1188 words 4 minute read – Let’s do this!

TPM 2024 is a wrap and we want to give a huge thank you to everyone that stopped by our booth this week. I did not attend this year but I heard it was quite a whirlwind, lots of events, excellent industry topics being discussed and much better weather than last year. If you didn’t get a chance to visit with us and want to hear more about what Port X Logistics has to offer, contact our team at Letsgetrolling@portxlogistics.com and don’t forget to follow our LinkedIn page for upcoming news and weekly Market Updates.

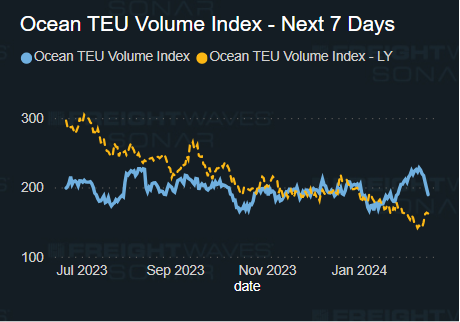

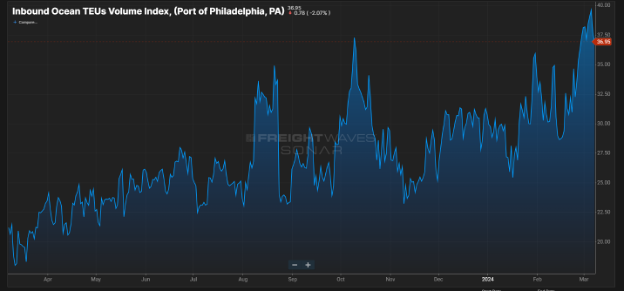

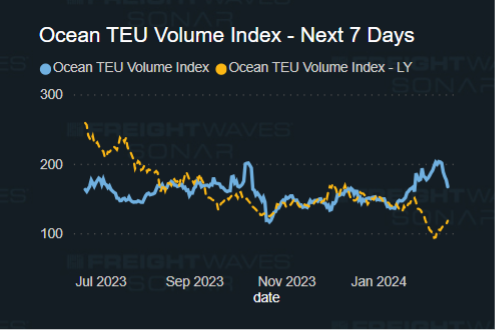

There were many conversations at TPM24 regarding the state of maritime transportation and the effects it has on drayage transloading and trucking. The Panama Canal, Blank sailings, Red Sea diversions past the Cape of Good Hope extending voyages by almost two weeks, the upcoming ILA contract negotiations for East and Gulf Coasts: Bottom line is that we are seeing more cargo with longer ocean transits and more cargo hitting the west coast. We are seeing more transloading in all west coast markets: Prince Rupert, Vancouver, Seattle, and Los Angeles. 2024 could be a year of epic disruption and we can help you get some plans in place – Port X Logistics is the Gold Standard in expedited drayage, transloading and trucking. We track your containers from the overseas and up until it reaches the port, dray your containers from any Port or rail in U.S. and Canada and transload with plenty of photos provided and once ready to load out to outbound trucks and we always include a shareable tracking link to track your final deliveries in real time. Contact us for all your West Coast, as well as all your other U.S. and Canada transload needs – letsgetrolling@portxlogistics.com

Air cargo has continued its strong start to 2024, with volumes and rates increasing at a fast pace even after Lunar New Year. The air cargo uptick is likely due to the disruption in the Red Sea that has led to ocean shipping schedule reliability falling to just 39.4% in January – the lowest since October 2022, according to Sea Intelligence. In its recent Analysis, Xeneta (Ocean and Air freight rate benchmarking and market analytics platform) reported that February offered a second consecutive month of double-digit growth in demand, and an uptick in general freight spot rates. “Following January’s 11% growth in volumes, February saw a similarly welcome upward curve for airlines and freight forwarders, with demand increasing 11% year over year,” it said. According to Xeneta, the average global cargo spot rate in February rose 2% on the previous month, to $2.29 per kg – this is unusual, as demand typically declines post Lunar New Year and the end-of-year peak season. As the potential costs increase with airfreight, it is even more valuable to have a premium service provider to handle your final deliveries – Make our Carrier911 team your first call. We have cargo vans, straight trucks, dry vans and specialized equipment for all your urgent air freight needs and we are available 24/7/365 and we can get most trucks onsite at the airport for pickup within 1 hour. All shipments will have shareable real time driver tracking links and a POD at your fingertips at time of delivery – to learn more or if you have an need for an urgent bail out contact the team at info@carrier911.com and follow the Carrier911 Linkedin page for our unique experiences.

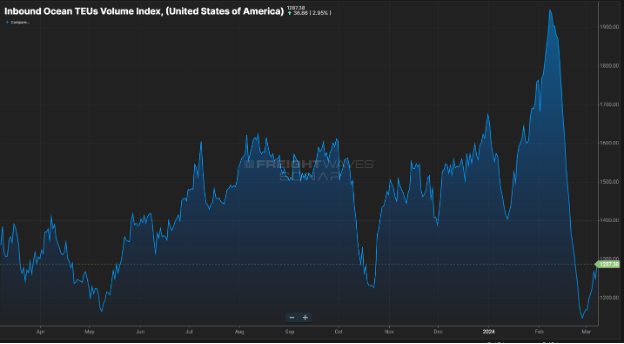

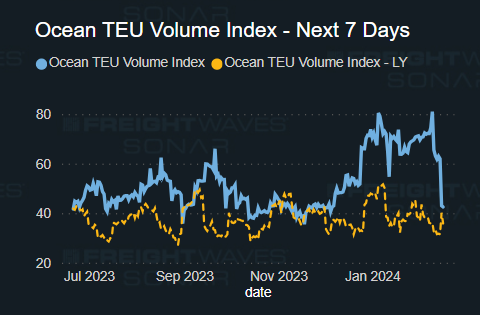

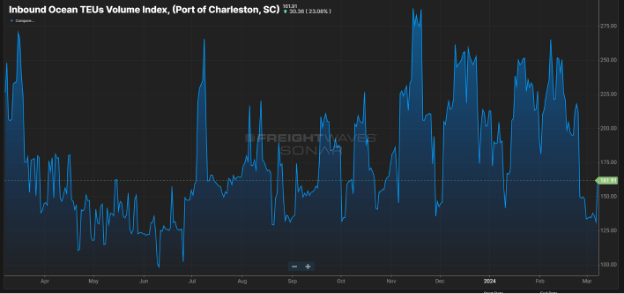

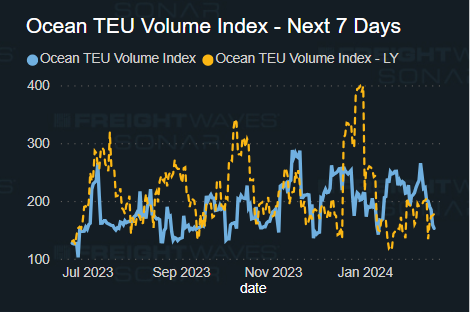

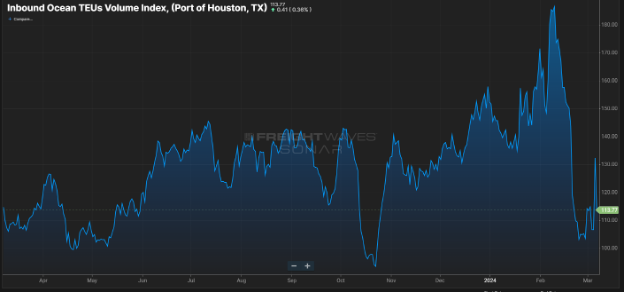

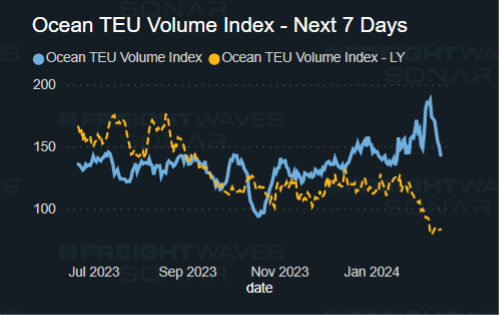

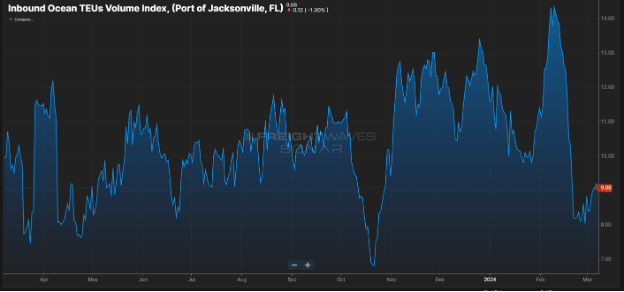

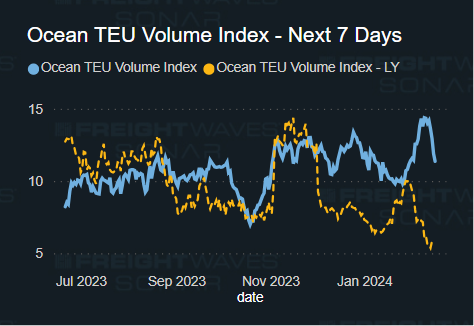

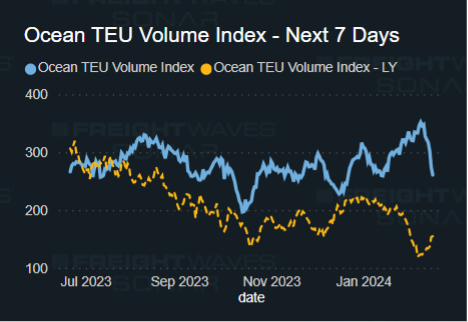

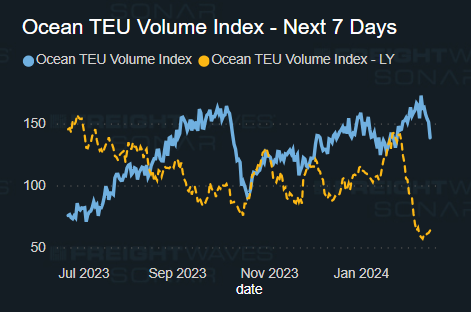

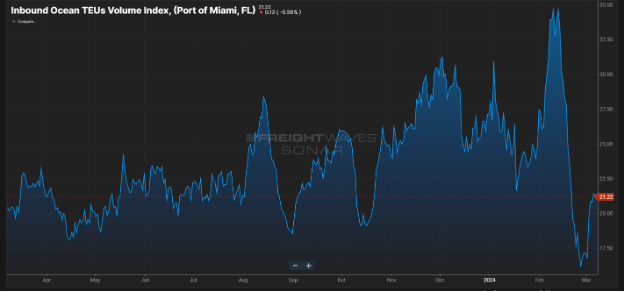

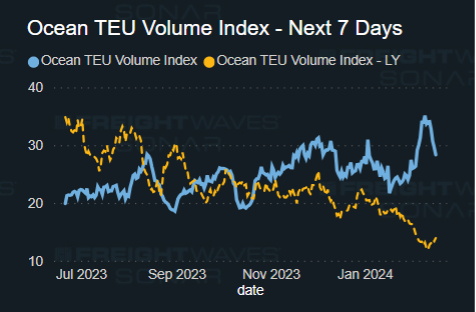

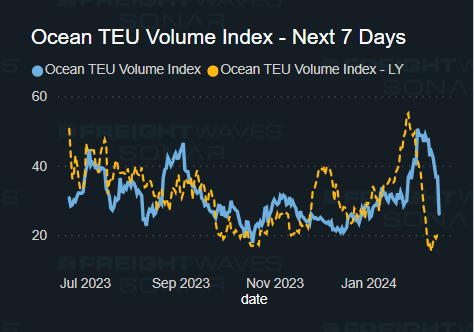

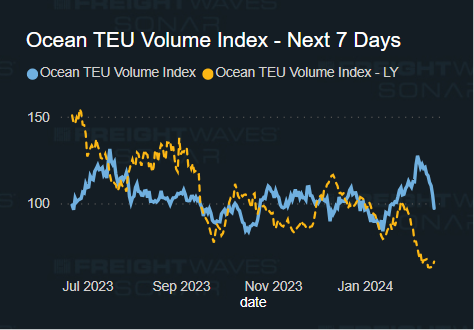

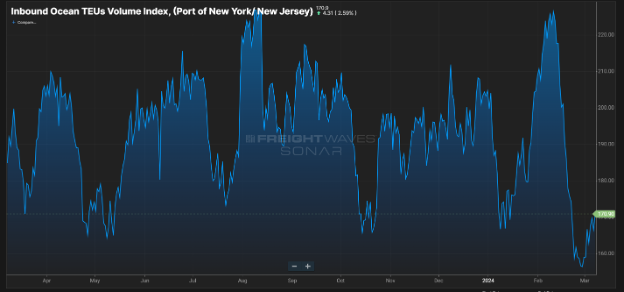

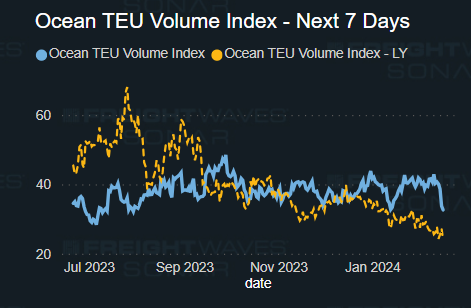

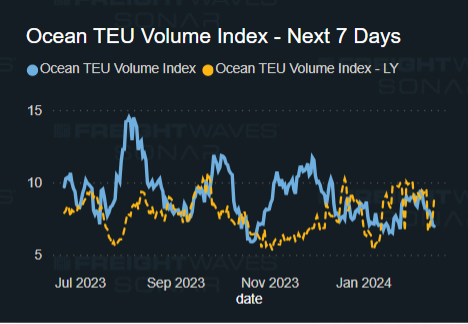

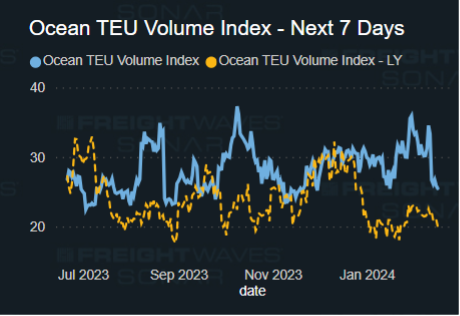

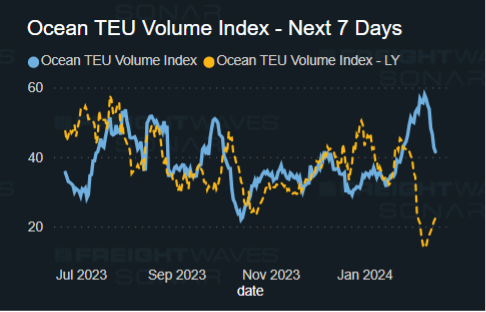

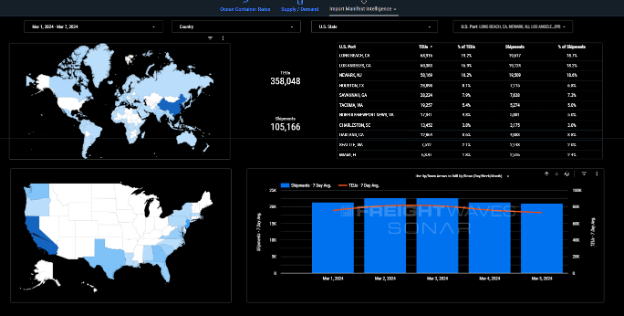

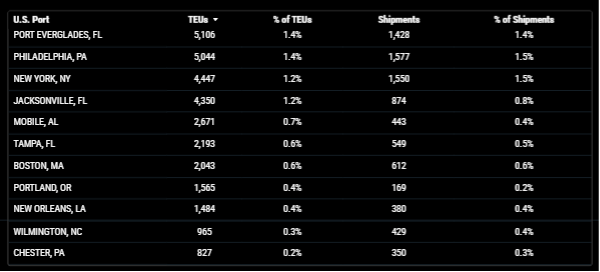

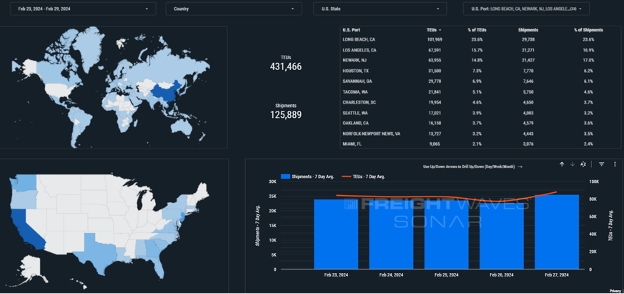

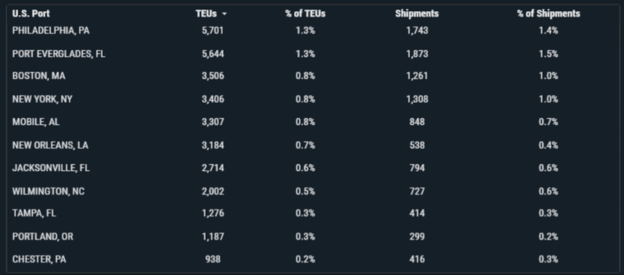

Import TEUs are down 17.01% this week from last, the heaviest volume this week arriving in Long Beach 19.2% of incoming TEU volume, Los Angeles 16.9% of incoming TEU volume and Newark 16.2% of incoming TEU volume. We are still expecting to see some post Lunar New Year volume increases, starting next week. Our team can help put some gameplans in place and guarantee no congestion and no demurrage charges if you act fast!

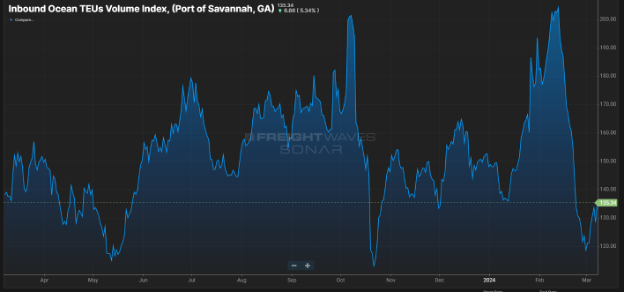

Below shows Port and Rail congestion as of today, Oakland, Long Beach, Miami, Savannah and Baltimore show the highest congestion in the U.S. and Vancouver, Prince Rupert and Toronto in Canada.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

Reminder! Daylight Savings starts Sunday March 10th

LA/LGB: Both Ports are experiencing higher volumes and equipment shortages creating more rail stacks and longer rail dwell times. Train releases are not a guarantee of rail loading and it also is dependent on the amount of rail equipment available and where the container is positioned in the rail stack. If you have urgent cargo that is on the verge of being affected by port or rail dwell times – transloading is the best solution, we have handled many successful shipments via drayage transloading and expedited trucking, delivered even before it would have hit the rail! Contact our west coast team for more information CA@portxlogistics.com

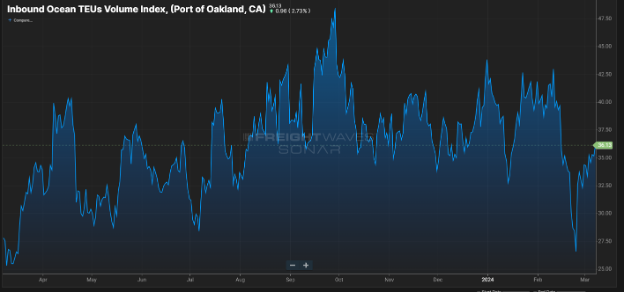

Oakland: Port congestion is at 5 days and Port dwell time is 5 days for imports in Oakland – this means capacity is filling in fast. We currently have plenty of drayage capacity in Oakland and are waiting to hear from you. We also have a transloading warehouse with a quick turnaround for your expedited transloads

Oakland@portxlogitics.com for capacity, great rates and even greater customer service.

Chicago: The congestion that has been occurring over the last few months at NS Landers is being addressed by the NS. Shawn Tureman, NS’s vice president of intermodal and automotive, acknowledged that issues with cranes and insufficient staffing have contributed to the delays at Landers, adding drivers make the situation worse when they cut the line rather than waiting their turn. “We are working with our [third-party terminal operator] to re-engineer staffing levels and shift changes to better align with [increased] gate activity,” Tureman said. He also urged drivers to arrive at the terminal in the early morning or evening. We are still seeing longer rail dwell times into Chicago off the west coast, will it cause more congestion and chassis shortages? It is very likely! All of our orders are tendered to on a first come first serve basis and as we love to say “the early bird gets the worm”. We have available drayage capacity in Chicago but it will fill up fast – Contact the team at letsgetrolling@portxlogistics.com and let’s get rolling in Chicago!

Did you know? To be on the lookout for BK speaking with Lori Ann LaRocco of CNBC about the current market and trends? The interview should be coming out in CNBC in the near future. If you would like to pick BK’s brain interview or podcast style contact marketing@portxlogistics.com to make arrangements to have a pow-wow with one of the industry’s absolute best!

SONAR Ima