1615 words 5 minute read – Let’s do this!

Welcome to 2024 – I hope everyone had a relaxing and joyful holiday season and I wish you all the best into 2024. Our founder Brian is always on top of market trends and predictions, a true industry expert. He posted his thoughts on 2024 on LinkedIn – join in the conversation with your thoughts and your predictions Check It Out Here We love to talk strategy, even more during the crazy times!

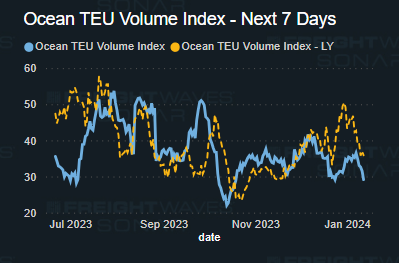

The start of the year is already bringing in ocean rate and transit time increases and vessel space shortages as attacks on commercial shipping vessels in the Red Sea by Houthi militants have forced container carriers to reroute vessels via the Cape of Good Hope, adding 6,000 miles and an additional two weeks in transit time. Southeast Asia to Europe was seeing the biggest impact so far, with delays increasing 105% from the week of Dec. 17-23 to the week of Dec. 24-31 and shippers are seeing prices of over $5,000 per FEU in the FAK [freight-all-kinds] market compared to $2,000 to $2,500 two weeks ago. Vessels on the route were expected to arrive eight days late on average. China to Europe ships were showing delays of four days, with vessels on the Southeast Asia to US East Coast lane coming in 2.5 days late. Many ocean freight teams are preparing for equipment shortages over the next few weeks and anticipating the traditional pre-Chinese New Year demand and a capacity shortage for the next few weeks with rates likely to increase even further. In a joint statement Thursday by the World Shipping Council, the International Chamber of Shipping (ICS) and BIMCO, the organizations expressed thanks to the 12 nations that have condemned the ongoing attacks on ships in the Red Sea and the unlawful detention of vessels and crews.“The shipping associations call on all nations and international organizations to protect seafarers, international trade in the Red Sea, and to support the welfare of the global commons by bringing all pressure to bear on the aggressors so that these intolerable attacks cease with immediate effect,” the statement read.

Additional ocean transit time is more than most shippers can afford to add to their incoming containerized cargo – the good news is that Port X Logistics makes it easy to save some time by opting to move your shipments as drayage, transloading and trucking and our end-to-end visibility via both our operators and our TMS Turvo allows us to monitor changes on the water and all the way through final delivery. We also offer a “No Demurrage Guarantee” on all import containers at all U.S. and Canada Ports – send us your container paperwork 5 days prior to vessel arrival and we guarantee no demurrage charges for all containers that are customs cleared and ready to roll within the ports free time. To learn more about drayage, transloading and trucking and our “No Demurrage Guarantee” email us at letsgetrolling@portxlogistics.com

With “no peace in the Middle East” causing ocean vessels to have late arrivals and delays for weeks, air freight expediting will increase and our Carrier911 team is on alert and available 24/7/365 for all your domestic expedited needs. We provide tracking for all your shipments and can provide cargo vans, straight trucks, dry vans and even specialized equipment for your airport and hot shipments and in most cases the drivers can be on site for pickup within one hour. Our tracking links are shareable and will track the driver from pickup to final delivery and POD digitally at your fingertips at time of delivery. Jason, Shane, and Jimmy can help to book your orders, provide competitive rates and answer any questions about Carrier911 contact info@carrier911.com it will seem impossible, until you see it for yourself.

I have been keeping an eye on chassis supply this past year and as JOC’s Ari Ashe has stated in an article posted today, chassis was not a huge problem through 2023. Supply and demand for chassis in the US reached equilibrium last year as new units ordered in 2022 were delivered to lessors and new manufacturers entered the marketplace, and demand for chassis this year will largely depend on US container import volumes and the percentage of those shipments landing at ports on the West, East and Gulf coasts. Demand for new chassis cooled considerably amid a sharp decline in US port volumes, prompting chassis providers to shift their focus to refurbishing existing units, which is cheaper than buying new equipment. Companies such as TRAC Intermodal and DCLI chose to stack thousands of units rather than let them idle unused, but there will always be worry that these providers will be too slow to unstack equipment when volume eventually picks back up. Pitts Enterprises is appealing a final decision from US Customs and Border Protection (CBP) to levy duties on chassis made by subsidiary Dorsey Intermodal. CIE Manufacturing, formerly known as CIMC Intermodal, is also fighting a preliminary decision from CBP to levy duties on its chassis. Both Pitts and CIE have suspended bringing in new chassis from overseas, which could become a major headache if the cases are not resolved before demand rebounds. There is no deadline for CBP to rule on the appeals.

Maintaining, refurbishing and upgrading chassis is ongoing and especially during busy times. One thing I think many people don’t think about are the wear and tear that chassis endure and the cost of maintenance. From a private chassis perspective it will cost on average $13-15 day to lease and around $5 per day for maintenance – but keep in mind that is every day including the days that a chassis sits idle in a yard or depot. Hydraulic hose, fittings and tire repairs and gear greasing are all a possibility of daily chassis maintenance, not to mention the cost of the mechanic. Chassis charges will increase as the cost of parts and labor increase, and we all know price increases are on the rise, we live and breathe it every day.

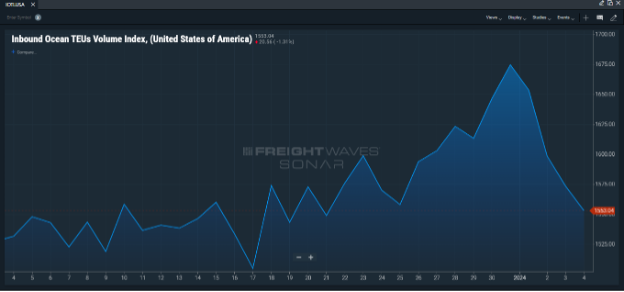

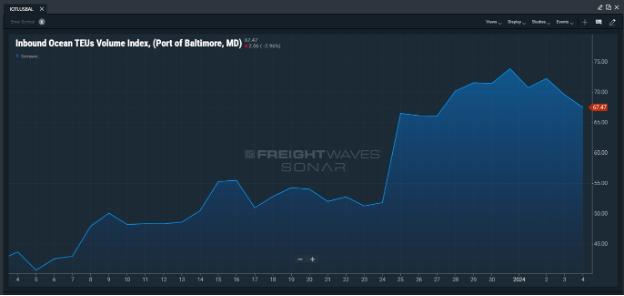

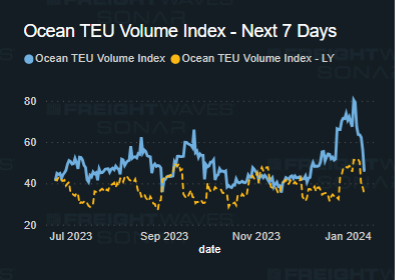

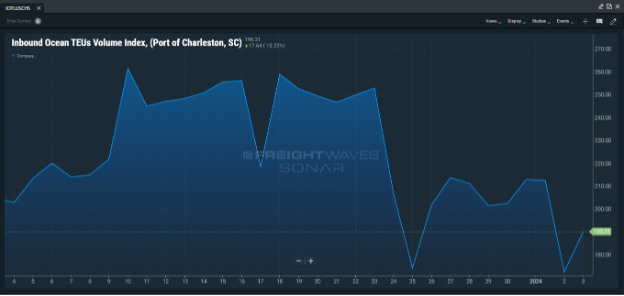

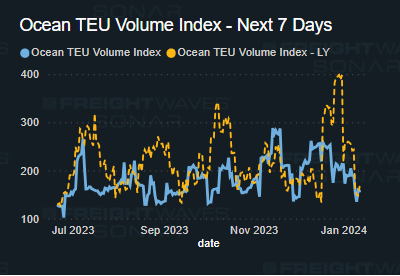

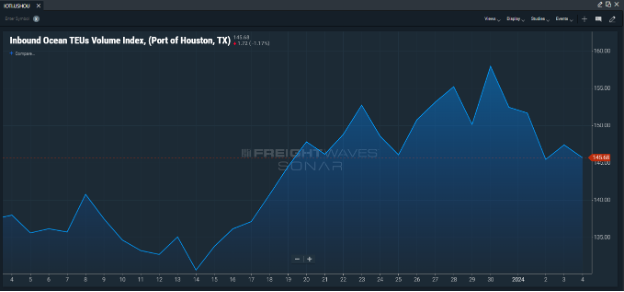

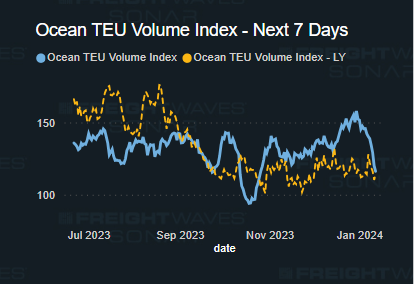

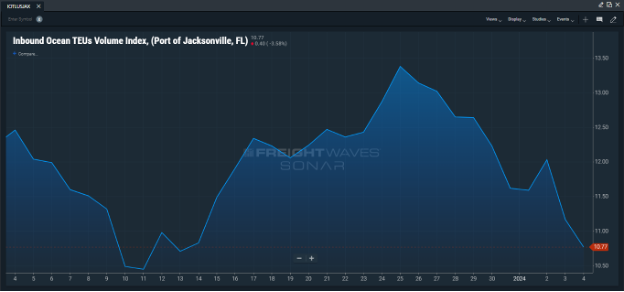

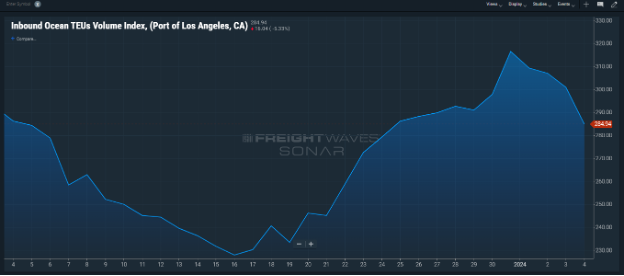

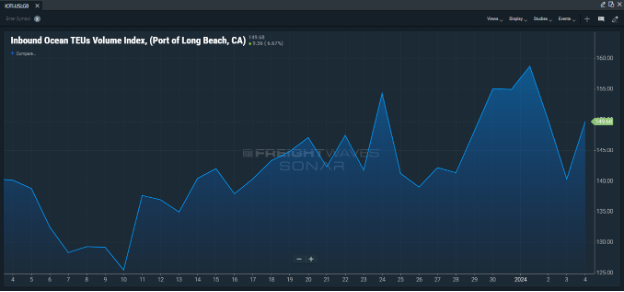

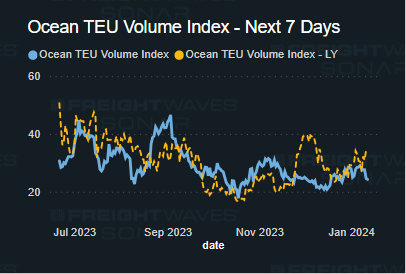

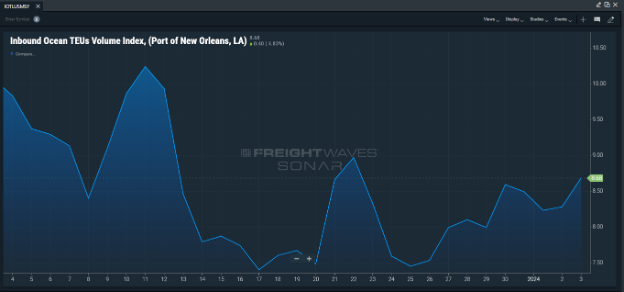

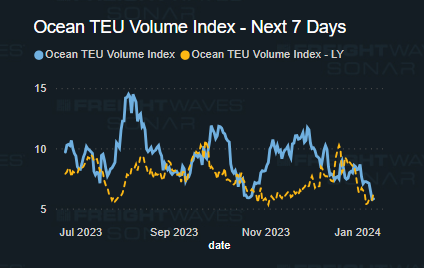

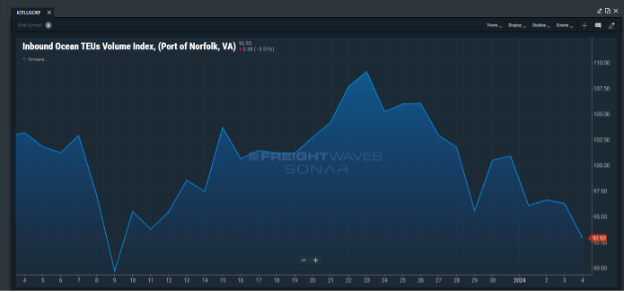

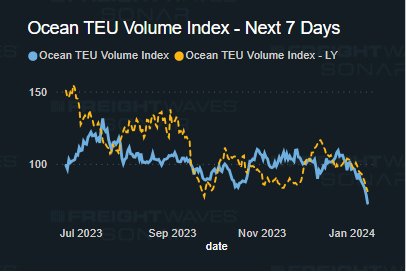

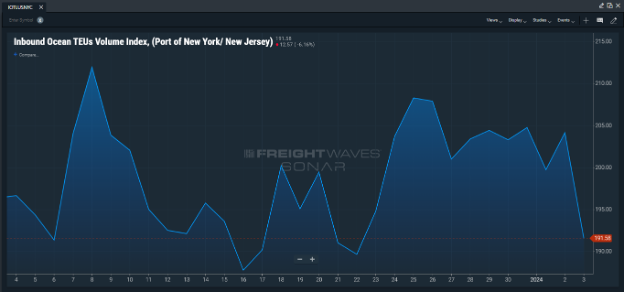

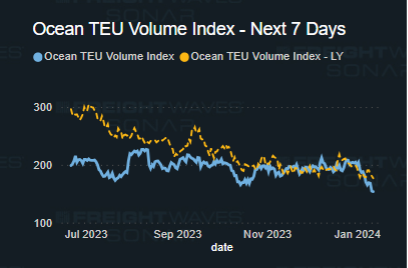

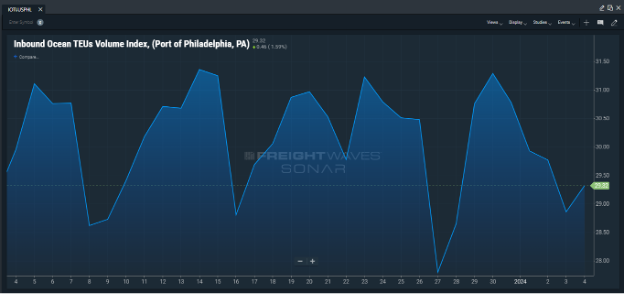

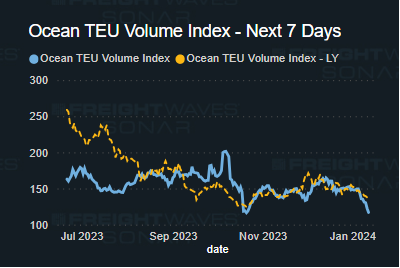

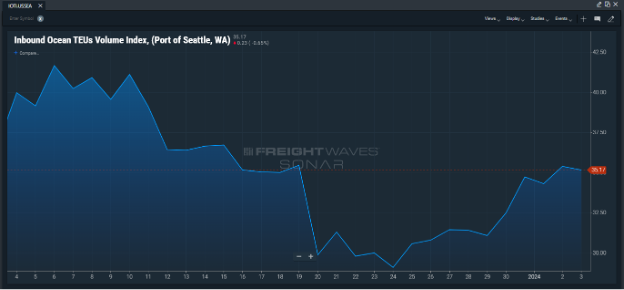

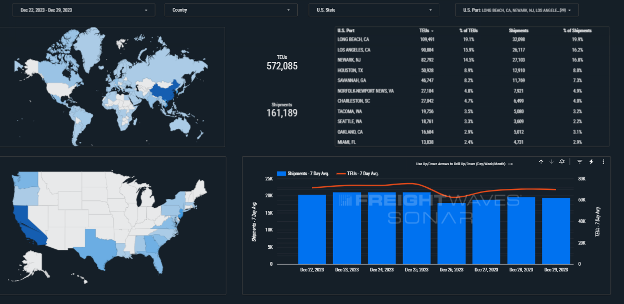

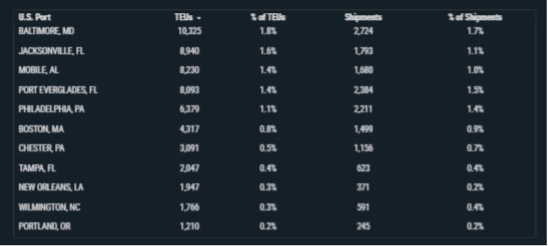

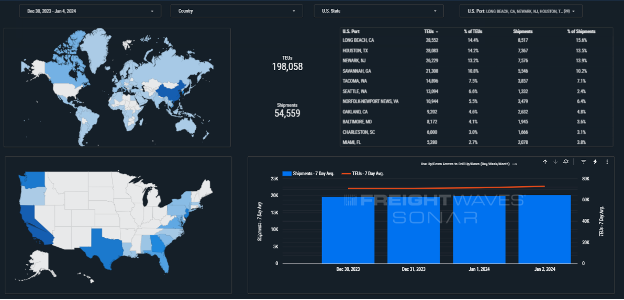

The week of December 22nd through December 29th had a huge amount of import TEUs into the major U.S. Ports with majority arriving into Long Beach 19.1%, Los Angeles 15.9% and New Jersey 14.5%. However, Import volumes are down 65.37% this week, still with majority coming into New Jersey port 14.7%, Long Beach port 14.2% and Houston 13.9%

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

LA/LGB : California truckers have until 1/31/2024 to register newly obtained diesel tractors with the state of California. After 1/31/2024 no new diesels can be added. Truck capacity in California will be capped for diesel tractors. This will raise rates for importers and exporters utilizing truckers in the Port of Long Beach, Port of Los Angeles and the Port of Oakland. On a positive note – we have plenty of drayage capacity and chassis for LA/LGB containers and open capacity at our transload warehouses, if you are looking for coverage and competitive rates contact the West Coast team CA@portxlogistics.com

Container Vessels currently in Port LA: 104 Expected Arrivals: 36

Container Vessels currently in Port LGB: 84 Expected Arrivals: 59

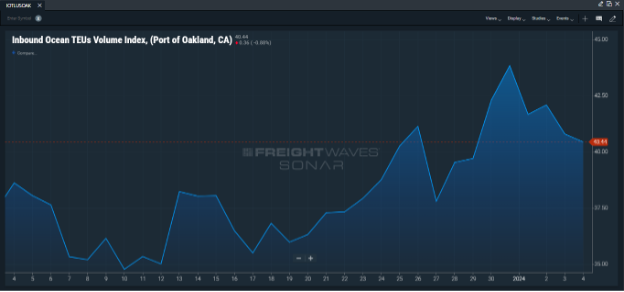

Oakland: Volumes are still up in Oakland causing congestion and extra wait times for drivers, in excess of 2+ hours. Reminder as of January 1st the GATE FEE at OICT has increased from $35 to $40 per transaction. Despite the increase in container volume, we have drivers available! Contact JP and the Oakland team for all your Oakland drayage needs Oakland@portxlogistics.com

Container Vessels currently in Port: 50 Expected Arrivals: 6

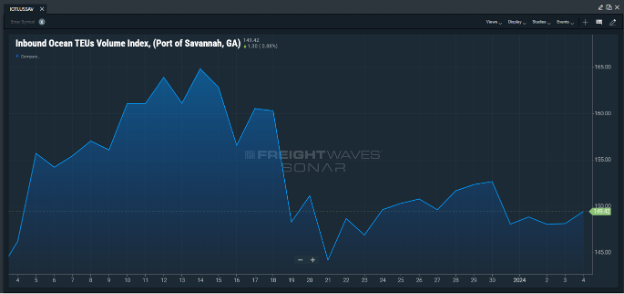

Savannah: Ocean Network Express will launch a new container ship service between Savannah and West India in May 2024. The new offering will give the Georgia Ports Authority 10 services via the Suez Canal, with nine calling on the Indian subcontinent. The new ONE announcement will give the Port of Savannah a total of 37 ocean carrier services to global destinations – the most of any port from the mid-Atlantic to the Gulf of Mexico. The new service will feature a fleet of nine vessels, all of which are operated by ONE. In a statement, ONE said the independent nature of the WIN will provide reliability and flexibility to customers. The main commodities include consumer goods such as electronics, perishables, textiles and chemicals. Are you interested in learning about shipping through the Port of Savannah? Port X Logistics has a drayage fleet and transload warehouse to make that transition smooth and successful. Contact our Savannah team to learn more sav@portxlogistics.com

Container Vessels currently in Port: 76 Expected Arrivals: 31

Did you know? Port X Logistics will be attending Manifest 2024 in Las Vegas, NV Feb 5th – 7th

Our founder BK and original Leadership team members Pat and Tom will be on site in Las Vegas and they want to meet with you!

https://www.linkedin.com/feed/update/urn:li:activity:7140719246472265729/

If you will be attending Manifest 2024 and are interested in meeting with our team, email marketing@portxlogistics.com to schedule meetings. We hope to see you there!

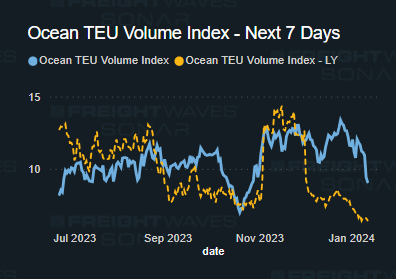

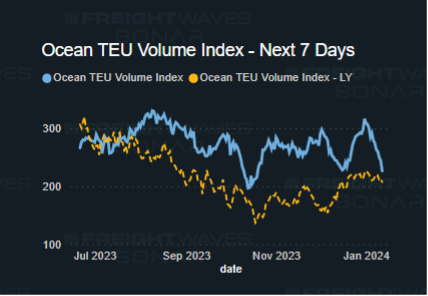

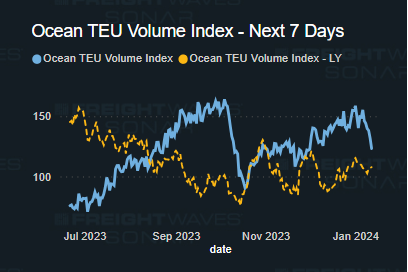

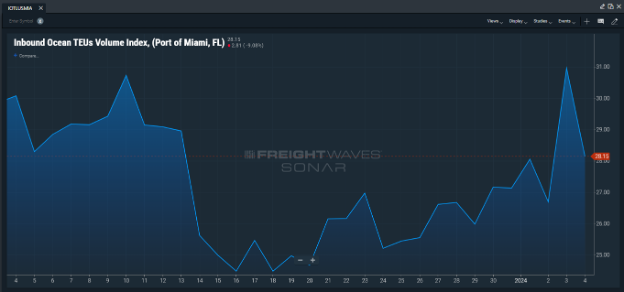

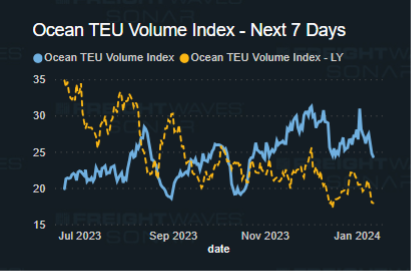

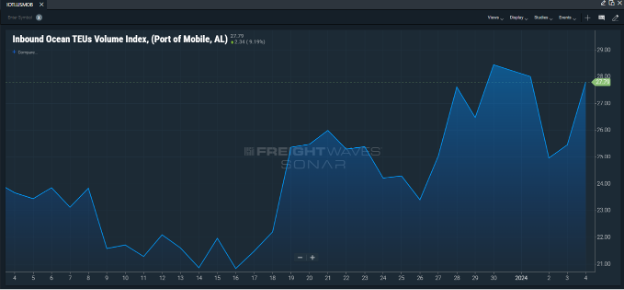

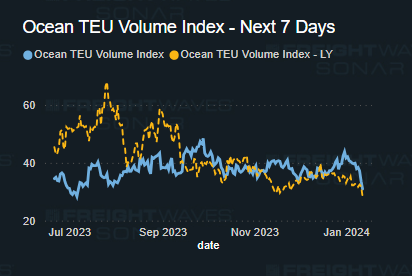

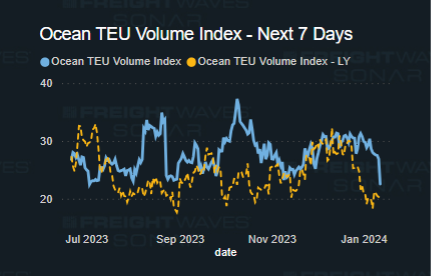

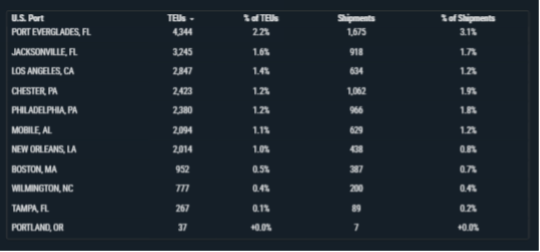

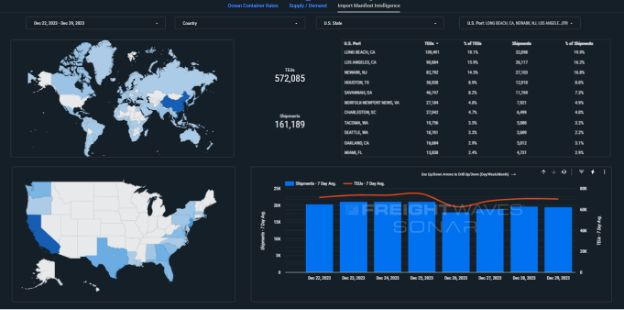

SONAR Images