1856 words 6 minute read – Let’s do this!

Canadian history is being made today, for the very first time in Canada a dual rail strike is taking place – freight traffic on Canada’s two largest railways has simultaneously ground to a halt, threatening to upend supply chains trying to move forward from pandemic-related disruptions and a port strike last year.

In the culmination of months of increasingly bitter negotiations, Canadian National Railway Co. (CN) and Canadian Pacific Kansas City Ltd. (CPKC) locked out 9,300 engineers, conductors and yard workers after the parties disagreed on a new contract before the midnight deadline. If you are permitted to get your containers diverted, Port X Logistics LLC is open to your transloads contact us asap as capacity is filling up fast. A strike as short as 5 days will take months for the rails to recover and could also cause congestion issues at the ports in both Canada and the U.S. We are headed for a similar situation if the ILA decides to strike, stopping labor at the U.S. and Gulf Coast ports in early October. Let us help you get your freight moving and don’t forget to subscribe to the Port X Logistics LLC LinkedIn page for up to date news and solutions for your supply chain and email Marketing@portxlogistics.com to sign up for this weekly Market Update Newsletter for updates on new and future industry related news.

Both the CN and CPKC were gradually shutting down since last week ahead of the contract deadline. Shipments of hazardous chemicals and perishable goods were the first to be stopped so they wouldn’t be stranded on train tracks during the stoppage. Canada’s railroads have shut down briefly in the past during contract negotiations – most recently CPKC was offline for a couple of days in March of 2022 – but it’s rare for both lines to stop at the same time and with both lines being stopped, the impact on businesses will be magnified.

All rail traffic in Canada and all shipments crossing the U.S. border have stopped, although CPKC and CN’s trains will continue to operate in the U.S. and Mexico. CN said it was waiting for a response on one final offer made late Wednesday when it locked the workers out. CPKC spokesperson Patrick Waldron said the union rejected its last offer that CEO Keith Creel made at the table in person. Both railroads have said they would end the lockout if the union agreed to binding arbitration.

“Despite the lockout, the Teamsters remain at the bargaining table with both companies,” the union said in a statement.

CN had been negotiating with the Teamsters for nine months while CPKC had been trying to reach an agreement for a year, the unions said.

The negotiations are stuck on issues related to the way rail workers are scheduled and concerns about rules designed to prevent fatigue and provide adequate rest to train crews. Both railroads had proposed shifting away from the existing system, which pays workers based on the miles in a trip, to an hourly system they said would make it easier to provide predictable time off. The railroads said their contract offers have included raises consistent with recent deals in the industry. Engineers make about $150,000 a year on CN while conductors earn $120,000, and CPKC says its wages are comparable. Canada’s Prime Minister Justin Trudeau has so far been reluctant to force the sides into an agreement or to require the Teamsters to go back to work. Deputy Prime Minister Chrystia Freeland also urged the companies and union to swiftly resolve their dispute, stating “no patience with dilly dallying” given the “serious” consequences. Freeland, who’s also finance minister, declined to comment on what it would take for the federal government to intervene, adding that she thinks the best deals are reached at the bargaining table.

What does the impact of a Canadian rail strike look like for both Canada and the U.S.? Vancouver’s intermodal rail yard is already reaching capacity as measured by dwell time. Vancouver Fraser Port Authority (VFPA) data shows that intermodal boxes are sitting for five to seven days on dock, compared with four days in July. “The impact to the Port of Vancouver will be significant, with approximately two-thirds of all cargo volumes at the port moved by rail, including 90% of international exports,” the VFPA’s statement said. “It took many months to clear the backlog of congestion from the British Columbia longshore workers 13-day strike at the Port of Vancouver in 2023, with delayed shipments and overburdened infrastructure struggling to restore normalcy.” The Canadian trucking industry cannot meet the domestic needs to keep critical supplies and daily goods flowing if the rail work stoppage continues, according to the leader of the British Columbia Trucking Association (BCTA). “There is no possibility trucking can fill the gap of any labor disruption on railways,” Dave Earl, president and CEO of the BCTA, said in an email to Trucking Dive.

Expect vessels to be diverted to U.S. ports and plans to halt bookings for inland destinations served by rail. Truckers that carry goods across the border, have already jacked up fees ahead of increased demand. But rail carries about $100 billion annually between the U.S. and Canada. U.S. based rail line Union Pacific warned that a Canadian strike would be “devastating.” The auto industry is particularly worried: Canadian trains move components for at least a dozen U.S. plants and 90% of those in Mexico.

Making a plan for the undetermined time that the rail strike continues and the aftermath gets cleaned up is crucial, Port X Logistics will to help formulate a plan if you choose to divert your rail cargo to the Ports and move it via Drayage, transloading and trucking. Port X Logistics is the Gold Standard in drayage, transloading and trucking. We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. Canada transload orders have been piling up and capacity is filling up – we have plenty of transload capacity available in all U.S. Ports, but we also urge you to get those orders in quickly as more vessels will change ports of call and more shippers will request diversions. Contact Letsgetrolling@portxlogistics.com all capacity is on a first come first serve basis.

Container spot rates from Asia to the U.S. east coast have settled at around $9,000 per 40 foot, and from Asia to the U.S. west coast around $6,000 per 40 foot – some 150% and 170% higher than a year ago, respectively, so there is a long way to fall if demand weakens significantly. A U.S. East Coast and Gulf Coast strike would be a spot rate “life line” for the ocean carriers, carriers will say that they will do all they can to adjust their networks to mitigate the impact of potential industrial action – however, the uncertainty will underpin pricing.

Earlier this week, the International Longshoremen’s Association (ILA) said that no further progress has been made in negotiations for a master contract and the two sides remain “far apart” on wages. The ILA is seeking a 76% wage increase over the contract’s six-year term, according to maritime employers. For its part, the United States Maritime Alliance (USMX) said last week it has offered the ILA an “industry-leading” wage proposal, along with other benefits. However, ILA President Harold Daggett has said the union will not extend the current contract and members are prepared to strike if a new deal is not signed before September 30th. The union is convening its locals in early September to discuss the wage proposal put before the USMX, as well as form strike committees in the event of a walkout.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

Seattle/Tacoma: Container lines calling in Tacoma are warning customers to expect extended rail congestion and shifting vessel rotations as imports surge and marine terminals struggle with a shortage of intermodal rail cars. Hapag-Lloyd, in a customer advisory Monday, said import rail container dwell times for Tacoma are 5.8 days at the Husky Terminal and 9.6 days at Washington United Terminal (WUT). Marine terminal congestion often occurs when rail container dwells consistently exceed three to four days. “The Port of Tacoma terminals are experiencing severe import rail congestion, which is impacting vessel operations,” ONE said in a customer advisory Friday. ONE is an exclusive partner to Union Pacific Railroad in the western U.S.

Our Seattle operations has plenty of drayage capacity with the addition of 11 new drivers and a huge amount of warehouse space for transloading and storage. Contact letsgetrolling@portxlogistics.com for capacity and great drayage and warehouse rates.

Charleston: SC Ports had an 8% uptick in container volumes in July compared to the year prior. The start of peak season and a growing population in the region boosted loaded imports by 6%.SC Ports handled 10,814 vehicles in July, which is down year-over-year as July is typically a slower month for this segment. SC Ports supports global automakers’ supply chains by importing parts and exporting finished vehicles for BMW Manufacturing Co., Mercedes-Benz Vans and Volvo Cars, among others. Our South Atlantic operation also has a drayage fleet of 12 trucks with service to and from Savannah, Charleston and Jacksonville ports as well as container yard space. We have a full service transload warehouse in Savannah and can handle your dangerous goods cargo and any last-minute urgent transloads and cross docks and we are currently operating with plenty of open capacity. Contact Kyle and the team sav@portxlogistics.com

LA/Long Beach: Amidst the rising concerns over supply chain disruptions, our widespread offices, assets, and real-time tracking services in LA and Long Beach ensure reliable drayage, transloading, and trucking solutions. Contact the team at letsgetrolling@portxlogistics.com to get you first in line and avoid all potential disruptions and with a “No Demurrage Guarantee”– ask about it today!

Did you know? Our dedicated project cargo team is skilled in navigating the complexities of large-scale logistics. From coordinating with multiple on-site parties to managing regulatory compliance, Port X Logistics ensures that every aspect of your project freight is meticulously planned and executed. We have the resources and expertise to manage your most demanding shipments, and our team is continuously growing with talent. To learn more about how the Port X Logistics team can help to lead you to industry expertise contact letsgetrolling@portxlogistics.com

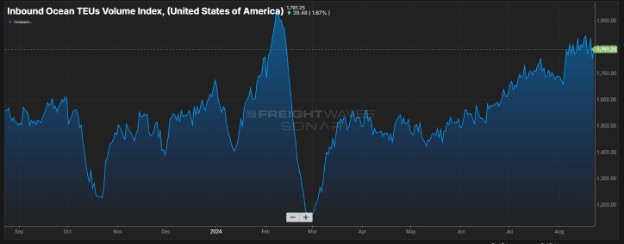

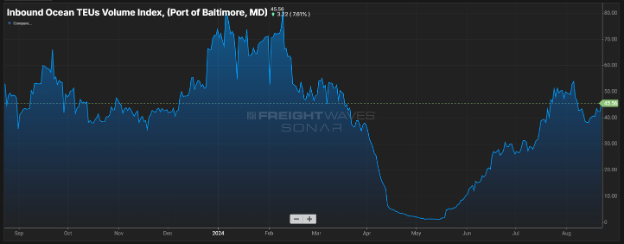

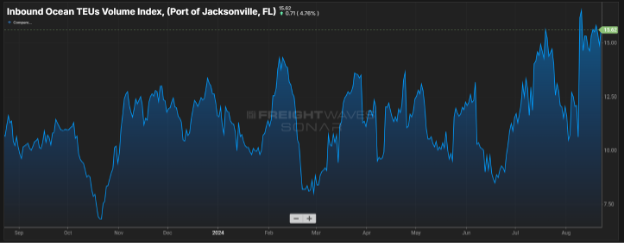

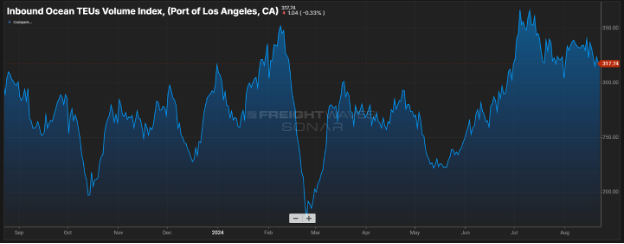

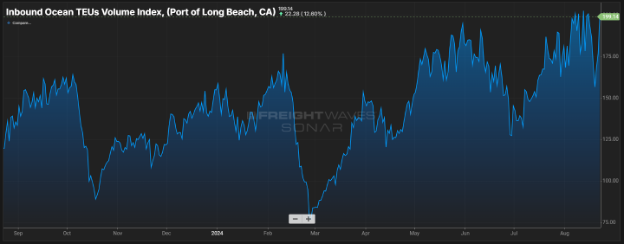

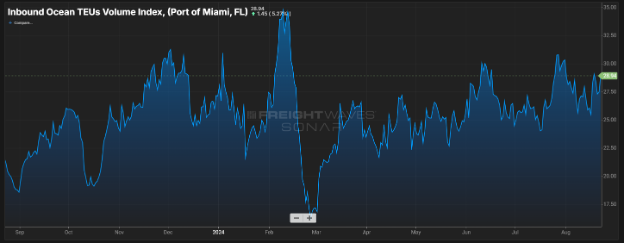

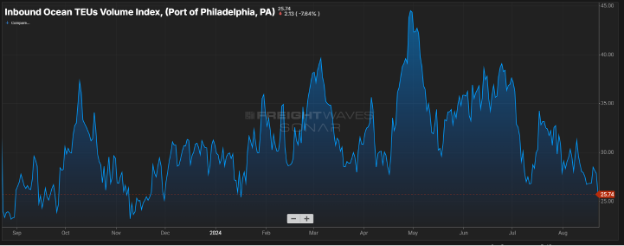

SONAR Import Data Images