The News

I feel like it was just June and the start of summer when I was just looking at the current market conditions, how is it already September?

A reminder that it is a holiday weekend. All terminals will be closed in the US and Canada on Monday, as will most shippers and receivers which contributes to hindering the flow of moving containers, driver capacity, transit times and solutions for last minute shipments.

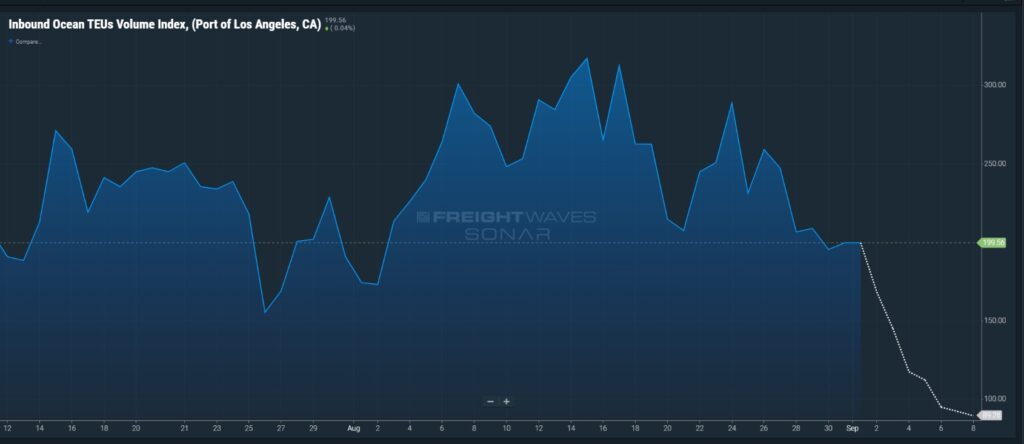

2022 is almost at Q4 and there have been so many changes to the freight world, and well, the economy. We have experienced some import and export slowdowns and crazy fuel fluctuations this summer, but the holiday shipping time is near. That means so much to plan for – planning for port congestion and market rate increases, chassis and yard space shortages, but somehow this year just feels different. Last year at this time was the start of planned ocean volumes importing to the west coast increasing at volatile speeds.

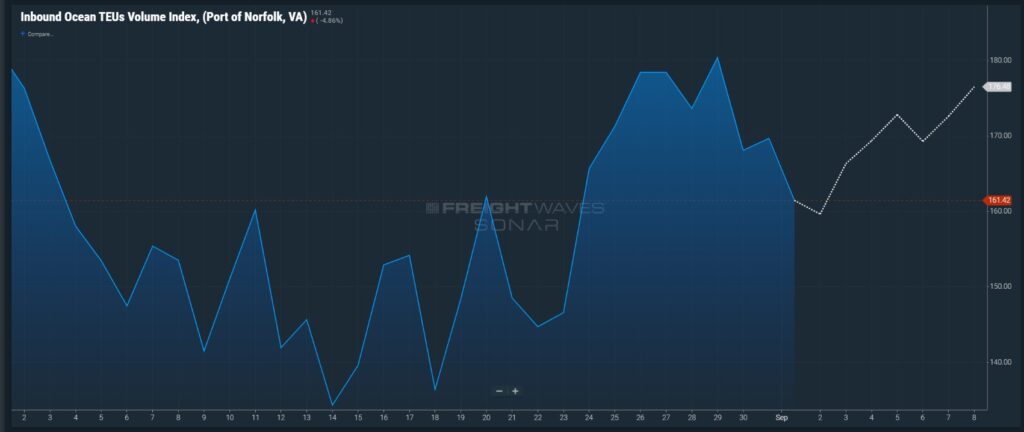

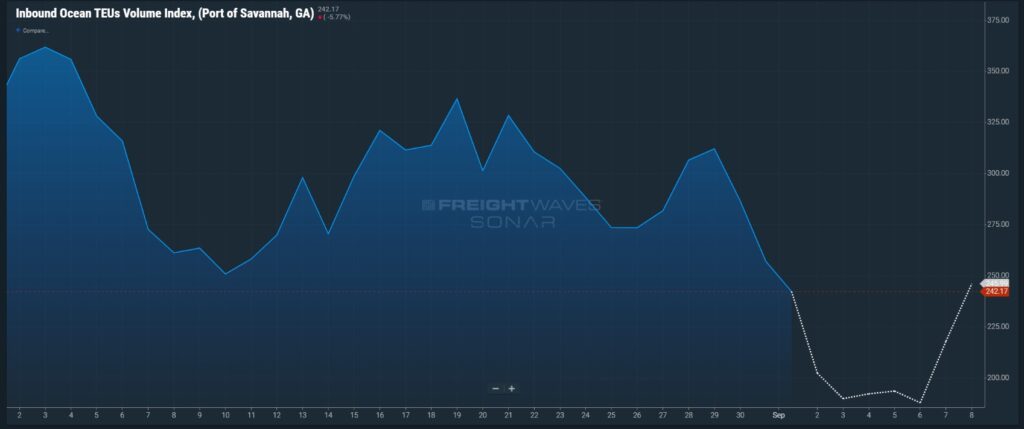

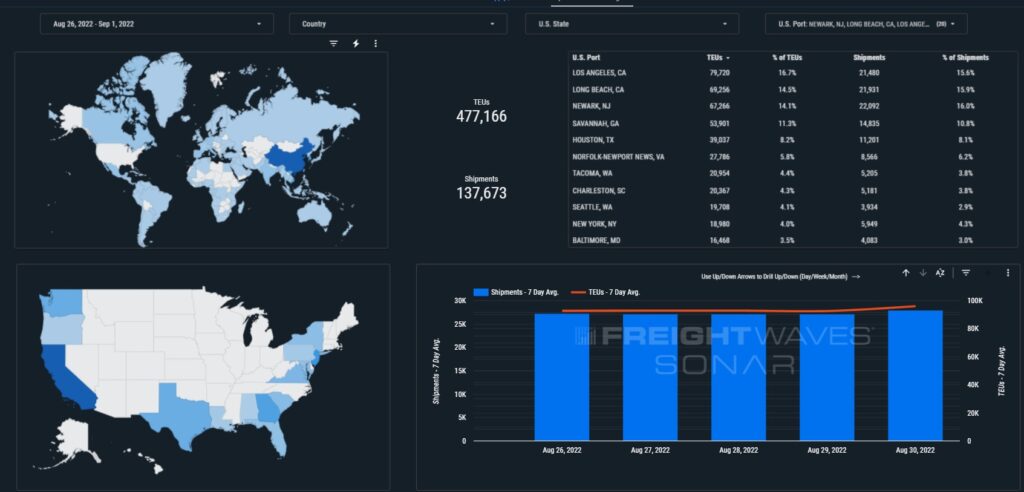

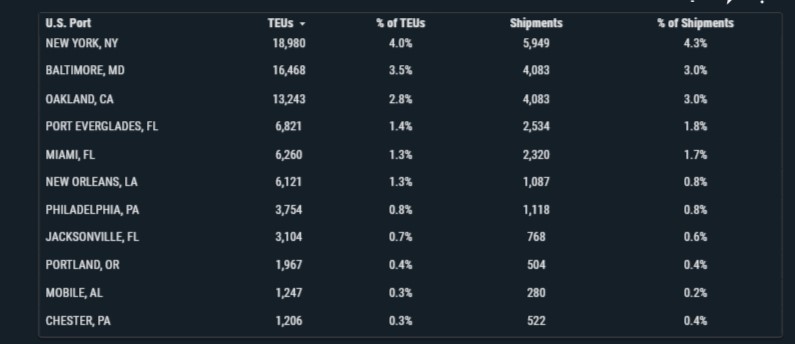

This summer everyone had different plans, send more to the Gulf and East Coast. While those ports may have easier and more open appointment systems, we are still starting to show the wear and tear of the backlog. An article posted yesterday in JOC states that there are no signs of relief from port congestion, and we are feeling it too. Chassis shortages in NY/NJ, Baltimore, Norfolk and Charleston, coupled with heavy congestion fees implemented in Miami are some of the challenges we face on the east coast. The weekly increased volumes we see on the charts each week show that the volumes in East Coast and Gulf Coast are here to stay.

“Asian imports landing at ports along the US East and Gulf coasts surged in July, offering no respite from the vessel backlogs and terminal congestion experienced by those regions in recent months. West Coast ports, meanwhile, saw a year-on-year drop in cargoes from Asia, demonstrating why those gateways have experienced far less congestion than last summer.”

“Asian imports moving through East Coast ports in July increased 14.3 percent year over year, while volumes along the Gulf Coast jumped 24.2 percent, according to data from PIERS, a JOC.com sister product within S&P Global. West Coast ports saw imports from Asia fall 5.2 percent from July 2021, the data showed.”

Even with the upcoming week being a short week due to the holiday, there is an overall increase of 7.5% of incoming TEU volume this week, as predicted in last week’s market update.

- NY/NJ another increase this week, causing port congestion to loom well into the fall season.

- Baltimore same as last weekwith volume increasing 20’ and 40’ chassis continue to be an issue, Breakbulk and Ro-Ro cargo are also on the rise.

- Norfolk increasing towards the end of the week. As of this morning VIT, VIG and APM show zero available chassis. You do the math.

- New Orleans has a pretty big spike this week, what is interesting is there is currently 59 container ship vessels at MSY but bookings are being cancelled, that could cause a lot of empty return issues in the near future. Capacity is getting slim in MSY as well.

What looks positive this week?

- LA/Long Beach are still tapering down, but there is still rail dwell time from backups. Plan for longer transit times for your containers to hit railheads or reach out to Port X Logistics for trans load options!

- Seattle is picking up in incoming container volumes but no current issues are taking place in Seattle as far as capacity or chassis shortages. There are still long wait times for drivers picking up and returning containers causing Port congestion fees to stick around.

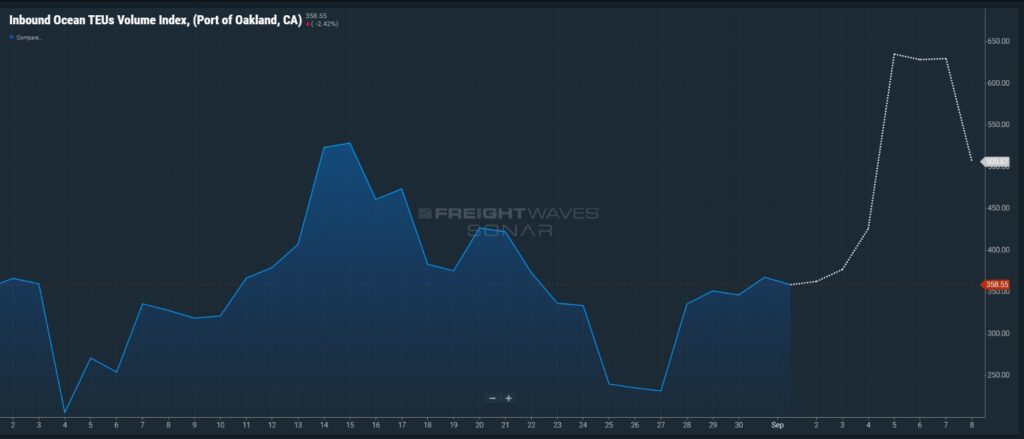

- Oakland picking back up this week but capacity is looking good with no major issues.

- Houston even with a 13.1% volume increase this coming week capacity is still good and only 10 container ship vessels at port as of this morning.

Update on the Pacific Northwest: Contract talks between the ILWU and the PMA are still “at a standstill” over the Terminal 5 (T5) issue. The International Longshore & Warehouse Union (ILWU) will not move on to negotiating on major issues like wages until a dispute is settled over which union will be responsible for equipment maintenance at a terminal that handles cargo at the Port of Seattle.

In a Twitter post on Friday the ILWU reiterated: “The union and the employer have agreed to not discuss negotiations in the media, and any rumors about what happens at the negotiating table are second, third or fourth hand. The union has no comment on unsourced rumors except to say that the parties continue to negotiate.” The ILWU previously reached an “agreement” with the PMA prohibiting strikes or lockouts during contract talks.

Let’s talk about a dirty topic for a minute. Tri-axles. Tri-axles and specialized chassis availability are decreasing, and there is a backlog of production and ordering of new specialized chassis. I have seen more and more desire to plan for overweight container imports and exports as of late. While it may seem like the most economical option from an ocean freight point of view, the capacity of chassis to move overweight containers is dangerously low in every market. Overweight container disasters have been a popular topic of discussion as of late and we have stories!

Did you know?

We are approaching our 5-year anniversary of Port X Logistics! The Port X Logistics Oakland office is one of the original founding offices and – yes we have assets! Contact our team for all your Oakland drayage and transloading needs Oakland@portxlogistics.com .

For FreightWaves charts or contact the leadership team via letsgetrolling@portxlogistics.com .

Sonar Images