1039 words 4 minute read – Let’s do this!

I guess nothing seems to phase me these days. People are way more broke than ever, yet Taylor Swift is cornering the market on ticket sales at crazy prices at booming the hotel industry everywhere she tours – with lots of fun conspiracy theories behind her successes. Yellow (YRC) has filed bankruptcy, shutting their doors, laying off tens of thousands of people yet their stock price goes up. And let us not forget – unions are still in contract battles. A “stop work” meeting was held yesterday morning at the union’s Vancouver headquarters, with members of the contract negotiating committee answering questions and all members encouraged to attend. A 3rd tentative agreement has been reached by the International Longshore and Warehouse Union (ILWU) Canada and the BC Maritime employers association (BCMEA), scheduled to be voted on tomorrow August 4th. With the BC Port drama ongoing and the union contract seeming almost like a fairytale, Port X Logistics will keep you up to date on the most current news at the BC Ports.

Weather related supply chain disruption has also come about this crazy summer, such as wildfires in Canada and low water levels on the Panama Canal, are becoming more frequent and more intense. The Panama Canal Authority (ACP) on July 25 said it is extending restrictions that limit the number of ships that can pass through its locks daily to 32 until weather conditions improve. Then there is the impact of higher temperatures on labor productivity and safety. Workers moving freight at marine terminals, cross-docks and inland rail hubs have wilted under record-breaking global highs in recent weeks. Following complaints of heat strokes among deliverers of packages and workers in other industries, the US Department of Labor on July 27 announced it will increase and improve its inspection of heat hazards, with manufacturing plants and farms as the top focus.

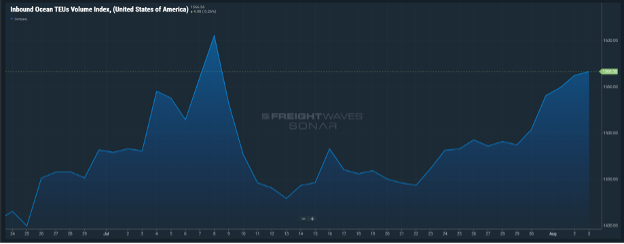

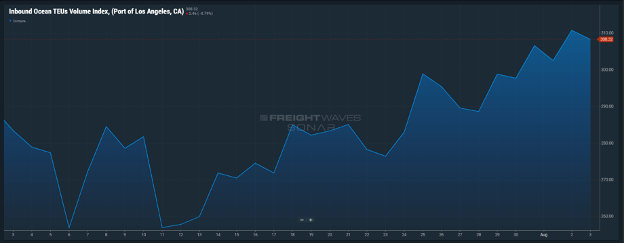

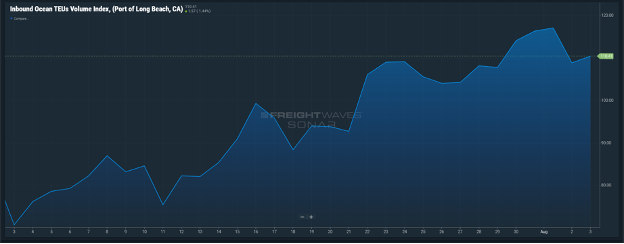

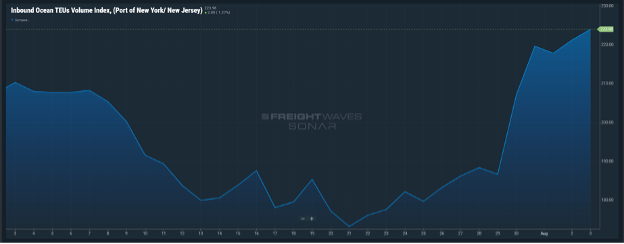

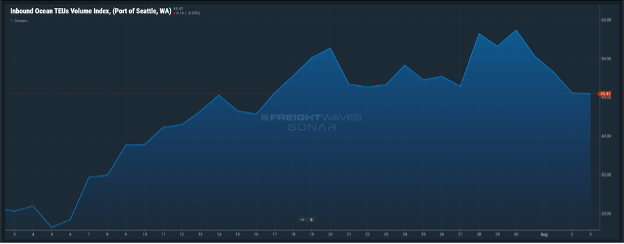

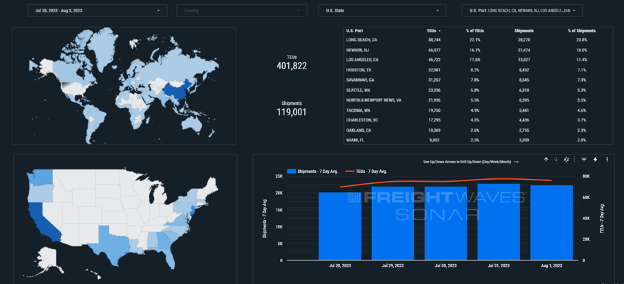

Import TEU volumes are down 1.53% from last week, which in my opinion evens out with the west coast Harry Bridges holiday closures last week. How is peak season looking? In a recent article in JOC, Sea-Intelligence Maritime Analysis said on July 30, “There is clearly a correlation between the sharp uptick in blank sailings activity on the trans-Pacific at the end of June, and the subsequent improvement in spot rates.”

Combined with what many expect to be at least somewhat of a volume recovery this fall, not necessarily tied directly to the holiday peak, the market seems to be headed for a firmer state. Although 2023 will see only a “muted peak season,” Matson Navigation CEO Matt Cox said he expects “trade dynamics to gradually improve for the remainder of the year as the trans-Pacific marketplace transitions to a more normalized level of consumer demand and retail inventory stocking levels.” The premise of a peak holiday season is focused on volumes — i.e., how much merchandise will move from Asia to the largest consumer markets in North America and Europe approximately between July and October. But while the magnitude of the peak in any given year may have macroeconomic significance in shedding light on the strength of consumer spending and the economy overall, it is only one factor driving the market conditions that affect the physical movement of goods.

Average spot rates from Asia to the US West Coast have jumped to about $1,700 per FEU from a low of about $1,000 per FEU as recently as June is clearly a reflection of growing market tightness. Recent reports of cargo rolling in Asia also reflect this reality.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads

https://portxlogistics.com/port-rail-updates/

Vancouver/Prince Rupert: The BC Ports shut down yesterday morning while members vote on new contract terms. No current updates on the anticipated outcome, but expected to be resolved by Friday

Vessels Currently at port Vancouver: 191 Expected arrivals 52

Vessels Currently at port Prince Rupert: 67 Expected arrivals 17

Oakland: Congestion looms from last week’s holiday closures and Port labor shortages

Vessels Currently at port: 57 Expected arrivals 8

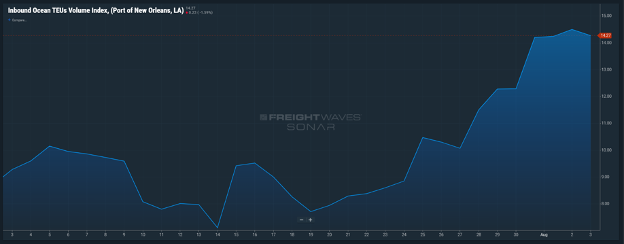

New Orleans: Chassis shortages are causing slight congestion issues, heavy amount of vessels at port could cause congestion to increase through the weekend

Vessels Currently at port: 350 Expected arrivals 60

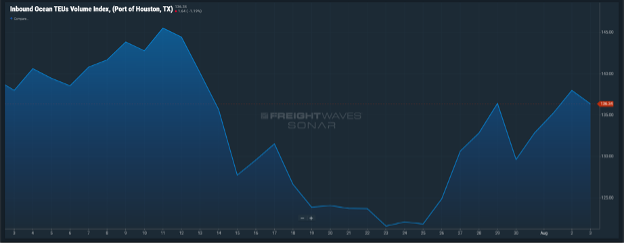

Houston: The weather in Houston may be extra hot, and there are 351 vessels currently at anchor, however the ports are running smooth and we have 40 trucks, yard space, specialize in the Houston to Dallas drayage lane and our warehouse can handle heavy and unique cargo like paper rolls and oversized pallets. Our team will provide you with proactive updates and transload photos and we will track your containers from origin to final destination. AND We have immediate capacity for your Houston and Dallas drays and transloads, reach out to the team today for rates and to WOW you with our service letsgetrolling@portxlogistics.com

Vessels Currently at port: 351 Expected arrivals 153

Did you know? The recent closing of Yellow/YRC has caused a backlog of missed Less-Than-Truckload (LTL) pickups and increased transit times from other union and non union common carriers, as well as anticipated rate hikes among these carriers. Carrier911 to the rescue! With a dedicated team of crisis management experts that are ready to take on your shipments that are being held up by the YRC crisis. From Sprinters, Straight Trucks and Dry Vans, we have the right equipment at a moment’s notice – 24/7 365, and we can pick up most shipments within 1 hour of dispatch. Once your shipment has been picked up we provide instant real-time tracking, messaging, pictures of your freight and a POD at time of delivery all found in one simple place on our TMS platform. You wont believe it… until you see it for yourself. info@carrier911.com

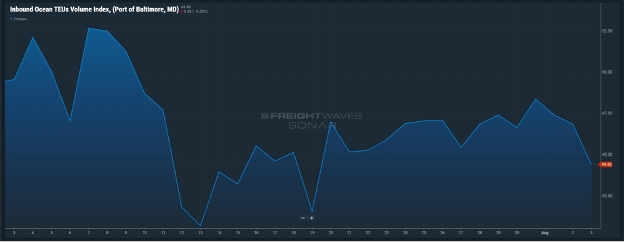

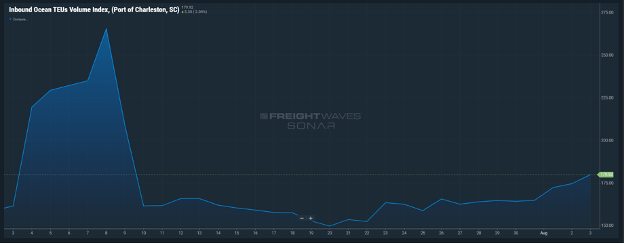

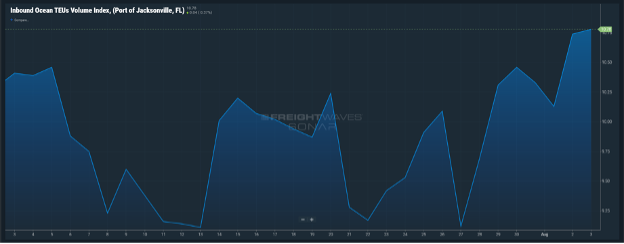

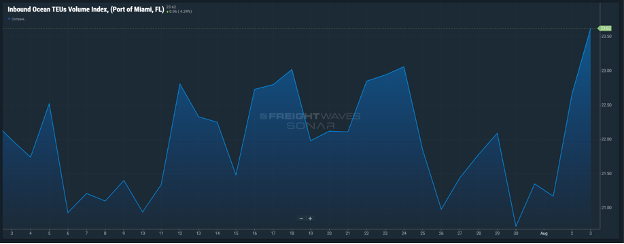

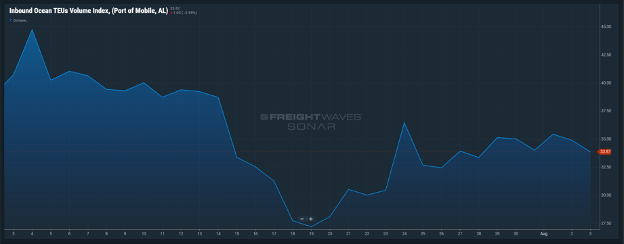

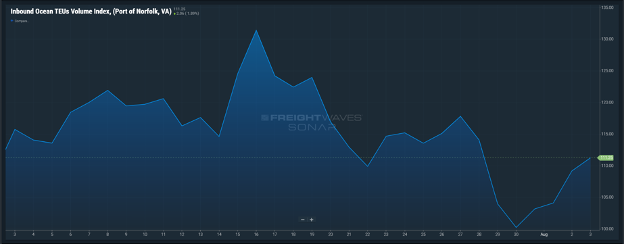

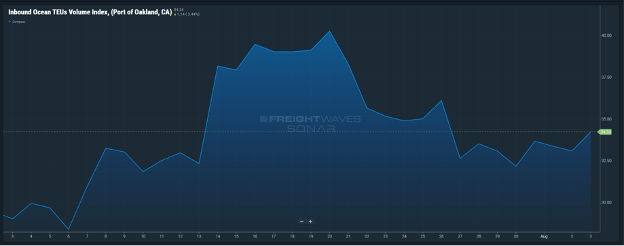

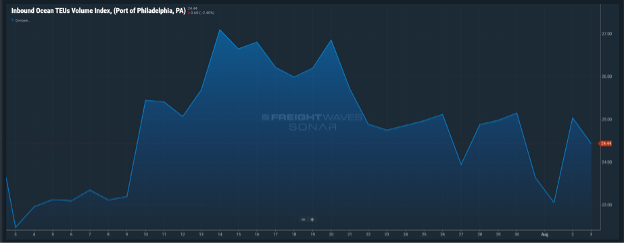

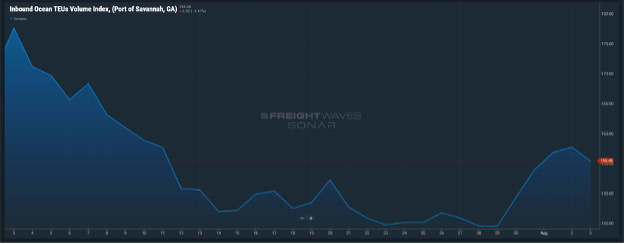

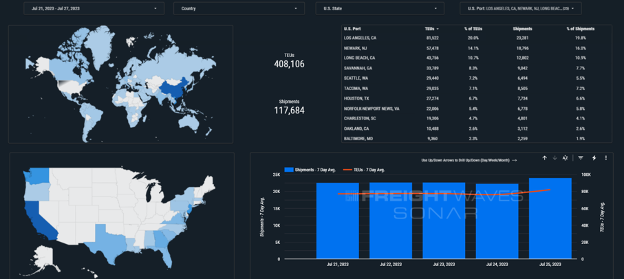

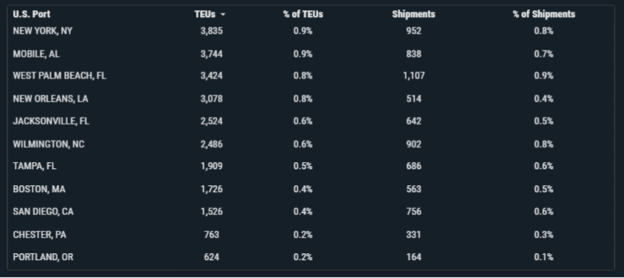

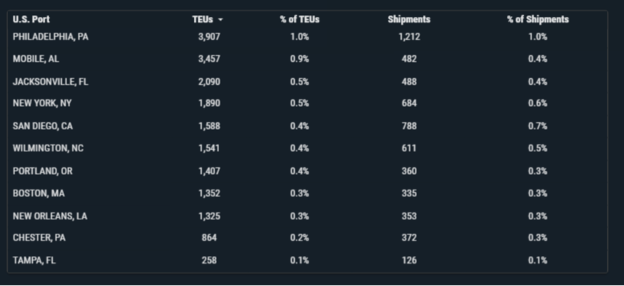

SONAR Images