2371 words 9 minute read – It’s a biggie – Let’s do this!

This is our last Market Update for the year, I can honestly say I don’t know where the year went, even with all the dramatic lows and minimal highs. I am very happy to start fresh in 2024 – and it is a BIG year ahead. The start of the new year brings Election year, which is always full of surprises, vessel reroutings to avoid the tensions between Israel-Hamas and the canal closures and Lunar New Year. What could possibly affect the industry in Q1? Let’s talk about that…

Further restrictions in the Panama Canal have been implemented for January and February, and complications in Suez Canal have prompted several steamship lines to take precautionary measures, such as rerouting or temporarily pausing services that would have passed through the affected area as a response to these safety issues. A RoRo vessel seizure followed by targeted attacks on container vessels transiting through the Red Sea has prompted security concerns.

Why is the Red Sea significant to global trade and why are ships being attacked there? The nearly 2,000-km Red Sea connects the Mediterranean Sea with the Indian Ocean via the narrow Suez Canal. Before the Suez Canal’s construction in 1869, ships had to go around the Cape of Good Hope in South Africa to travel between Europe and Asia. The Suez Canal cut the time and resources it took to cover that distance considerably, by providing a direct route. According to the US Energy Information Administration, the Suez Canal accounted for 9.2 million barrels per day of total oil flows in the first half of 2023. Twelve percent of global trade depends on the Suez Canal, compared to 5% on the Panama Canal. The Houthis say they have been attacking vessels in the Red Sea with links to Israel. They say this is in protest of Israel’s military offensive in Gaza after the Palestinian militant group Hamas launched an attack against Israel on October 7. Earlier in November, Houthi militants also hijacked an India bound ship Galaxy Leader. Vessel journeys rerouting through Africa will increase to around 10-15 days, containers bound for the Middle East could attract war risk surcharges, and fears or oil prices rising are all things to look out for, although Goldman Sachs analysts have said the disruption is unlikely to have a large effect on crude and liquefied natural gas prices because apart from rerouting, production itself is not being affected. Shippers can expect a 15-25% reduction in capacity and an additional 10 to 15 days in transit times. Some carriers require allocation plans, and Israel bookings are limited. Prepare for surcharges (estimating at $500-$1000 per TEU) and a potential rate increase per container. Insurer adjustments may lead to higher costs and delays in equipment return and longer transit times may impact Lunar New Year shipments. That is a lot to take in…

Those extra 10 to 15 days of transit time are more than most shippers can afford to add to their incoming containerized cargo – the good news is that Port X makes it easy to save some time by opting to move your shipments as drayage, transloading and trucking and our end-to-end visibility via both our operators and our TMS Turvo allows us to monitor changes on the water and all the way through final delivery. We also offer a “No Demurrage Guarantee” on all import containers at all U.S. and Canada Ports – send us your container paperwork 5 days prior to vessel arrival and we guarantee no demurrage charges for all containers that are customs cleared and ready to roll within the ports free time. To learn more about drayage, transloading and trucking and our “No Demurrage Guarantee” email us at letsgetrolling@portxlogistics.com

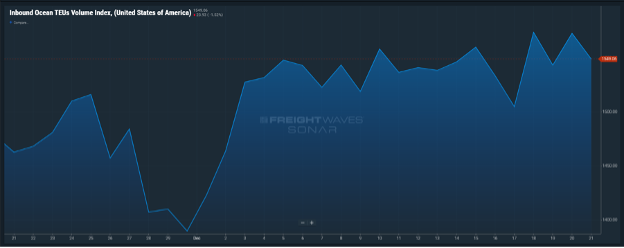

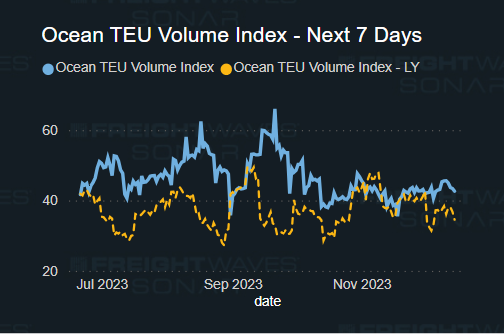

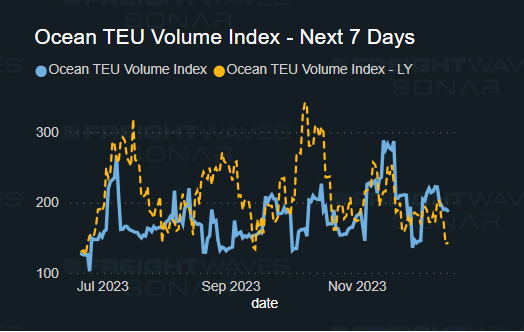

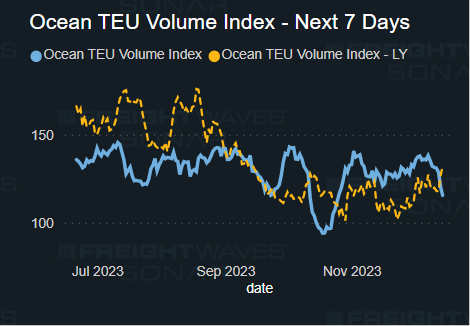

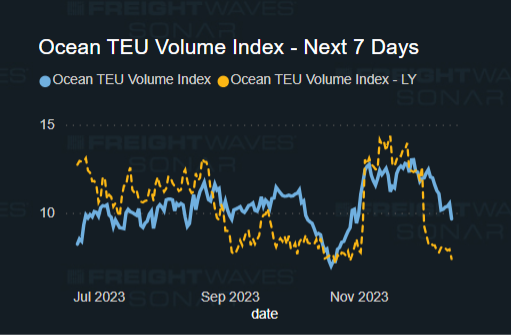

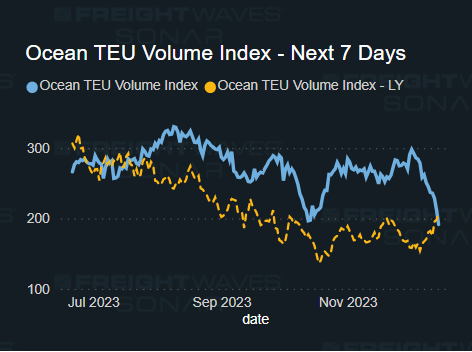

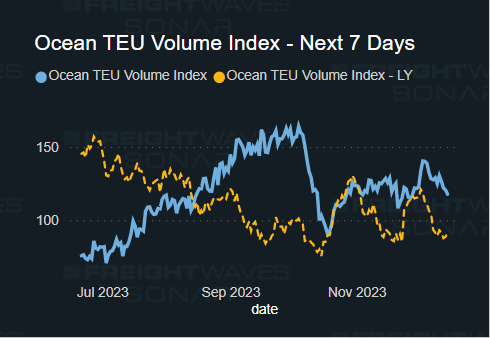

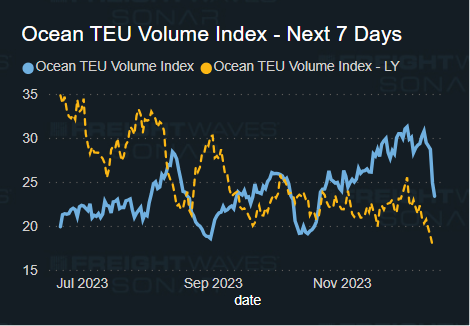

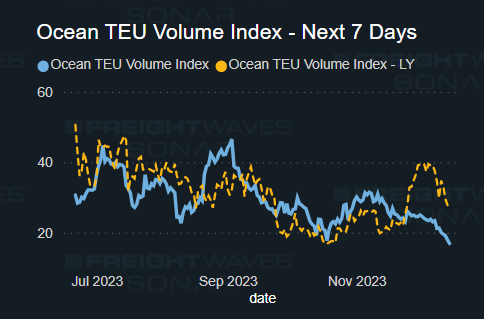

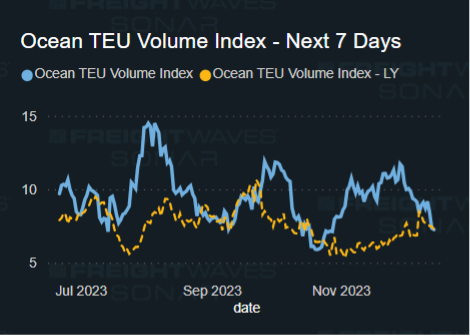

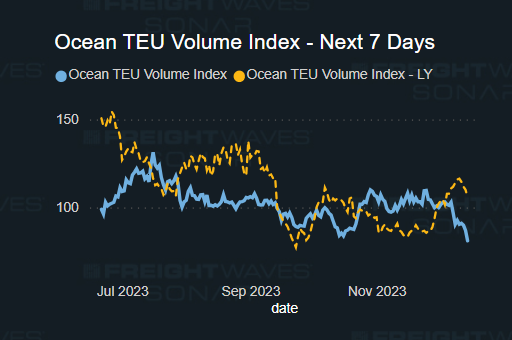

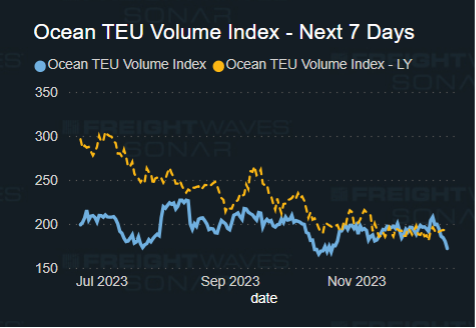

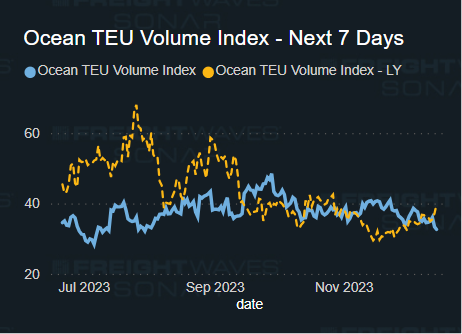

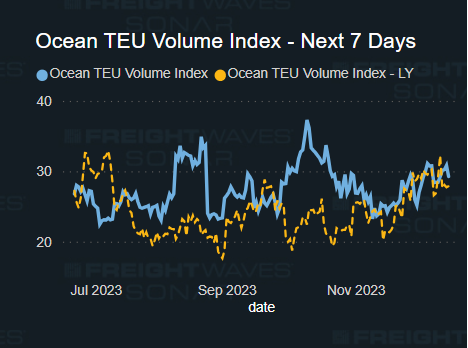

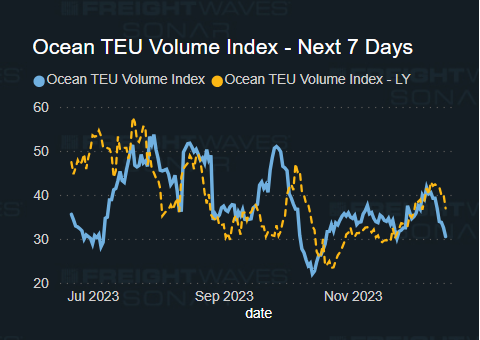

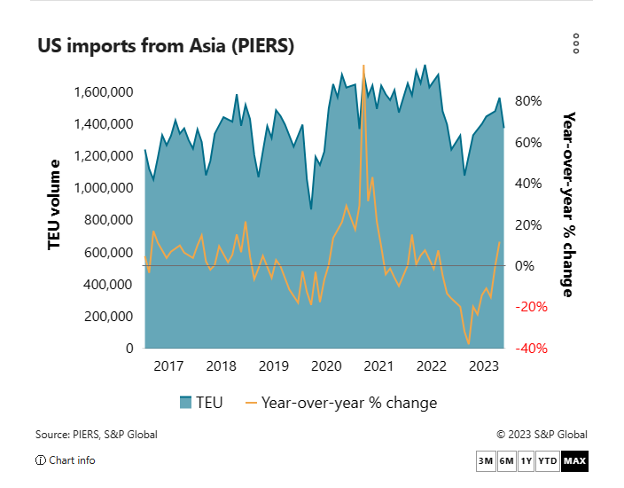

The slow Lunar New Year was a bit of a hard pill to swallow in 2023, following the post couple years and that pretty much also goes for most of 2023, it was a dud year. The snail’s pace momentum of the market was an adjustment for most of us that were used to volatility in capacity, rates and surcharges now being brought back to the pre pandemic realities. U.S. Inventories were abundant from the year prior and in the process of regulating, causing less purchasing, and there was less spending within the U.S. due to uncertainties in the economy. According to a post in JOC – U.S. retailers are becoming more ambitious in their ordering for early 2024, thanks to steady end-of-year holiday sales that include a strong Black Friday performance. (Love that!) That has pushed up import forecasts as sellers expect record holiday sales despite mixed economic signals. On a year-over-year basis, US imports from Asia have been rising since April, with volumes in November up 10.8% over the year-earlier period.

Our VP of Sales Pat Morrison is taking the spotlight this week and giving his 2024 predictions: Continuation of capacity reduction in overall market (Drayage & OTR) as drivers and companies leave the industry due to declining volumes and rising costs/lower profits. Expedited transloads make a return as ocean routings and time on the water are changing/increasing due to the Panama Canal and Suez/Middle East situations.

Air cargo volumes are increasing and need for expedited air cargo recovery as a way to off-set the increased ocean times.

Geo-political pressures involving the South China Sea/Taiwan will continue to stress the ocean market and drive manufacturing out of China and into India, Vietnam and other SE Asia countries. Near-shoring back to Mexico and Central America will see an increase as well. U.S. Intermodal transit will continue to increase to help off-set lowering driver capacity.

Pat will be attending both: Manifest 2024 in Las Vegas Feb 5th – 7th and TPM24 in Long Beach March 4th – 6th.

Pat is currently scheduling customer visits for the 1st quarter and will be in Salt Lake City, Dallas-Fort Worth, Houston, Atlanta and Chicago to name a few. Reach out to him pat@portxlogistics.com if you’d like to set up a visit in your neck of the woods!

Speaking of Manifest and TPM – Port X Logistics will be attending a few heavy hitter conferences during Q1

Manifest 2024 in Las Vegas, NV Feb 5th – 7th

AirCargo Conference in Louisville, KY February 11th – 13th

2024 SC Automotive Summit in Greenville, SC February 13th – 15th

and of course, the Superbowl of industry: TPM24 in Long Beach March 4th – 6th.

If you will be attending any of these conferences and are interested in meeting with our team or being a part of something cool like a helicopter ride over the Port of Long Beach at TPM24, email marketing@portxlogistics.com

Our Buffalo KAM, Jordan posted a recent post on Linkedin that is about to hit viral status highlighting the importance of communication in the industry and the long-lost art of picking up the telephone to call someone. Sure we are heading into 2024 and yes we live in a world where text messaging and email is normal, but 2 things get lost in the text message shuffle – urgency and human interaction. In this industry urgency and human interaction give anyone an edge. Time is of the essence in logistics and supply chain, and as we always say, the early bird gets the worm. And let’s face it, customer service in every industry has gotten stale – especially with automated phone systems. Nothing like wasting 10 minutes listening to messages and clicking buttons only to get you back to square one or worse disconnected. I have been to a few conferences in 2023 and a hot topic was always customer service with human interaction and the benefits it brings to this industry. As more and more of my friends and family members that were working remotely are getting called back to work more days in office in 2024, I can’t help but wonder if it is more companies pushing to bring back the telephone! Show Jordan some love and support of the old “Pick up the phone and start dialing” movement

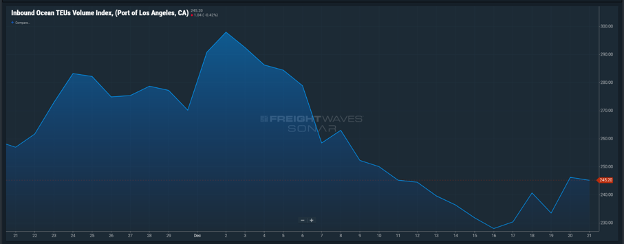

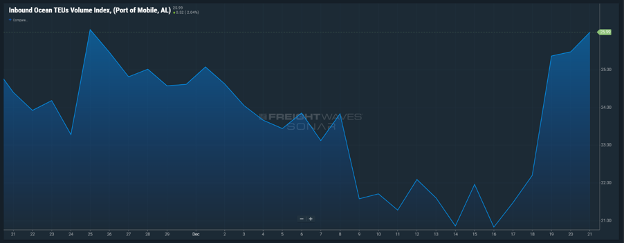

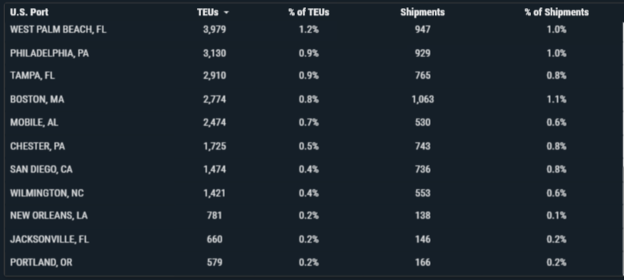

Import volumes are down 6.67% as we slide into short weeks for the next 2 weeks. The next 2 Mondays are the biggest holidays of the year and the days that most every shipper, receiver, port and rail are closed. We keep a close eye on your containers and how the holiday can affect terminal appointments and free time and provide proactive updates on all your containers from overseas port to door.

Airports continue to remain open but often air cargo stations often have reduced hours. If you have air freight due in over the next 2 weekends, remember that our Carrier911 division is available 24/7/365 for all your expedited needs. We provide tracking for all your shipments and can provide cargo vans, straight trucks, dry vans and even specialized equipment for your airport and hot shipments and in most cases the drivers can be on site for pickup within one hour. Our tracking links are shareable and will track the driver from pickup to final delivery and POD digitally at your fingertips at time of delivery. Let us do your holiday freight babysitting this holiday season – contact info@carrier911.com to get your last minute, end of the year shipments on the board and prepared for pickup.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

REMINDER – Most Ports and Rails will be closed on Monday December 25th and Monday January 1st in observance of the holidays

CLICK HERE For Port & Rail Updates

LA/LGB : Trapac has been causing grief to all truckers as of yesterday as they are not assisting with last free day extensions due to an issue with eModal not working to schedule Trapac Y258 import appointments. Wait times at APM terminal are over 2+ hours for drivers due to a fiber optic connectivity issue on Tuesday. APM wait times are slowly improving, but we expect continued wait times and appointment issues to occur next week due to the short week. We do have plenty of drayage capacity and chassis for LA/LGB containers and open capacity at our transload warehouses, if you are looking for coverage, competitive rates or more information about the new chassis proof rule, contact the West Coast team CA@portxlogistics.com

Container Vessels currently in Port LA: 108 Expected Arrivals: 37

Container Vessels currently in Port LGB: 85 Expected Arrivals: 43

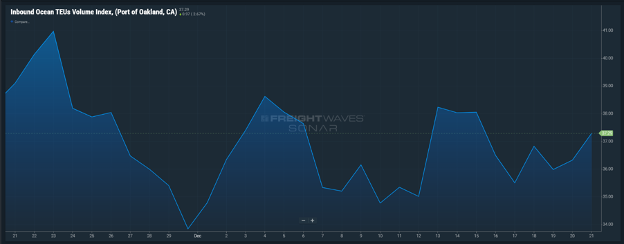

Oakland : Volumes are increasing at the Port of Oakland and OICT is out of chassis, and congestion is on the rise. Driver wait times are 5+ hours per container. If you are struggling to get capacity for your Oakland containers, we still have some capacity left for the end of this week and next week. Get your orders in early to our team at Oakland@portxlogistics.com

Container Vessels currently in Port PRR: 301 Expected Arrivals: 53

Container Vessels currently in Port Vancouver: 301 Expected Arrivals: 6

Did you know? We are taking the week off next week from the Market Update but we will be back hot and heavy on January 4th – We want to wish everyone a very Happy Holidays and a very healthy and prosperous start to the new year. We appreciate everyone that reads and interacts with the Market Update and we are happy to bring these to your inbox and social media every week. If you are new to the Port X Logistics world I would like to reintroduce you to our services and our asset profile below and let everyone know we have plans to greatly expand our assets into 2024 – we are approaching a very exciting year and we will be honored if you stick around for the ride and join the revolution! letsgetrolling@portxlogistics.com

We offer and excel at:

- Drayage, transloading, and trucking. We like to say drayage transloading and trucking 2000 miles in just 2 days.

- Transloading and trucking of open tops, break bulk, and flat racks throughout the USA. We do have contracts with stevedores to help expedite transloading of some of this cargo directly at the port.

- Local and Regional drayage

- Long Haul Drayage – for imports or exports that cannot be transloaded

- 53’ Domestic intermodal service, 1100 Refrigerated Trailers On Flat Car, and 300 refrigerated domestic containers.

Asset Profile (Port X Logistics Owned)

- Oakland – 47 trucks, yard space, and transloading (local and long haul drayage – lots of Reno)

- Long Beach -36 trucks, yard space, and transloading (in heavy weight corridor 27 acres) (including specialized equipment)

- Denver -12 trucks, yard space, and transloading

- Kansas City -59 trucks, yard space, and transloading (58 acres and equipped with lift capabilities)

- Memphis – 48 trucks, yard space, and transloading (92 acres of yard space and depot equipped with lift capabilities). **Yard backs up to the UP in Marion**

- Savannah – 22 trucks, yard space, and transloading

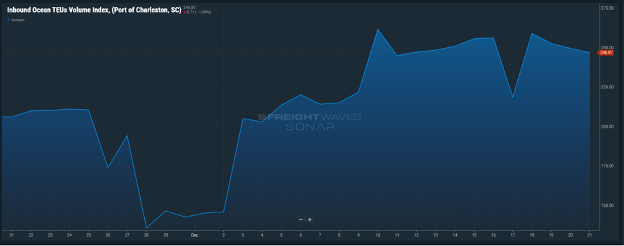

- Charleston – 12 trucks, yard space, and transloading

- Chicago – 80 trucks, yard space, and transloading (including specialized equipment)

- Norfolk – 24 trucks, yard space, and transloading (including specialized equipment)

- Houston – 40 trucks, yard space, and transloading (including specialized equipment)

- Dallas – 23 trucks and yard space

- Seattle-Tacoma – 35 trucks, yard space, and transloading (including specialized equipment).

- Elizabeth, NJ / Jacksonville / Atlanta Locations all to be online by JAN ’24

- IMC service – 1100 trailers that can ride on flat car, as well as domestic EMPU and UMAX boxes for domestic intermodal

**** Also remember our two Canadian offices. Drayage, transloading, and trucking including services to move in bond and remanifest the bond on your customers behalf.

Not only do we have exceptional service and customer experience, but our technology is the best in the business. We even track the cargo on the water all the way from origin port into the U.S. and onto the final destination. It’s a game changer for the operators and your customers.

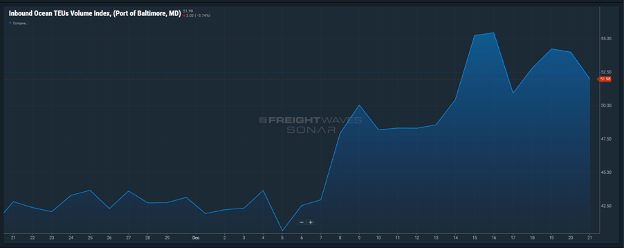

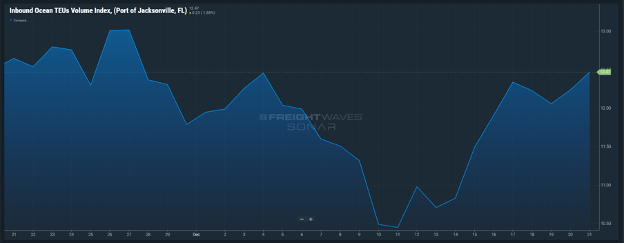

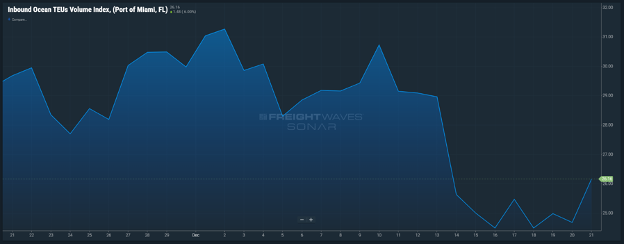

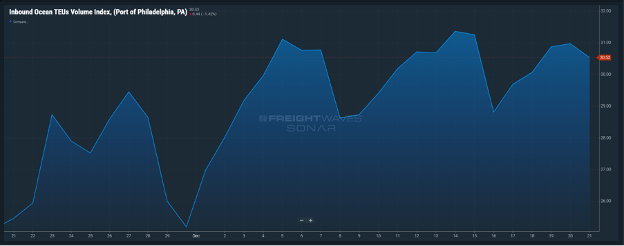

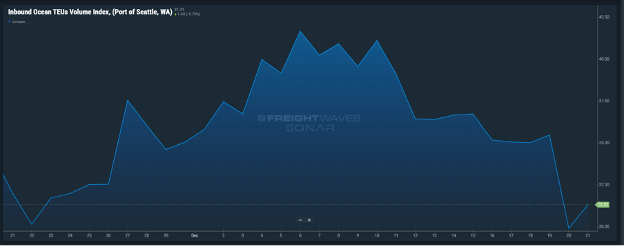

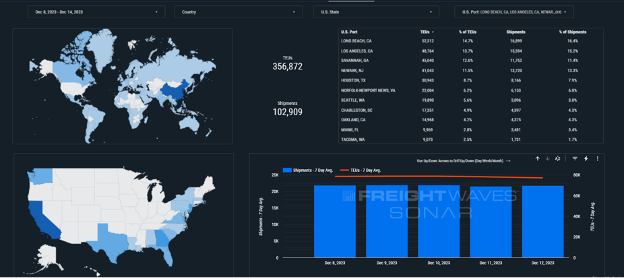

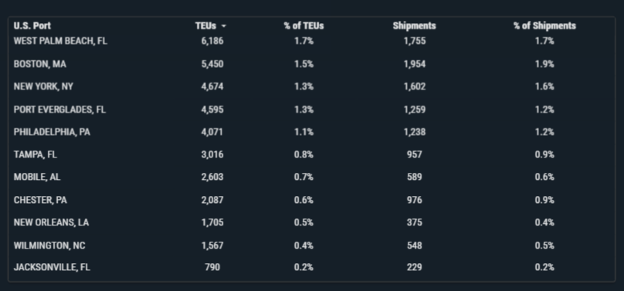

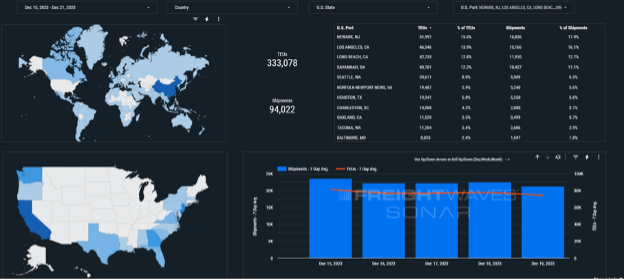

SONAR Images