1500 words, 6 minute read – Let’s do this!

Imagine asking for a 32% raise in today’s economy? Say hello to more price hikes to our already overinflated prices – everything is getting more expensive and customer service is dwindling. Truly a great time to be alive!

Congratulations to the International Longshore and Warehouse Union (ILWU) at least you guys can afford it. In case you have been living in a closet or just plain hate hearing news and current events, the West Coast ILWU have reached a tentative agreement on a new contract that would give them a 32% pay increase over the next six years. The agreement also includes a one-time “hero bonus” of $70 million for their work during the pandemic. The announcement was made last Wednesday, but the deal still needs to be ratified by both employers and dockworkers. The wage increase will be paid retroactively to July 1st 2022, when the previous contract expired. At the beginning of each contract negotiation, the ILWU and Pacific Maritime Association (PMA), which represents employers, operate under an informal agreement that longshore workers will be paid retroactively. However, because these negotiations have continued for 13 months, the retroactive pay issue became a bargaining point. The tentative agreement stipulates how many mechanics will be assigned to work at automated terminals. But the demand by ILWU locals in Southern California to get negotiators at the coast level to agree to increase manning requirements for certain cargo-handling equipment at conventional terminals reportedly failed. The PMA and ILWU have now entered the ratification phase of the contract process. Leaders from each organization will discuss the details of the tentative agreement with their respective memberships, and then the 70-member PMA, and the ILWU, with more than 20,000 rank-and-file members, will vote to ratify the deal. Based upon past contracts, the process usually takes about three months, which would push ratification into the early fall.

Peep the recap of the earnings of West Coast longshore workers who worked 2,000 hours annually, or a 40-hour work week, in 2022:

$197,514 for general longshore workers

$220,042 for marine clerks

$306,291 for foremen

So now what is the next union issue? We still haven’t seen an update on the UPS strike, so will this give them an advantage on their contract? Also just a reminder on the definition of tentative: not certain or fixed; provisional. Still time for things to go sideways…

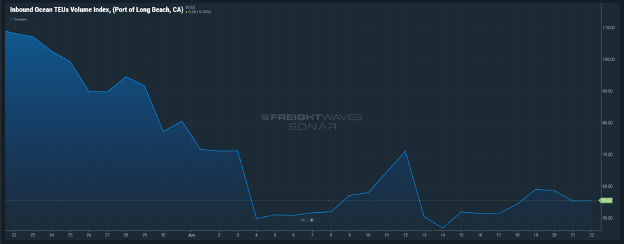

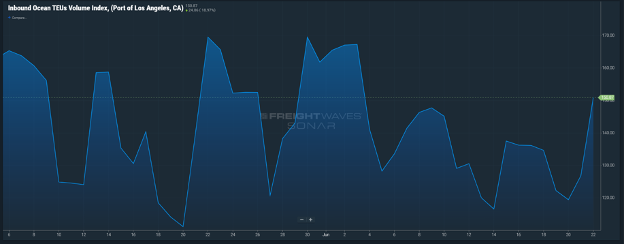

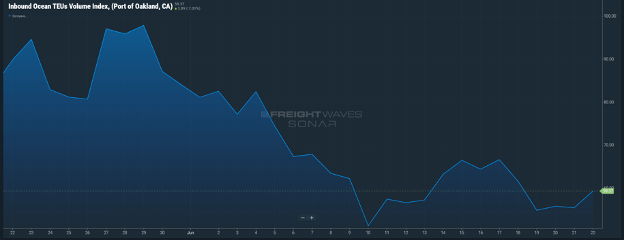

The time leading up to the West Coast tentative contract, have led to a “significant surge” in container backlogs, according to maritime analytics provider MarineTraffic. The week following June 5th witnessed an increase in the average number of containers waiting outside the port limits at the Port of Oakland, rising from 25,266 to 35,153.

According to CNBC, a MarineTraffic spokeswoman further revealed that a more dramatic rise from the Port of Los Angeles and Long Beach in the same week where the average TEU waiting off port limits rose from 21,297 to 51,228. The combined value of the 86,381 container boxes stalled across West Coast ports has reached approximately $5.2 billion, reported CNBC. In a recent letter to the Biden Administration, the US Chamber of Commerce cautioned about the potential financial consequences of a “serious work stoppage” at West Coast ports, estimating a daily cost of $1 billion to the US economy. The Chamber further implored the President to appoint an “independent mediator” to expedite negotiations and to facilitate a resolution between the Pacific Maritime Association (PMA) and the International Longshore and Warehouse Union (ILWU).

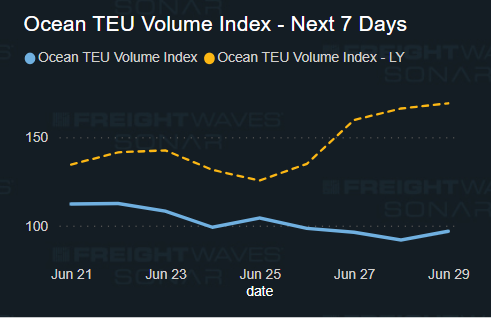

On the opposite side of the border, the ILWU Canada is still facing port strike potential at Vancouver and Prince Rupert. Many shippers are starting to take precautionary action to prevent their containers from getting stuck in the heat of the battle. The cooling off period was dated to June 21st, Should union members go ahead with a strike, the soonest it could happen would be June 24, following the 72-hour notice that would be given at the June 21 end of the “cooling-off” period mandated by the FMCS. No new updates have been found at the time of writing this Market Update.

Rail dwell times are also increasing and affecting the CP and CN rails into the U.S. current dwell times at Vancouver can be seen below:

https://www.portvancouver.com/wp-content/uploads/2015/05/container-terminal-performance-update.pdf

https://www.rupertport.com/wp-content/uploads/2023/05/PRPA-Dwell-Update-2023.05.26.pdf

Taking the news down south – a freakishly excessive decline in water levels at the Gatun Lake, which supplies the canal with fresh water, has resulted in spikes in surcharges and weight limits for vessels traversing the canal. The Panama Canal will expand weight restrictions on the largest ships crossing the waterway, one of the world’s busiest trade passages, the canal authority’s administrator said on Wednesday, citing shallower waters due to drought.

The measure follows a series of depth restrictions in the 50-mile (80 km) canal since the beginning of the year due to a drought, which authorities had hoped would ease by the start of the Central American country’s rainy season.

The situation could get even worse with the arrival of the El Niño condition developing in the western Pacific Ocean, which is anticipated to disrupt normal weather patterns by the year’s end. Subsequently, the canal could see an increase in temperature and an intensified drought in 2024, reported Head of the canal’s Water Department, Erick Córdoba, in a recent interview.

In response, the PCA has implemented several measures to curtail the impact of the drought, while maintaining maritime operations in the canal. The PCA has cut the canal’s draft limit to 44.5 feet from its standard 50 feet requirement, with the limit set to drop again on 13 June to 44 feet.

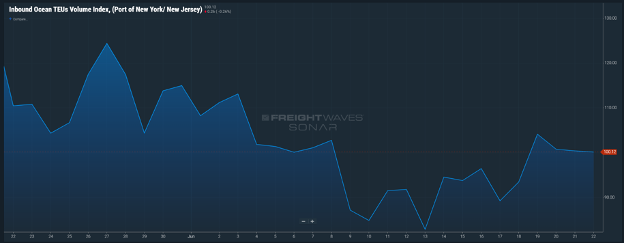

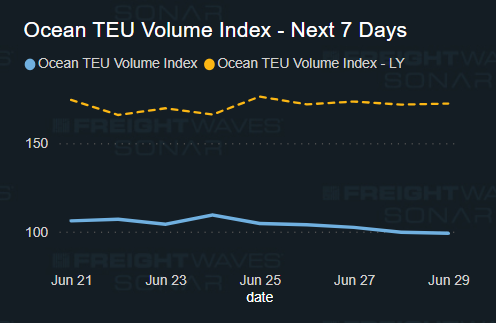

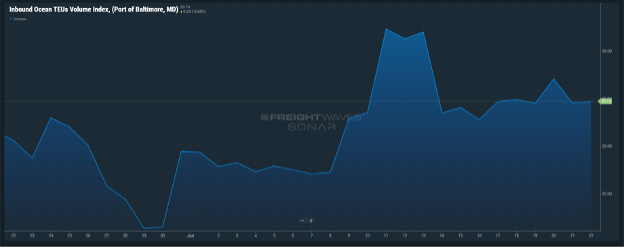

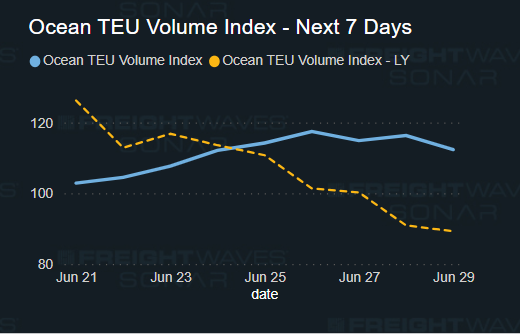

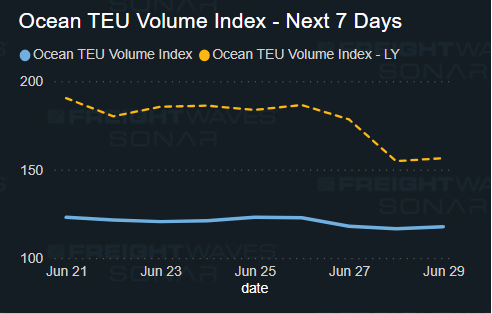

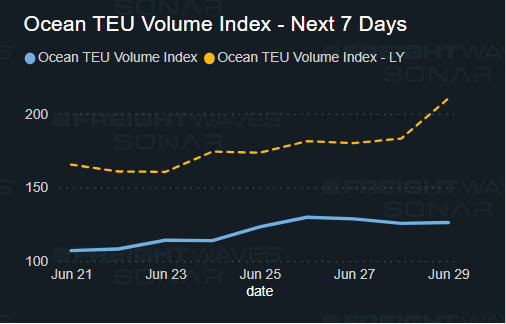

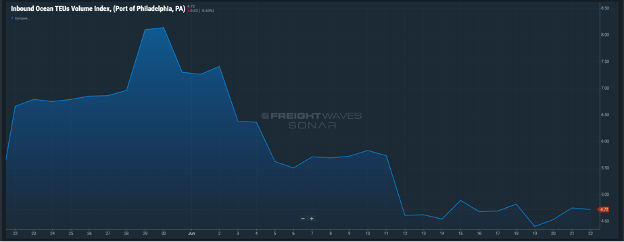

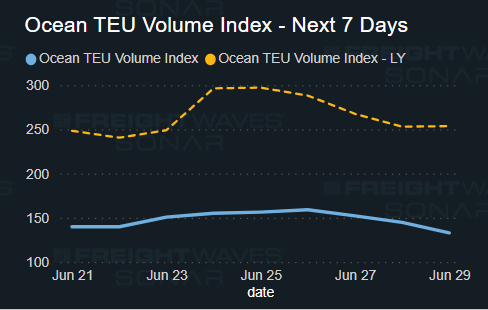

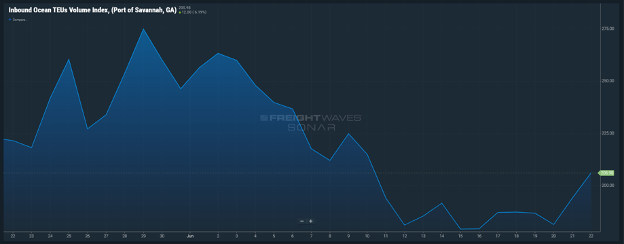

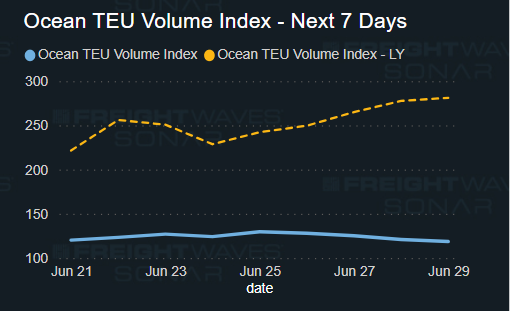

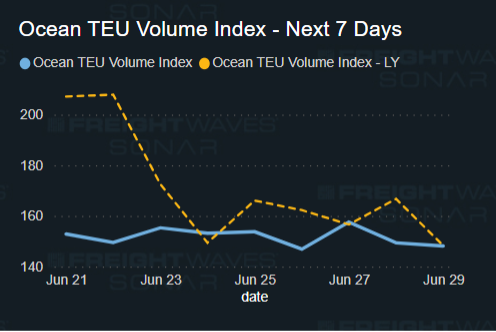

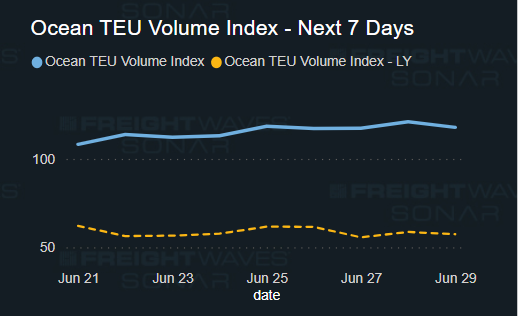

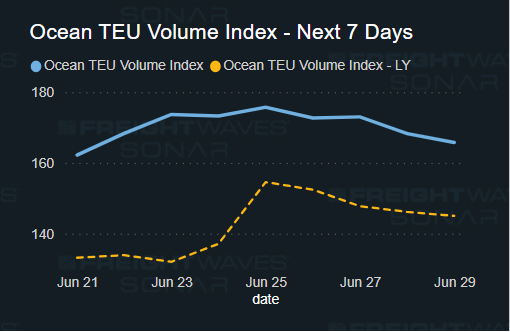

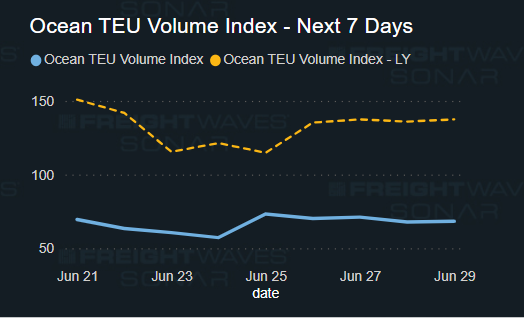

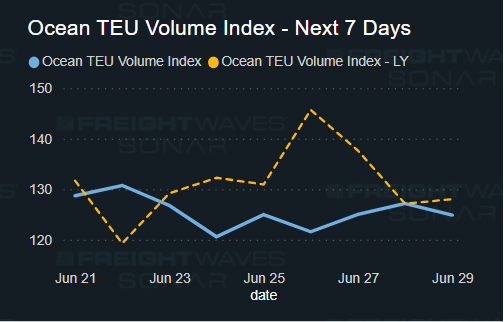

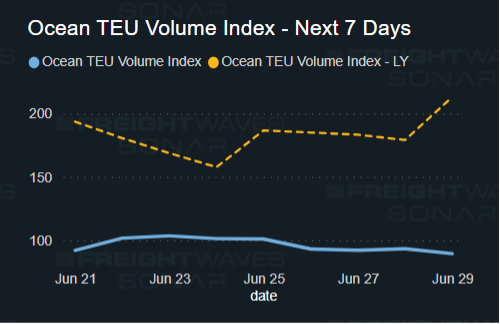

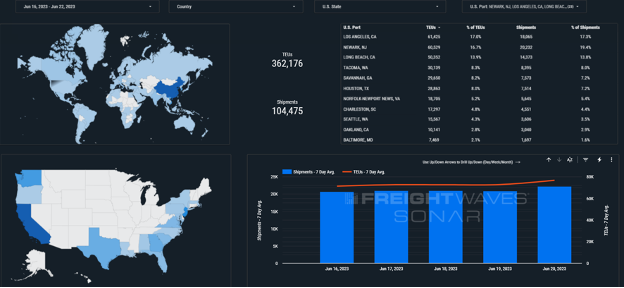

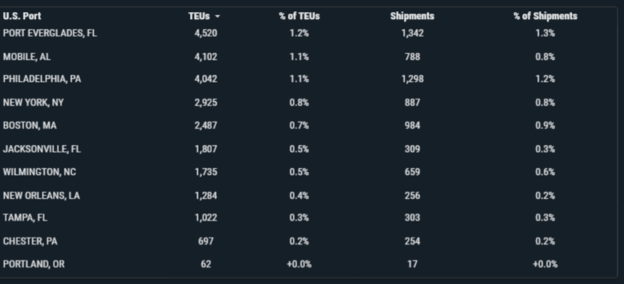

Good news on the import TEU front, import TEU volume rose 1.098% this week, with the majority volume coming into Los Angeles 1st , New Jersey 2nd and Long Beach 3rd. May was the highest month of imports into the U.S. Ports in 2023 thus far, but are still down 20.4% compared to 2022.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads

https://portxlogistics.com/port-rail-updates/

LA/LGB: Increased rail dwell times are still emanate and can be seen on the link below

PowerPoint Presentation (portoflosangeles.org)

Vessels currently at port Los Angeles: 142 Expected Arrivals: 40

Vessels currently at port Long Beach: 68 Expected Arrivals: 63

Oakland: Excess delay times for drivers at the port, rumored to still be the cause of labor shortages. Vessels currently at port: 64 Expected Arrivals: 20

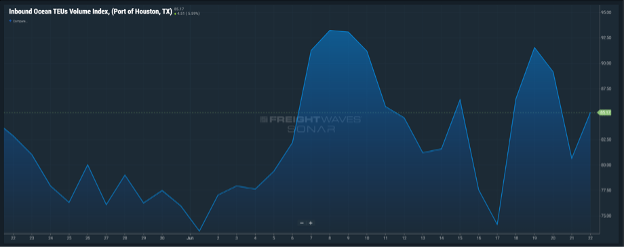

Houston: Severe overnight storms north of Houston leave more than 150,000 homes without power. Currently no major Port disruptions to report as of yet, but vessel delays can be expected as there are currently 339 vessels at Port.

Vessels currently at port: 339 Expected Arrivals: 150

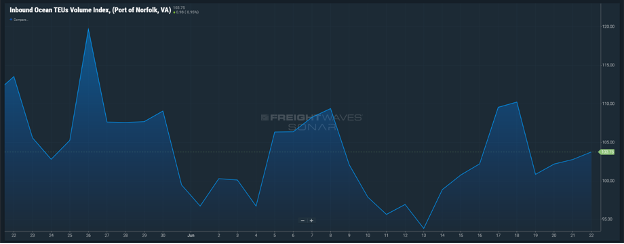

Chicago Rail: Rail dwell times are over a week from containers coming into Chicago through Western Canada on Canadian Pacific or Canadian National will be delayed. The Norfolk Port dwell times have decreased and getting containers on the trains fairly quickly. Predict that anything coming into Chicago on the east coast through Norfolk, moving on the Norfolk Southern or the CSX, will move inland quicker than usual once discharged from the vessel.

Did you know? Things are heating up with the Port X Logistics Atlantic Division driver fleet! 🔥

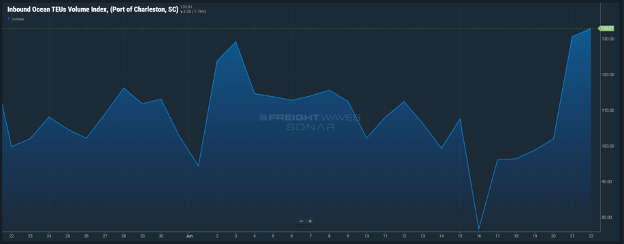

Buckle up and get ready: We’ve taken a huge leap forward and are now FULLY SERVICING the Charleston Port and Jacksonville Port in all of their glory.

We’re here to unleash the powerhouse of services that you know and love, and we’re not holding anything back.

Drayage? We’ve got you covered! Our drivers will handle your freight with the utmost care and precision, ensuring it reaches its destination in record time.

Same day transloading? Yuuup! Our warehouse in Savannah is ready and available, making the whole process a breeze. We’ll continue to deliver the speed and efficiency you’ve come to expect, even in our exciting new drayage operations at the Port of Charleston and Port of Jacksonville.

We know a lot of you depend on our real-time tracking tech, and guess what? It’s coming with us to the Port of Charleston and Port of Jacksonville. You’ll be able to monitor your cargo’s journey every step of the way, bringing peace of mind like never before.

Reach out today to get started 👉🏼 SAV@portxlogistics.com

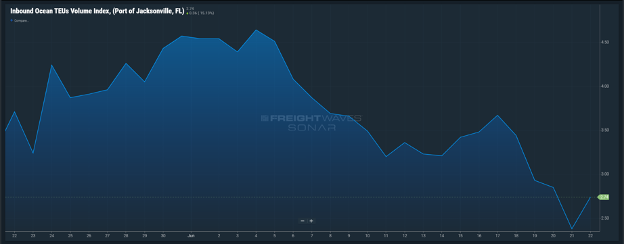

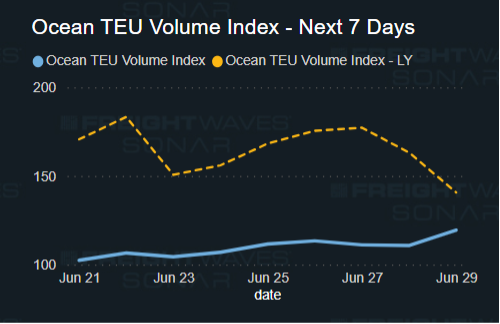

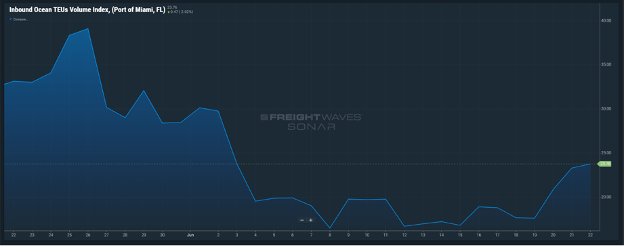

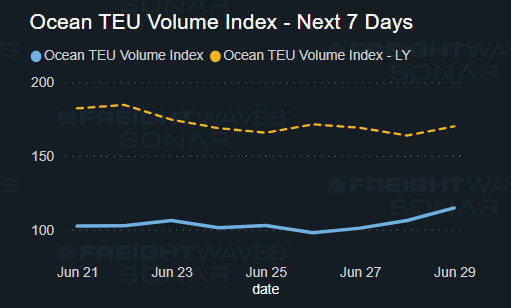

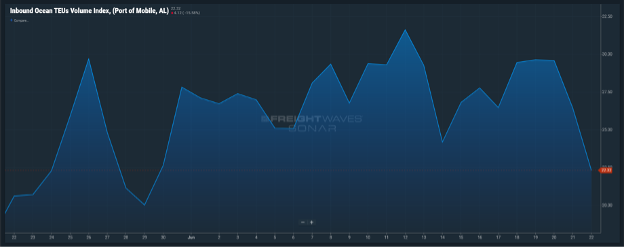

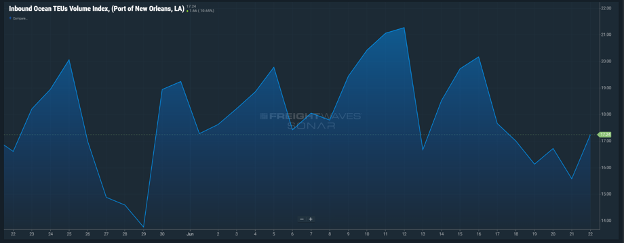

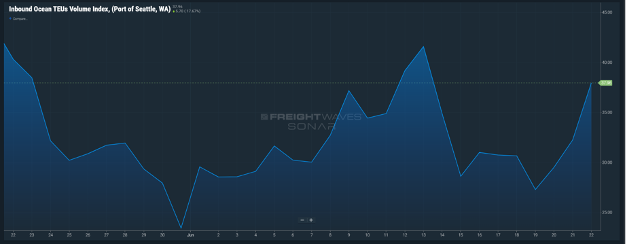

Sonar Images