1270 words 5 minute read – Let’s do this!

As we approach the halfway mark of October it has definitely been an eventful week in the news and much of which will impact the industry. Fourth quarter may be a bust, but anything can happen in 2024. Plant, airline and seaport closures can deplete inventories and increase the need to expedite goods. Port X Logistics was designed for shipments that require urgency and visibility, with a top-notch team keeps you updated and gives you a piece of mind. Want to learn more about how Port X Logistics has built a brand with elite customer service in mind and about our services and asset network? Contact letsgetrolling@portxlogistics.com and join the revolution – let us be your heroes through all the industry disruptions.

The United Auto Workers (UAW) strikes are still pushing forward without a contract resolution. The union expanded its strike action against Detroit Three automakers on Wednesday to include 8,700 members at the Ford Kentucky Truck Plant in a move the car giant denounced as “grossly irresponsible.” Union workers at Volvo Group owned Mack Trucks went on strike on Monday after rejecting a proposed five-year contract, the United Auto Workers said, the latest tentative labor agreement in the U.S. to be voted down. About 73% of the unit’s 4,000 workers in Pennsylvania, Florida and Maryland voted against the deal that included a 19% pay raise, said the UAW, which is in the midst of contract talks with Detroit’s Big Three automakers. Ford Motor in those talks has offered a 23% wage hike.

The devastating events in Israel will take an economic and supply chain toll. There are now 500 multinationals operating in Israel – mainly research and development centers after buying Israeli start-ups – from Intel to IBM, Apple, Sony, Microsoft, Google, and Facebook. In 2015, Israel spent 4.3 percent of its gross domestic product (GDP) on civil research and development, the highest ratio in the world. Israel is also home to many electronics and semiconductor companies and facilities.

Disruption in transportation, including flight cancellations and sea route blockades, has also significantly impacted the supply chain. Many airlines have suspended flights to and from Israel, leaving travelers stranded and affecting the movement of goods. Sea freight operations have faced additional controls by the Israeli Navy, making getting cargo in and out of the country increasingly difficult. Thousands of travelers are stranded in Tel Aviv’s Ben Gurion airport, and many Israelis cannot return home from many different countries. Both UPS and FedEx joined a long list of airlines that have sharply reduced international flights into Israel. On Monday, UPS said it had stopped flying to Israel. Sea freight is compromised. Getting cargo in and out of the country has become increasingly difficult as the Israeli Navy imposes extra controls.

Overall, the Israel-Hamas conflict has introduced substantial challenges and uncertainties to the electronics supply chain, affecting multinational companies, production facilities, and the movement of skilled labor and goods. The situation emphasizes the sensitivity of global supply chains to geopolitical conflicts and highlights the need for adaptability and contingency planning during these times.

If flight cancellations are affecting your supply chain flow and you don’t have another minute to waste once the flight touches down in North America, then our Carrier 911 division is the only 911 you need. Cargo vans, straight trucks, dry vans and more available for pickup at all U.S. and Canada airports, often times as little as one hour of the cargo being available – complete with driver tracking and signed proof of delivery available immediately at time of delivery. Jason, Shane and Jimmy are available 24/7/365 info@carrier911.com

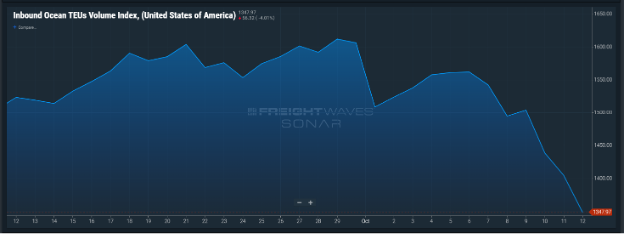

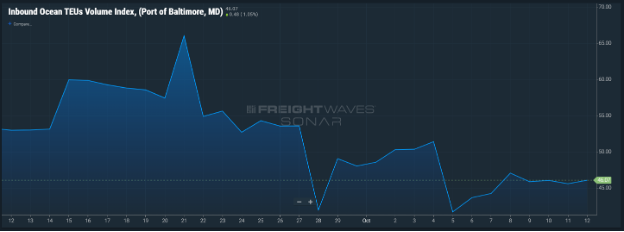

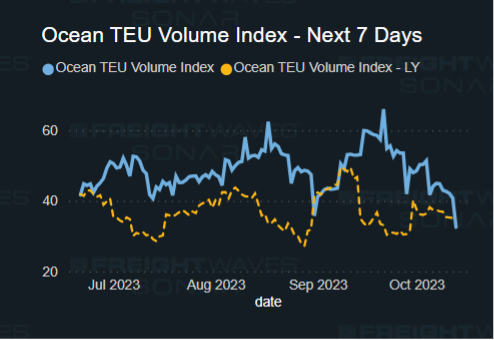

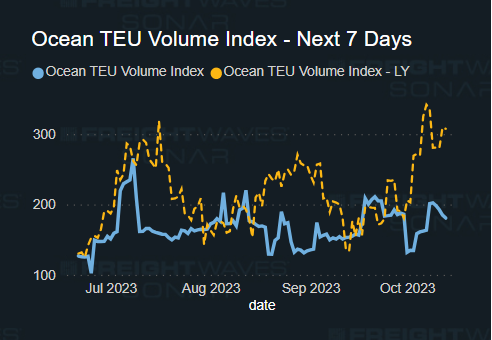

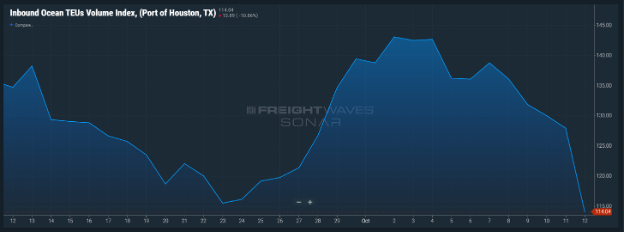

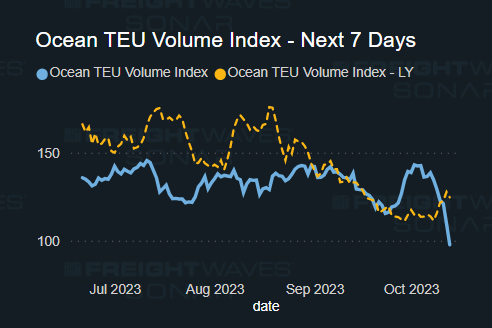

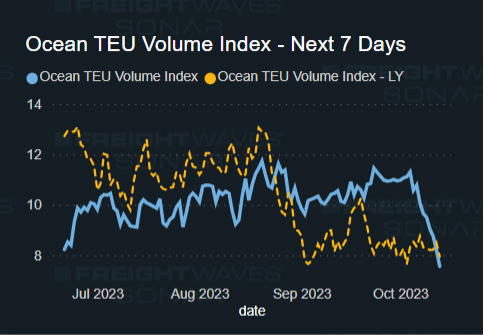

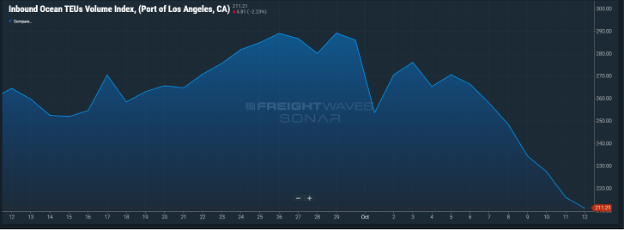

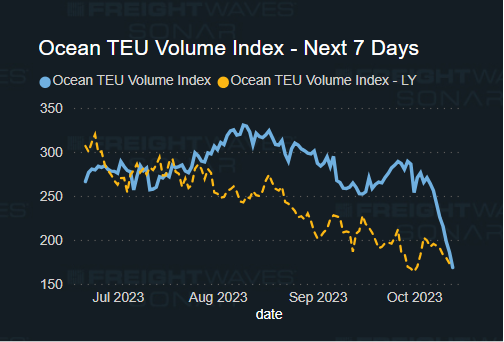

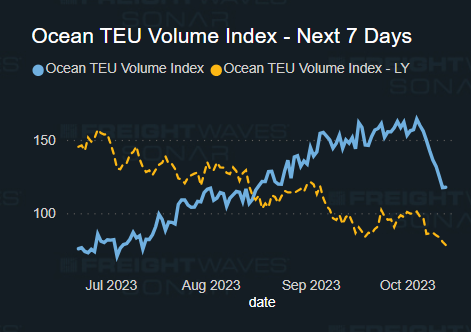

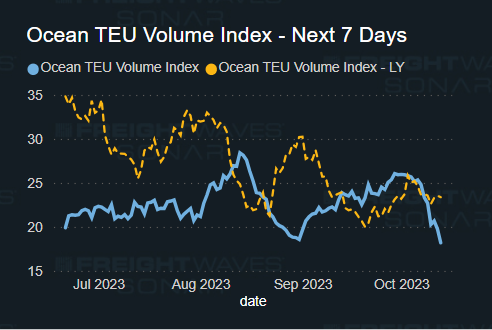

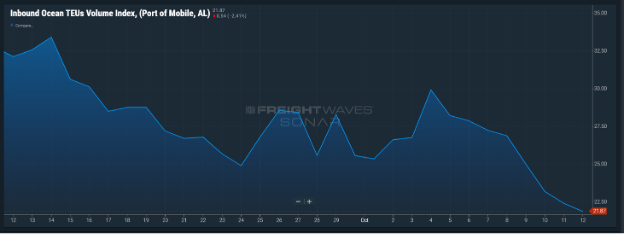

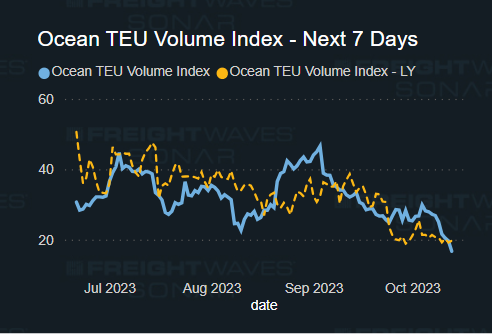

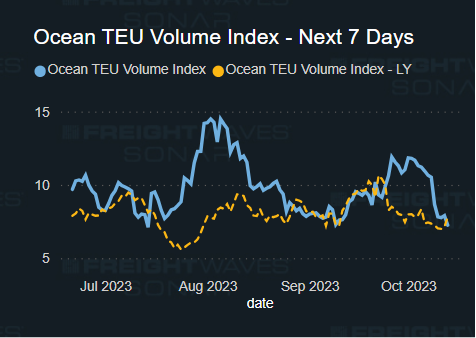

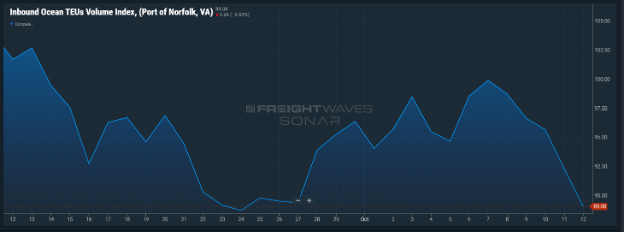

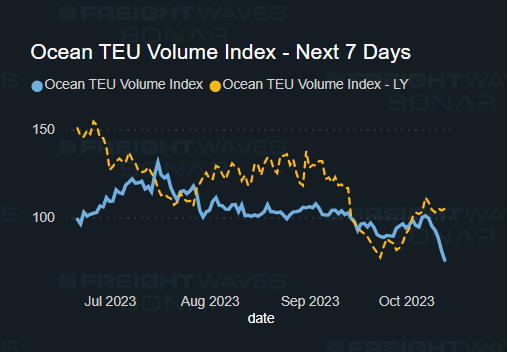

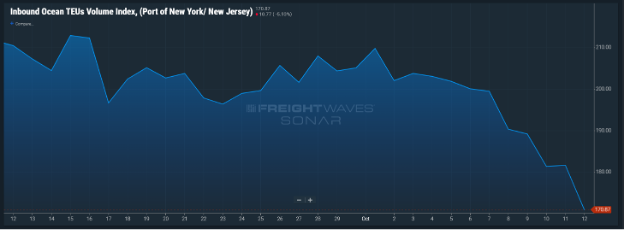

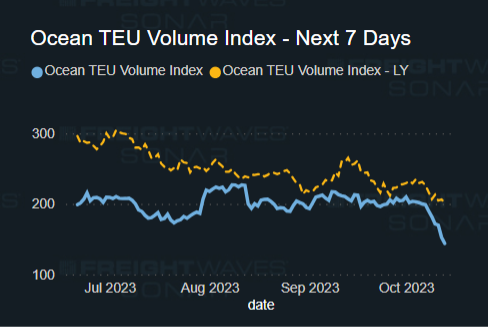

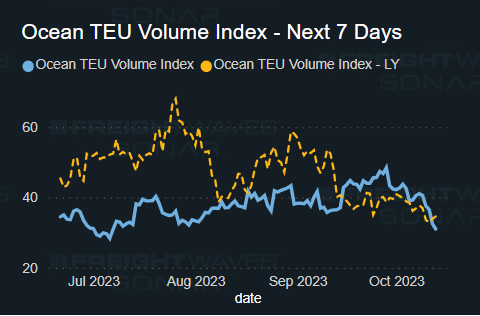

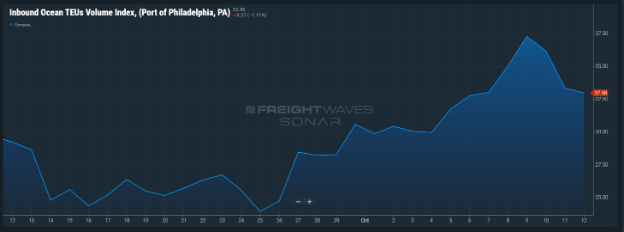

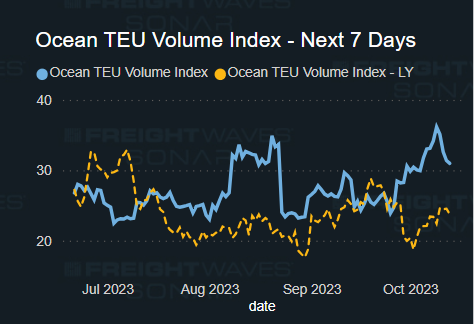

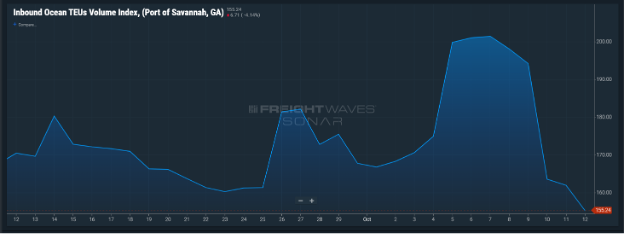

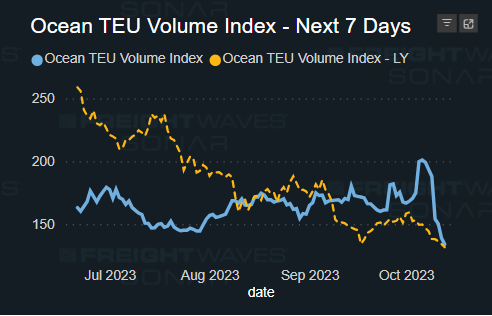

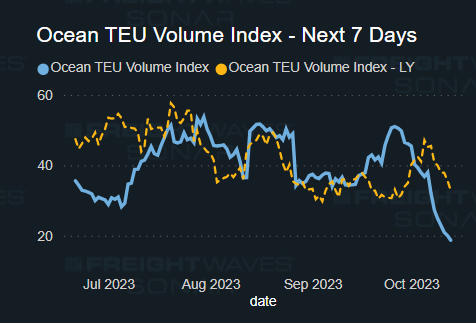

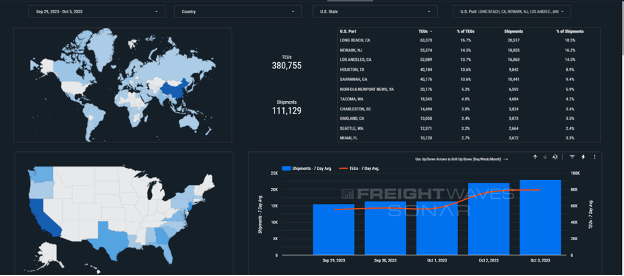

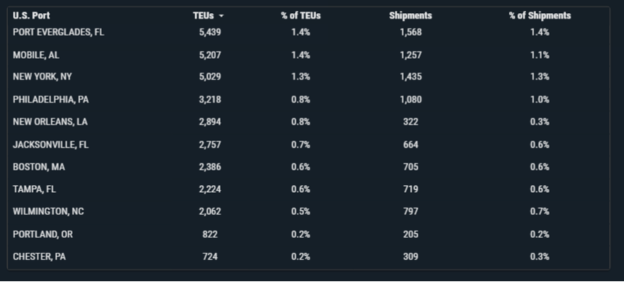

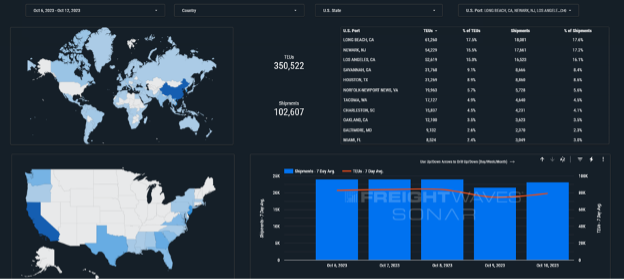

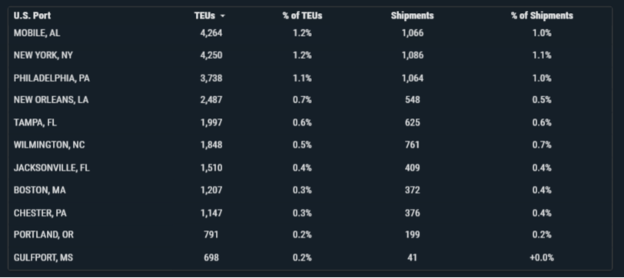

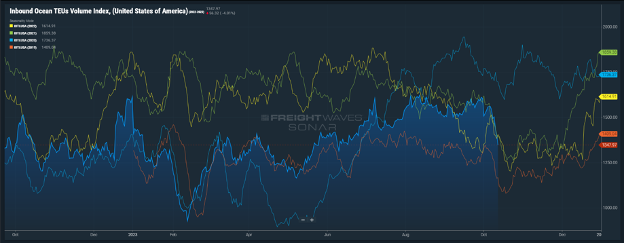

Import TEU volumes are down 7.94% this week from last week. As I have said a few times in past Market Updates, U.S. containerized imports, which year to date through August were almost exactly at the level of 2019, may or may not bounce back next year due to difficult-to-predict factors as varied as tightening consumer credit, inflation, high mortgage rates or student loans coming due. Trans-Pacific spot rates fell last month, implying a drop-off in U.S. demand from Asia and the wind-down of peak season. This month, FreightWaves’ propriety bookings indexes are showing the same decline. The data in the first chart below shows the trend in bookings (measured in TEUs) based on scheduled departure date. The indexes for U.S. bound bookings from all foreign load ports and those specifically from China have both declined sharply in October, implying weaker imports in November and December – as is the case in any normal, non-pandemic year. The strength of these bookings indexes in June-September aligns with relatively strong import numbers through last month. The second chart below shows the TEU volume index annually over the past 4 years, dating back to 2019 (orange line).

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads

Port & Rail Updates

LA/LGB: There’s a bit of a rail car shortage causing containers to stick around on the docks longer than usual. It’s been a slow climb since June, peaking in September, and even a small pre-Golden Week import bump added to the dwell time. While solutions are underway (BNSF Railway is upping their equipment game by 8%, and the Northwest Seaport Alliance is bringing in extra rail cars), there’s still a ripple effect going on. Rail dwells are uncontrollable especially if a railway is short on rail cars. You can avoid the ripple effect by asking your SSLine to divert your containers to stay in the West Coast ports and choosing to transload your containers. Port X Logistics has immediate dray, transload and road capacity at our LA/LGB location and we are standing by to get those rolling for you ca@portxlogistics.com

Vessels currently in Port Los Angeles: 150 Expected Arrivals: 49

Vessels currently in Port Long Beach: 86 Expected Arrivals: 57

Chicago: No major issues at any of the railheads to report, however the west coast rail dwell is sure to affect Chicago the heaviest. We currently have very close to unlimited capacity and are open to accept all new orders – The earlier the better! We service all Chicago railheads and can even move the heaviest containers and those damaged, shifted load or problematic containers quickly out of the yards and to final destination. Our Chicago Pro Danny has all the intel and can offer all the help that is needed to get your Chicago orders pre booked and ready to roll the second the hit availability in Chicago. Letsgetrolling@portxlogistics.com

Did you know? Seattle Terminals are working on minimal hours with T18 closed on Fridays throughout October? Did you also know that Seattle/Tacoma is our new home! We have a warehouse in Seattle with 240,000 square feet of warehouse space and operates 24/7 – we have competitive rates and unmatchable service in the area, 40 trucks and drivers, 110 x 40′ private chassis and 18 super chassis/tri axles for overweight containers and more – and we have full capacity to pull containers as early as your containers become available. Got Seattle/Tacoma containers? We got you covered Letsgetrolling@portxlogistics.com

Vessels currently in Port Seattle: 432 Expected Arrivals: 37

Vessels currently in Port Tacoma: 86 Expected Arrivals: 23

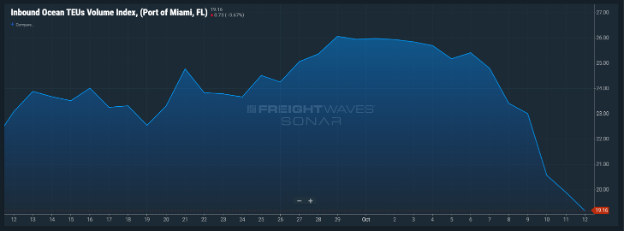

SONAR Images