1629 words 5 minute read – Let’s do this!

Here we are, Day 9 of November – 52 days left of 2023. This week was both election week and Veterans Day which will have a small impact on the market into next week caused by port closures or shipper shut downs. Also this week: Some of the workers at United Auto Workers (UAW) Local 659 said “no” to the tentative deal with General Motors. Among the autoworkers on the production side of Flint Engine, 52% voted against the deal while 48% voted to approve it. However, other worker units under Local 659 overwhelmingly voted in favor of the deal. While many workers have spoken out in favor of the offers under the new deals — which include significant wage increases and shortening the time to reach a top wage, among other things — there has been some criticism online from UAW members, and not just about the GM Deal. UAW Vice President Rich Boyer addresses his membership Tuesday, Nov. 7, saying that he has heard some of the complaints over the deal with Stellantis. Boyer went on to say that the bargaining team is pleased with the landmark offer it secured at Stellantis. But, still, some members are unhappy that the UAW couldn’t get the Big Three automakers to budge on a return to pensions or a shorter work week. Before the tentative deals were brought to the UAW membership to vote on, the union’s national councils for each of the Big Three companies reviewed the agreements and approved them. Now, the fate of the agreements rests in the hands of the autoworkers they represent. If the majority of UAW workers approve the four-and-a-half-year deals, they will take effect. If the majority of union members reject the deals, it’ll be back to the drawing board for negotiators. More than 40,000 of the UAW’s 146,000 autoworkers at facilities in over 20 states had joined the strike before it ended. UAW workers were asked to return to work almost immediately after the tentative agreements were reached, rather than waiting for the ratification of the deals. If the deals are rejected, it’s likely the strike could resume — though it’s not entirely clear how that would pan out. UAW President Sean Fain was set to address union members on Wednesday and set to meet with President Joe Biden today at the Stellantis Belvidere plant in Illinois, which the UAW managed to reopen under the tentative contract agreement.

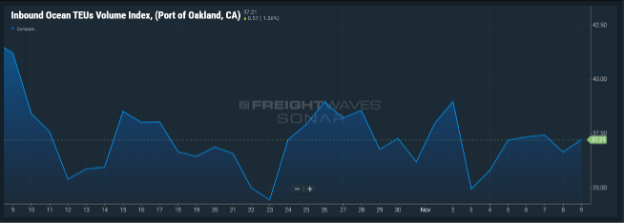

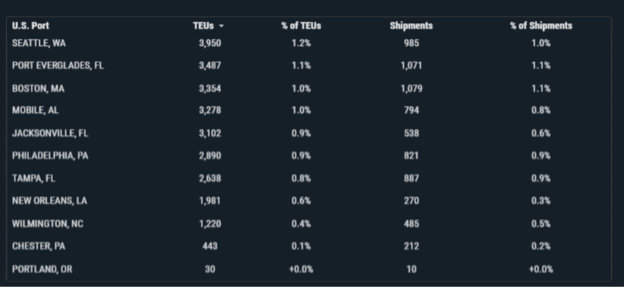

It looks like the outcome of all the 2023 strike victories has impacted the East and Gulf ports as they head into contract negotiations late 2024. The President of the International Longshoremen’s Association (ILA) Harold Daggett has advised the ILA members to be prepared for a strike in October 2024, threatening the possibility of the first labor disruption since 1977. Daggett said he will present an update on wage negotiations with ocean carriers and other waterfront employers at an ILA meeting this week in Nashville. The union will hold firm on its pledge not to extend the contract beyond its expiration date of September 30, 2024. In those negotiations, the ILA and the United States Maritime Alliance (USMX), its management counterpart, will be influenced by wage increase levels included in an agreement struck between employers and West Coast dockworkers in June and ratified in August, ending months of labor disruption woes. The West Coast agreement included a 32% salary increase over 6 years to be paid retroactively to July 1,2022, plus a one-time $70 million bonus spread throughout ILWU’s 20,000 members for working through the pandemic shutdowns. As the contract negotiations as well as the Supreme Court case involving the Charleston Leatherman terminal start to get closer, some shippers are getting nervous and could be looking to shift some cargo away from the East and Gulf Ports like they did amid the reverse ILWU contract negotiations. If your shippers are looking to move to the West Coast in an attempt to avoid the East and Gulf Coast ports. We also offer full service drayage, transloading and trucking in all West Coast Ports and most recently purchased a 240 square foot transload warehouse in Seattle! To hear about our West Coast container delivery services email CA@portxlogistics.com

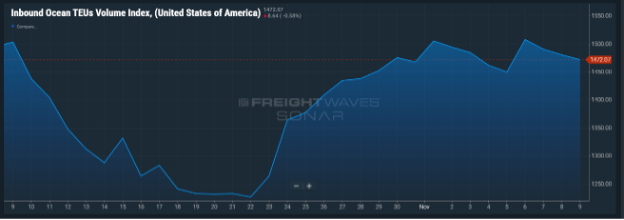

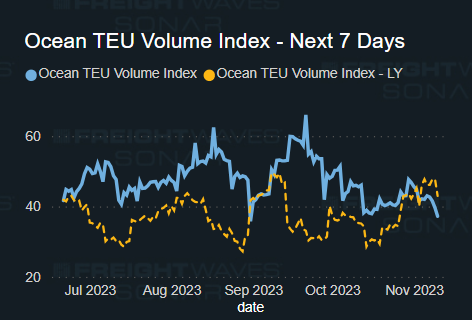

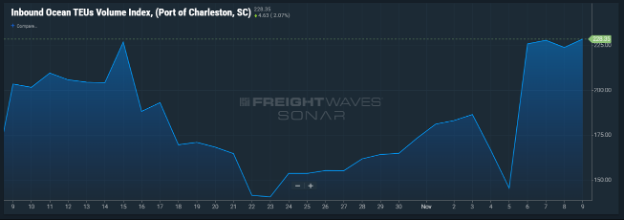

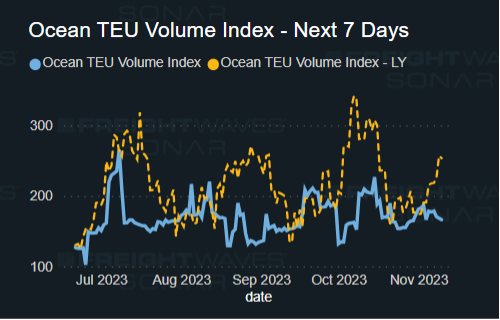

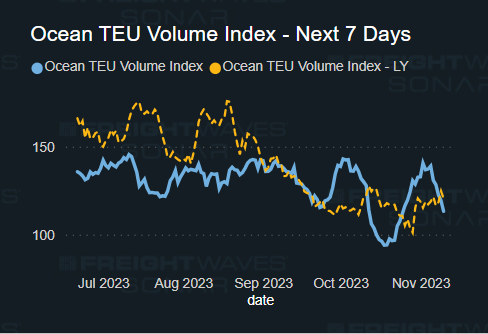

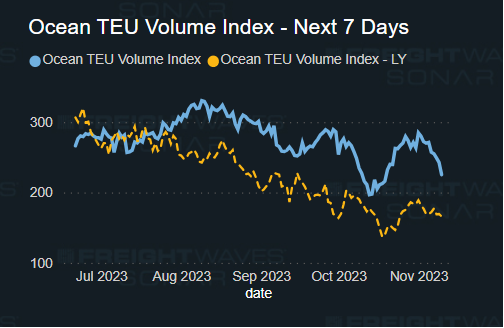

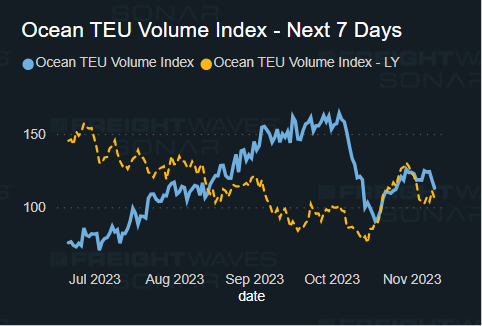

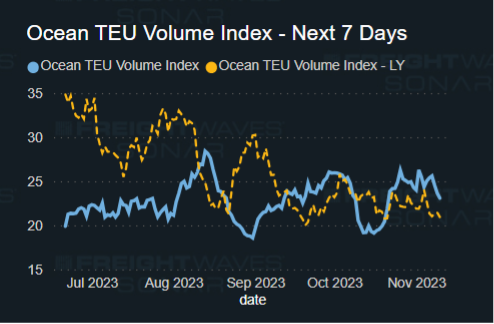

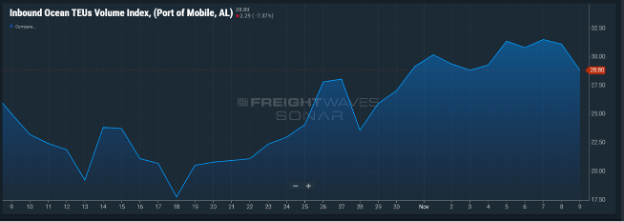

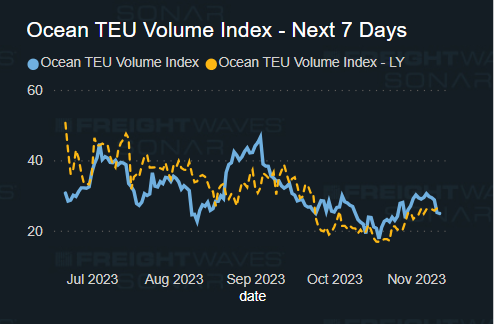

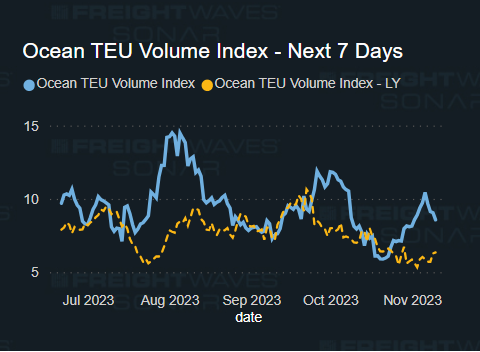

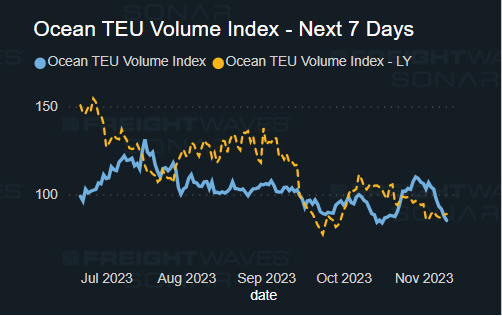

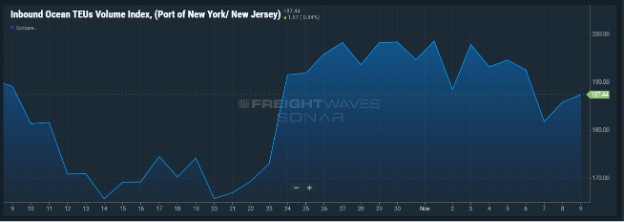

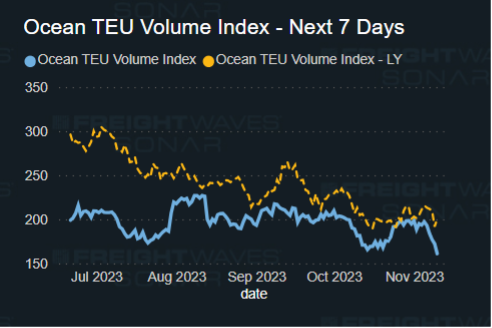

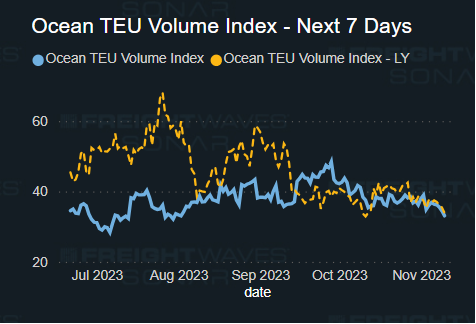

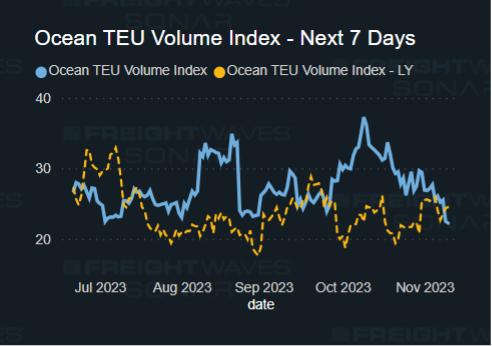

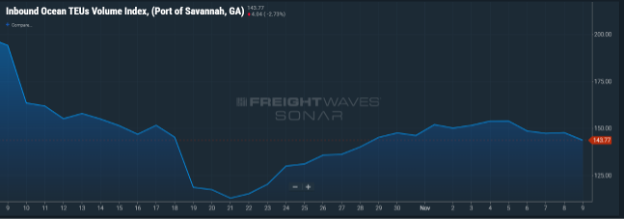

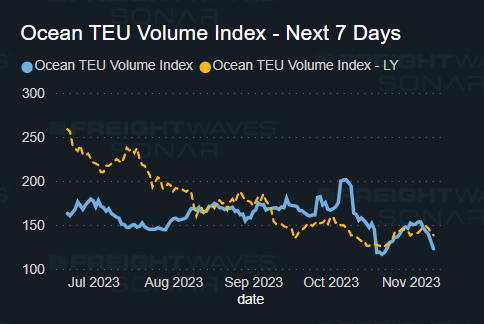

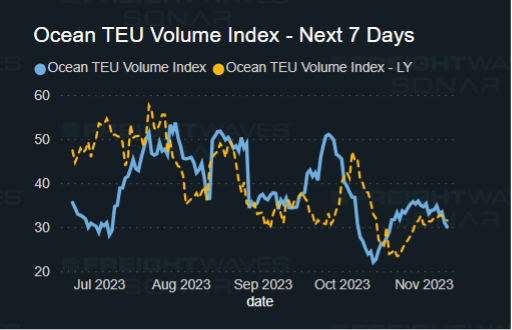

Import TEU volumes is down 7.37% this week from last week – and blank sailings from India into the U.S. are up. Shippers and freight forwarders on the India-U.S. trades are reporting serious vessel space limitations as carriers adjust capacity to match weakening cargo loads. Those concerns follow an array of blank sailing announcements and other service reliability issues plaguing the major India-US East Coast connections through the month. The Indamex 1 which call on New York/New Jersey and Norfolk and Indamex 2 which calls on Savannah and Charleston —services led by Hapag-Lloyd and CMA CGM — together have three void calls in weeks 47 and 48, while Mediterranean Shipping Co.’s “Indusa” routing has declared one blanking as of now for week 46, according to available schedule updates. Indamex 2 discontinued direct calls to Norfolk in the beginning of this month due to cooling demand.

On top of the sailing cuts, some recent vessel arrivals at India have been behind schedule by up to a week, resulting in cargo rollovers, according to forwarder sources, and these blank sailings are starting to disrupt some shipper’s planning schedules. The schedule disruptions caused by blank sailings will increase the need for expedited container deliveries once arrived at the U.S. East Coast ports. Port X Logistics is your go-to guys when it comes to expedited containerized deliveries. We offer the full package when it comes to drayage, transloading and trucking. We have immediate drayage capacity in Savannah and Charleston to cover your delayed Indamex 2 Charleston and Savannah containers and we also have a transload warehouse to expedite your longer haul deliveries. Contact our Port X Logistics Atlantic team to learn more about our services along the Atlantic SAV@portxlogistics.com

What’s happening at the ports and rails?:

REMINDER Friday November 10th through Monday November 13th are observed for the Veteran’s Day Holiday and most ports and some railheads will be closed on one or more of these days

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Click here for Port & Rail Updates

Seattle/Tacoma: Tacoma has been in the literal hot seat for the past week – A fire broke out at Tacoma Rail on Wednesday in the 2100 block of Marshall Avenue near the Port of Tacoma. At one point, flames grew to 30 to 40 feet above the car. Some of the autos inside the train car appeared to have burned. Adjacent rail cars were carrying denatured alcohol and petrol products, but those were moved and did not catch fire. The fire has since been put out, but Tacoma Fire crews remained at the scene Thursday morning and an investigation is underway. The military ship believed to be bound for Israel that caused closures at Husky terminal from protestors left the port Monday evening, and port operations returned to normal Tuesday, according to the Port of Tacoma. Between the protesting port closure and the upcoming Veteran’s Day holiday there are sure to be backups starting early next. We have plenty of drayage and transloading capacity in Seattle/Tacoma to help with your lingering Seattle and Tacoma containers. Contact letsgetrolling@portxlogistics.com to expedite your SEA/TAC containers right away, once your orders have been received, we will get with the port scheduling system and get you on our schedule and stop the demurrage clocks from ticking!

Vessels currently in port Seattle: 461 Expected Arrivals: 29

Vessels currently in port Tacoma: 84 Expected Arrivals: 28

Boston: Port congestion at the Paul Conley Terminal caused by chassis shortages, drivers waiting for empty chassis returns. Wait times reported in excess of 2-3 hours

Vessels currently in Port: 56 Expected Arrivals: 4

Memphis: Some congestion is looming at the BNSF in Memphis, due to lift shortages and maintenance. Some drivers are reporting wait times exceeding 2 hours. Did you know we have a SUPER drayage asset and huge container yard and depot adjacent to the UP in Memphis? To learn more and get rates contact the team at letsgetrolling@portxlogistics.com

Did you know? I recently found out this week that there are a lot of you out there that actually didn’t know that Port X Logistics has an expedited division called Carrier911. The story of the name of Carrier911 is actually a funny one, our Founder Brian Kempisty called Shane Canahai, the first operator ever involved in Carrier911, and asked Shane to see if the email domain carrier911.com was available and it was – and that was how the planning, brainstorming and roll out of Carrier911 was born! Through Carrier911 you can book cargo vans, straight trucks, dry vans and more for expedited pickups at all airports in the U.S. and Canada, and most drivers can be onsite within 1 hour of dispatch with shareable tracking links and PODs uploaded right at time of every delivery. If you are in the airfreight industry you also know that every airfreight delivery ends with a story – and we also love to tell ours. Like our Carrier911 Linkedin page for all the fun stories and contact the Carrier911 team Jason, Shane, Jimmy to help reduce your stressful stories, and for great rates and coverage for all your inbound domestic hot shot needs. Info@carrier911.com

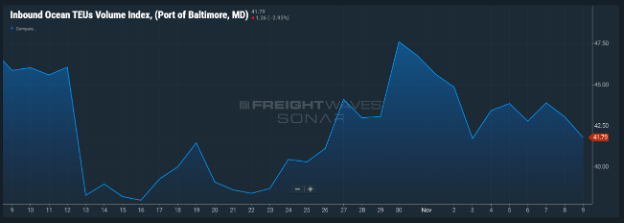

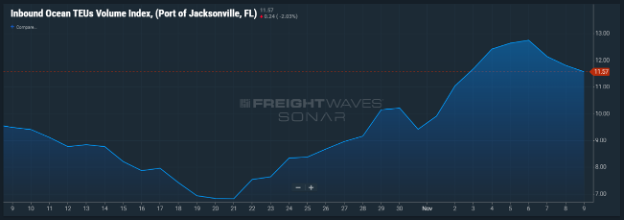

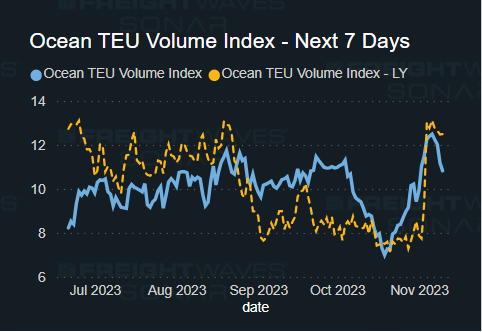

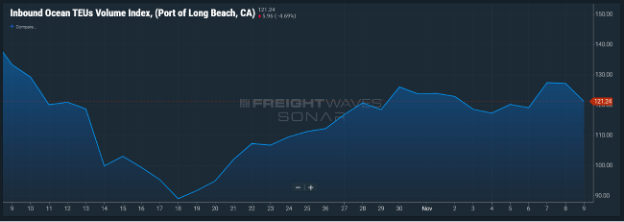

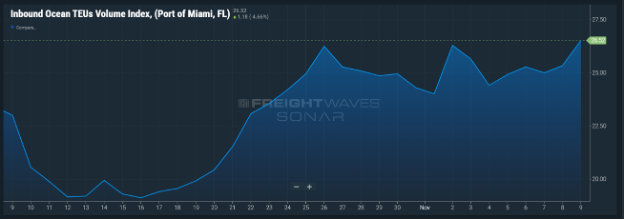

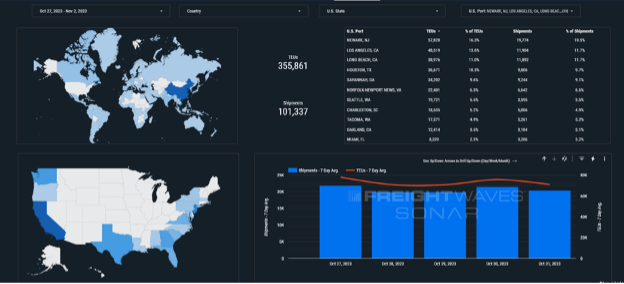

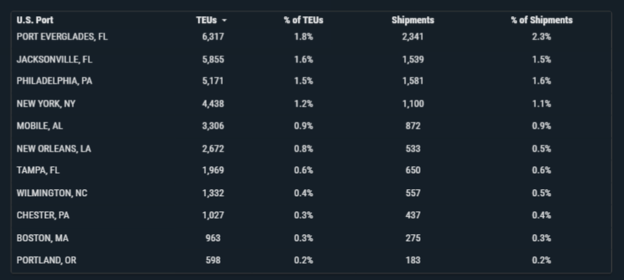

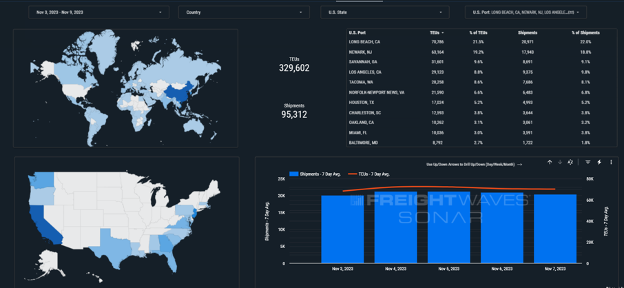

SONAR Images