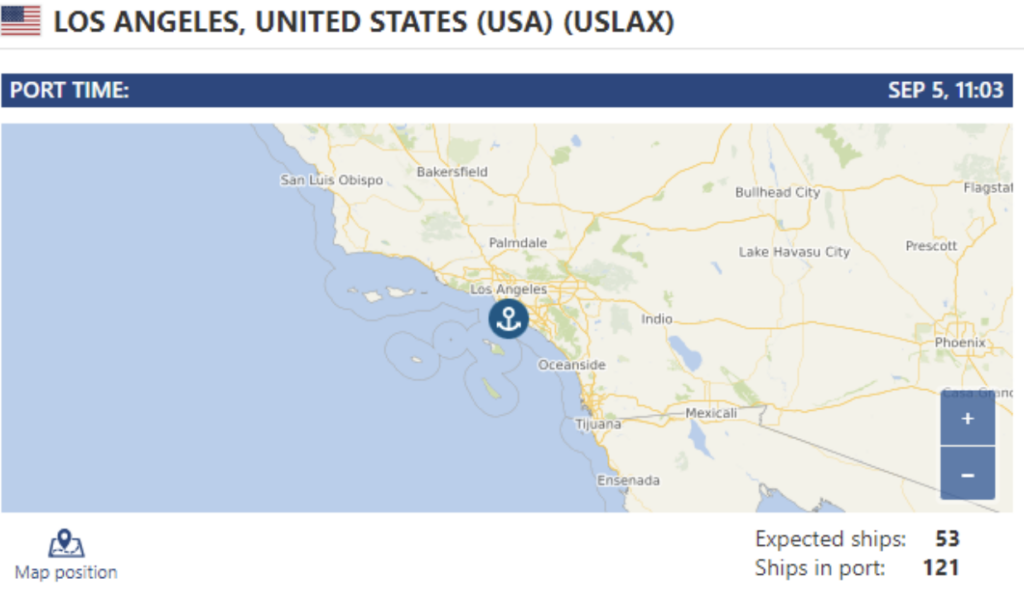

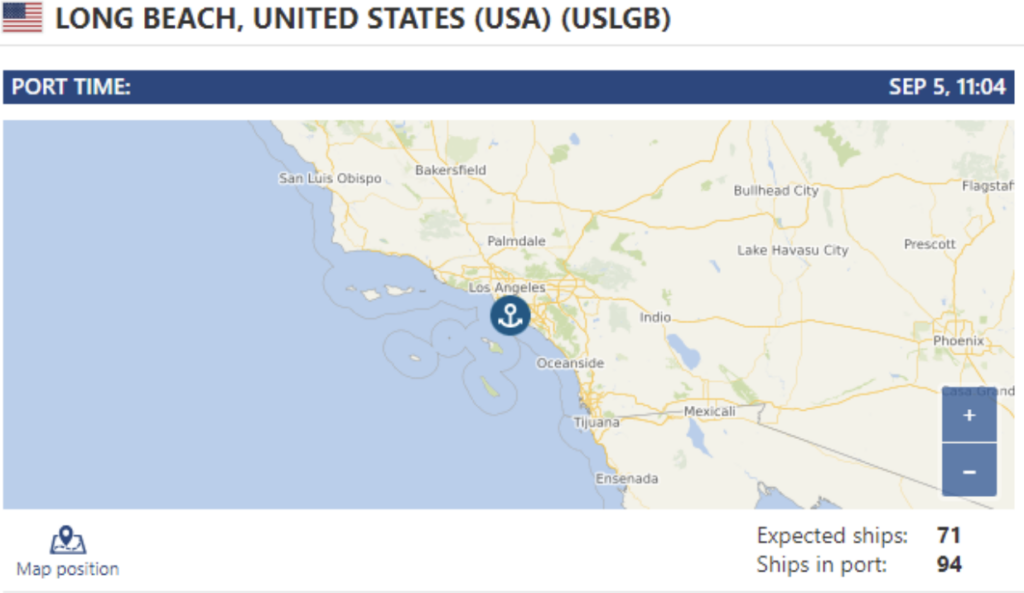

LA/LGB: Rail container dwell times at the LA-LB port complex increased to 5.66 days in July from 4.73 days in June, according to the Pacific Merchant Shipping Association (PMSA), which represents terminal operators and shipping lines. According to the Port of Los Angeles website on August 26th, almost 28% of the rail containers at the port’s six container terminals were seeing average dwells of 7 days or longer.

Excess rail dwell can increase the need for expedited transload solutions and transload orders have already been piling up as many shippers have been taking the early initiative to avoid a potential strike at the East and Gulf Coast ports. We currently have transload openings and will honor service on a first come, first serve basis, orders that are received 72 hours prior vessel arrival are also entitled to our “No Demurrage Guarantee”. Contact CA@portxlogistics.com to ask about our “No Demurrage Guarantee” and for all your West Coast drayage, transloading and trucking needs.

Chicago: Severe driver congestion remains at the BNSF due to the long wait times for a container lift. Drivers reporting wait times in excess of 6 hours for picking up containers not mounted to chassis. Despite the wait times at the BNSF, our Chicago asset drayage team has full capacity to get your Chicago containers moving – we have 80 trucks and secured yard space and we are able to obtain special permits to haul heavy containers. For Chicago drayage capacity and supreme customer service contact Danny and the team letsgetrolling@portxlogistics.com

Did you know? Why Port X Logistics is called the “Gold Standard” in Drayage, Transloading and Trucking? If you are new to the Port X Logistics world, I would like to reintroduce you to our services and our asset profile below and let everyone know we have plans to greatly expand our assets through 2024 and into 2025 – we have very exciting growth plans and we will be honored if you stick around for the ride and join the revolution! letsgetrolling@portxlogistics.com

We offer and excel at:

Drayage, transloading, and trucking. We like to say drayage transloading and trucking 2000 miles in just 2 days.

Transloading and trucking of open tops, break bulk, and flat racks throughout the USA. We do have contracts with stevedores to help expedite transloading of some of this cargo directly at the port.

Local and Regional drayage

Long Haul Drayage – for imports or exports that cannot be transloaded

53’ Domestic intermodal service, 1100 Refrigerated Trailers On Flat Car, and 300 refrigerated domestic containers.

Asset Profile (Port X Logistics Owned)

Oakland – 47 trucks, yard space, and transloading (local and long haul drayage – lots of Reno)

Long Beach -36 trucks, yard space, and transloading (in heavyweight corridor 27 acres) (including specialized equipment)

Denver -12 trucks, yard space, and transloading

Kansas City -59 trucks, yard space, and transloading (58 acres and equipped with lift capabilities)

Memphis – 48 trucks, yard space, and transloading (92 acres of yard space and depot equipped with lift capabilities). **Yard backs up to the UP in Marion**

Savannah – 22 trucks, yard space, and transloading

Charleston – 12 trucks, yard space, and transloading

Chicago – 80 trucks, yard space, and transloading (including specialized equipment)

Norfolk – 24 trucks, yard space, and transloading (including specialized equipment)

Houston – 40 trucks, yard space, and transloading (including specialized equipment)

Dallas – 23 trucks and yard space

Seattle-Tacoma – 35 trucks, yard space, and transloading (including specialized equipment).

IMC service – 1100 trailers that can ride on flat car, as well as domestic EMPU and UMAX boxes for domestic intermodal

**** Also remember our two Canadian offices. Drayage, transloading, and trucking including services to move in bond and remanifest the bond on your customers behalf.

Not only do we have exceptional service and customer experience, but our technology is the best in the business. We even track the cargo on the water all the way from origin port into the U.S. and onto the final destination. It’s a game changer for the operators and your customers.

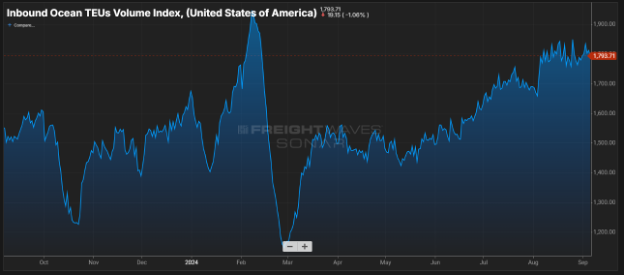

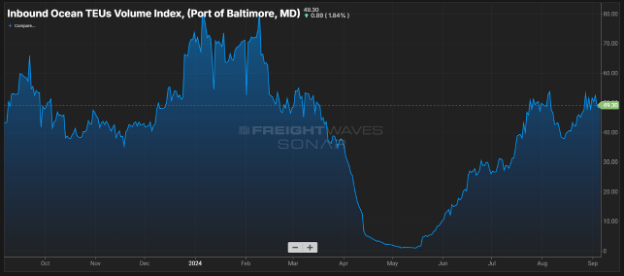

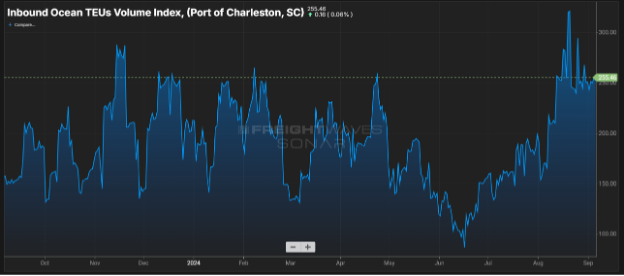

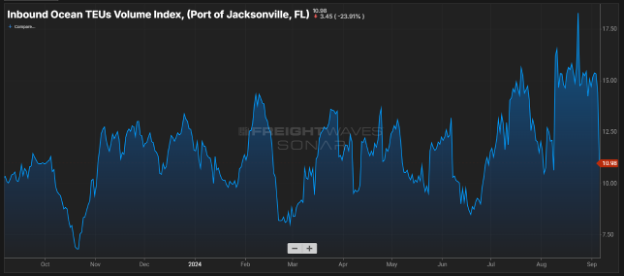

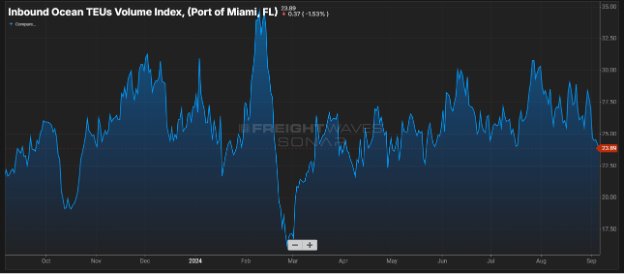

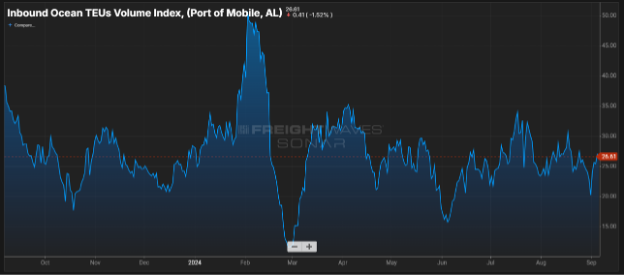

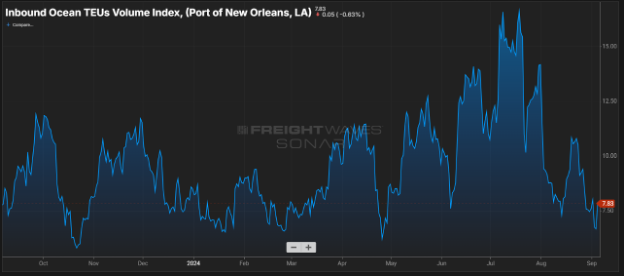

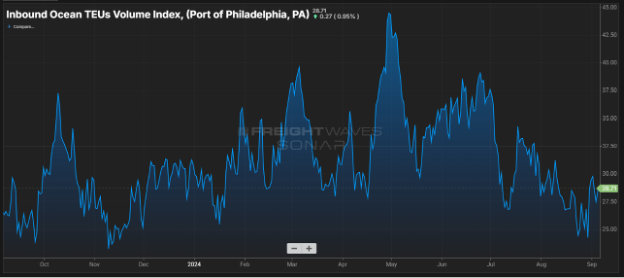

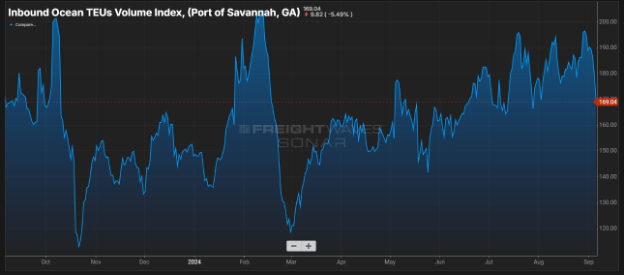

SONAR Import Data