903 words, 5 minute read – Let’s talk about the first quarter!

One more day left of Q1. How is 2023 looking so far?

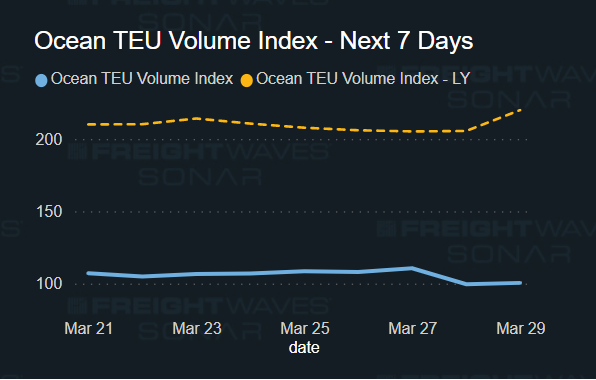

January was as expected, a lull from the holidays with more foreign holidays on its heels. February was an all-time low with what seemed like an extra-long Lunar New Year pause and import volumes the lowest we’ve seen in years. March volumes seemed to take on a little improvement in import volumes, but it is now back to the good old days of major contract and rate negotiations. Things usually get worse before they get better, and there’s so many things that need to be repaired. The pandemic left us all tired and overspent on so many things. Although it’s not easy to relax when our industry depends on your hustle, it’s so hard to get the groove back when we went from chaotic madness to not even a ripple in the water in a few short months. The US economy has slowed down and I think it’s still hard for shippers to want to make any big shipping commitments.

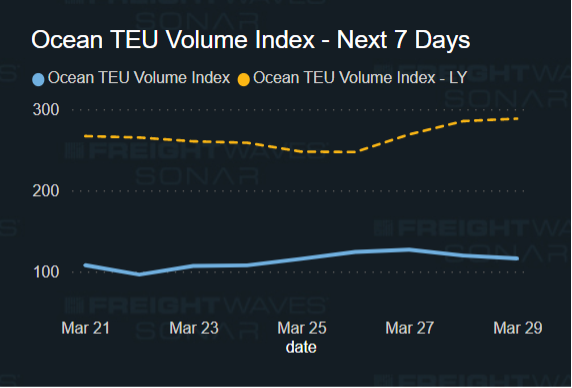

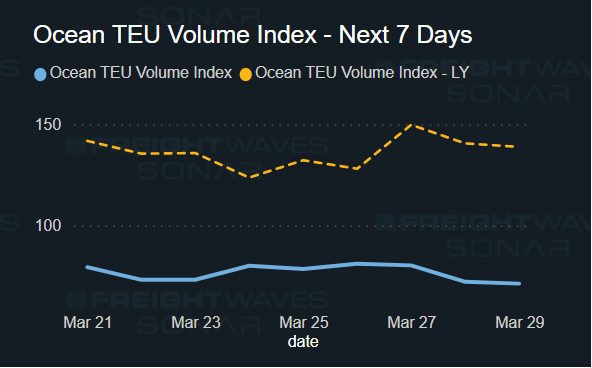

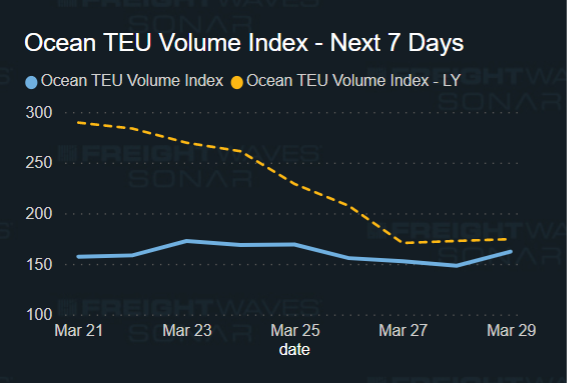

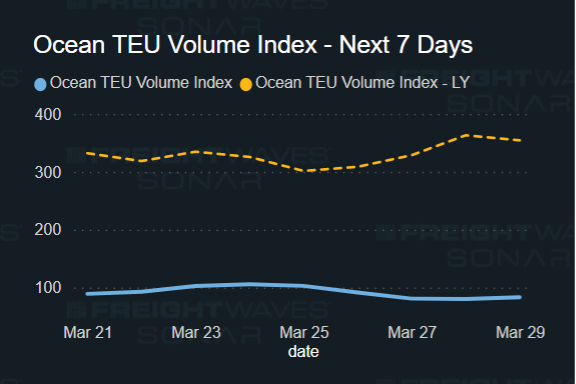

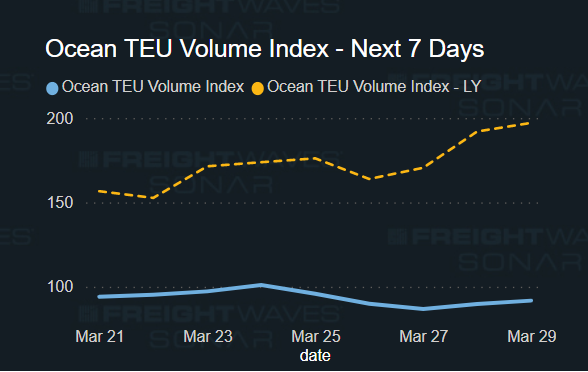

Ocean carriers plan to cancel almost 50 voyages that were scheduled to depart from Chinese ports now through the end April, amounting to as much as 443,000 TEU in trans-Pacific capacity that will be blanked, according to data from container shipping analysts. US imports from China in February fell 37 percent year on year to 640,846 TEUS. February was the sixth consecutive month of year-over-year declines in Asian imports that began in September. Still, those declines are being compared with the record or near-record import volumes that were posted in late 2021 and early 2022. https://loom.ly/tk-tD-o

Issues on the West Coast between the Pacific Maritime Association (PMA) and the International Longshore and Warehouse Union (ILWU) still drag on. Marine terminal operators at the West Coast ports are canceling at least one work shift per week due to volume declines that have been caused by the fear of port disruptions caused by contract negotiations between port employers and the ILWU. The Longshore workers have accused marine terminals of sporadically shutting gates in recent months, saying that employers aren’t faultless in the decrease in port operating hours. The contract talks have continued for more than 10 months, and there is still no resolution in place at this time.

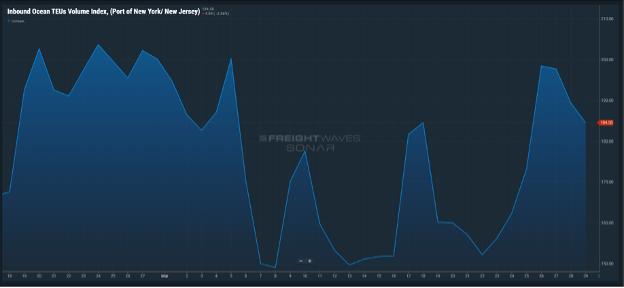

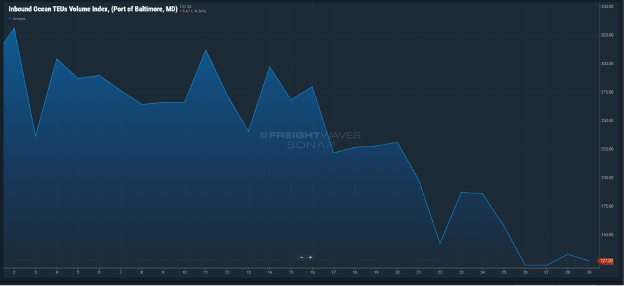

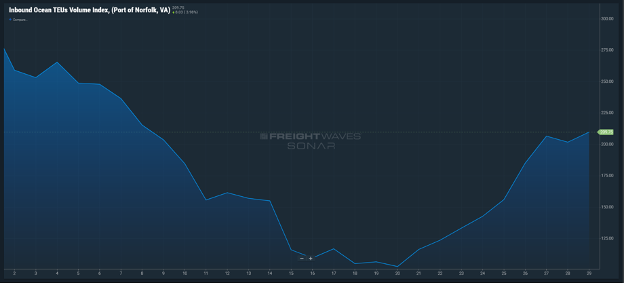

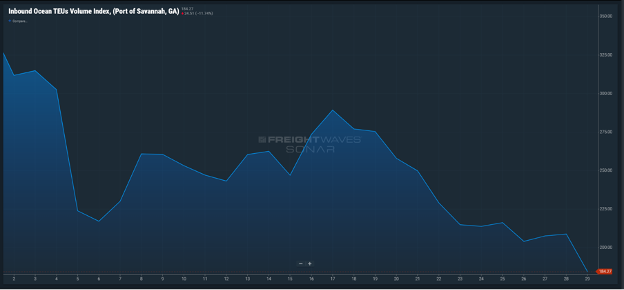

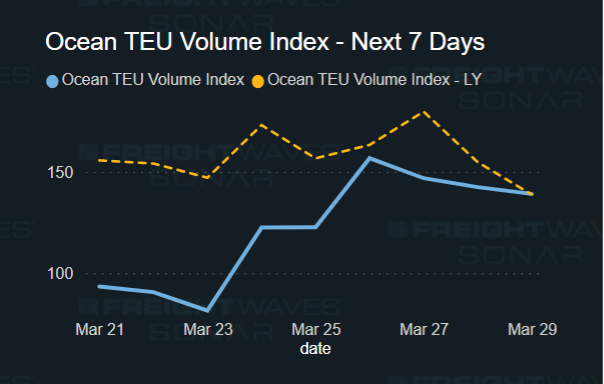

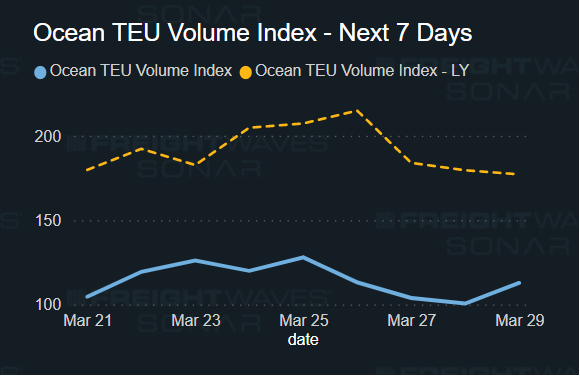

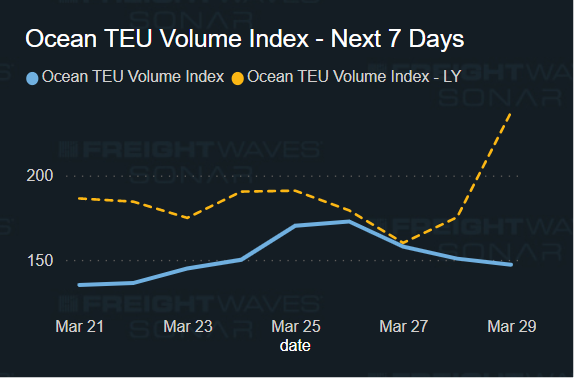

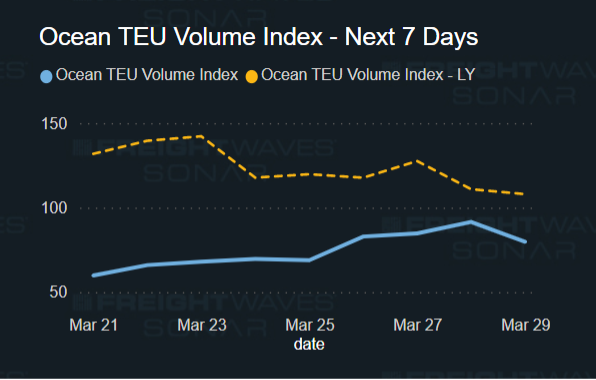

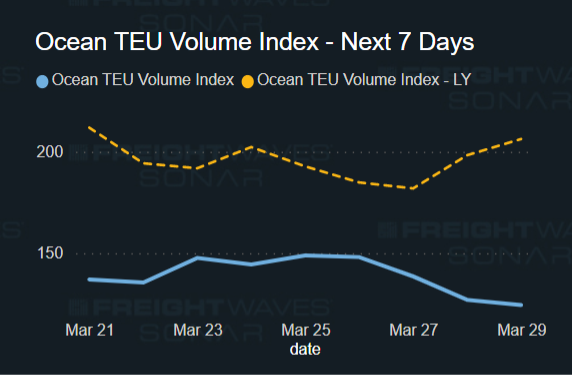

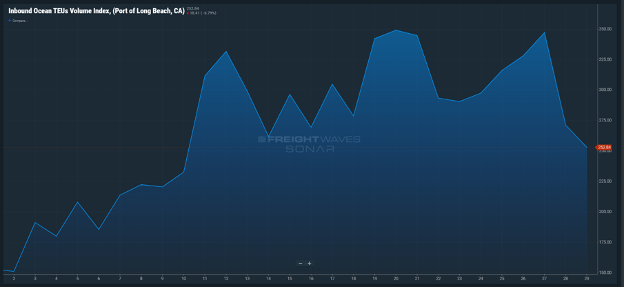

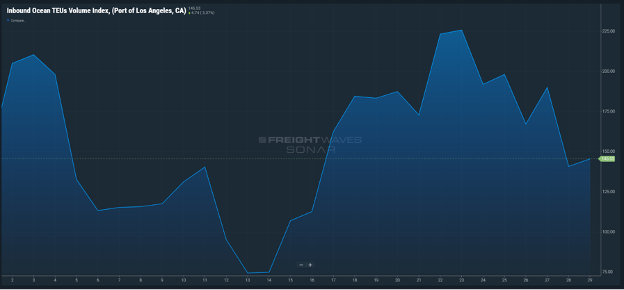

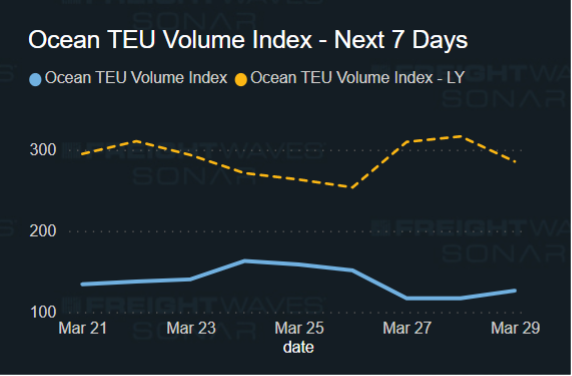

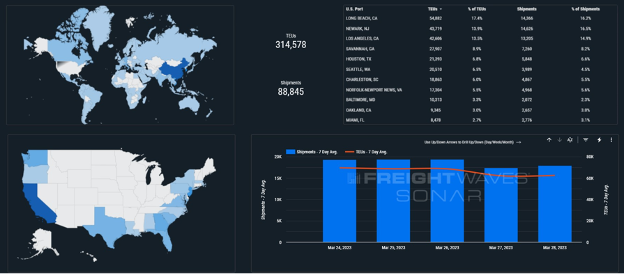

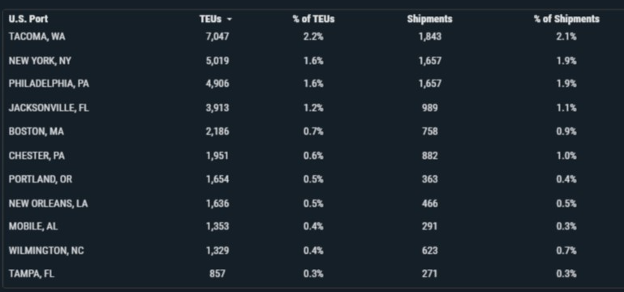

Import TEU Volumes are down this week 14.534% from last week across the US.

Now, who’s hot, who not? The Port of Oakland experienced “another slow month” in February, with container traffic reaching just 153,837 TEU. That figure is the port’s lowest monthly total going back to February 2015, when operations at west coast ports were interrupted by a labor dispute. Loaded containers fell 23% from 147,620 TEU in February 2022 to 113,814 TEU in February 2023, and Full exports also declined, falling 10.6% in February 2023 to 55,741 TEU.

The Port of Houston continues to show strong increases in monthly container traffic. Houston was the only top-10 US container port to see an increase in import containers (+12.7%) in February. Export volumes in Houston remain strong, up 42% this month.

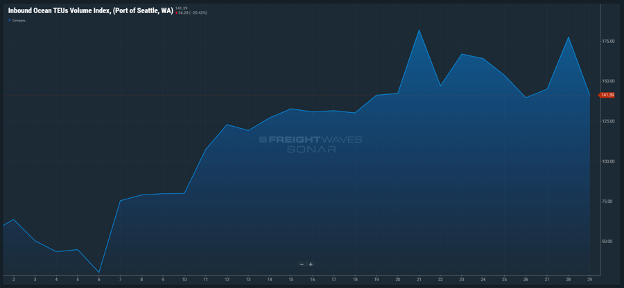

The other nine ports in the Top 10 Savannah recorded the lowest decline in import volume (-16.7%), while the west coast ports of Los Angeles (-41.2%), Seattle/Tacoma (-40.2%) and Long Beach (-34.7%) saw the steepest declines.

What’s going on? (Oh, what’s going on?) Somebody tell me (what’s going on?)… at the ports and rails this week:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads

https://portxlogistics.com/port-rail-updates/

NY/NJ: Newark PNCT: There are no container ships at anchorage. APMT Port of Elizabeth: Vessels are bunching due to bad weather around the coast, causing one-day delay on some services

Oakland: Ports closed 1st and 2nd shift Friday March 31st for Cesar Chavez Day

Savannah: There are 2 container vessels at anchor. There are no Maersk vessels at anchor and 1 Maersk vessel under operations. We have capacity! For immediate availability and competitive rates contact Sav@portxlogistics.com

Chicago rail: Rail delays into the from the west coast due to higher volumes and equipment imbalance related to weather

We are passionate about keeping you connected with up to date information about the ports and rails as well as keeping you informed on critical industry news and Port X Logistics assets, location and team updates and you can see it all here: https://www.linkedin.com/company/port-x-logistics-llc/ Please follow our Linkedin page as we strive for 10k followers!

Did you know? We announced some very exciting news last month. We have partnered with U.S. Multimodal Group and now have access to more equipment, yards, and terminals. Port X Logistics will lead more asset divisions to provide drayage, transloading, and trucking services throughout the USA and Canada. We will now have more assets under our umbrella. Company drayage assets in Oakland, Los Angeles/Long Beach, Denver, Memphis, Chicago, Kansas City, Savannah, with more locations on the way. Read about it here! https://loom.ly/0hw04BI

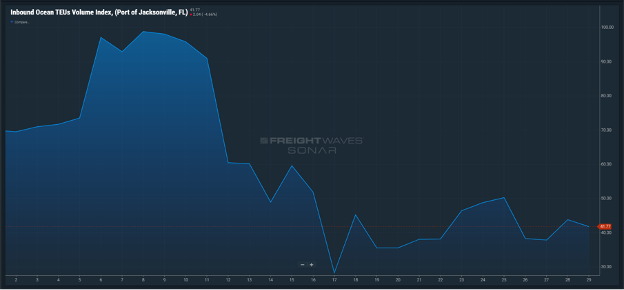

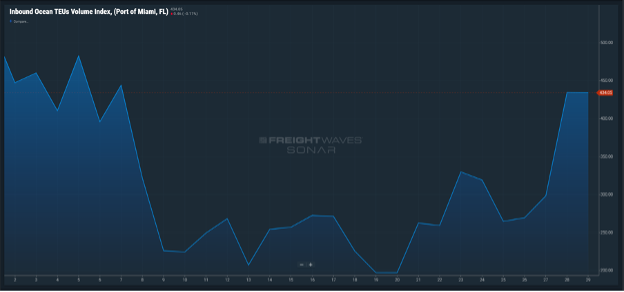

SONAR IMAGES