1259 words 4 minute read – Let’s do this!

Welcome to August everyone – Most of the U.S. is still feeling the heat as we leave July 2024 behind for good. We are approaching peak seasonal shipping time and there is still a lot of uncertainty with the shape of the labor Unions in Canada (rail and West Coast Ports) and the U.S. East and Gulf Coasts – and strikes could wreak havoc on the state of your supply chain. The Port X Logistics’ team works hard every week to keep you well informed so you can stay ahead of the disruptions – follow our LinkedIn page for the latest news and Weekly Market Updates and email Marketing@portxlogistics.com to sign up for this weekly Market Update Newsletter.

Canadian Pacific Railway (CPKC) CEO Keith Creel said on Tuesday, With labor negotiations at a standstill, a Canadian rail strike is likely to occur in late August. CPKC and the Teamsters Canada Rail Conference (TCRC) are still talking but remain far apart on a new contract, Creel said on the railway’s second-quarter earnings call. The Canadian Industrial Relations Board (CIRB) has said it will release a decision by August 9th on what commodities are vital to health and safety and must keep moving during a work stoppage. Members of the TCRC, which represents engineers and conductors on CPKC and Canadian National (CN), have voted to authorize a strike that could begin with 72 hours notice once the CIRB decision is issued. A strike would shut down both CPKC and CN in Canada and it would also affect commuter operations in Vancouver, Toronto, and Montreal because the trains operate on trackage dispatched by CPKC rail traffic controllers, who are represented by the TCRC. Some U.S. shippers have shifted away from Canada and into the U.S. in preparation of avoiding a strike issued by the TCRC. Weekly performance data provided by CN shows intermodal loads dropped from a peak of 48,403 loads in the week ending May 12th to 41,800 in the week ending June 30 and averaged 41,468 in the first two weeks of July. Intermodal volume dropped 17% from May 12th to July 14th, according to CN’s data and the railroad’s overall volume dropped 8% in the same period.

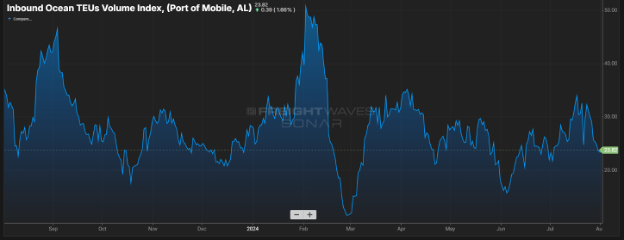

Options are getting slim for a Port change to container arrivals as the September 30th deadline approaches for the International Longshoremen’s Association (ILA) contract. Container lines aren’t offering “Plan B” options, according to carriers and cargo owners. Rerouting services to avoid the U.S. East and Gulf coasts come with their own challenges, which are still exacerbated by an earlier peak season weighing on already stretched capacity and container equipment due to ongoing Red Sea diversions. As of late July, contract talks remained stalled due to a dispute the ILA has with APM over automation projects at its Port of Mobile container terminal.

A work stoppage that drags on for five or six days can take ports up to a month or more to return to normal performance. Planning ahead is crucial and choosing Port X Logistics to help formulate a plan is you choose to divert your rail cargo to the Ports and move it via Drayage, transloading and trucking. Port X Logistics is the Gold Standard in drayage, transloading and trucking. We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. Transload orders have been piling up as many shippers have been taking the early initiative to speed up deliveries whether it was an ocean delay or to avoid the rails, but we have all the capacity in the world for you! If you want more information on how you can get your cargo diverted at the port and on the road for a speedy delivery with full visibility contact Letsgetrolling@portxlogistics.com

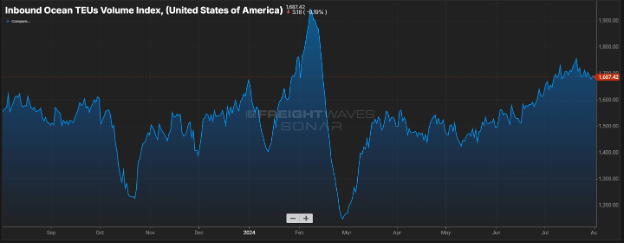

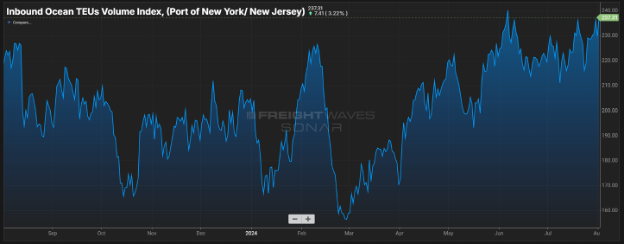

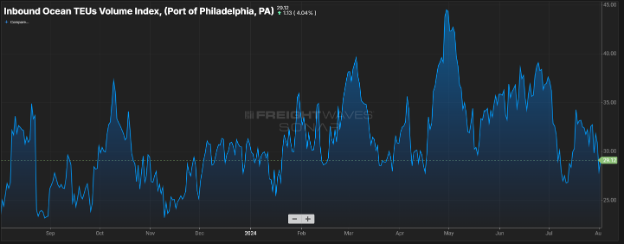

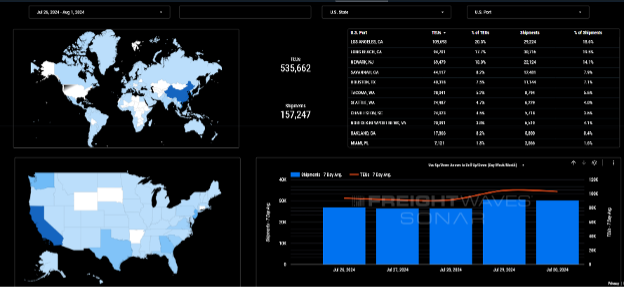

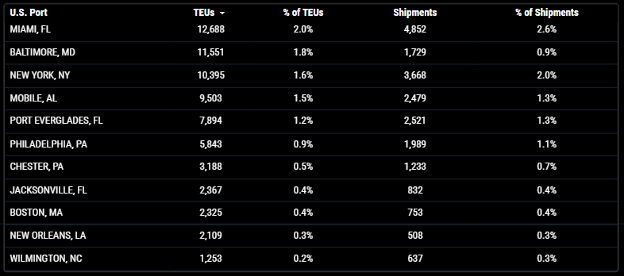

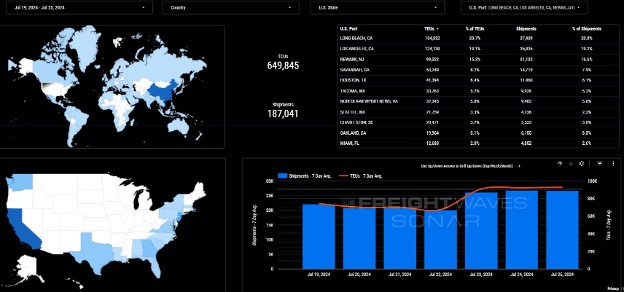

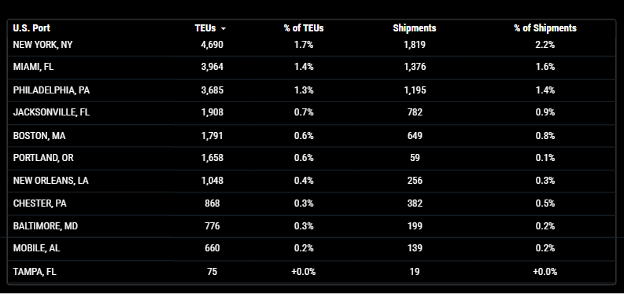

Import TEUs are down 17.57% this week from last, the heaviest volume this week arriving in Los Angeles 20.5% of incoming TEU volume, Long Beach 17.7% of incoming TEU volume and Newark 13% of incoming TEU volume. Asia-U.S. container spot rates have been easing since mid-July but are still well above $6000 USD per FEU to the West Coast. The National Retail Federation (NRF)said it expects U.S. imports in August to jump 13.5% over the same month in 2023 in its most recent Global Port Tracker (GPT). That’s up from June’s GPT, which forecast that August’s imports would climb 10.6% year over year. The strong import volumes from Asia are due to several factors, including holiday merchandise, and a diversion of some discretionary cargo to the West Coast from the East and Gulf coasts due to concerns of the possible ILA strike that we talked about earlier in this Update.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

Vancouver/Prince Rupert: Rail Dwell times in VAN and PRR are increasing, With Vanterm CN and Terminal having dwell times in excess of 7 days.

If you have containers arriving at the Canadian rails – even if they are destined for U.S. railheads, we urge you start exploring the options of drayage, transloading via port diversions. Rachel, Erin, and the team have a wealth of experience and knowledge of cross border deliveries and are ready to help answer your questions and support your needs. Contact

Canada@portxlogistics.com

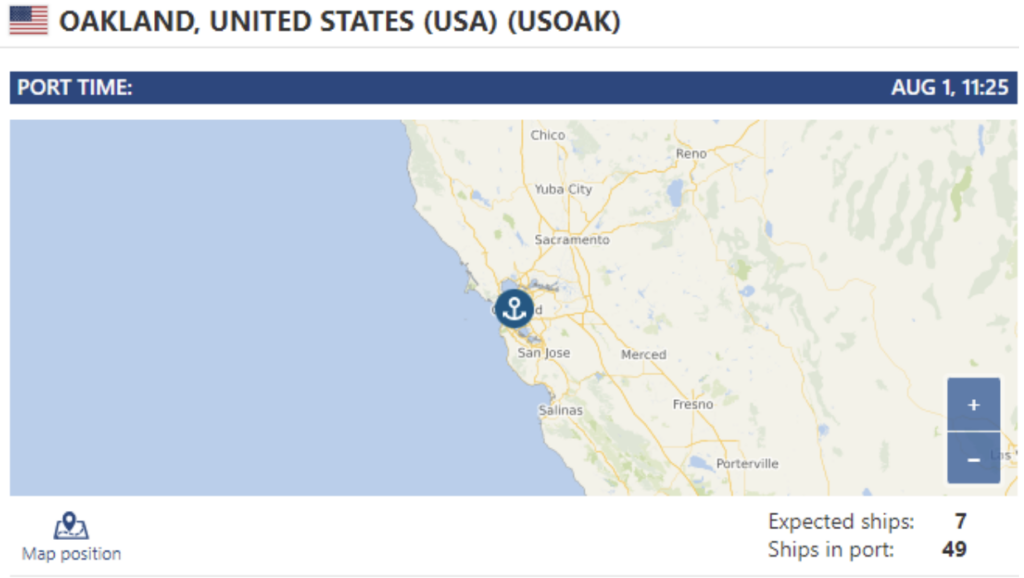

Oakland: Port congestion has increased this week from Harry Bridges Birthday holiday closure on Monday. We have seen driver wait times up to 10 hours this week. If you are looking for capacity, we encourage you to get your orders in early for the most guaranteed capacity. Send all orders and requests to our Oakland team at Oakland@portxlogistics.com

Chicago: The BNSF Elwood is seeing 4-6 hour wait times during peak hours and in some worse cases we have had drivers waiting for 8 hours for container pickups. Even with all that wait time, our Chicago asset drayage team has full capacity to get your Chicago containers moving. We have 80 trucks and secured yard space and we are able to secure permits to haul heavy containers. For great rates, capacity and supreme customer service contact Danny and the team at letsgetrolling@portxlogistics.com

Did you know? Imports coming into the Seattle and Tacoma ports are on the rise – perhaps resulting from shippers trying to avoid the Canada rail or International Longshore and Warehouse Union’s (ILWU Canada) possible plans to strike at the Vancouver and Prince Rupert Ports after last week’s DP World hearing, pending the decision of the Canada Industrial Relations Board (CIRB)

Did you also know? Our all-star Seattle drayage/transload warehouse team has plenty of drayage capacity with the addition of 11 new drivers and a huge amount of warehouse space for transloading and storage. We can handle overweight containers and have heavy lift capacity to handle all containerized transloads – Interested in hearing more about our services? Contact Letsgetrolling@portxlogistics.com We are ready to roll!

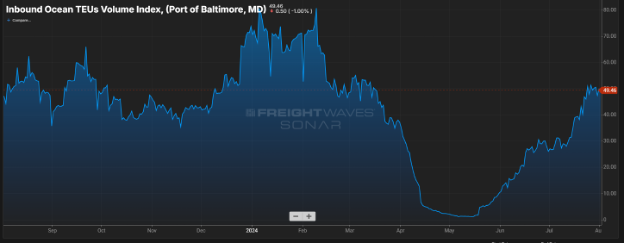

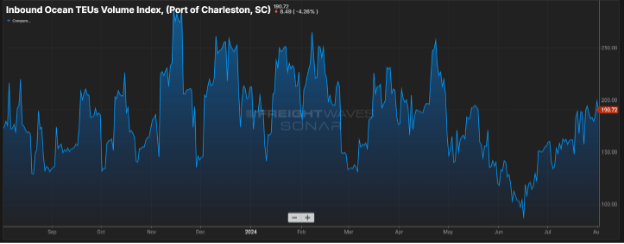

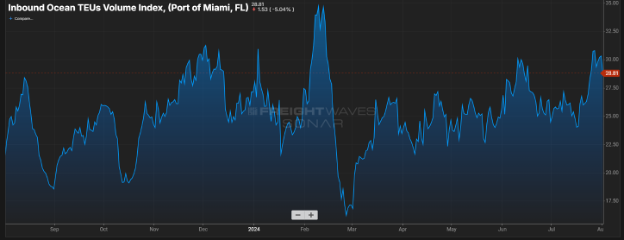

SONAR Import Data