1370 words 6 minute read – Let’s do this!

Ah yes, Superbowl weekend is upon us, this is the weekend that most Americans break their healthy New Year’s resolutions – and this year it is for the love of the game or for the love of Taylor Swift. I will be “super” interested to see how many more people tune into the game now that Pop Culture has entered the arena. And how many side bets there are involving the “Swifties” Lord and Savior. A fun fact about how the Superbowl: The Super Bowl accounts for an estimated 20% of annual avocado sales in early February, according to the U.S. Department of Agriculture (USDA). Mexico supplies about 81% of the avocados eaten in the U.S. In 2023, the total value of U.S. imports of avocados from Mexico was about $2.5 billion, according to the USDA. Last year, over 6,000 truckloads of avocados were imported to the U.S. in the weeks prior to the Super Bowl. More than 90% of avocado imports from Mexico cross into the U.S. through Texas ports of entry in Laredo and Pharr. We would love to hear your thoughts on final Super Bowl scores and if guac is on your menu! Wishing everyone a fun and gluttonous Super Bowl weekend.

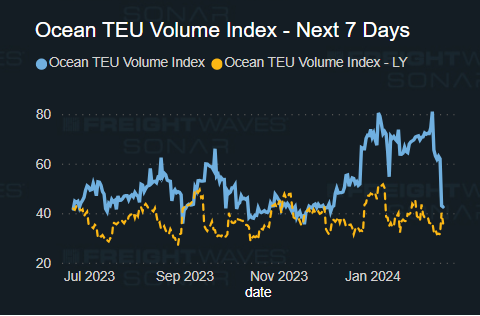

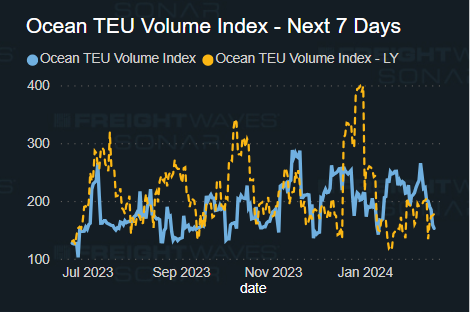

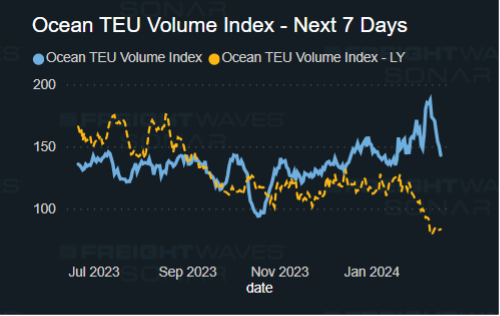

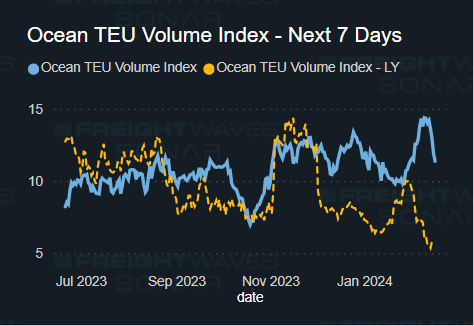

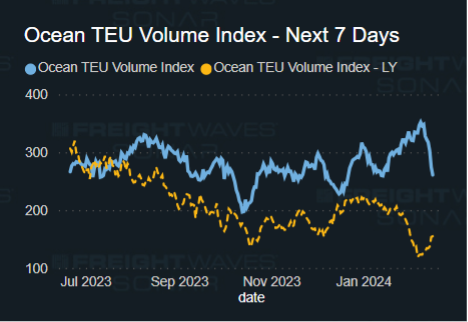

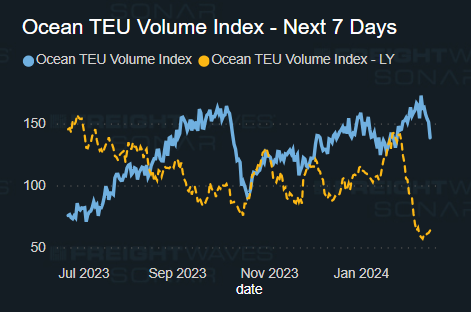

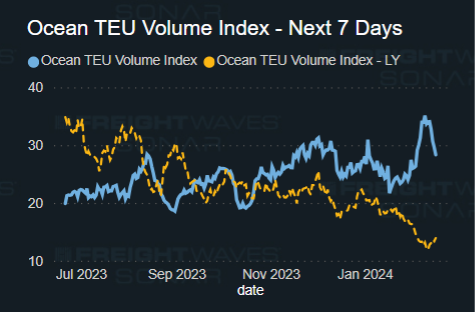

Ocean carriers have been granted emergency approval from the Federal Maritime Commission (FMC) to add surcharges to their ocean freight tariffs without the thirty day advance notice required under the U.S. Shipping law, since December 21st. These surcharges are to cover higher operational costs that ocean carriers are facing with the need to divert ships away from the Suez Canal to avoid the Red Sea attacks. Shippers have expressed concern during a hearing this past Wednesday, that the waivers granted to Ocean Carriers by the FMC are allowing Ocean Carriers to take charge surcharges that surpass the actual increased costs of the extended transit around the Cape of Good Hope – and 6% of global capacity will be routed through the Cape of Good Hope. Shippers and Retailers are asking for the FMC to provide more transparency to the surcharges as they will affect different parts of the shipping markets such as retailers and agricultural exporters that have pre-set tariffs and prepaid shipping costs to their customers. FMC Chairman Daniel Maffei told the hearing that with the sudden rerouting of ships, ocean carriers need to recoup higher operating costs, lest vessel services halt altogether. Still, Maffei said carriers should ensure that surcharges are justifiable. “It is not unreasonable for carriers to recover some of these higher costs,” he said. “The terrorist threat in the Red Sea is well within the purpose of these exceptions because without these waivers ocean freight service could be dramatically curtailed, creating a far worse situation. “However, granting these special permissions does not provide ocean carriers carte blanche to invent fees and surcharges for unrelated reasons,” Maffei added. “Fees and surcharges must be clearly defined, serve a specific purpose, and have an end date.” Joe Kramek, a director at the World Shipping Council, said the diversions are an emergency given the risk to seafarer safety from the Houthi attacks. Kramek said the many ancillary decisions that ocean carriers face — from rearranging transshipping options and bunkering ports to redeploying vessels from one service to another — due to rerouting ships away from the Suez Canal make it difficult to calculate the full costs immediately. “It’s a major disruption to [one of] the biggest sea canals in the world, and cargo is still flowing,” he said. “That’s because our members have made significant operational decisions to keep that cargo flowing. “It’s not just the extra distance or the days of travel time that’s significant,” Kramek added. “You have to reposition feeder services and transshipment points because these are global networks. It’s not an easy decision to make.” Regardless of the outcome, Ocean rates will likely continue to have added surcharges during the Red Sea Crisis and/or until the Panama Canal limitations have been lifted.

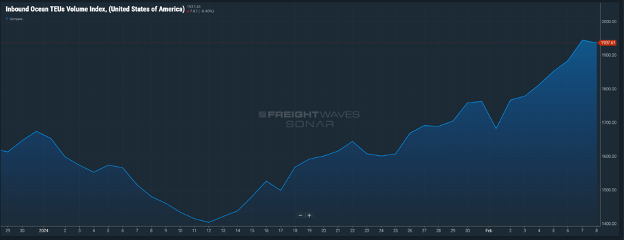

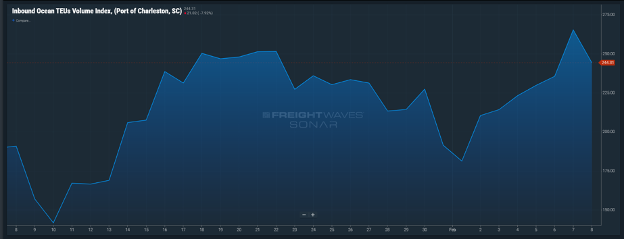

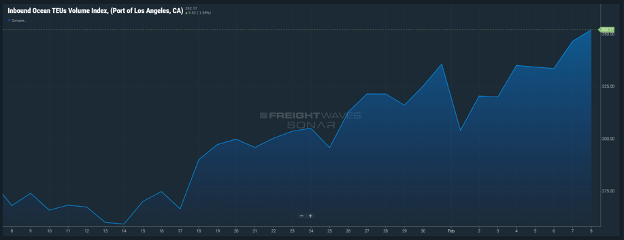

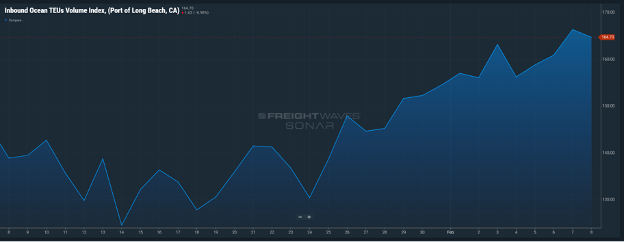

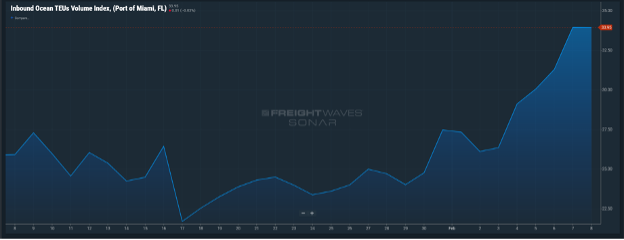

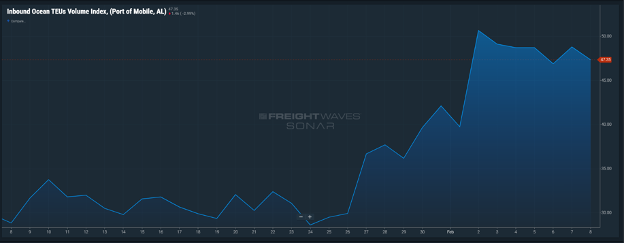

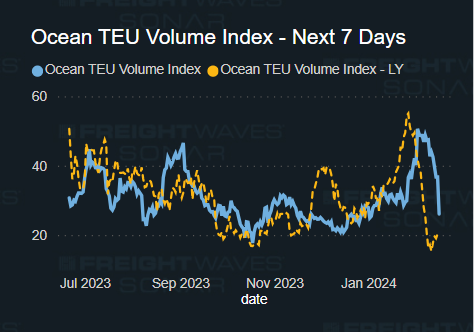

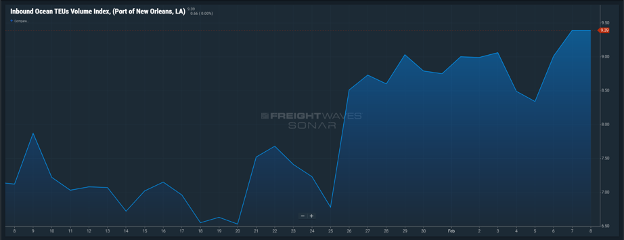

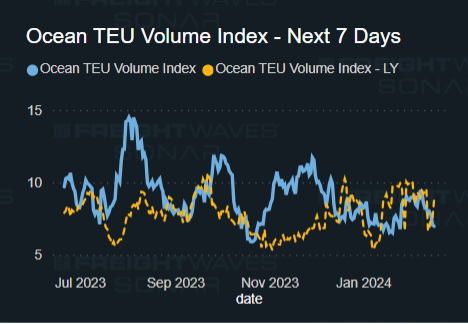

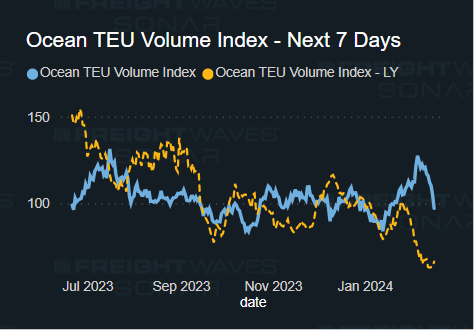

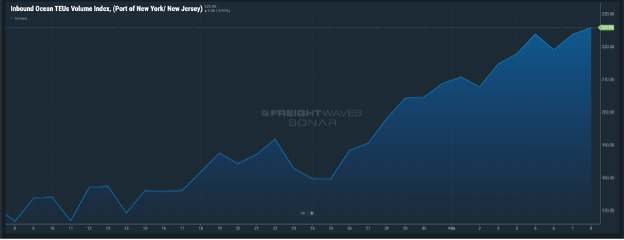

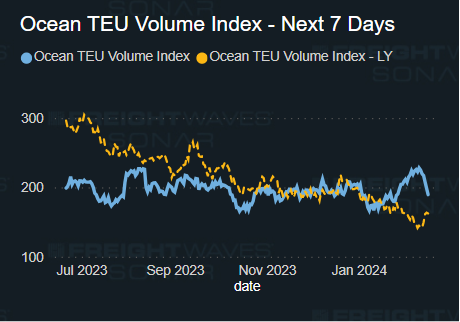

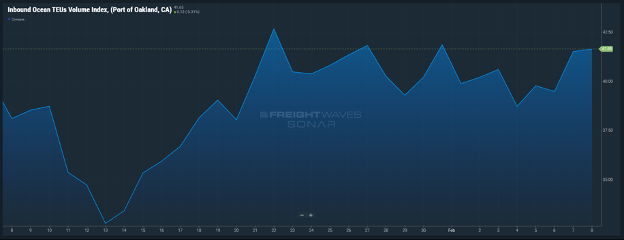

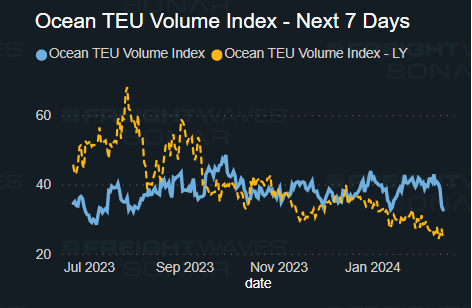

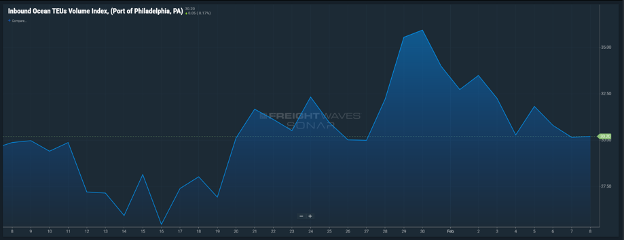

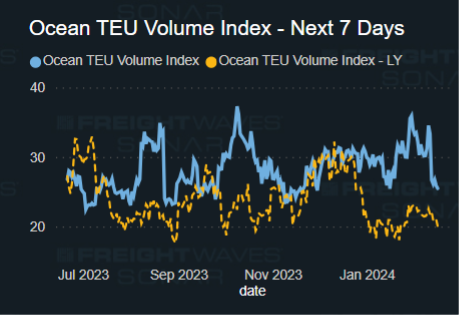

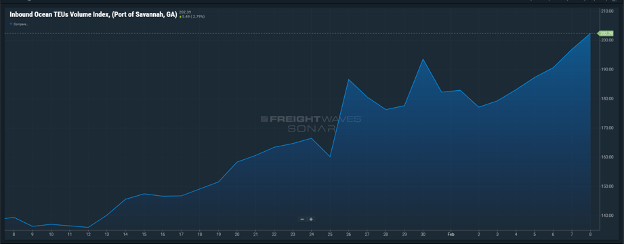

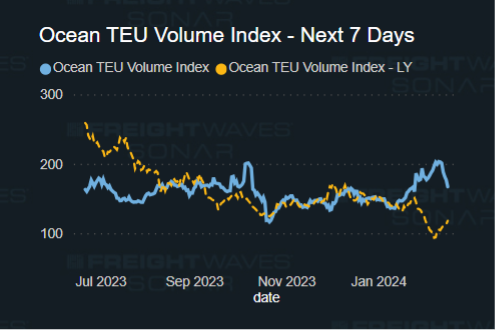

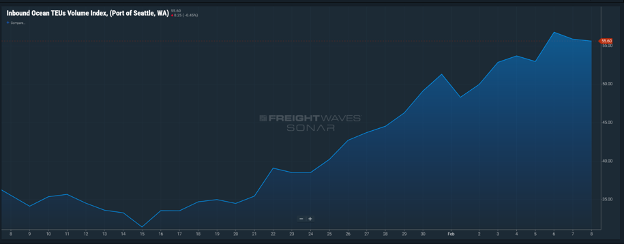

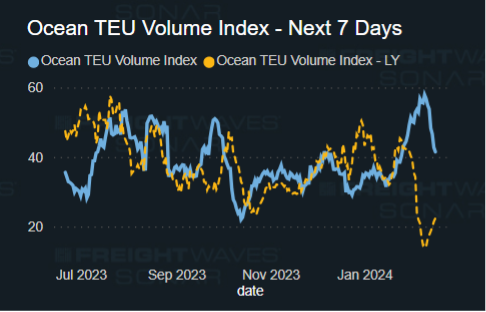

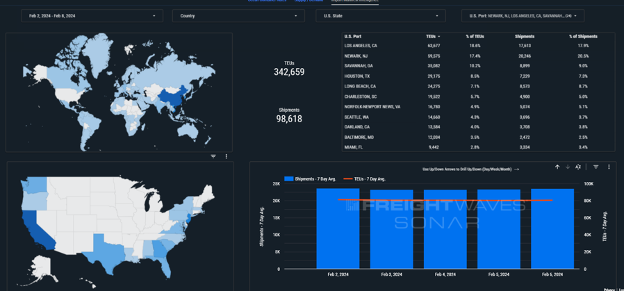

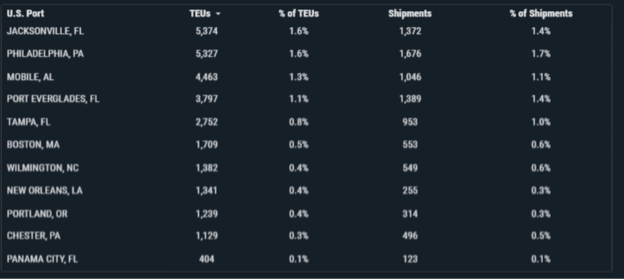

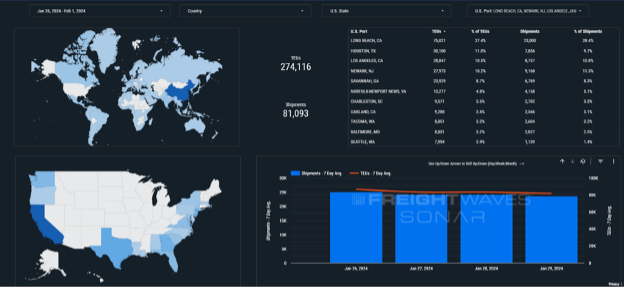

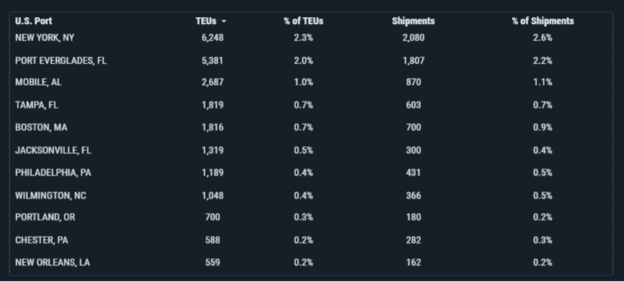

Import TEUs are up 25% this week from last, the heaviest volume this week arriving in Los Angeles 18.6% of incoming TEU volume, Newark 17.4% of incoming TEU volume and Savannah 10.2% of incoming TEU volume. Lunar New Year begins on February 10th so expect to see a decline of import volumes over the next couple weeks. Are you new to the industry? Every year, the Lunar New Year holidays significantly impact the Asia to U.S. trade lane, and if you source from China, your company’s supply chain. Lunar New Year traditionally lasts for 16 days. How long does Lunar New Year affect shipping? Here’s what the period of Lunar New Year looks like in 2024:

| Mid-December, 2023 | Production begins to slow down at factories |

| Late January, 2024 | Factories stop manufacturing; peak export rush at major Chinese ports to ship out goods |

| Early February, 2024 | Workers start to leave for the holidays; ports have limited operational capacity |

| February 9-16, 2024 | Lunar New Year holiday week |

| Mid-February, 2024 | Workers start returning to factories and ports |

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

https://portxlogistics.com/port-rail-updates/

Oakland: Weather issue delays have caused the Ports to remain open for first and second shift on Monday February 12th, the observed date for Lincoln’s Birthday. For containers traveling to Nevada through the mountains and Donners Pass, there is a need for snow chains and even have been some screening mandating the need for snow chains. If you have questions about snow chain season and surcharges or if you are looking for drayage capacity in Oakland and great rates contact the team at Oakland@portxlogistics.com.

LA/LGB: Persistent rain causing floods in the LA and Long Beach areas, but ports are currently open and operating. Heavy congestion looms at APM terminal and APM continued to cancel appointments through yesterday and yesterday 1st shift was fully canceled. We are still accepting drayage orders for LA/LGB ports, send us your orders ASAP to get your port appointments in and your capacity guaranteed

Contact CA@portxlogistics.com We got you covered!

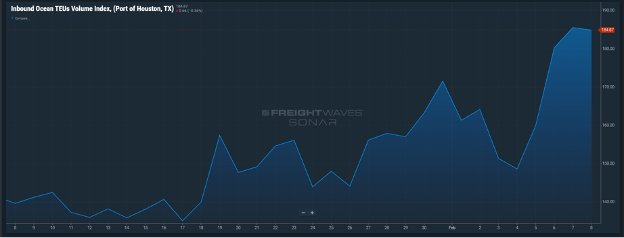

Houston: Up to 1 day waiting time for vessel berthing at Barbours Cut terminal and 4 days at Bayport Container Terminal. inclement weather in the Gulf of Mexico continues to cause closures at ports south of Houston and delays on arrival, on short notice. The average gate turn times at Barbours Cut Container Terminal are 44 / 45 minutes at Bayport Container Terminal. Even with the slow down at the port, we have you covered. Port X Logistics has drayage assets in Houston with the capability of long-haul drayage and we have a transload warehouse in LaPorte that can transload anything from standard pallets, to heavy lumber and industrial coils. If you need help in the Houston area we got your back, contact letsgetrolling@portxlogistics.com

Did you know? It is not quite time for the Kentucky Derby, but we have something coming to Louisville that is even faster than Amante Bianco! Our Carrier 911 Team will be onsite at the 2024 AirCargo Conference – AirCargo 2024 – To set up a meeting with Jason and Tom contact marketing@portxlogistics.com. With creeping disruptions in the market, the need for airfreight could be on the rise and our Carrier911 team is your best option for your incoming expedited freight – We have cargo vans, straight trucks, dry vans and specialized equipment for all your urgent air freight needs and in most cases we can have drivers onsite at the airport within one hour after dispatch for pickup. We are available 24/7/365 and all shipments will have shareable real time driver tracking links and a POD at your fingertips at time of delivery – to learn more or if have an need for an urgent bail out contact the team at info@carrier911.com and follow the Carrier911 Linkedin page for our unique experiences.

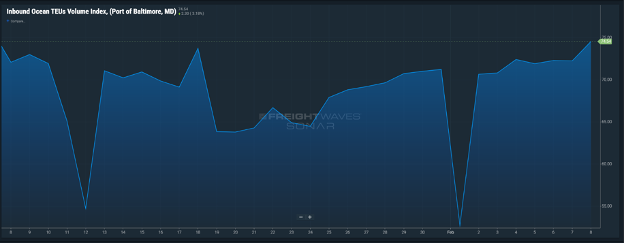

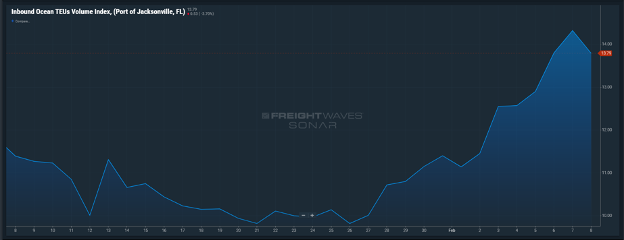

SONAR Images