1,383 words 4 minute read – Let’s do this!

Only 14 full days left in November – the clock is ticking. I guess it is obvious that the market is as good as it is going to get for the remainder of 2023, and the market is soft – softer than a two-hand touch football game and a bag of marshmallows on a sweet potato pie.. Here are some market recap highlights from late October and into mid November:

· Retail sales at gas stations up 0.9% and the Consumer Price Index (CPI) component for gasoline up 2.3%

· Freight Market Overview: September and October freight demand was strong compared to the previous eight months of 2023 but still down from a year over year perspective.

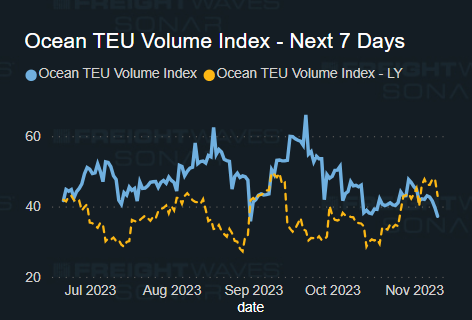

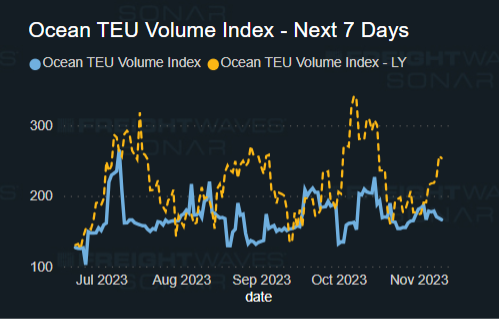

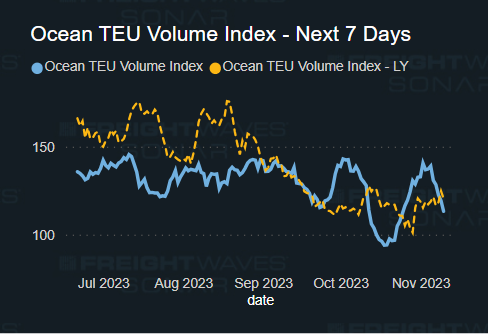

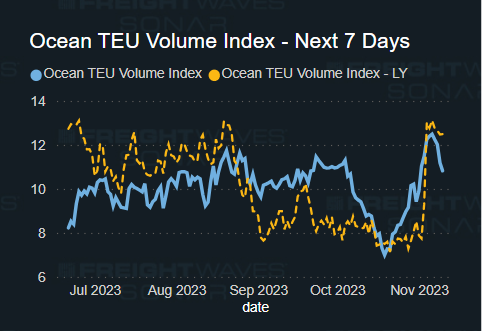

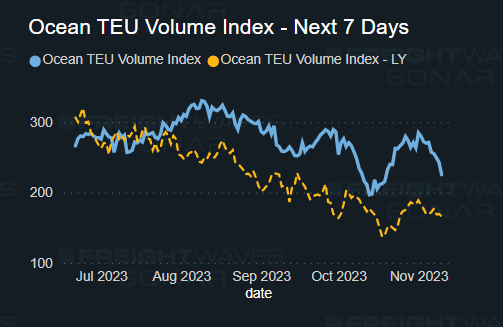

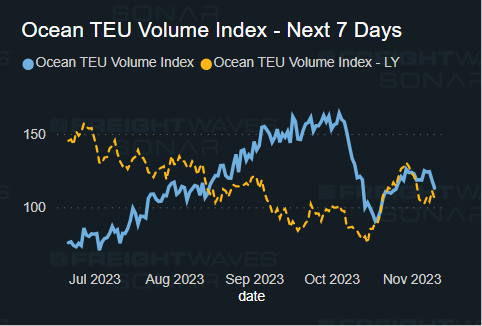

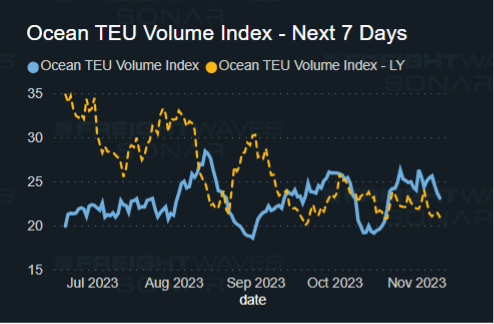

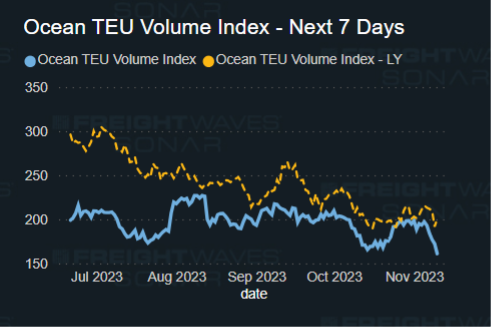

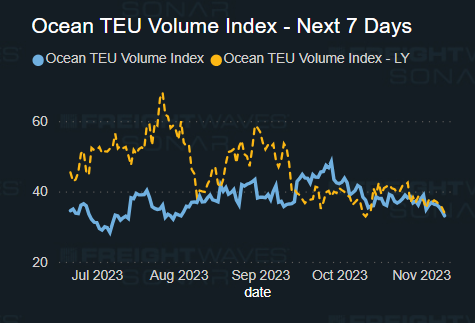

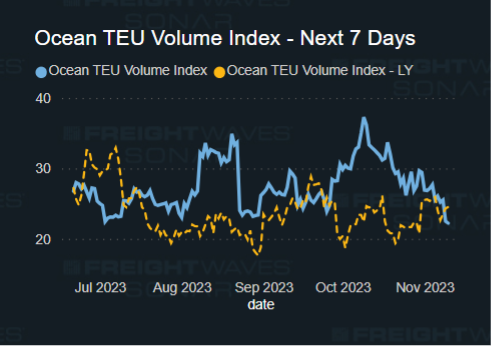

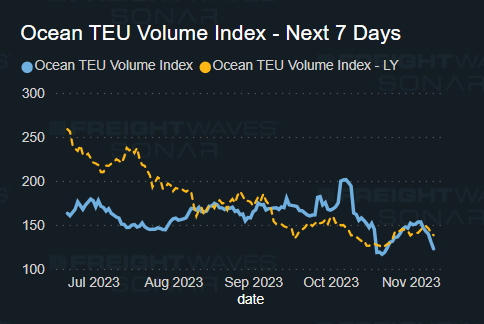

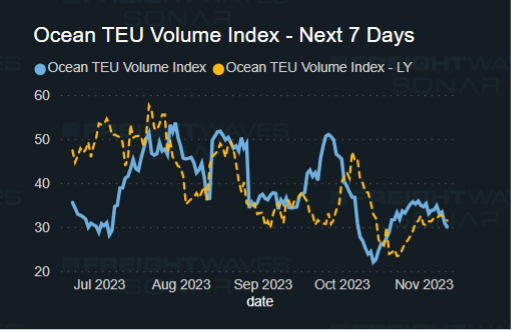

· The maritime market had a higher demand for September and October but still subdued compared to the previous several years.

· Zim Integrated Shipping Services Q3 2023 was hit with a net loss of $2.2 billion compared with net profits of $1.1 million in Q3 2022 – they took a $2 billion impairment loss in preparation for a loss-making 2024 expecting excess capacity and weak demand keeping rates at low levels.

· Rail demand appears to be taking share from trucking as demand for loaded containers jumped in early October on the heels of a relatively strong September excluding the holiday.

· Capacity remains in significant excess to demand, which appears will remain true for several more months.

· Elevated interest rates and depleted savings will limit big ticket purchases and retailers will likely look to host more “deal days” and extended discounts to capture sales (early Black Friday sales!)

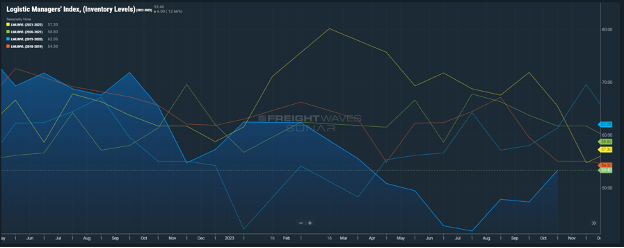

· As indicated below, retail inventory levels are low, while sales are also down

Something to watch out for in 2024: A new bill introduced last Thursday in both the House and Senate will nix the 1938 law that exempts motor carriers from providing overtime pay. A Democratic lawmaker introduced a bill to guarantee overtime pay for truck drivers in April 2022 but the legislation did not move forward. Two Democratic senators and a bipartisan team of two House representatives are now pushing for the bill. It still faces a long road ahead, which includes committee review before potential votes in front of the full House and Senate. Control of Congress is currently split, with Republicans holding the House majority while Democrats run the Senate. Passing this bill would benefit truck drivers and likely challenge employers. Truck drivers, under current federal regulations, operate under strict hours-of-service requirements; they are not allowed to drive more than 11 hours in a 14-hour window and are capped at 70 hours of work in an eight-day period. They’re typically paid per mile. The American Trucking Associations believes that the law, if enacted, would bring about “supply chain chaos and the inflationary consequences for consumers.”

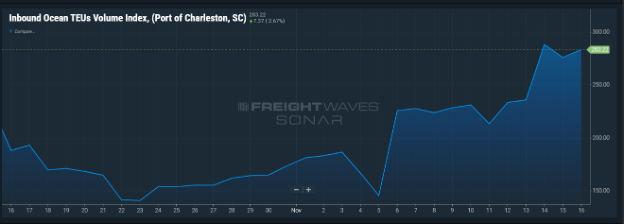

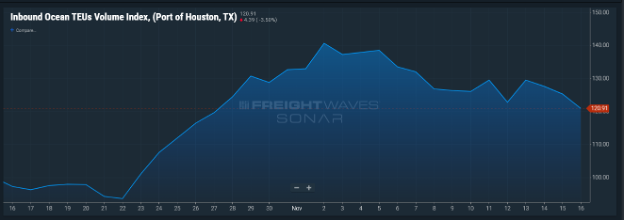

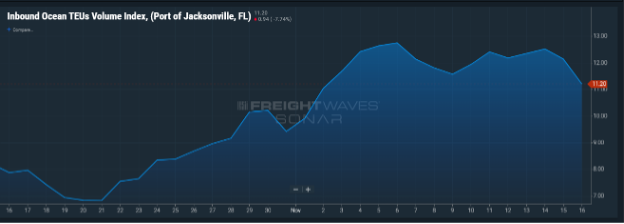

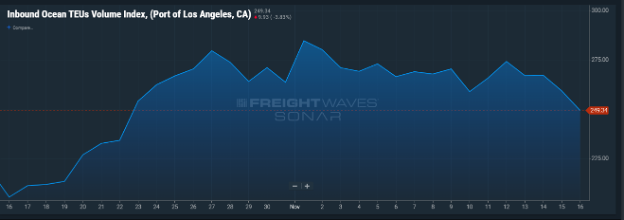

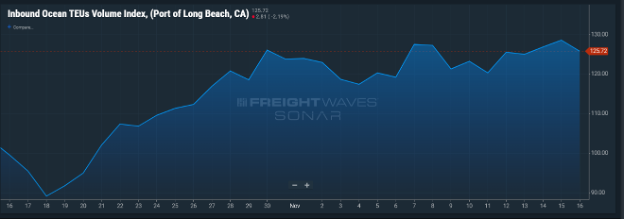

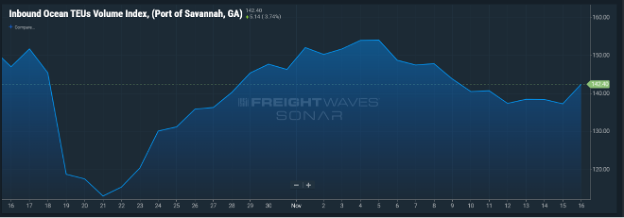

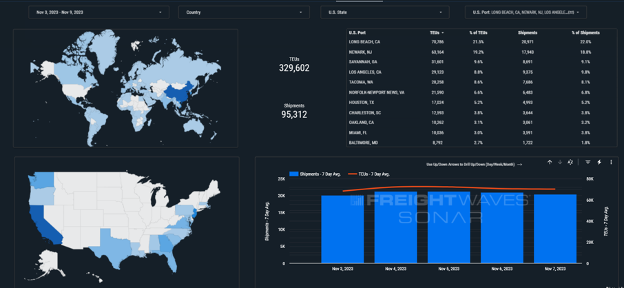

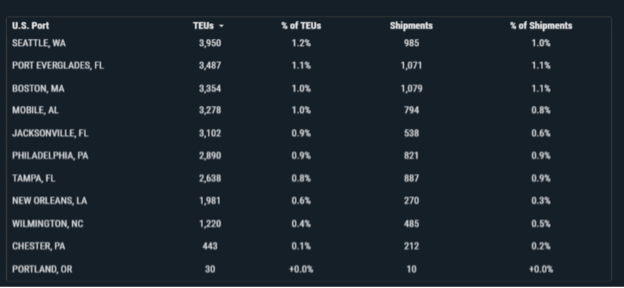

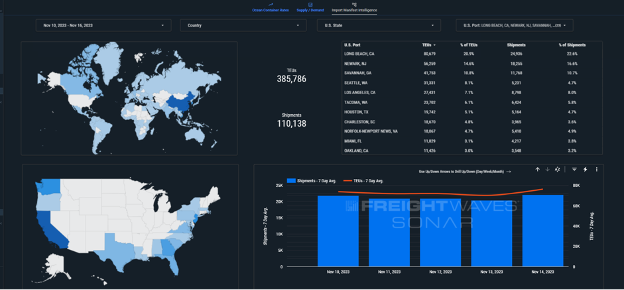

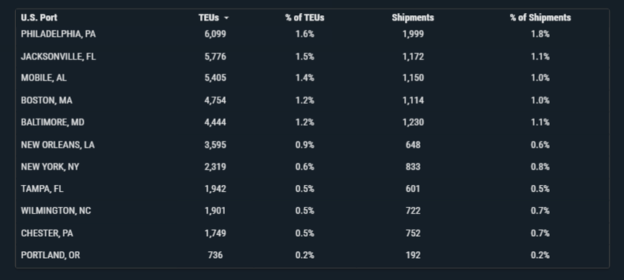

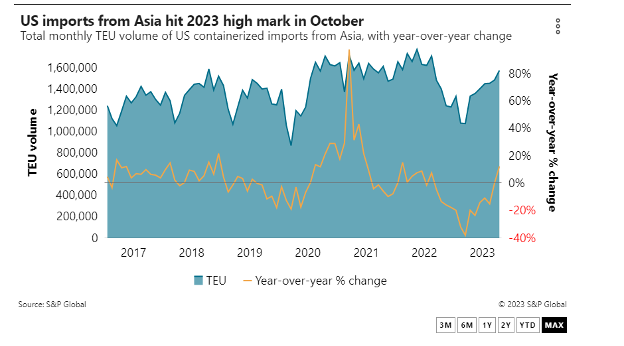

Import TEU volumes are up 17.04% this week from last week, with the majority percentage into the Long Beach Ports: 20.9% of U.S. inbound TEUs for the week. U.S. imports from Asia in October hit a high-water mark to date for 2023 as retailers rushed to get their merchandise into the country ahead of end-of-year holiday sales. Containerized imports were up 5.9% from September and jumped 12.4% from October 2022 as the peak shipping season in the Eastbound trans pacific drew to a close and the largest U.S. trade lane appeared to return to a more typical seasonal flow. Still, year-to-date imports were down 16.6% compared with the first 10 months of 2022 due to lower import volumes for much of the year as inflation and high interest rates muted consumer spending. Last month’s imports from Asia were up 1.1% from pre-COVID October 2019.

Although October is typically one of the busiest months of the year for West Coast ports, the region’s market share of imports from Asia slipped markedly, and unexpectedly, from September — down to 53.6% from 57.7%, according to PIERS. Line carriers stated that higher amounts of blanks sailings into the U.S. West Coast are to blame for the lower volumes, rather than due to shippers shifting West Coast containers into the East and Gulf Coast ports.

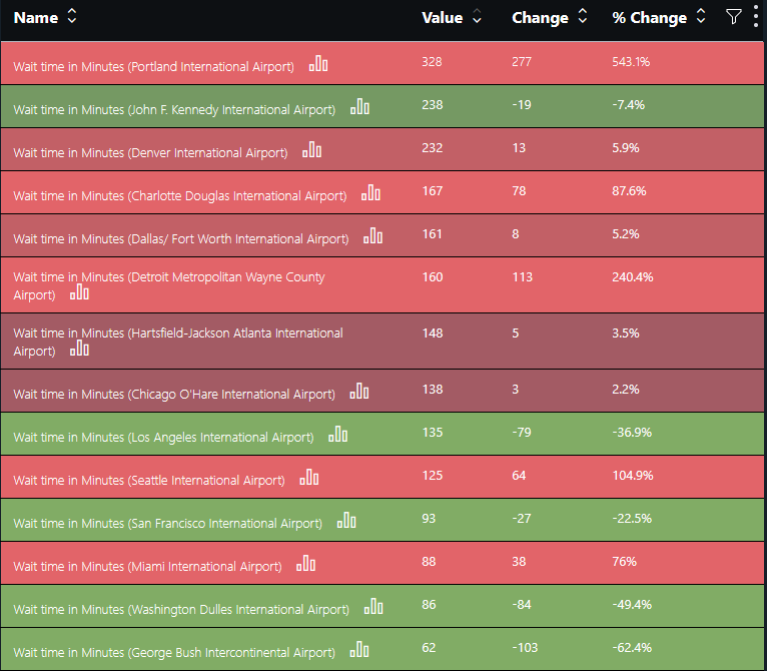

With the upcoming holiday, we are sure to see longer wait times at U.S. airport cargo hubs below are the most up to date current wait times at heavy volume airports as of November 5th

A short holiday week also means a greater demand for airfreight and hot shipments. Don’t let your urgent air freight ruin your Thanksgiving holiday and let our Carrier911 team help get back your family time. Just present us with your airway bill and pickup and delivery information for your domestic U.S. and Canada hot deliveries and we will have a rate and a truck on site for pickup in most cases within an hour of dispatch. Our Carrier911 team will manage your entire shipment from pickup to proof of delivery, and provide you with a shareable tracking link to share with your customer – no shipment babysitting even needed! Contact info@carrier911.com 24/7/365 – it will seem impossible, until you see it for yourself.

What’s happening at the ports and rails?:

REMINDER Thursday November 23rd is observed for the U.S. Thanksgiving Holiday and most ports and some railheads will be closed on one or more of these days

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Click Here For Port & Rail Updates

Vancouver: U.S. Bound rail cargo into Vancouver and Prince Rupert has declined due mainly to what most believe to be a result of the past covid congestion years and most recently the labor uncertainties International Longshore and Warehouse Union (ILWU). As for containerized import volume that is not intermodal rail moves — Vancouver has actually gained a greater share of U.S. discretionary cargo volumes through the BC ports and the Pacific Northwest. Vancouver, Canada’s largest port, commanded 51.9% of all inbound cargo into the region in the first three quarters of this year, having steadily seen its share rise from below 46% just four years ago. Did you know? – We have an office in Vancouver and we can handle all your Canada or U.S. bound transloads into Vancouver and PRR ports quickly and efficiently. Our Canadian team led by Rachel comes with many years of experience handling cross border transloads and can get any urgent container loads on the road as quickly as customs allows. Contact the team for rates, capacity and any information pertaining to Canada shipments canada@portxlogistics.com

Vessels currently in port Vancouver: 219 Expected Arrivals: 69

Vessels currently in port Prince Rupert: 57 Expected Arrivals: 17

Boston: To quote our industry expert Holly “Boston port is gross!” Port congestion at the Paul Conley Terminal caused by chassis shortages, drivers waiting for empty chassis returns. Wait times reported in excess of 2-3 hours

Vessels currently in Port: 61 Expected Arrivals: 70

Chicago: The Chicago railways are running efficiently with minimal wait times and what is even better – we have 80 trucks, open yard space and a wide range of specialized chassis and equipment to handle your overweight and most troublesome containers. We have plenty of capacity through the holiday week and are welcoming all volume projects. Contact Danny and the team at letsgetrolling@portxlogistics.com

Did you know? Did you know we’re excited to sponsor the Empire State Ride again this year? It’s an epic week-long, 500+ mile cycling journey across New York from Staten Island all the way to Niagara falls, raising funds for critical cancer research. Every mile cycled brings us closer to new breakthroughs in the fight against cancer. We are so proud to be part of this awesome event! To follow our journey into helping to race for a cure ad for more exciting Port X Logistics news follow our LinkedIn Page!

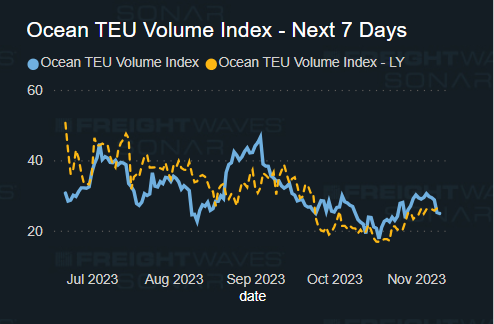

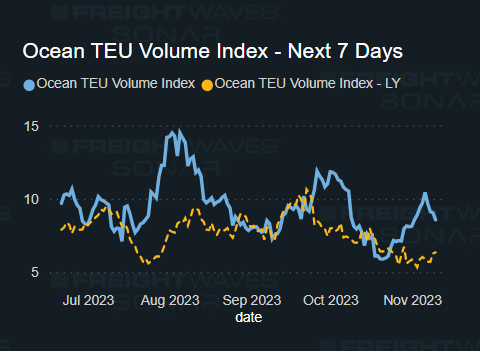

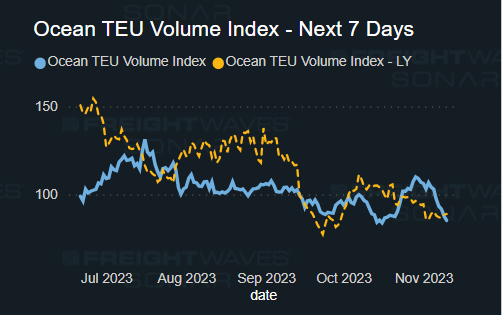

SONAR Images