2618 words 8 minute read – Let’s do this!

It’s a busy news week in the industry, Union news taking over the North American ocean logistics world. Before we talk about it, I want to remind you that we are here for you every week to bring you Port X Logistics Weekly Market Updates, where we sum up the current events and the future chaos in the industry. So tag or email this to a friend and follow our LinkedIn page for the most up to date industry news and topics and email us for more information about Port X Logistics and how we can help be an industry knowledge tool for you and your team Marketing@portxlogistics.com. And here we go…

The Teamsters Canada Rail Conference (TCRC) said in its update that under Canadian labor law, the strike mandate from May is set to expire on June 30th. A legal strike or lockout cannot occur until a Canada Industrial Relations Board (CIRB) decision, and it is unclear when that decision will be made. After the CIRB decision, TCRC would have to give 72 hours’ notice before a strike can begin. The CIRB may grant the rail carriers’ request for a 30-day extension, starting from the decision date, before the 72-hour notice can be served. The rail carriers have estimated that given the CIRB process, a strike will not start before mid-to-end July.

The TCRC says that it has sent the CIRB written submissions and attended a pair of in-person meetings but has received “no indication” as to how long the process might take. The TCRC expressed frustration with the open-ended timeline in a June 11th news release, noting that Canadian National Railway (CN) and Canadian Pacific Kansas (CPKC) have withdrawn from negotiations since the review began. Moving forward, the union says it will conduct a new strike vote between June 14th – 29th, promising a “quick process.”.

The uncertainty behind a possible Canadian Rail strike has sparked shipping lines on the trans pacific trade to begin canceling calls to Canada’s main pacific gateways, Vancouver and Prince Rupert. There are 14 port swaps and diversions away from Canada into U.S. ports confirmed from week 24 onward, as well as three completed since mid-May. Of the forthcoming blank sailings announced through to the end of week 31 and the beginning of August, six are on Zim’s ZPX service, which is now not scheduled to call at Vancouver until at least week 31. During the same period, MSC’s Chinook, SM Lines’ PNS and THE Alliance’s PN4 service will all blank Vancouver once, as will the Ocean Alliance’s PNW1 and PNW4 strings, and its PNW3 service twice. At Prince Rupert, just three blanks – one each on the THE Alliance’s PN4 and the Ocean Alliance’s PSW2 and PNW2 services – have so far been announced for the period. Anticipation of a strike keeps carriers on their toes, with some already taking significant action to omit, blank, or swap calls into Vancouver in June and beyond.

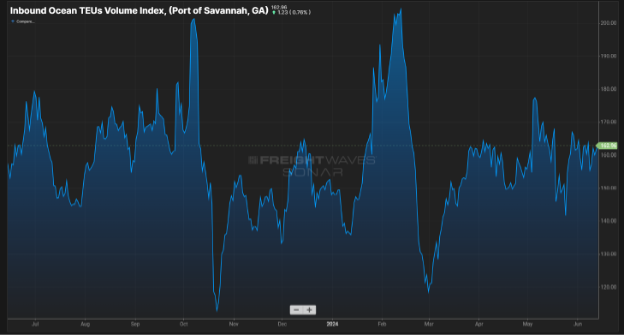

Vessel space in Asia for cargo destined to the U.S. is limited, we are seeing it on our end. With the potential Canada rail strike, ocean spot rates on the rise, Panama Canal drought restrictions, the ongoing Red Sea crisis, Asian port congestion and sudden demand spikes, the container shipping market has entered into the same supply-constrained problems we saw during the pandemic disruptions. What’s next Amidst the already volatile ocean freight environment?

YEP, there is more – On Tuesday, The International Longshoremen’s Association (ILA) suspended negotiations with the United States Maritime Alliance. The labor union said it discovered that APM Terminals and Maersk Line, which are both owned by A. P. Moller – Maersk Group, are utilizing an auto gate system that autonomously processes trucks at multiple ports, including the Port of Mobile, Alabama. The ILA said it will not meet with USMX until the auto gate issue is resolved. APM Terminals said that they committed to upholding its agreements while fostering a safe and efficient working environment and are disappointed that the ILA has chosen to make selected details of ongoing negotiations public in an effort to create additional leverage for their other demands.

The ILA also called out the member companies of its maritime employers for generating record profits. According to the ILA, the “enormous” profits and sales raked in by the United States Maritime Alliance (USMX) has the union demanding wage hikes “commensurate with these revenues.” As we all likely predicted, the ILA is targeting a wage increase larger than the 32 percent that was negotiated by its West Coast counterpart—the International Longshore and Warehouse Union (ILWU) in its six-year contract signed and ratified last summer. Last July, ILA leadership indicated that the union’s Great Lakes District already secured a 40 percent increase in wages and benefits for a new six-year deal.

Shippers may face another disruption towards the peak holiday shipping months as it appears a quick and painless renewal process is highly unlikely as the conflicts have already begun. The union walked away from master contract negotiations for 45,000 dockworkers across 36 ports from Maine to Texas on Monday, and has insisted that the members will go on strike if a new deal is not in place by its Sept. 30 expiration date. If you are into gambling, take this one to Vegas – An ILA strike is looking to be a pretty lucrative bet.

Some shippers have already begun shifting their cargo from the East and Gulf Ports into the West Coast to ensure that they have vessel allocation and empty containers ready for their imports to the U.S. before it’s too late down the line into peak season. How can you effectively shift your cargo from coast to coast without it affecting tight delivery cut-off deadlines? By choosing to move cargo via Drayage, transloading and trucking. Port X Logistics is the Gold Standard in drayage, transloading and trucking. We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. Transload orders have been piling up as many shippers have been taking the early initiative to speed up deliveries whether it was an ocean delay or to avoid the rails, but we have all the capacity in the world for you! If you want more information on how you can get your cargo diverted at the port and on the road for a speedy delivery with full visibility contact Letsgetrolling@portxlogistics.com

It may technically be beach season, but the storms are starting, and in my opinion this year seems a little crazy already… A tropical disturbance has brought a rare flash flood emergency to much of southern Florida and more heavy rainfall on Thursday and Friday. Numerous roads remained flooded and impassable for vehicles. Southbound traffic was being diverted around a flooded section on the main Interstate 95, and the Florida Highway Patrol advised the interstate will not reopen until after water has drained. Port Everglades Terminal ceased operations on Wednesday due to the extreme weather conditions.

The National Hurricane Center is monitoring two areas where tropical development is possible, bringing tropical rain to Florida, Mexico, Texas and parts of Louisiana this week and weekend. An area of low pressure brought heavy rain to Florida this week before moving offshore into the southeastern U.S. Coast. Florida will continue to see heavy rain as the tropical weather moves northeast over the next few days. Environmental conditions are generally unfavorable, although some slow development is more likely when the system is off the East Coast. Further development is possible when it encounters the Gulf Stream. If this system becomes our first named storm, it will be called Alberto. The low-pressure system now has a 40 percent chance of developing into a tropical depression sometime next week. The system is expected to slowly move west, or west-northwest bringing tropical moisture to Mexico, Texas and potentially to Southeast Louisiana.

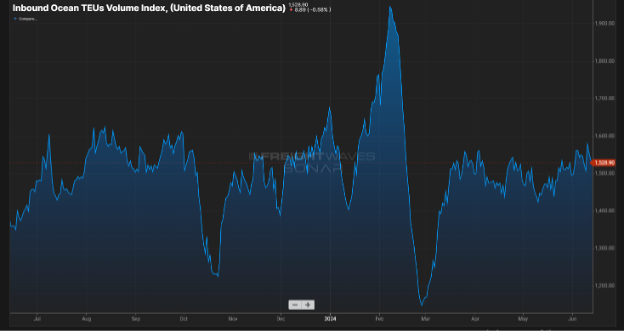

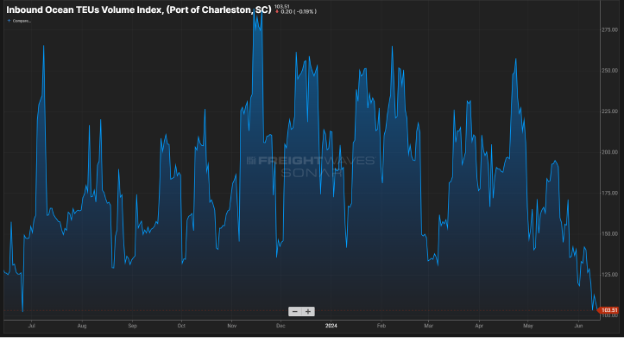

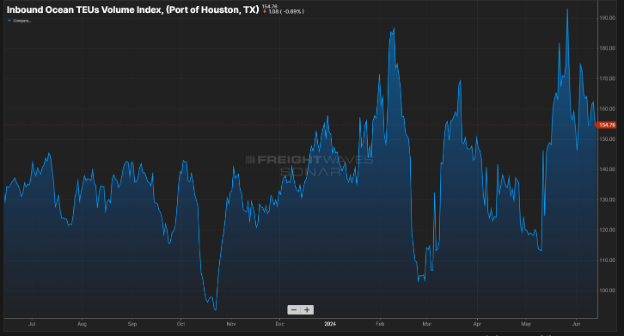

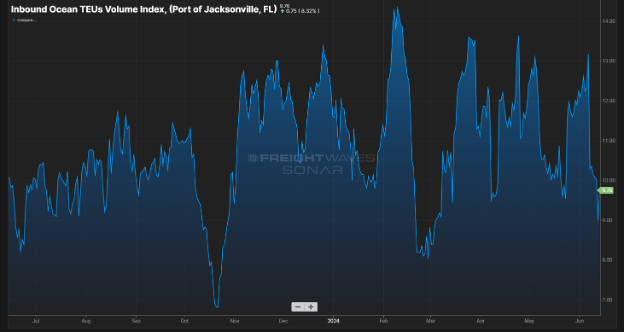

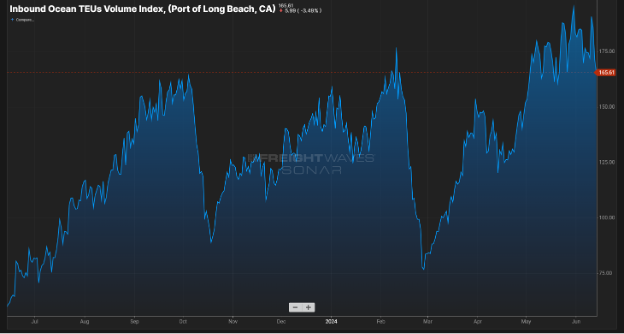

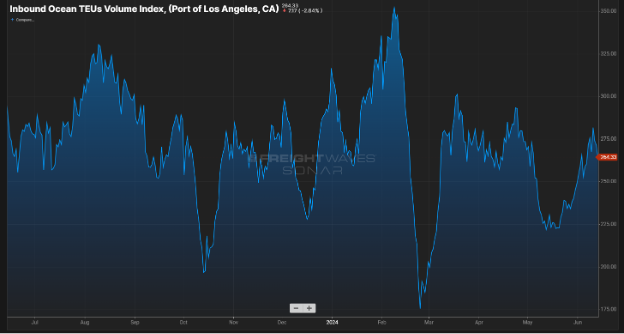

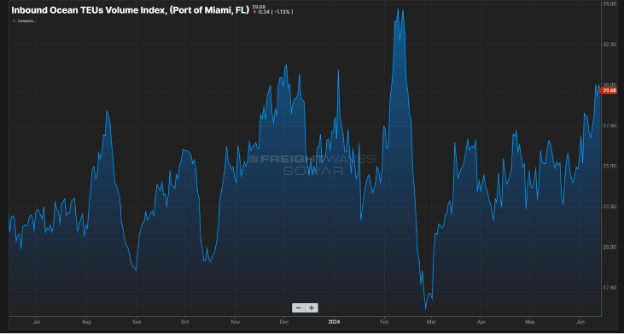

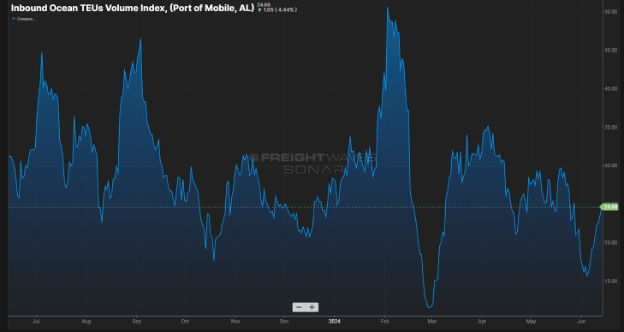

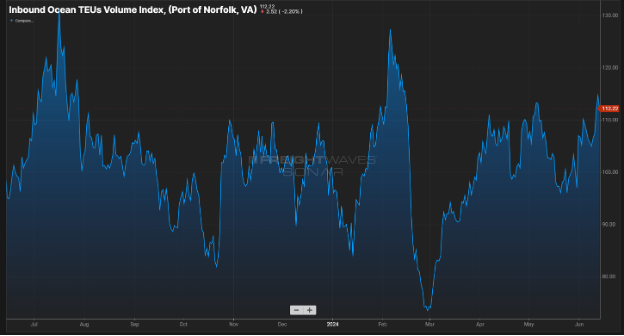

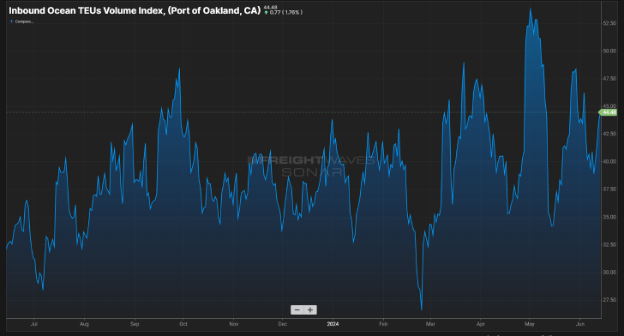

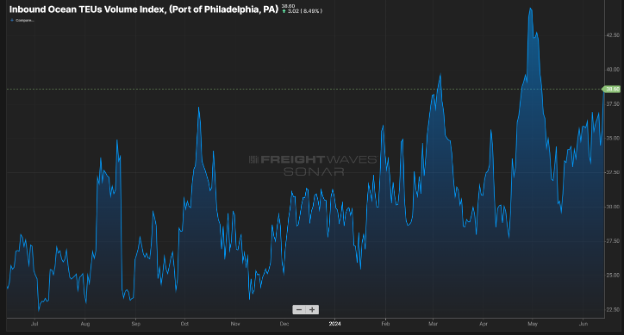

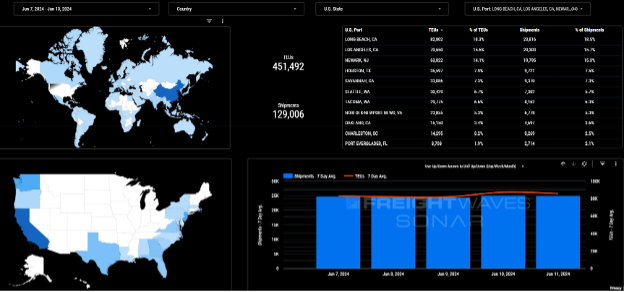

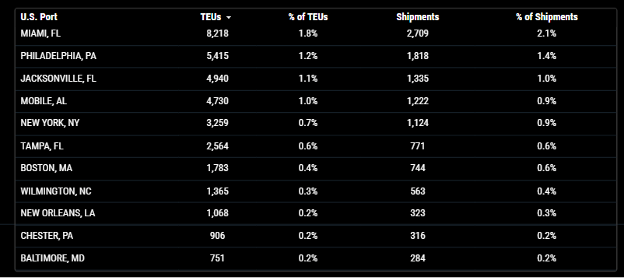

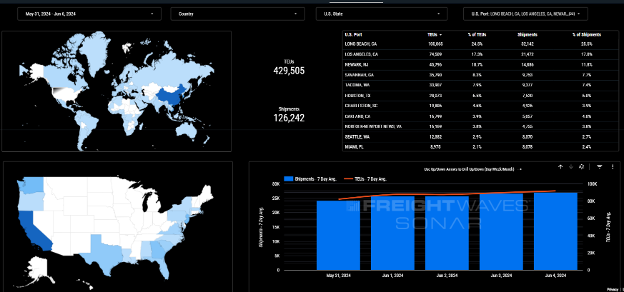

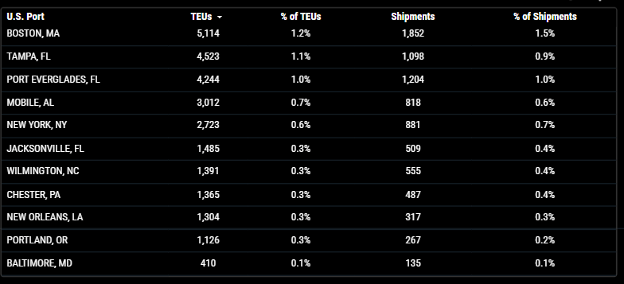

Import TEUs are up this week 5.11% this week from last, the heaviest volume this week arriving to Long Beach 18.3% of incoming TEU volume, Los Angeles 15.6% of incoming TEU volume and Newark NJ 14.1% of incoming TEU volume. U.S. retailers are expecting an extended peak season this year and have upgraded their forecast for imports for each month through September, stating consumer spending is projected to increase this year between 2.5% and 3.5% over 2023. The June Global Port Tracker (GPT) is now forecasting that June imports will increase 15.2% year over year, up from the 10.7% jump predicted in last month’s report. Imports in July are expected to grow 9.5% from July 2023 compared with the previous forecast of a 5.5% gain. Upgrades were also made for August imports (10.6% year-over-year growth vs. 7.1% forecast in last month’s GPT), and September (1.7% growth vs. 0.5%). West Coast ports are experiencing the strongest growth as Imports through the East and Gulf are being compromised from the uncertainties discussed earlier in this Market Update.

Ocean spot rates from Asia to the U.S. are increasing amongst the disruption. Average spot rates from Asia to the U.S. West Coast have increased by 30% since April 2024. Spread between spot market rates and long-term freight contract rates for Asia to U.S. West Coast containers have also reached its highest level since September 2021. As of June 7, 2024, spot rates for shipping from Asia to the U.S. have continued to increase:

Shanghai-New York: $7,214 per 40 ft

Shanghai-Los Angeles: $5,975 per 40 ft

In the container shipping market presently, capacity tends to go to those willing to pay the most — as is the case in many other industries when demand exceeds capacity. A lesson from the pandemic era is that when there is insufficient capacity, shippers are competing head-on with other shippers for a limited resource: access to both vessel capacity and empty equipment. This is a clear disadvantage for shippers who are moving large bulky commodities, such as furniture. It is also a disadvantage for smaller shippers more exposed to the spot market than very large shippers who are better able to move at least part of their volume on lower contract rates. A competitive advantage for larger shippers versus their own smaller competitors. It is not just a game of pricing between the carrier and the shipper, it is also a head-on competition between the shippers themselves.

Ocean rates from India to the U.S. East Coast continued to drop in June, largely as a result of supply overhang after Ocean Network Express (ONE) began on the WIN (West India-North America) trade lane last month. The continuing rate decline comes as some carriers, including Hapag-Lloyd, CMA CGM, Mediterranean Shipping Co. and Maersk prepare to implement peak season surcharges (PSSs) ranging from $500 USD to $750 USD per container on Indian loads to the East Coast, mostly from June 15th. However, due to schedule disruptions out of Asia, India-U.S. West Coast rates have increased substantially, between $800 USD to $1000 USD per container among the lead operators month over month. MSC (India), stated in a customer advisory, noted that the increases are necessary to “maintain the high level of reliability and efficiency of services to meet the needs of customers.”

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE for Port & Rail Updates

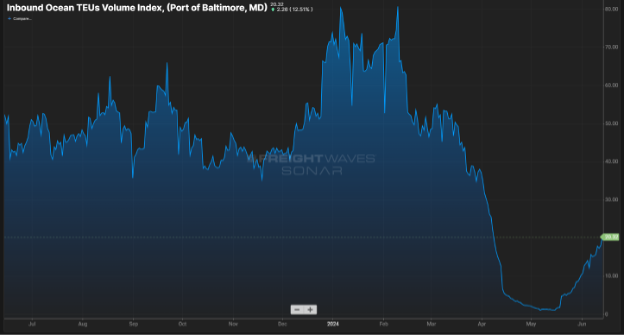

The Port of Baltimore fully reopened this week for the first time since the collapse of the Francis Scott Key Bridge in March. Commercial shipping traffic through the Port of Baltimore is expected to return to normal levels next month.

The Port of Nevada officially opened this week, accepting cargo in CMA CGM containers and becoming the 3rd new intermodal facility to open in the western U.S. this year. It is a 224-acre, inland port operation and intermodal ramp in Northern Nevada and will offer intermodal service for imports and exports between Fernley and the Port of Oakland. This venture is the result of their collaboration with Union Pacific Railroad, the CMA CGM Group, and the Port of Oakland.

Port Highlights:

Seattle/Tacoma: The Northwest Seaport Alliance of SEA/TAC has rebound from a 2 year decline of cargo volumes and anticipates a healthy peak season for Asia import volumes. An NWSA spokesperson said an analysis by the port shows that discretionary import cargo using the gateway is up 4% this year through April. Husky over the past few weeks has offered Saturday gates and has implemented “double-flex” gate times in the mornings. Under the coastwide ILWU contract, terminal operators on the West Coast can not only offer a flex gate, which opens at 7 a.m. rather than the normal 8 a.m., but can now offer a double-flex gate that opens at 6 a.m. If you have an immediate need for SEA/TAC transloads or have questions on how port diversions through the SEA/TAC ports can benefit your Canada rail bound or East Coast bound shipment and if you are looking for an all-star drayage/transload warehouse team, our Seattle operation has plenty of drayage capacity with the addition of 11 new drivers and a huge amount of warehouse space for transloading and storage. Contact letsgetrolling@portxlogistics.com for capacity and great drayage and warehouse rates.

Vancouver/Prince Rupert: Rail time has drastically increased from last week with the exception of Deltaport. Prince Rupert DP World and Vancouver Vanterm have reached 7+ days on dock. We will continue to monitor rail dwell times through June, as we inch closer to the TCRC’s decision towards a potential rail strike.

If you have containers arriving to the Canadian ports – even if they are destined for U.S. railheads, we urge you start exploring the options of drayage, transloading via port diversions. Rachel, Erin, and the team have a wealth of experience and knowledge of cross border deliveries and are ready to help answer your questions and support your needs. Contact Canada@portxlogistics.com

Did you know? We are a little over a month away from this year’s Empire State Ride, and we still need your help! This year marks the 10th Anniversary of the Empire State Ride and they have a 2024 fundraising goal of $10 million. Funds raised from the Empire State Ride go directly to breakthrough cancer research at one of the nation’s top cancer research hospitals Roswell Park Comprehensive Cancer Center. Roswell Park has some of the best and brightest researchers and doctors who have come from around the world to dedicate their life to studying and treating cancer. Because of the promising studies going on at Roswell Park every dollar donated will fund an additional $23 in research via external matching grants.Port X Logistics is proud to announce we are back for year three as the presenting sponsor of Empire State Ride and we’re thrilled to be along for the ride on our 500+ mile adventure across New York State, exciting news – We are matching donations to the Empire State Ride to help reach their goal! To Donate, Click here and select a team or participant.

SONAR Import Data