896 words 4 minute read – Let’s do this!

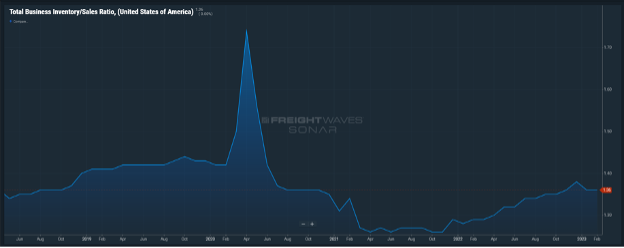

Inventory correction – what does it mean? During and after covid inventories plummeted leading to an abundance of overordering once factories were back to work and the world opened again. Unfortunately that also led to the great congestion woes of the fall of 2021. I know that this is no news for us in the industry, we have been dealing with the highs and lows of the pandemic for a few years now. A funny story, my aunt is a nurse and when Covid shutdowns started, she said it would take years for the effects to go away. We laughed at her, but she was right and here we are. Back to inventory correction: Inventory corrections can be used to adjust the in-stock quantity of a product. This might be used to correct the quantity of an item after a stock take or to write off damaged items. When items are added or removed the necessary accounting adjustments will be made automatically. Below states the total business inventory sales ratio from mid 2019 through February of 2023 (latest reported data).

Inventory levels surged in April of 2020 which is likely to include majority or medical supplies and covid care items that were a large shortage in early 2020. The summer of 2021 shows a huge drop in inventory levels closely related to stimulus check spending and supply and demand issues from factory closures and world shit down cause and effects. In 2023, we are now pretty close to the inventory index level back in mid 2019, which was considered the last trucking recession prior to the pandemic. Inventory levels remain stable which indicates there is not much importing since inventories are well stocked and shows the current state of the industry to be not so great.

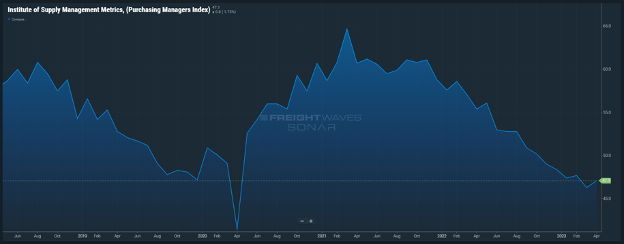

As we take a look at the U.S. Import Purchasing Managers Index. Anything above the 50.0 index is indicative of expansion and anything below 50.0 is indicative of contraction. We are hopeful that there will be an increase in inventory purchases as we approach peak season, but as shown on the previous graph, we are sitting pretty in the stable inventory levels lane.

Just like all the shippers over the past couple years, even Chachi is moving out of Southern California. Scott Baio is fleeing his family out of Hollywood and it was an internet sensation topic of the early week – what can I say, America loves its Hollywood gossip. Guilty Americans here! I also grew up watching Charles in Charge and consider it one of the top tier 80’s sitcoms.

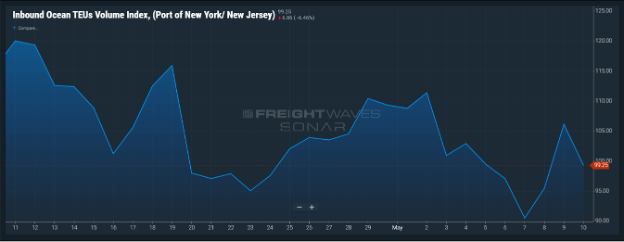

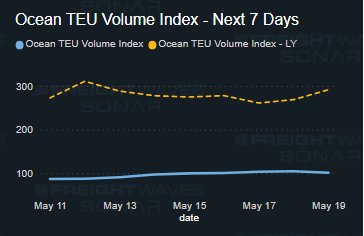

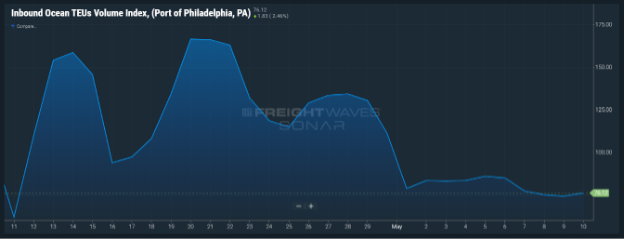

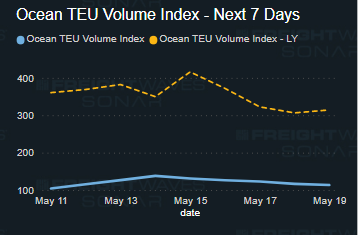

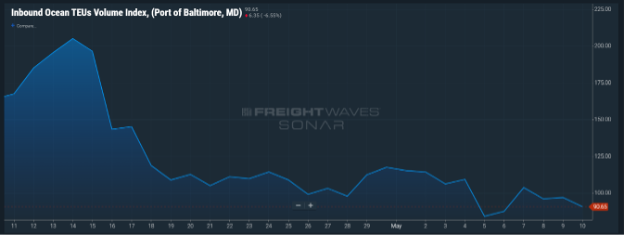

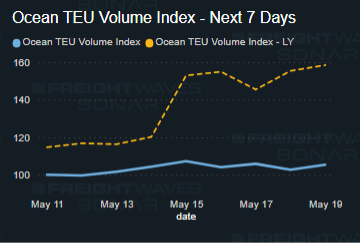

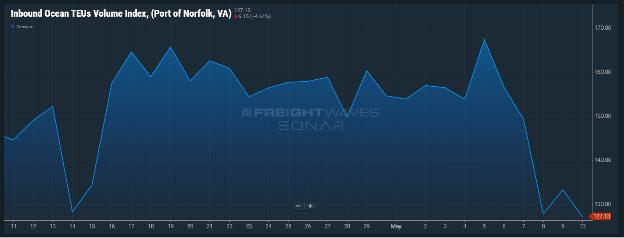

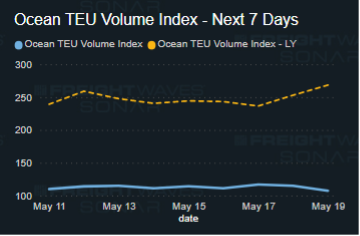

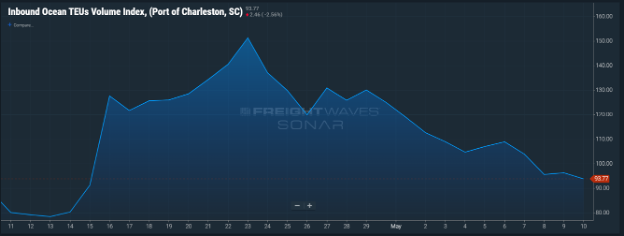

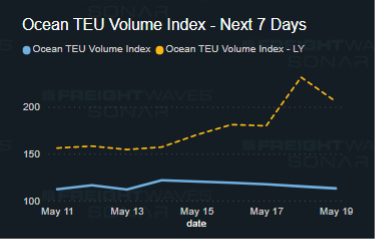

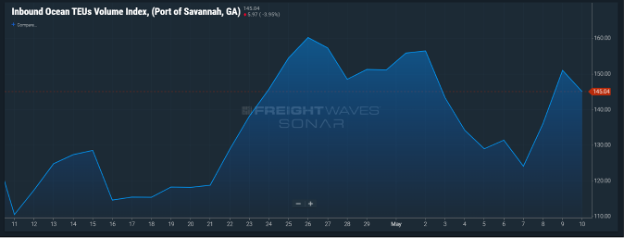

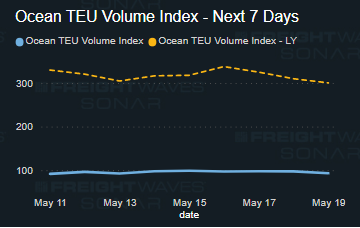

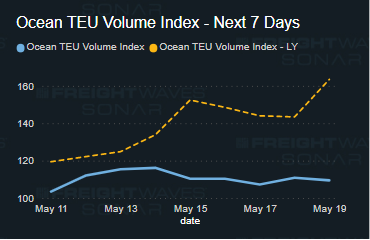

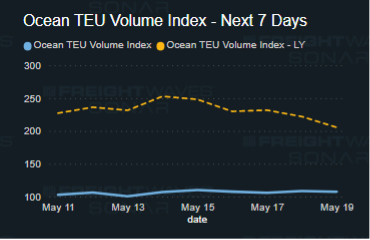

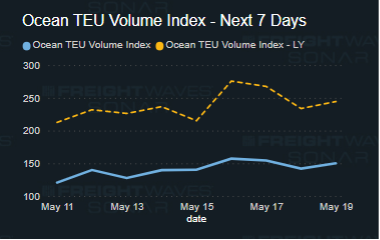

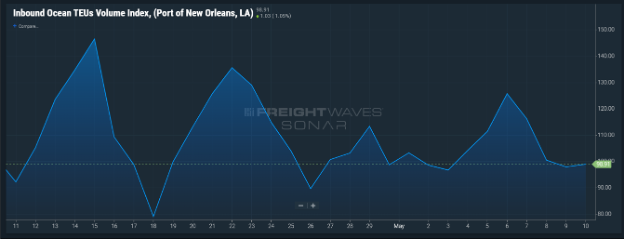

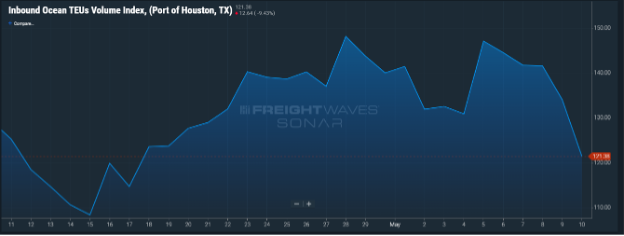

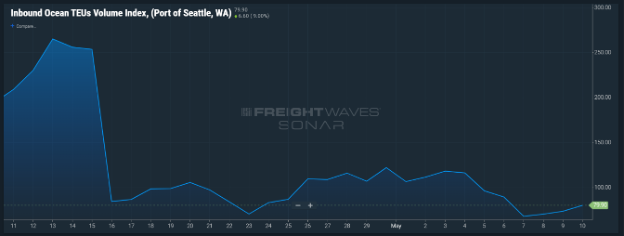

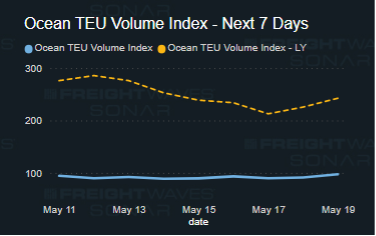

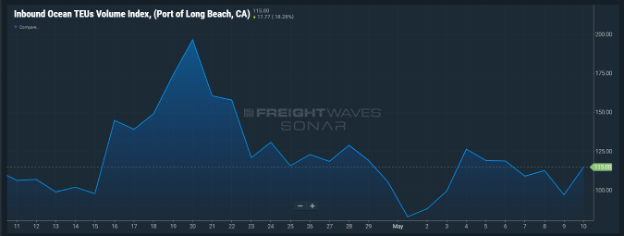

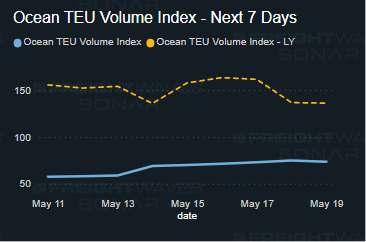

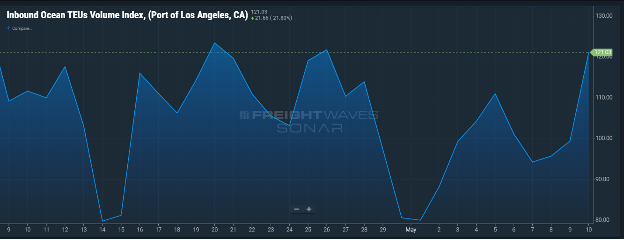

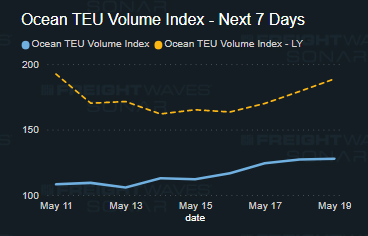

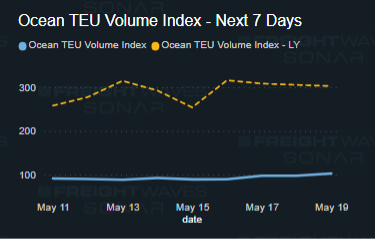

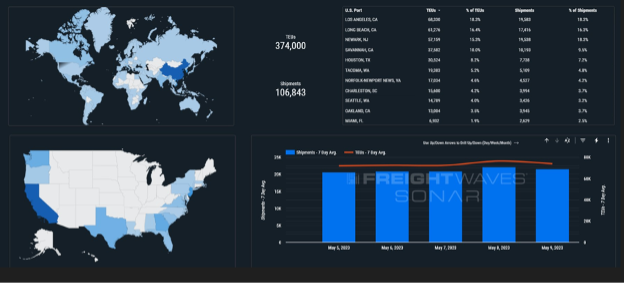

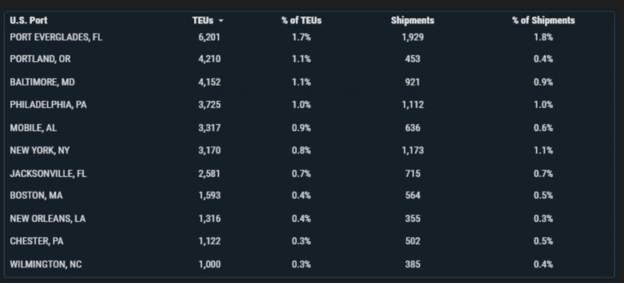

What’s next? Port TEU volumes went up very very slightly 1.689% this week from last week. 18.3% of the volumes this past week came into Los Angeles Ports, and 16.4% came into Long beach, however incoming Vessel arrival counts remain very low through this weekend for both locations.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads: https://portxlogistics.com/port-rail-updates/

Highlights:

Houston: Some mild flooding occurred this week in Houston, but it has not caused too much congestion trouble as of yet, but looking at vessels it does look like there was a delay in cargo vessel arrivals. There is currently 1 vessel that just arrived with 13 arriving tonight, 21 more arriving through tomorrow and 19 more through the weekend.

NY/NJ: There have been delays this week at APM terminal, slower wait times for drivers likely due to labor shortages. 21 vessels to arrive through the weekend

LA/Long Beach: Super slow ending to the week for LA/LGB ports – 2 cargo vessels currently in the LA port with 9 through the weekend and just one vessel currently in LGB with 18 to arrive through the weekend. Could this be the cause and effect of the ongoing union (ILWU) contract negotiations?

Vancouver/Prince Rupert: Speaking of the ILWU, both ports were expecting to see diversions from the U.S. west coast into Canada west coast ports, but sources say that has not been the case. The ILWU Canada contract has now expired. Government-mandated mediation and cooling-off periods will enforce the status quo in Western Canada through at least June, but it is possible that strike actions or lockouts could occur thereafter. If the US West Coast situation is resolved, then we could see fear of labor disruptions fueling diversion away from Western Canada, making what appears to be a bad situation even worse. 1 vessel currently in Vancouver, 16 en route over the weekend. In Prince Rupert, 1 vessel current and 3 over the weekend

Did you know? Port X Logistics is providing the quickest and easiest access to container visibility for anyone in the supply chain. One click gets anyone Vessel ETA, hold alerts, arrival, availability, last free day, out gate information, Delivery updates, and Empty Termination. No more chasing, no more wondering. It’s how you always wished it could be. Reach out and let us show you how simple it can be. One click. For a 1-on-1 Demo, reach out to Tommy Turvo at Tom@portxlogistics.com.

~ Jill Rice

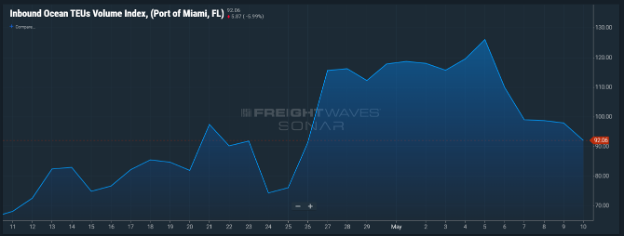

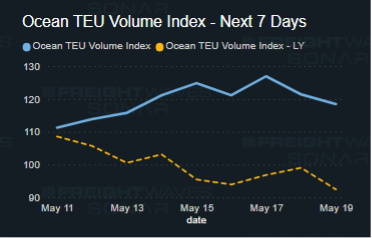

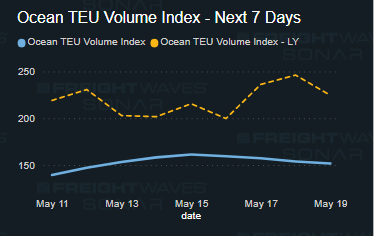

Import Volume Charts