1623 words 4 minute read – Let’s do this!

Confidence in the Panama Canal to process container vessel transits appears to have completely bombed over the past week in the logistics world. There have been widespread diversions of Asia-North America east coast sailings to Suez and Indian Ocean routes, as the canal faces a crazy ongoing drought, causing its lowest water levels since the mid-1900s. The result has been a severe reduction in the canal’s transit capacity and an outrageous line of ships waiting to get through. Dozens of ships aiming to pass through the canal connecting the Pacific and Atlantic oceans are instead dealing with significant delays and losses for businesses, affecting the trade of energy, consumer goods and food. Some shipping companies are opening their checkbooks in desperate attempts to get their cargo through the Panama Canal in a timely manner. It takes about 8 to 10 hours to transit the 50-mile-long canal, compared to several weeks to travel around South America’s Cape Horn. But now ships are waiting about 1-2 weeks in line, depending on which way they’re headed. Some companies have decided they can’t afford the wait and will now pay exorbitant amounts to bypass the queue, creating competition among vessels. Numerous reports have been made of firms paying as much as $4 million to move to the front of the line, thus bypassing the wait times. Since January, only five neopanamax boxships will be able to transit the Panama Canal each day, down from eight.

As of this morning, eeSea data showed a queue of seven vessels waiting to transit the Panama Canal, one in transit and a further 15 at anchor in surrounding port areas; at Suez, there are seven vessels waiting for passage and two in transit, while 21 vessels are confirmed to arrive within the next week at the Cape of Good Hope. According to eeSea analysts, there are 12 vessels on THE Alliance’s EC1 service expected to divert from their established routes over the coming week – three have already been confirmed heading towards the Cape, based on their trajectory and positional data. Ocean carriers of THE Alliance will halt Panama Canal transits through February for ships on three of its weekly container services between the US and Asia, opting instead for longer sea routes through the Suez Canal. Hapag-Lloyd, HMM, Ocean Network Express and Yang Ming make up the global shipping network THE Alliance. The Suez Canal route from Northeast Asia takes about five to eight days longer than through the Panama Canal, but THE Alliance will deploy more ships into the services to maintain their schedules. THE Alliance’s EC6 service, for example, has six vessels that are all indicating diversions to the Suez Canal as far out as mid-January. However, expectations that this might result in an increase in vessels transiting the Suez Canal have been dented by the recent attacks on commercial shipping by Houthi rebels, off the coast of Yemen – in the latest incident, OOCL boxship Number 9 was the subject of a drone attack for which the militants claimed responsibility. It seems many vessels that had originally planned to utilize a divergent route through the Suez Canal are now avoiding the area for fear of the safety of their crew and the vessels. The conflict could significantly reduce traffic through both canals. For the first time in a long time we could possibly see a significant downturn of traffic through the Suez and the Panama canals, with a high volume of vessels preferring passage past the Cape of Good Hope.

Photo courtesy of VesselFinder

The Panama Canal is the preferred choice of U.S. shippers heading to the East Coast because it is faster than going through the Suez Canal. The shipping time for ocean cargo from Shenzhen, China, to Miami using the Suez Canal is 41 days. Traveling through the Panama Canal, which is more expensive, takes only 35 days.

WARNING Disruption in the market! As the Panama Canal situation continues to force re-routing of vessels, many are entering uncharted waters (no pun intended). Revised ocean routes will mean additional days on the water and arrivals to ports that possibly add transit times on land as well. Port X Logistics is well versed in handling expedited containerized cargo via drayage, transloading and trucking. Our end-to-end visibility via both our operators and our TMS Turvo allows us to monitor changes on the water and all the way through final delivery. Essentially, despite any unfamiliarity that may arise due to re-routes, Port X Logistics can provide full visibility, flexibility and know-how through the fog of uncertainty. Consider us your lighthouse in the storm to guide you into safe harbors!

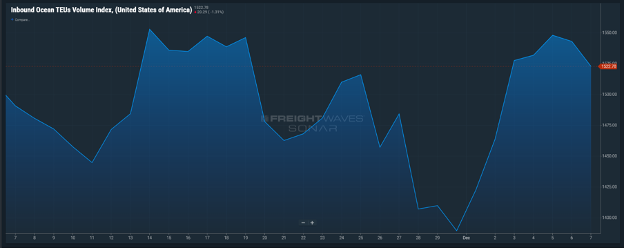

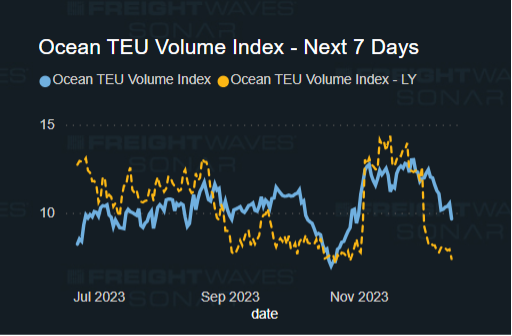

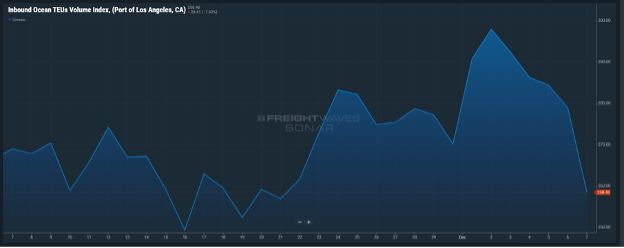

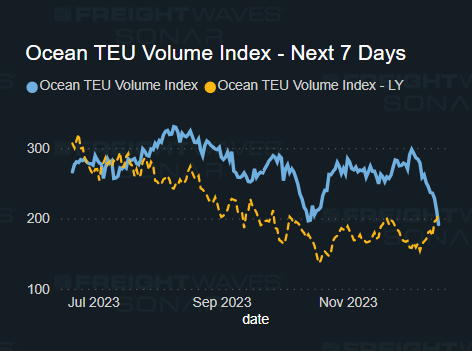

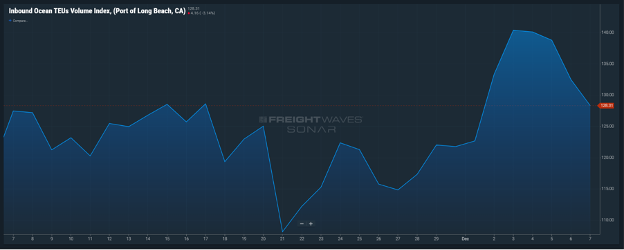

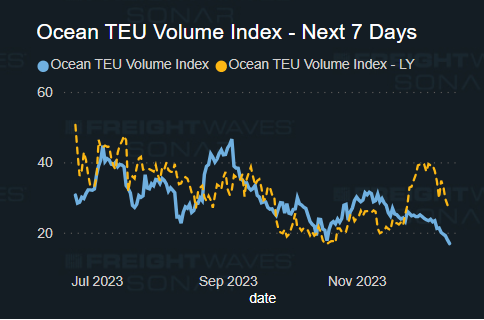

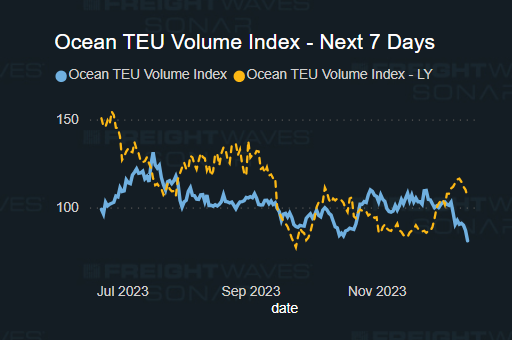

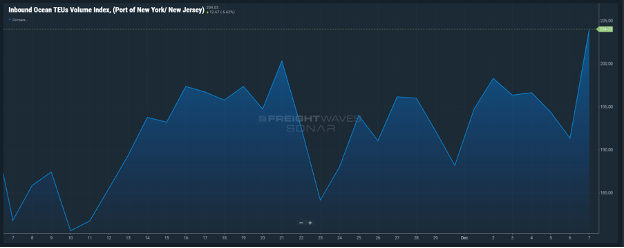

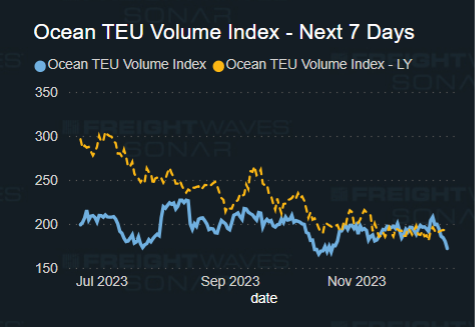

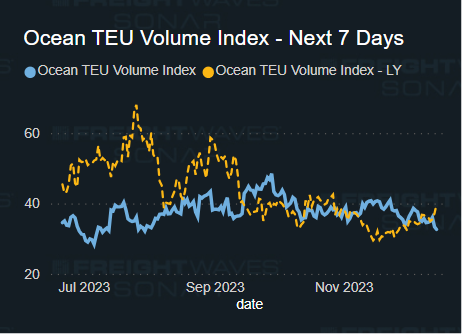

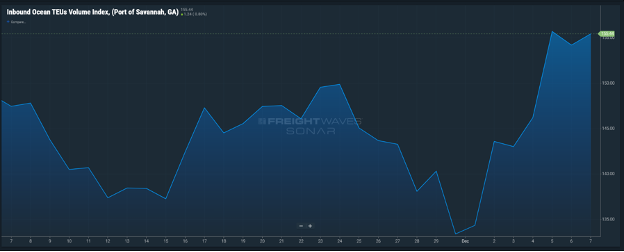

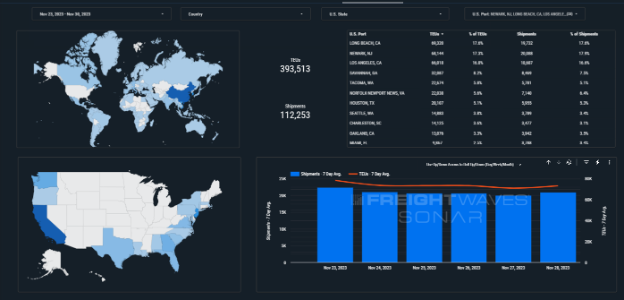

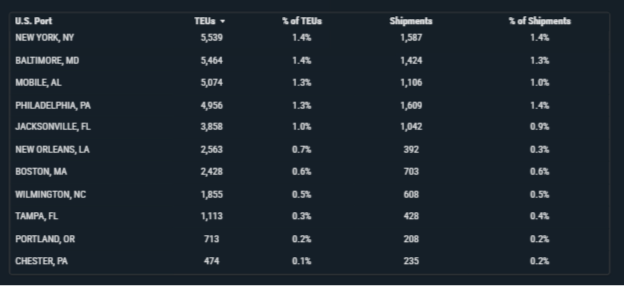

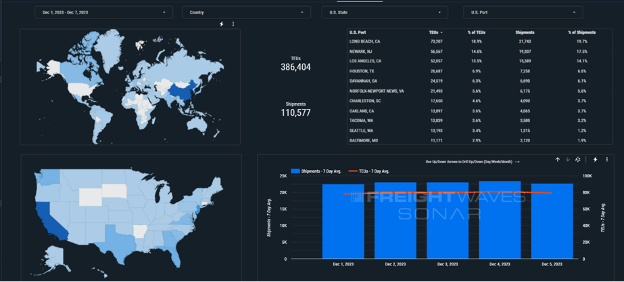

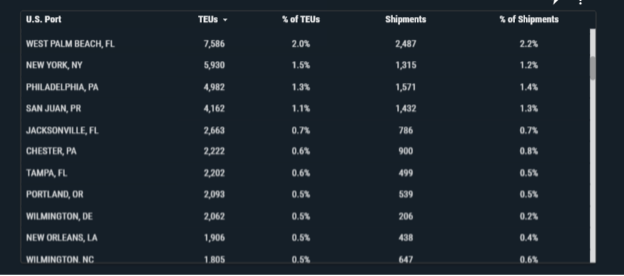

Import volumes are down 1.8% this week from last week. The Port of Long Beach has the highest imports this week at 18.9% of all U.S. import TEUs coming through Long Beach Port, New Jersey port second with 14.6% and Los Angeles port 3rd with 14.1% . The Port of Long Beach has released plans to build a facility to help California and the nation reach renewable energy targets in the coming decades. The floating offshore wind facility – known as Pier Wind – would support the manufacture and assembly of offshore wind turbines standing as tall as the Eiffel Tower. It would be the largest facility at any U.S. seaport specifically designed to accommodate the assembly of offshore wind turbines. The facility would span up to 400 acres of newly built land located southwest of the Long Beach International Gateway Bridge within the Harbor District and construction could potentially start in January 2027, with the first 100 acres operational in early 2031, the second 100 acres operational in late 2031, and the last 200 acres coming online in 2035.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Click Here For Weekly Port & Rail Updates

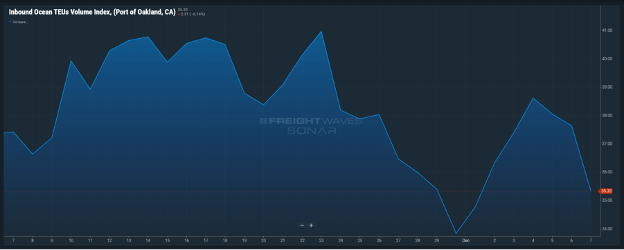

Oakland: Terminals remain busy with 28 vessels making stops at the Port of Oakland during the next 7 days. Slight congestion and extended wait times for drivers. Snow chain season has arrived for Oakland containers headed towards Lake Tahoe and beyond – just like putting snow tires on your own vehicles doesn’t happen with the snap of a finger or without a labor charge, it takes a lot of effort for drivers to chain their tires to conquer the conditions ahead, while being outside braving the elements in the most unsafe conditions. We have plenty of drayage capacity in Oakland and a transload warehouse on site, if you are looking for coverage, competitive rates or more information about the need and process for snow chains contact our Oakland team Oakland@portxlogistics.com

Container Vessels currently in Port: 9

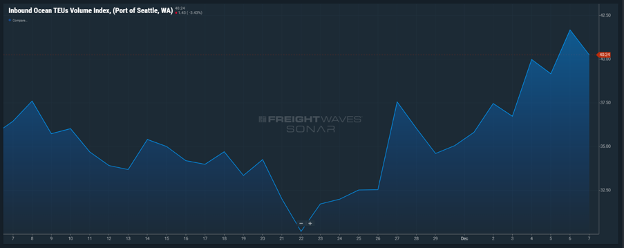

Seattle/Tacoma: Did you know? All berths at Garden City Terminal are now open and can serve 7 ships simultaneously including 4 vessels with a capacity of 16,000 TEUs. The Port of Savannah has seen imports grow from 2.2 million TEUs in 2019 to 2.8 million TEUs in 2022, that period includes the two and a half year closure of Berth 1 at the Garden City Terminal for renovations to develop another big-ship berth and an additional 1.5 million TEUs of capacity. Did you also know – Port X Logistics has an Atlantic team that can handle drayage for Savannah, Charleston and Jacksonville Ports and we have a warehouse in Savannah for all your transloading needs – with the best rates in town! Contact the team at letsgetrolling@portxlogitics.com for capacity, rates and unbeatable service

Container Vessels currently in Seattle Port: 8

Container Vessels currently in Tacoma Port: 4

LA/LGB: A lot of delays for containers out gating the Port of LA today there will be delays. There is construction on the bridge leading out and Cal Trans is not letting oversized/out of gauge cargo through and only civilian vehicles and standard containers (see photo below) Ongoing construction could lead to congestion moving forward. If you are looking for more information on the current conditions and the LA/LGB Ports our West Coast team is always on standby with the latest updates. Our team is on site in Long Beach just minutes from the port and are Top-Notch industry experts ready to move all your West Coast containers. Contact CA@portxlogistics.com to chat with our industry professionals

Container Vessels currently in LA Port: 26

Container Vessels currently in LGB Port: 18

Did you know? Even with the craziness of the Panama Canal holdups and rerouting transit time hikes Port X Logistics STILL offers a “No Demurrage Guarantee” on all import containers at all U.S. and Canada Ports? Let us help you stop the cost and transit time bleeding – send us your container paperwork 5 days prior to vessel arrival and we will guarantee no demurrage charges for all containers that are customs cleared and ready to roll within the ports free time. We also track your containers from the time your vessel leaves overseas all the way through port arrival AND provide shareable tracking information for deliveries from port to door. To learn more drop us an email and be sure to follow our Linkedin page for the latest and greatest news in the industry!

letsgetrolling@portxlogistics.com

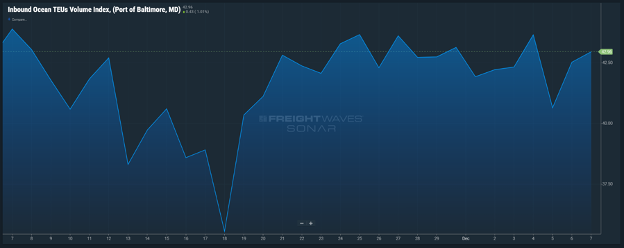

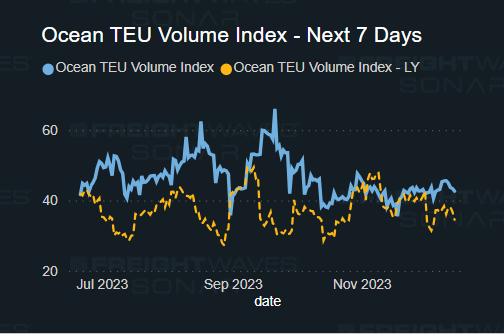

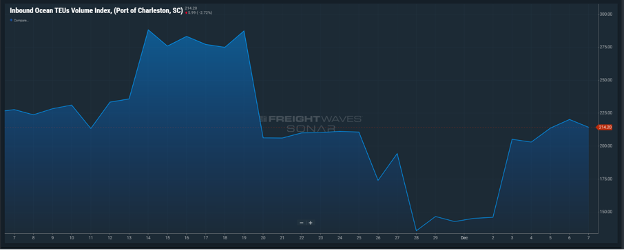

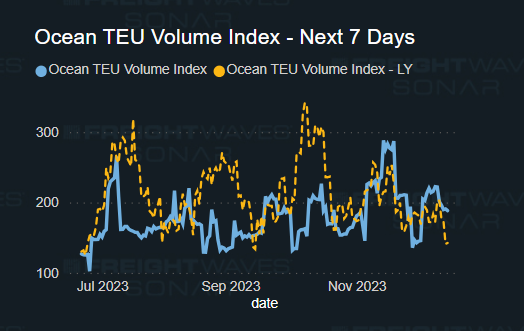

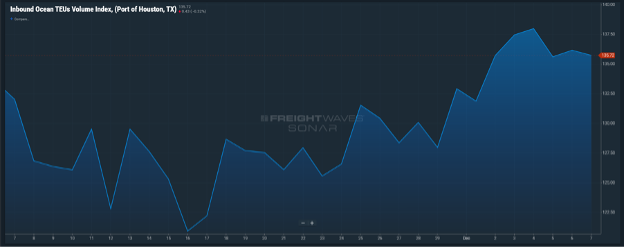

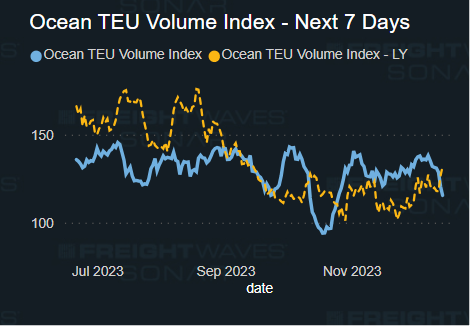

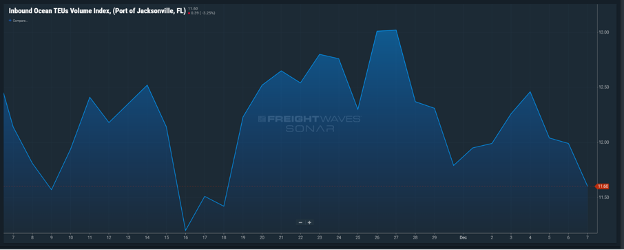

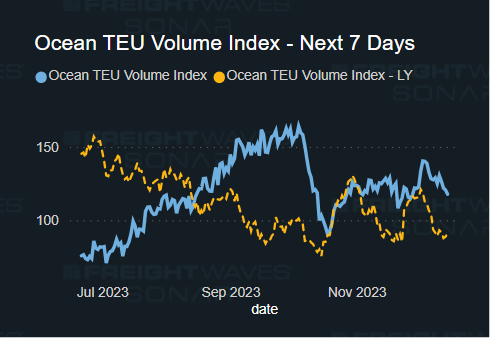

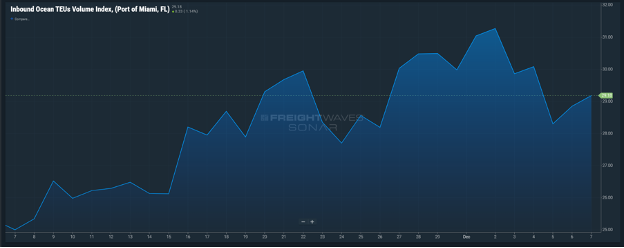

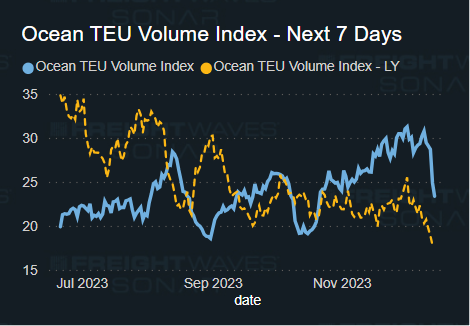

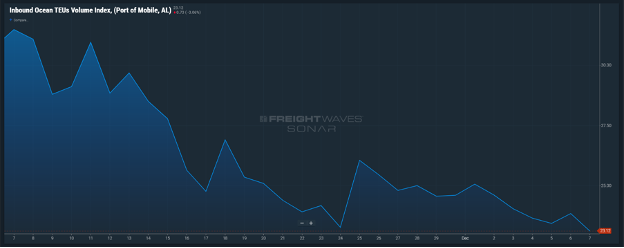

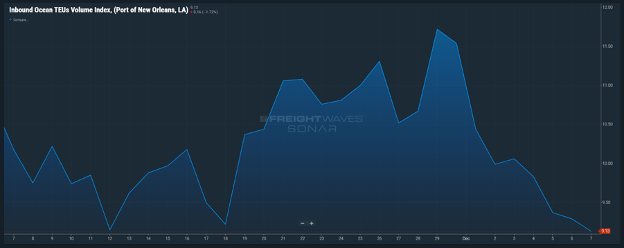

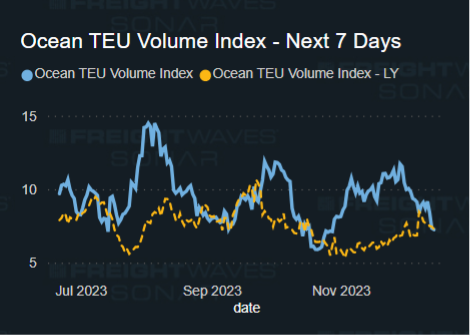

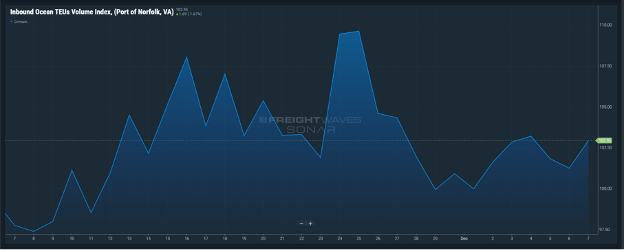

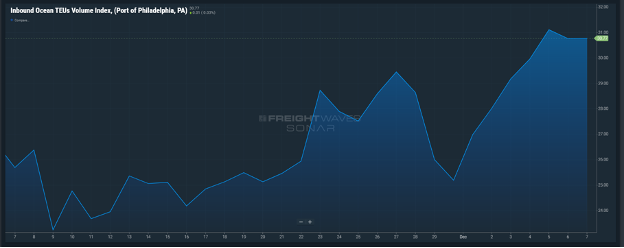

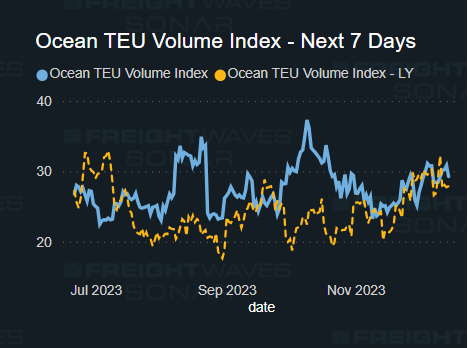

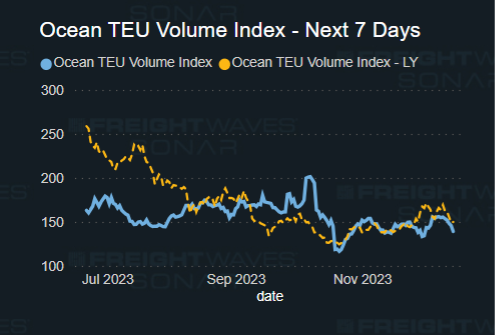

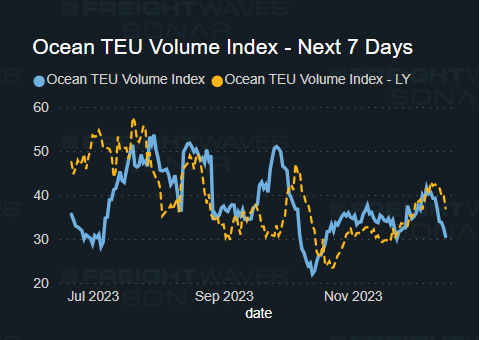

SONAR Images